Transfer Death Deed Beneficiary With Trust

Description

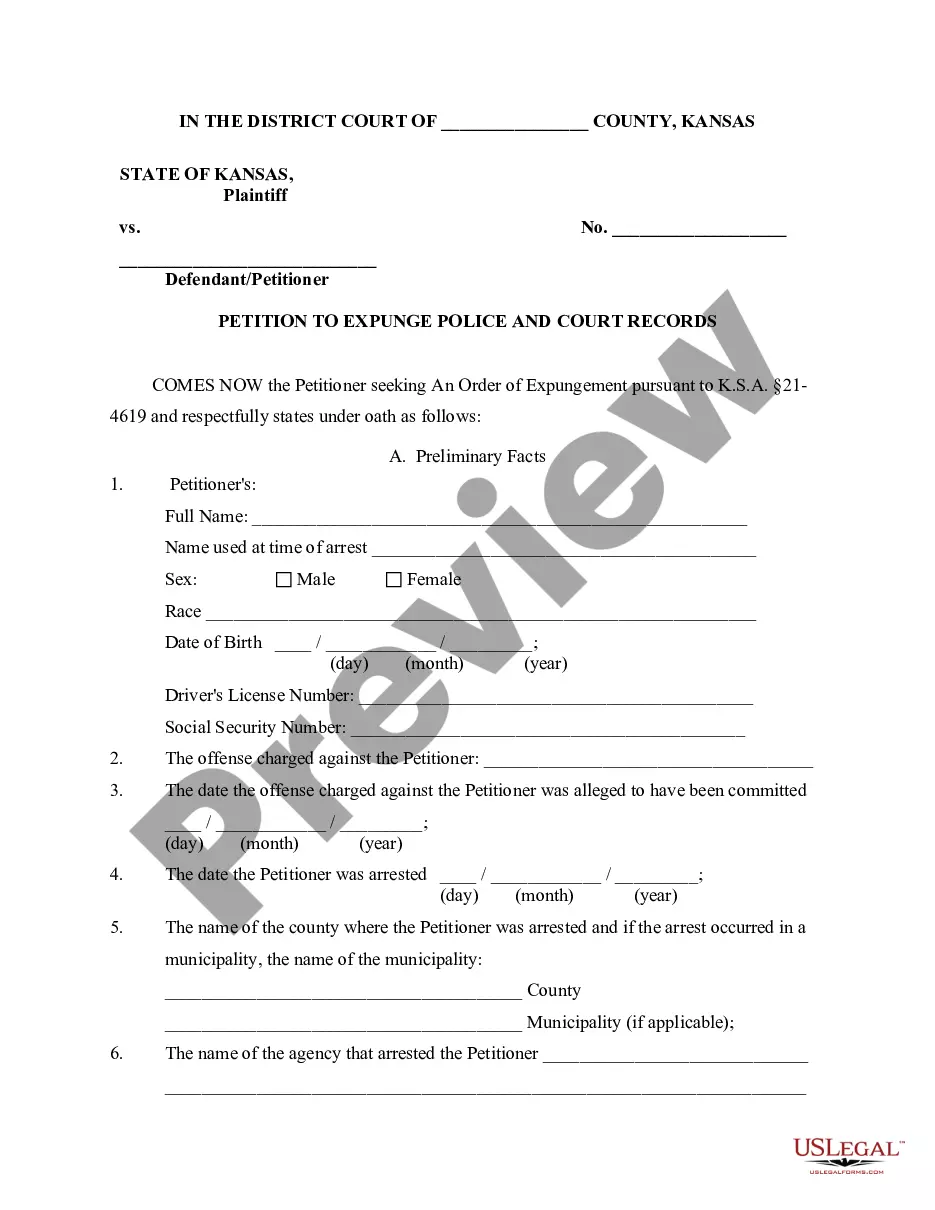

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

- Access your US Legal Forms account by clicking here to log in, ensuring your subscription is active.

- If you're a first-time user, start by reviewing the form descriptions in Preview mode to choose the specific template you need that complies with your local regulations.

- Utilize the Search tab to find additional templates if necessary and confirm your selection is accurate.

- Select the document you need by clicking the Buy Now button, then choose your appropriate subscription plan and create an account to access our resources.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download the completed form and store it on your device, accessible anytime in the My Forms section.

By following these steps, you can ensure a smooth transfer of a death deed beneficiary with trust, allowing for secure and efficient management of legal documents.

Leverage the capabilities of US Legal Forms today. Start your free trial and navigate your way through legal paperwork with confidence!

Form popularity

FAQ

A transfer on death deed generally does not avoid inheritance tax. However, when you utilize a transfer death deed beneficiary with trust, it streamlines the inheritance process. While property under such a deed passes directly to the beneficiary, estate tax implications may still apply. Consulting a tax professional can help you understand the specific effects on your estate.

A trust deed transfer is a process that allows you to move property into a trust. This can simplify the transition of your assets upon your passing. When you transfer a death deed beneficiary with trust, you ensure that your heirs receive the property without probate delays. This approach helps protect your estate and supports your family's financial future.

The time it takes to transfer property after death varies significantly. If a transfer on death deed is used, this process can often be completed rapidly, sometimes in a matter of weeks. However, if probate is necessary, you may face delays that could extend the transfer to several months. To mitigate delays, consider using services like US Legal Forms for straightforward legal solutions.

Yes, a trust can serve as a transfer on death beneficiary. This arrangement allows the property to seamlessly pass into the trust, ensuring it is managed according to your wishes. It can provide significant flexibility and protection for your beneficiaries. Consulting with a legal expert can help you navigate this option effectively.

While a transfer on death deed offers benefits such as avoiding probate, there are disadvantages to consider. For instance, if the property owner incurs debt, creditors may still claim against the property. Additionally, if the property owner changes their mind about the transfer, they can revoke it, but this requires proper documentation. Understanding these nuances is crucial for effective estate planning.

Transferring a deed after death can take anywhere from a few weeks to several months. This timeline depends on whether there is a will, the type of asset, and state-specific regulations. If a transfer on death deed is already in place, the process is typically faster. Legal guidance can help ensure the transfer is compliant and efficient.

The time it takes to transfer a deed to a family member can vary based on several factors, such as state laws and the property's circumstances. Generally, it can take a few weeks to several months to complete the transfer. You can expedite this process by using tools on platforms like US Legal Forms. They provide resources to help streamline the process of transferring a death deed beneficiary with trust.

The best way to leave property varies based on individual circumstances, but using a transfer death deed beneficiary with trust can be highly effective. This method allows for a smooth transition of property without the hassle of probate. It's important to consider your state's laws and your family dynamics when making this decision. US Legal Forms can assist you in establishing clear and effective estate planning documents.

While a Transfer on Death deed can simplify property transfers, it also carries potential risks. It might not address all aspects of your estate plan, leading to unintended consequences. Furthermore, if property titles are complex, relying solely on a transfer death deed beneficiary with trust may not provide sufficient protections. Consulting resources from US Legal Forms can clarify these concerns and enhance your planning.

The choice between a Transfer on Death (TOD) deed and a beneficiary deed often depends on your individual needs. A TOD deed is simple and effective for transferring property outside of probate, while a beneficiary deed may offer additional benefits in estate management. Evaluating the options related to transfer death deed beneficiary with trust can reveal the best strategy for your situation. US Legal Forms provides valuable templates to help you make an informed decision.