Michigan Inheritance Laws Without A Will

Description

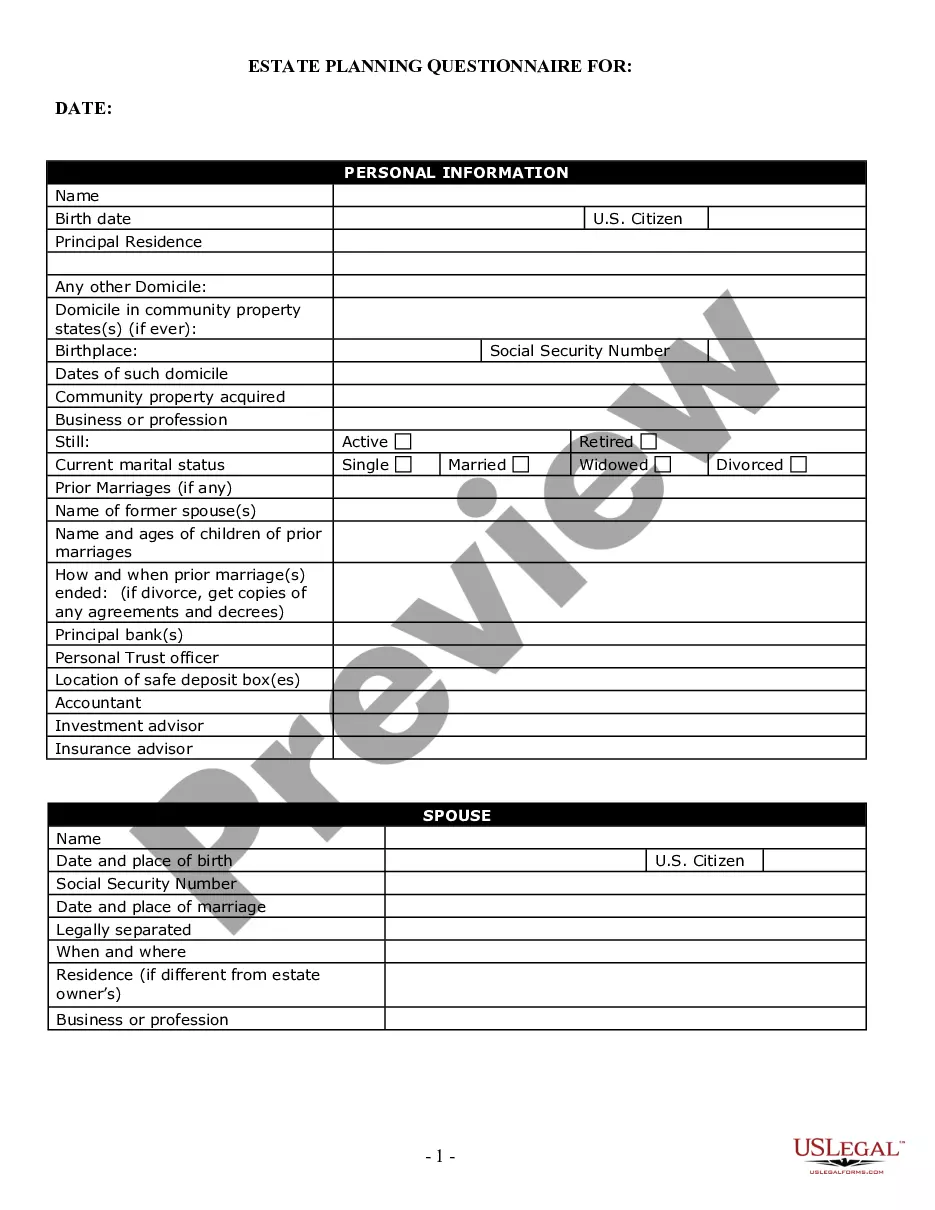

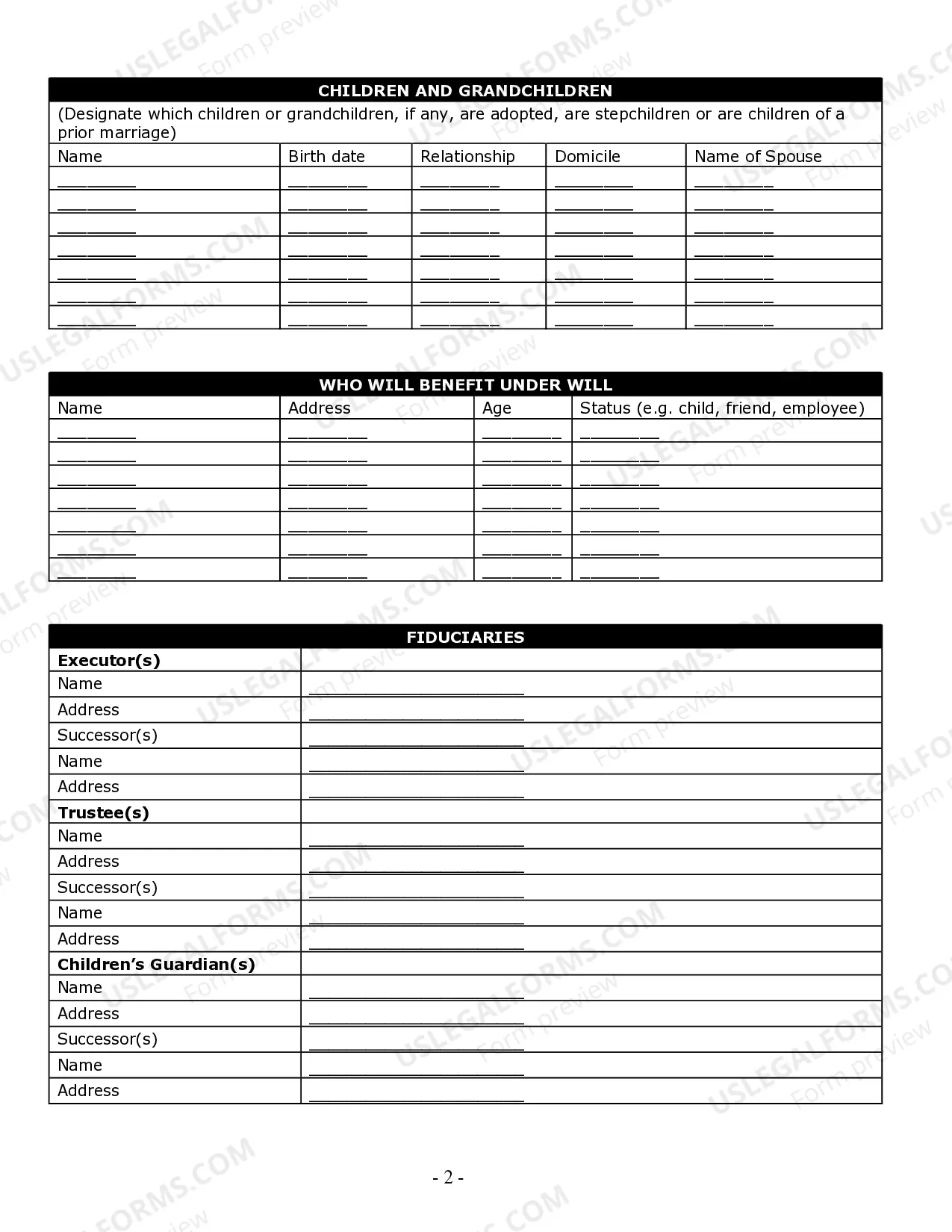

