Transfer On Death Deed For Joint Owners

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

- If you're already a US Legal Forms user, log in to your account. Ensure your subscription is valid, and then simply find the Transfer on Death Deed for joint owners and download it directly.

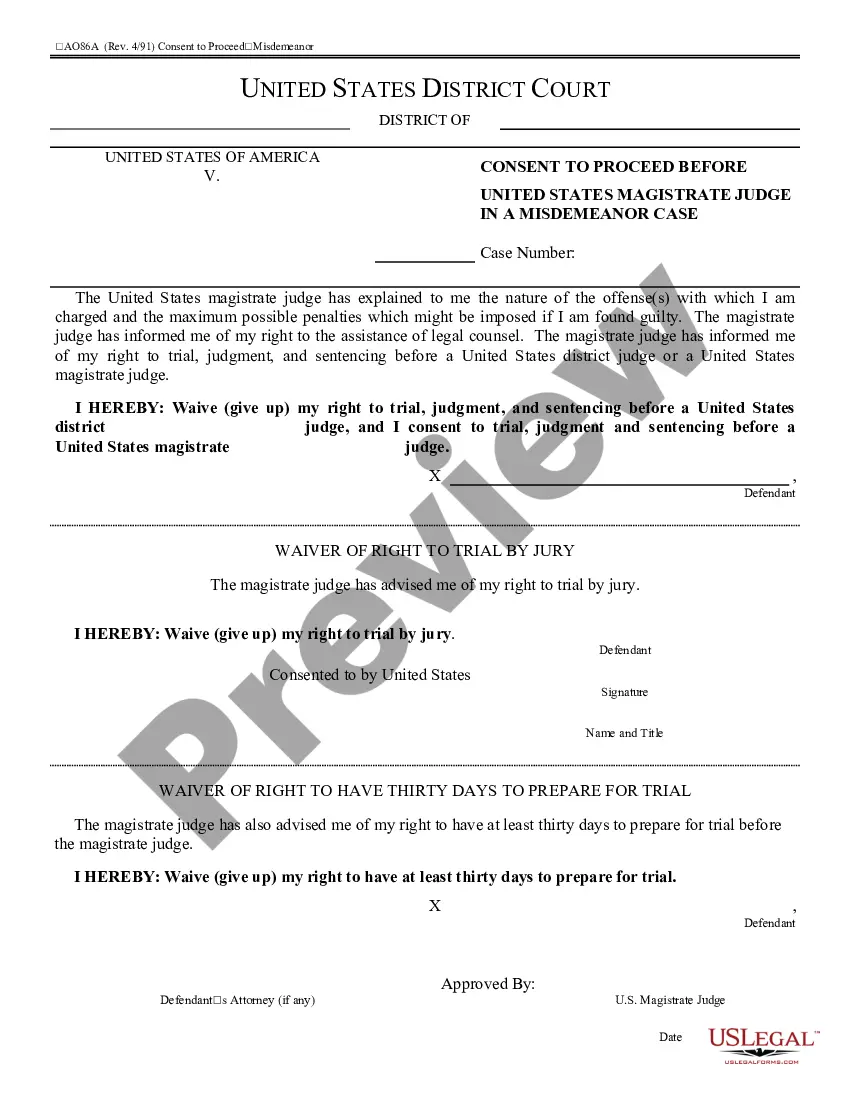

- For first-time users, start by checking the Preview mode of the document. Confirm that it meets your specific needs and complies with your local jurisdiction requirements.

- If needed, utilize the Search tab to find alternate templates. Verify each form's correctness to ensure it aligns with your requirements before proceeding.

- Next, click on the Buy Now button to purchase the required document. Choose a subscription plan that suits you; registration may be necessary to unlock full access.

- Complete your payment through a credit card or PayPal. Once the transaction is successful, you will be able to download your document.

- Finally, save the form to your device. You can access it anytime via the My Forms section in your profile, ensuring you have what you need at your fingertips.

In conclusion, using US Legal Forms simplifies the process of obtaining legal documentation like a Transfer on Death Deed for joint owners. With their expansive library and support from premium experts, users can confidently create legally binding documents.

Start your journey today by visiting US Legal Forms and streamline your legal form procurement!

Form popularity

FAQ

A Transfer on Death deed for joint owners can have disadvantages depending on individual circumstances. It may not accommodate all types of property, and some may face challenges regarding creditors or disputes among heirs. Additionally, if not executed correctly, it may fail to accomplish your intentions. Always consider consulting a legal expert to discuss possible downsides and find the best solution for your estate planning.

Choosing between a Transfer on Death deed for joint owners and designating beneficiaries involves weighing different factors. A TOD deed directly transfers property outside of probate, which can speed up the process. In contrast, designating beneficiaries might apply to certain accounts but may not cover all property types. It often depends on your specific situation and goals for your estate.

While it is not strictly necessary to consult an attorney for a Transfer on Death deed for joint owners, seeking legal advice can be beneficial. An attorney can help you understand state-specific regulations and ensure that the deed is drafted correctly. Additionally, they can clarify the implications of the deed and make certain your intentions are executed properly. Overall, professional guidance helps avoid potential pitfalls.

Using a Transfer on Death deed for joint owners can be an effective way to leave property upon your death. This method allows you to specify who will receive your property without needing to go through probate. It ensures your chosen beneficiaries obtain the property directly, which can save time and expenses. Ultimately, it secures your wishes while providing peace of mind.

Yes, a Transfer on Death (TOD) account can be established for joint owners. This allows both individuals to ensure their wishes regarding asset distribution are clear. Upon the passing of one owner, the other automatically retains full control over the account. This feature provides a seamless transition that can reduce confusion and legal processes.

Yes, you can name two beneficiaries on a transfer on death deed for joint owners, allowing both to inherit the property automatically upon your death. This can help streamline the inheritance process and avoid probate. Make sure to clearly outline both beneficiaries on the deed to prevent any confusion.

The disadvantages of a transfer on death deed include limitations related to existing debts and the risk of disputes among beneficiaries. Furthermore, if the property is not adequately documented, there could be complications during the transfer process. Consider these aspects carefully to determine if this option is right for your situation.

You don't always need a lawyer to complete a transfer on death deed for joint owners. While it is straightforward and many people manage it on their own, consulting a legal professional can be beneficial for specific advice and potential pitfalls. This is especially true if there are unique issues related to the property or beneficiaries involved.

Once an owner passes away, the transfer on death deed for joint owners takes effect immediately, allowing the property to pass without delay. However, beneficiaries must handle any necessary filings to ensure the transfer is officially recorded. Be sure to check state laws for specific timelines and requirements.

The disadvantages of a transfer on death deed for joint owners include potential challenges if the owners are not in agreement about the property after death. Additionally, any debts owed on the property may still affect the beneficiaries. It's crucial to consider these factors before proceeding with this option.