Affidavit Of Heirship Minnesota With Waiver Of Rights

Description

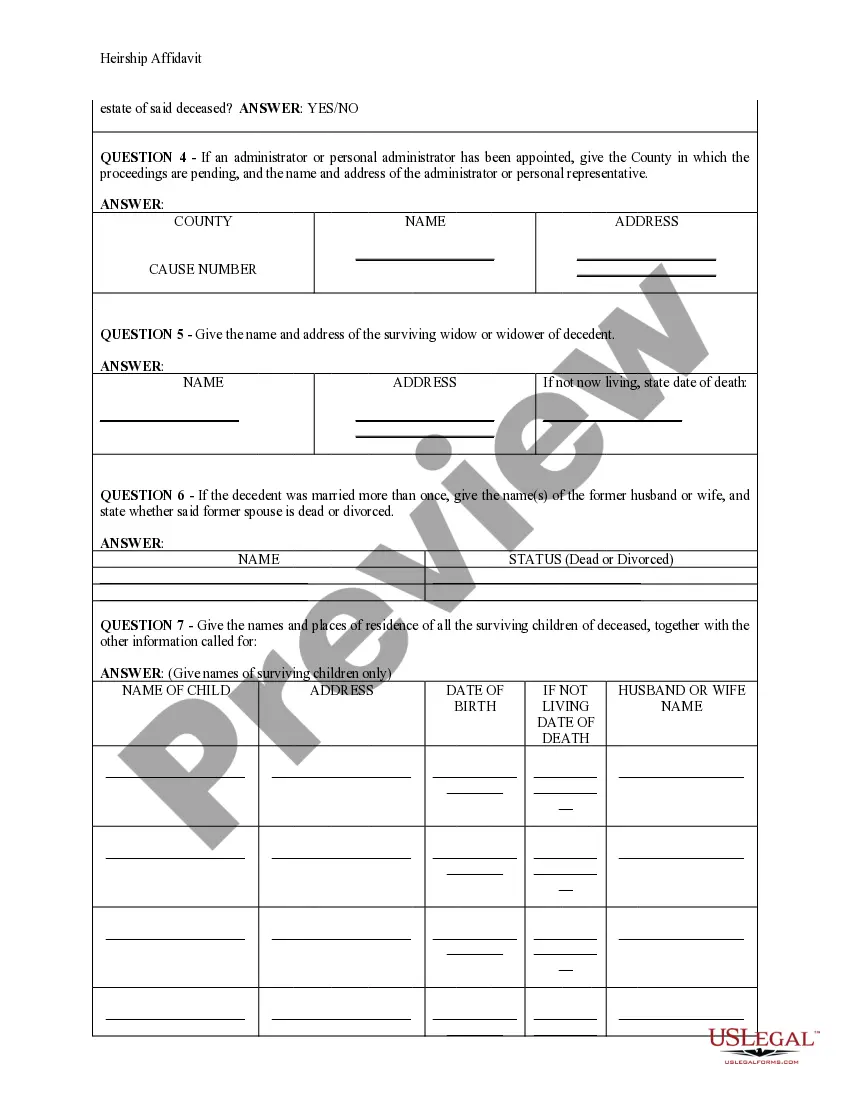