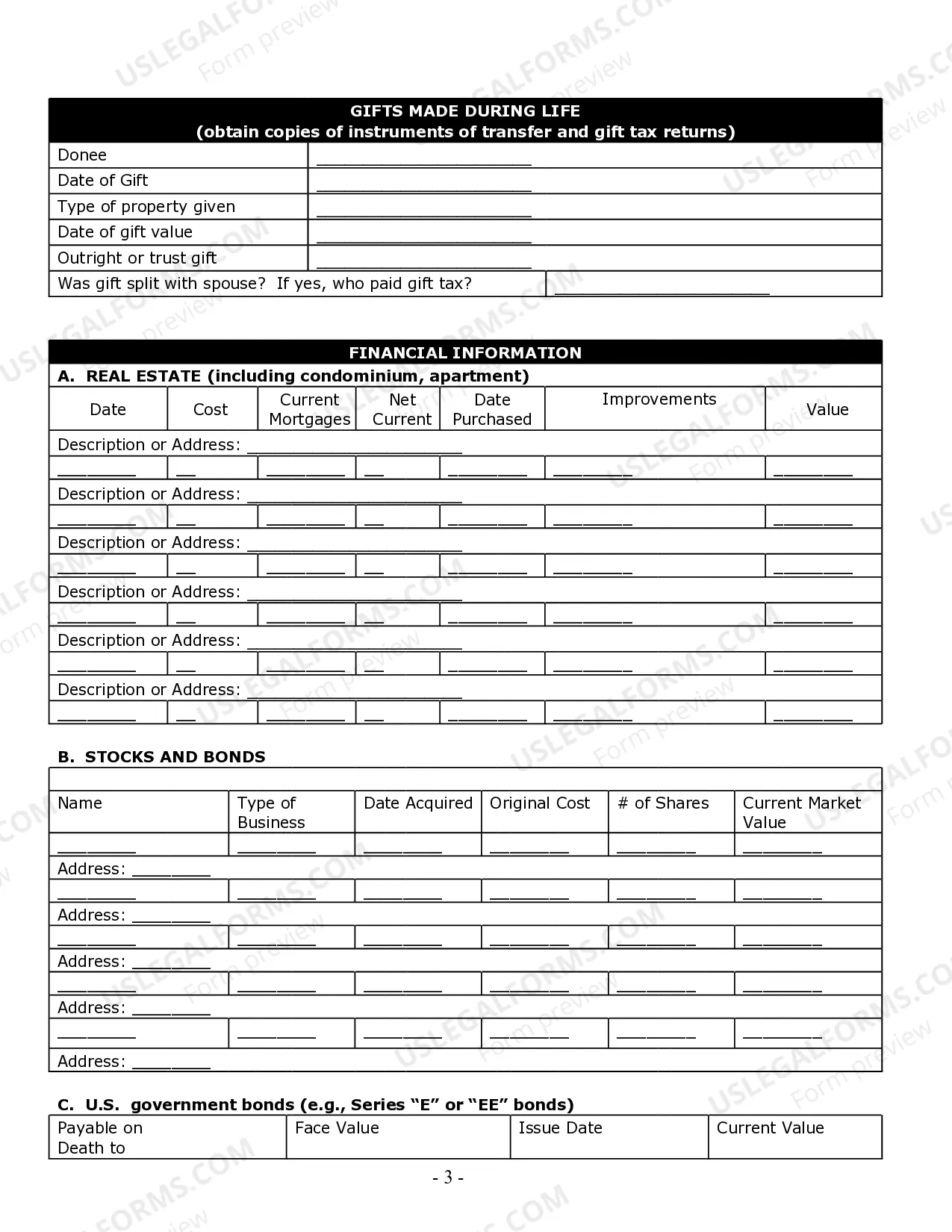

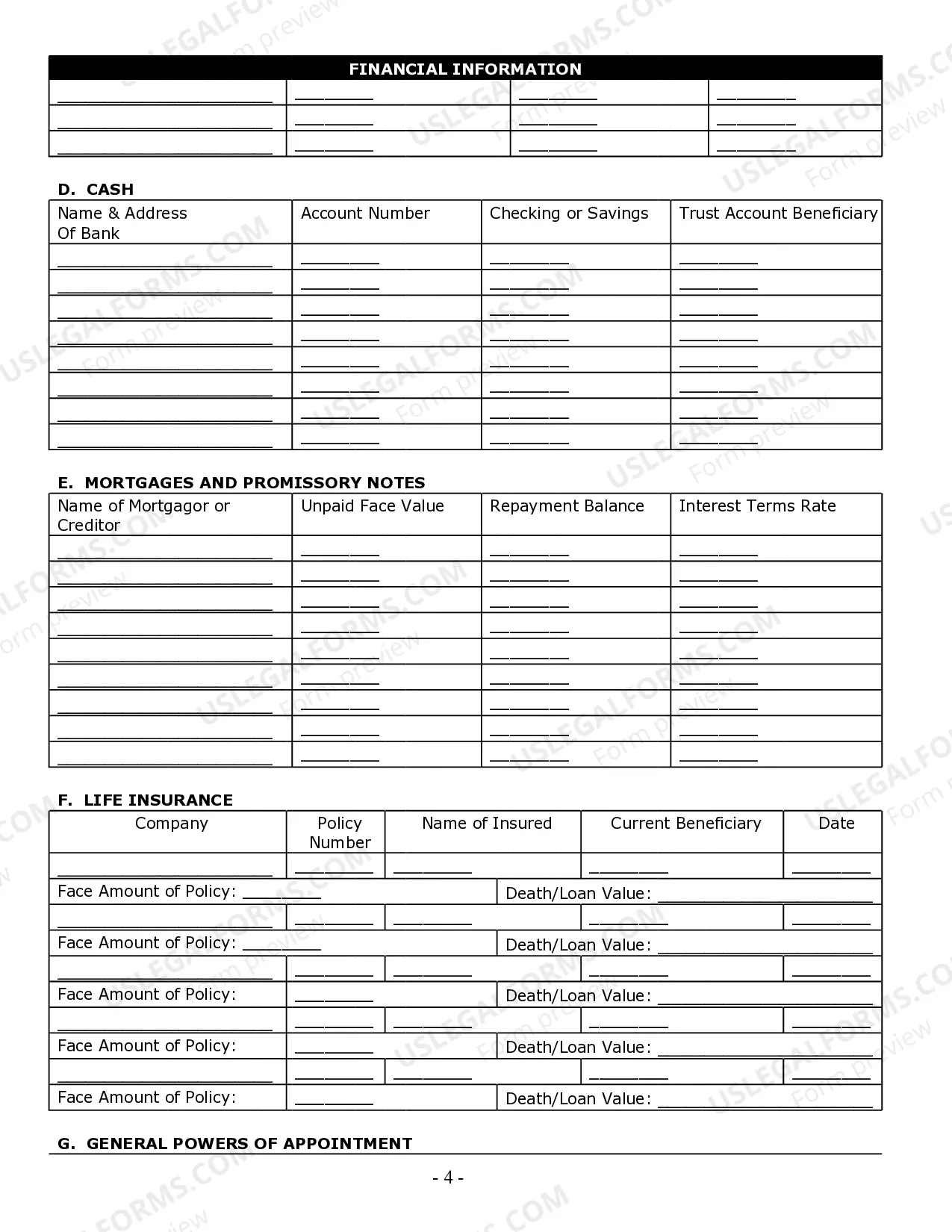

