Limited Lliability

Description

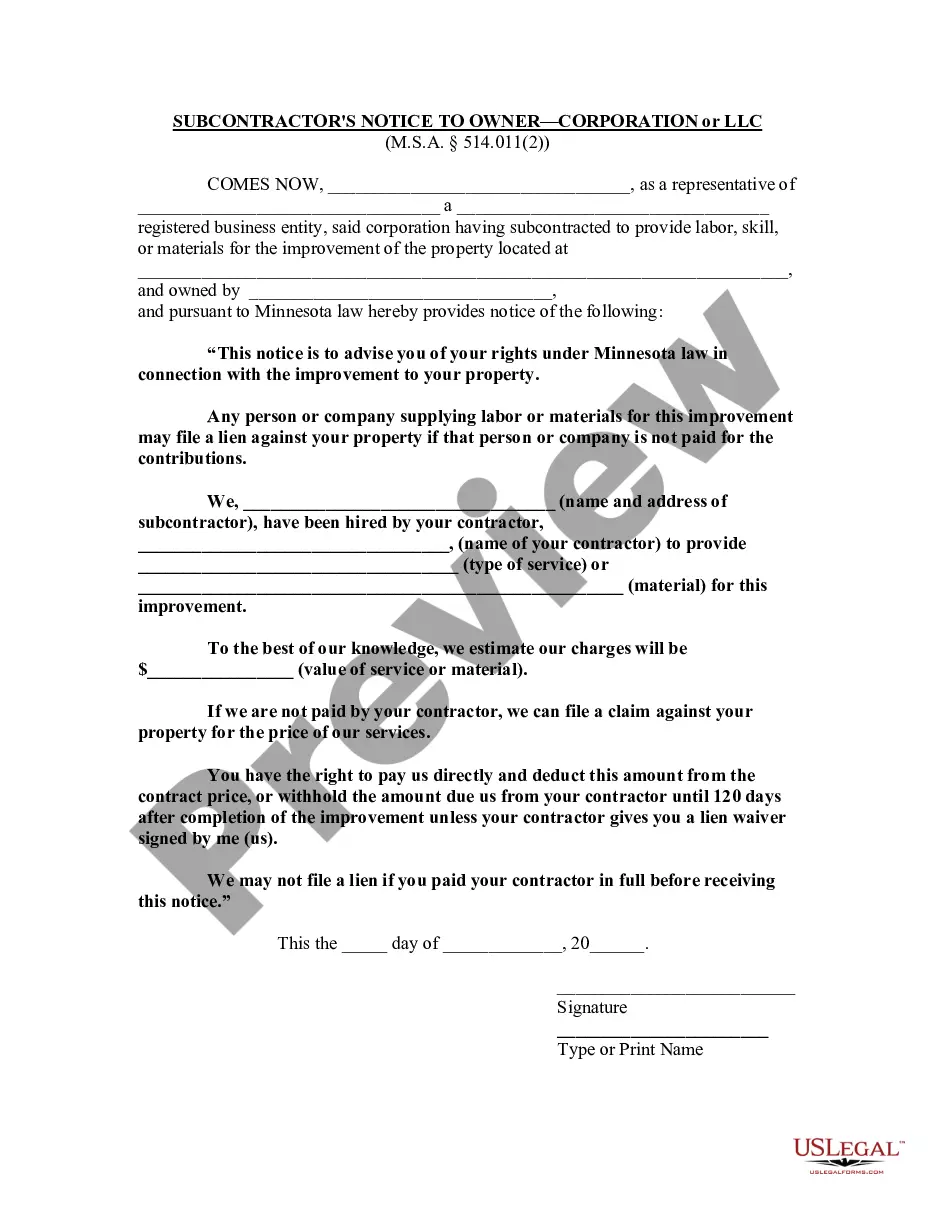

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- If you already have an account, login and verify your subscription is active. Click the 'Download' button for the necessary form template.

- For new users, start by checking the Preview mode and form description. Ensure it aligns with your needs and local jurisdiction.

- If you need another template, utilize the Search tab to find the correct form that fits your requirements.

- Select the desired document by clicking the 'Buy Now' button and picking your subscription plan. You must register for an account to access our extensive library.

- Complete your purchase with your credit card details or PayPal account to finalize your subscription.

- Once purchased, download your form to your device for completion. You can always access it in the My Forms section of your profile.

By leveraging US Legal Forms, you can confidently create legal documents that meet all necessary specifications. Our robust collection outshines competitors, offering over 85,000 fillable forms.

Start your journey toward legal empowerment today with US Legal Forms and ensure your documentation is precise and compliant!

Form popularity

FAQ

Filling out an LLC requires you to download the appropriate forms from your state’s government website. Enter necessary information such as the name of your LLC, principal address, and member details. Ensure that you review the document for accuracy before submission to avoid delays in processing your limited liability application. Taking advantage of US Legal Forms can streamline this task by providing user-friendly forms and guidance throughout the process.

To write an LLC example, start with the title that clearly indicates it is an LLC formation document, like 'Articles of Organization for Your LLC Name'. Include typical sections such as the purpose of the business, the registered agent information, and the names of the LLC members. Tailoring the document to meet your state’s requirements is crucial for validating your limited liability claim, and US Legal Forms provides useful examples and templates to help.

Yes, you can file your LLC by yourself if you feel confident in navigating the necessary steps. However, be aware that each state has its specific requirements and processes for forming a limited liability company. While it is possible to do it alone, seeking guidance from services like US Legal Forms can be beneficial in ensuring that you complete every step correctly without missing any critical details.

Writing a limited liability company involves creating foundational documents such as the Articles of Organization. You'll need to include certain essential details, like your LLC's name, address, and the nature of the business. Additionally, drafting an Operating Agreement is advisable, as it outlines the management structure and operational procedures for your limited liability company. Utilizing resources from US Legal Forms can guide you in crafting these documents accurately.

Yes, as a sole owner of an LLC, you will file both your LLC and personal taxes together on your personal tax return. The income and expenses from your LLC are reported on Schedule C, which is part of your Form 1040. This unified filing approach simplifies your tax obligations while ensuring your limited liability status remains intact.

Regardless of income, your limited liability company must file taxes if you are engaged in business activities. Even if your income is minimal, it's still necessary to report earnings to comply with IRS regulations. Keeping accurate records will help you remain compliant while taking advantage of the limited liability benefits of your LLC.

For a single member LLC, you do not file taxes separately from your personal finances. Instead, income from your LLC flows through to your personal tax return, making it simpler for you. This approach allows you to benefit from limited liability without the complexities of separate filings.

Typically, a limited liability company files a Form 1065 or uses Schedule C, depending on its structure. For single-member LLCs, the preferred method is filing as a sole proprietorship, which utilizes Schedule C attached to your Form 1040. This way, you maintain your limited liability protections while fulfilling your tax obligations.

Yes, if you're running a single member LLC, you should file your personal and business taxes together. The IRS allows you to report profits and losses from your LLC on your personal tax return. Combining these filings streamlines your tax reporting while helping you maintain the limited liability status that protects your personal assets.

A single member LLC generally files taxes as a sole proprietorship by reporting income and expenses on Schedule C of your personal tax return. This means that you can enjoy the benefits of limited liability while still keeping things simple at tax time. Remember, this structure helps protect your personal assets while allowing for easy management of your business finances.