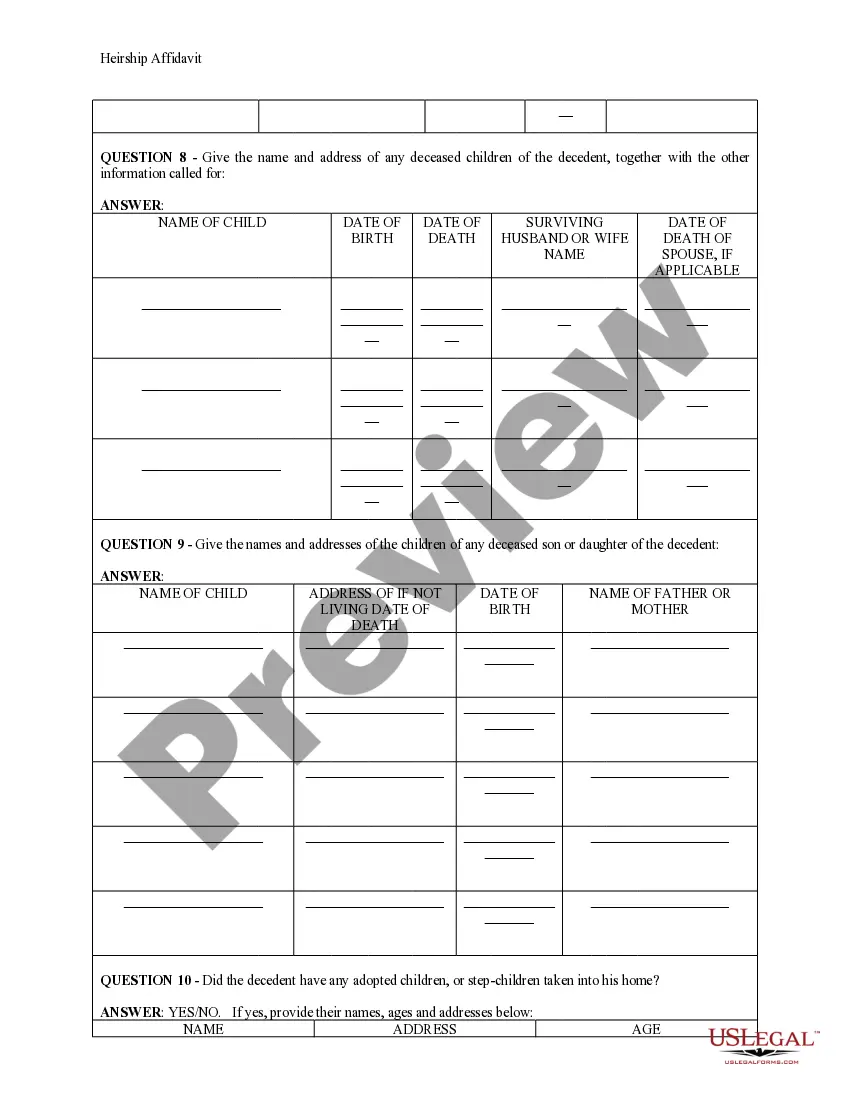

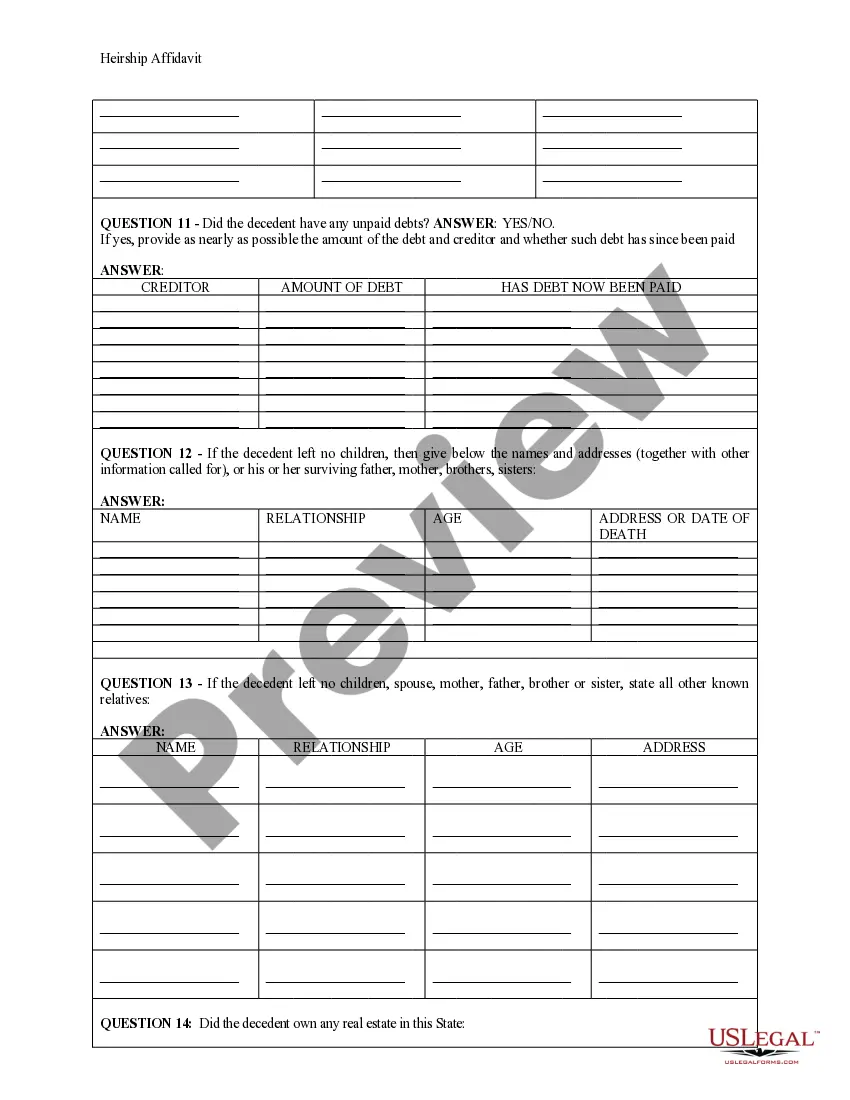