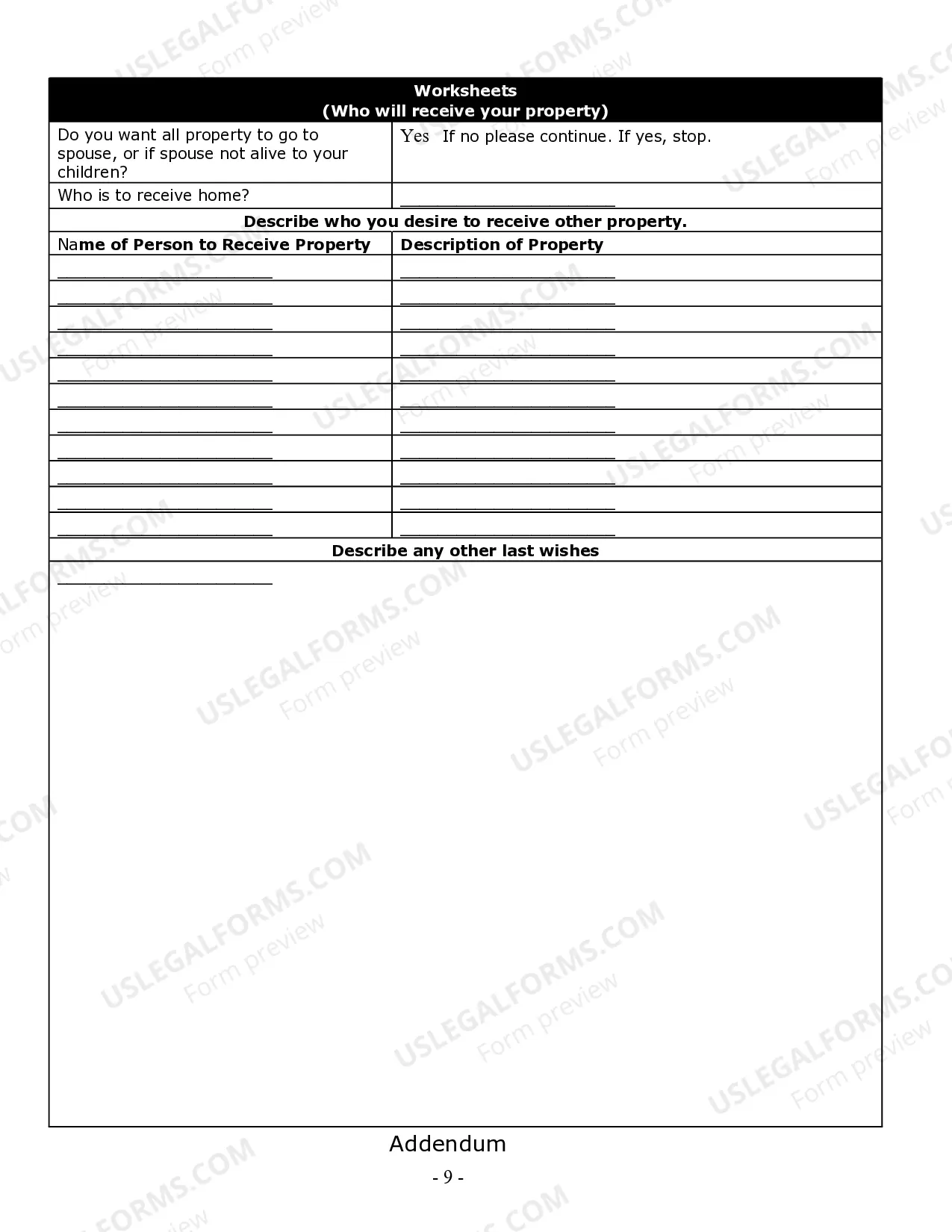

How to fill out Michigan Estate Planning Questionnaire And Worksheets?