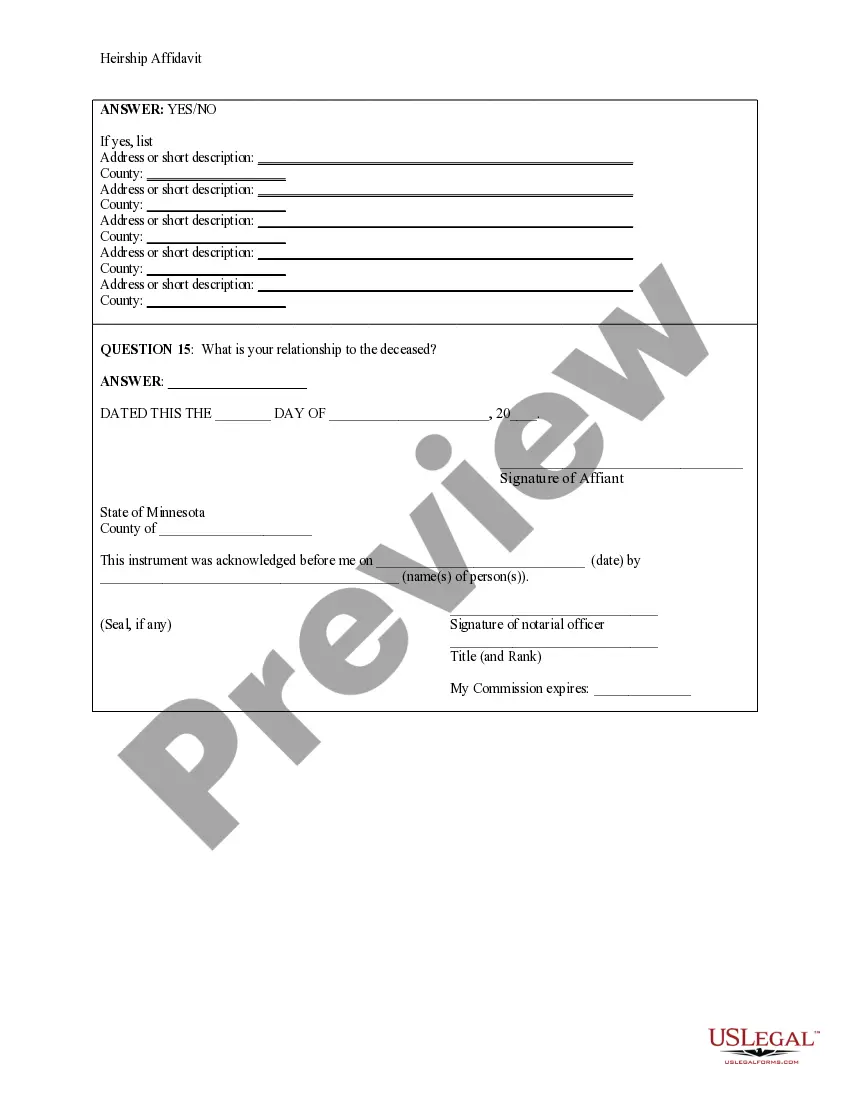

How to fill out Minnesota Heirship Affidavit - Descent?

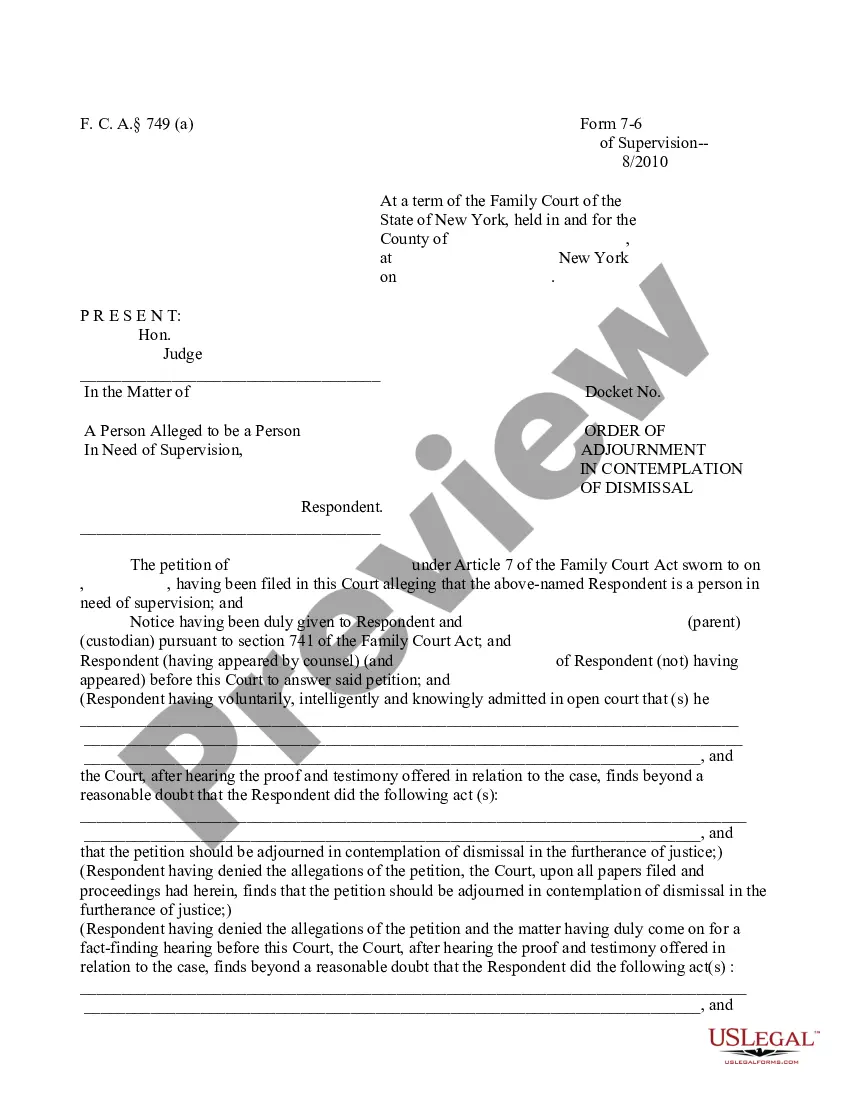

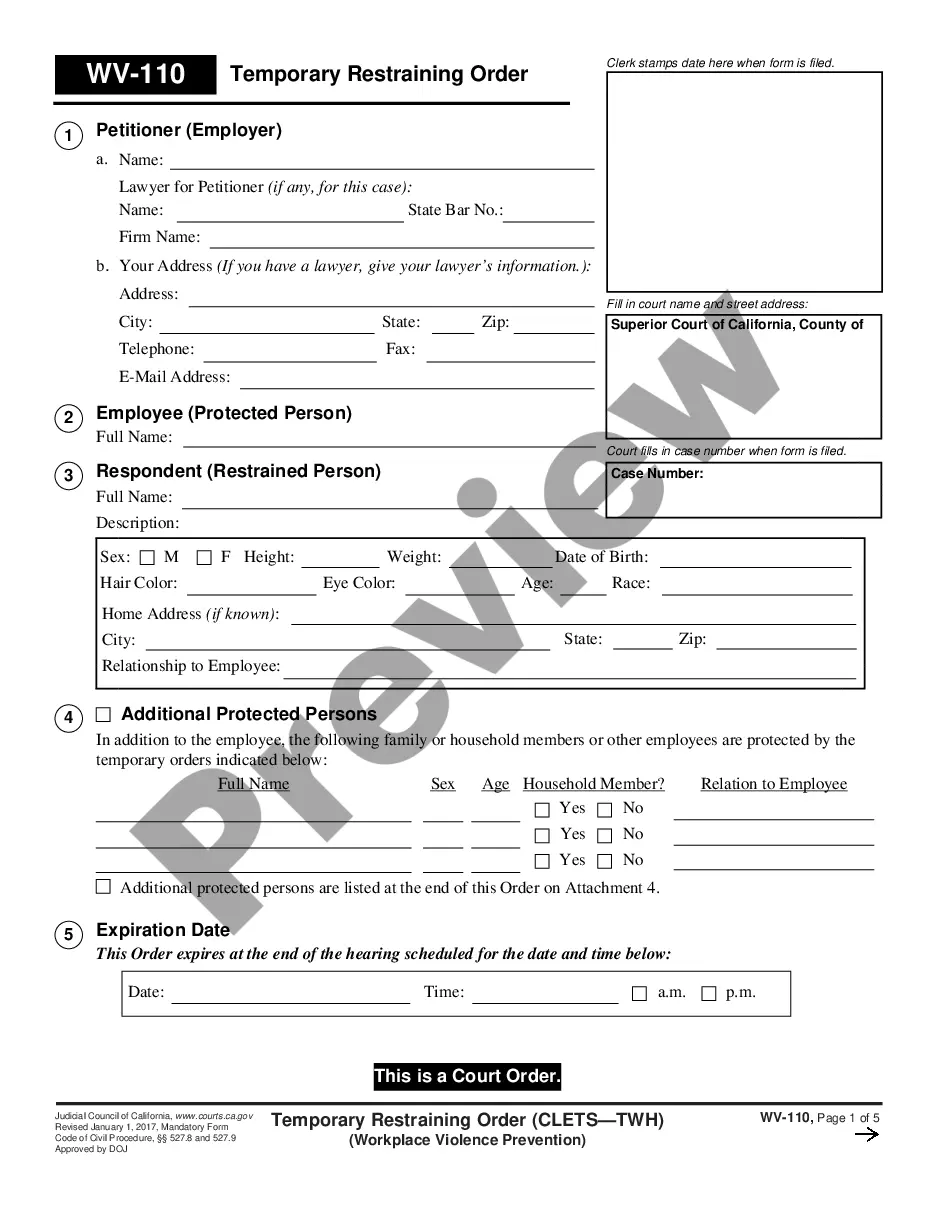

Using legal templates that meet the federal and local regulations is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the right Affidavit Of Heirship Minnesota With Waiver Of Rights sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are simple to browse with all files arranged by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when obtaining a Affidavit Of Heirship Minnesota With Waiver Of Rights from our website.

Obtaining a Affidavit Of Heirship Minnesota With Waiver Of Rights is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the guidelines below:

- Take a look at the template using the Preview feature or via the text description to make certain it fits your needs.

- Locate another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Affidavit Of Heirship Minnesota With Waiver Of Rights and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate.

Minnesota law allows people to establish living trusts to avoid probate for most every asset that you own. This includes real estate, vehicles, bank accounts, art collections, and more. In order to create a living trust, a trust document needs to be established. This is similar to a will.

The informal probate process is initiated by filing an application with the probate court. In some counties, you must file the application in person. If the probate registrar determines the application is complete, the registrar will issue a statement of probate and appoint a personal representative.

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.

Who Gets What in Minnesota? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no descendantsspouse inherits everythingspouse and descendants from you and that spouse, and the spouse has no other descendantsspouse inherits everything4 more rows