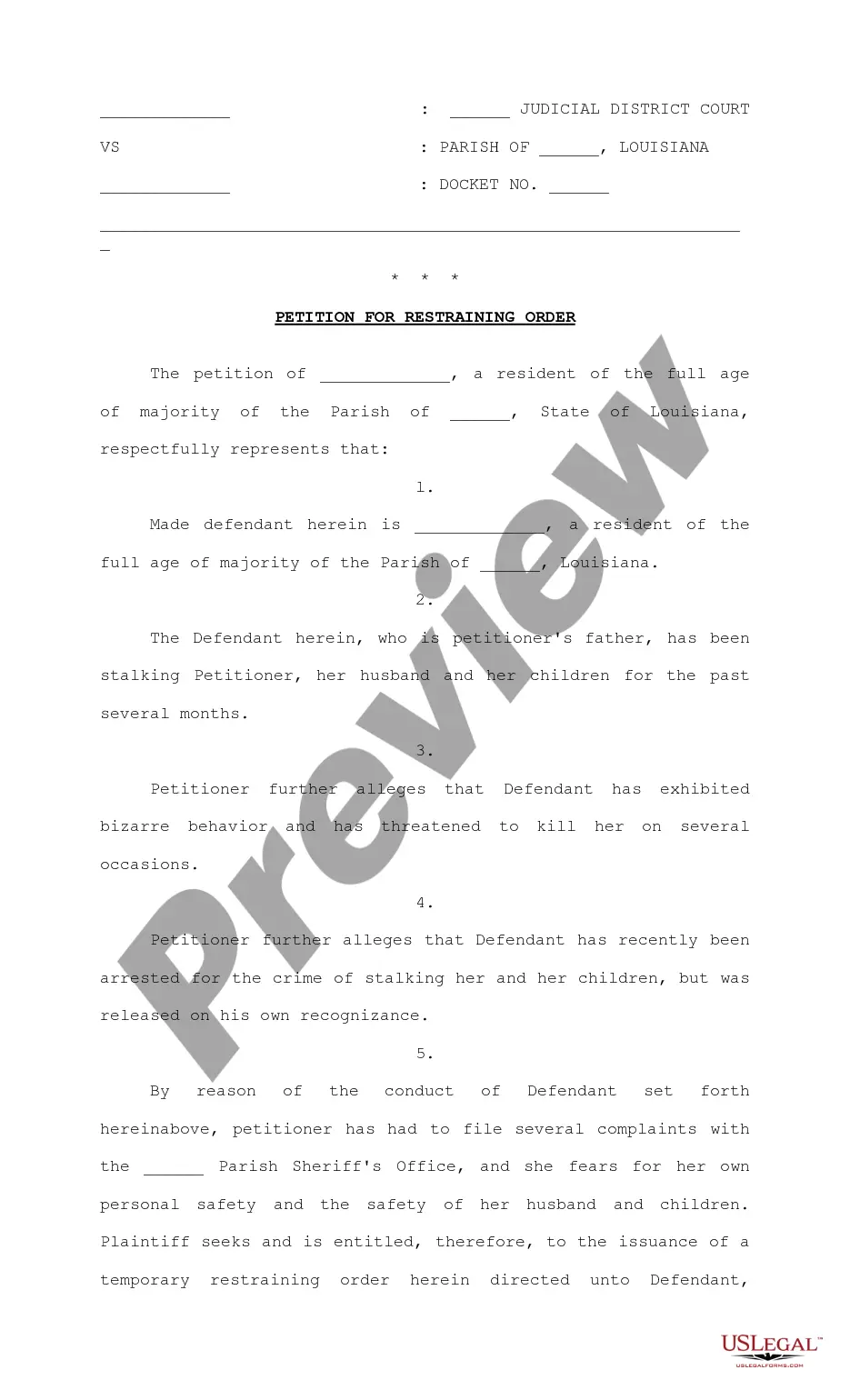

Finding a go-to place to access the most current and relevant legal samples is half the struggle of handling bureaucracy. Finding the right legal papers requirements precision and attention to detail, which is the reason it is very important to take samples of Michigan Inheritance Laws Without A Will only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and see all the details concerning the document’s use and relevance for your circumstances and in your state or region.

Consider the following steps to complete your Michigan Inheritance Laws Without A Will:

- Make use of the library navigation or search field to find your template.

- Open the form’s description to see if it suits the requirements of your state and area.

- Open the form preview, if available, to make sure the template is the one you are searching for.

- Resume the search and find the correct document if the Michigan Inheritance Laws Without A Will does not match your requirements.

- If you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that suits your needs.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a transaction method (bank card or PayPal).

- Pick the file format for downloading Michigan Inheritance Laws Without A Will.

- When you have the form on your gadget, you can alter it with the editor or print it and complete it manually.

Get rid of the hassle that comes with your legal documentation. Explore the comprehensive US Legal Forms collection to find legal samples, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

An individual age 18 or older who has sufficient mental capacity may make a will. 2. There are several kinds of wills. If you choose to complete this form, you will have a Michigan statutory will.

Broadly speaking, Michigan law gives highest priority to the surviving spouse of the decedent, followed by their children and grandchildren, then parents and siblings, followed by more distant relatives.

Inheritance Without a Will in Michigan Your assets will be distributed to legally recognized beneficiaries ing to intestacy succession law. Some aspects of intestacy law in Michigan include: If you are married with no living parents, children, or grandchildren, your living spouse receives your entire estate.

Children in Michigan Inheritance Law Intestate Succession: Spouses and ChildrenChildren, but no spouse? Children inherit everythingSpouse and children with that spouse and children from other relationship? Spouse gets first $150,000 of intestate estate value, plus 50% of the balance ? Descendants inherit everything else4 more rows ?