Michigan Executor Laws

Description

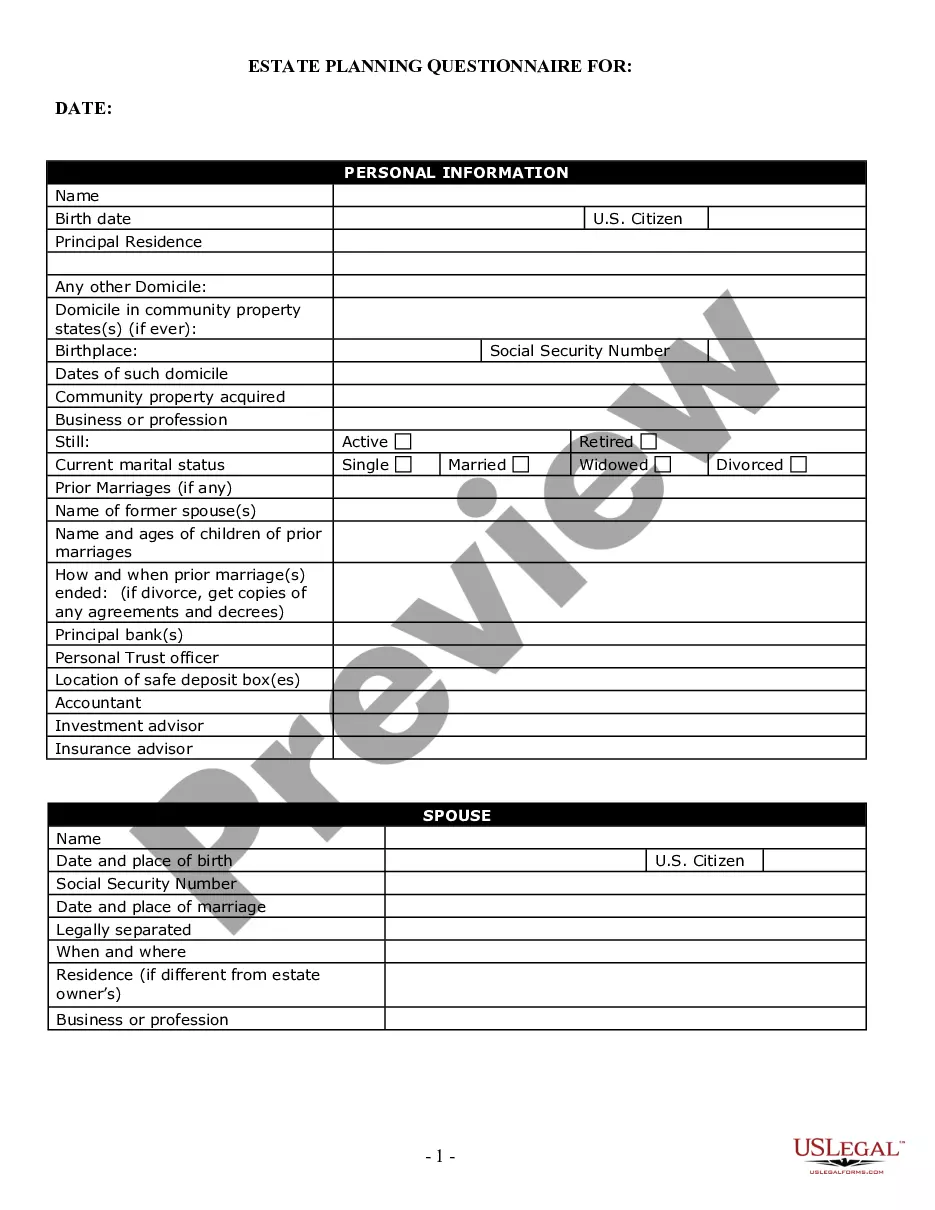

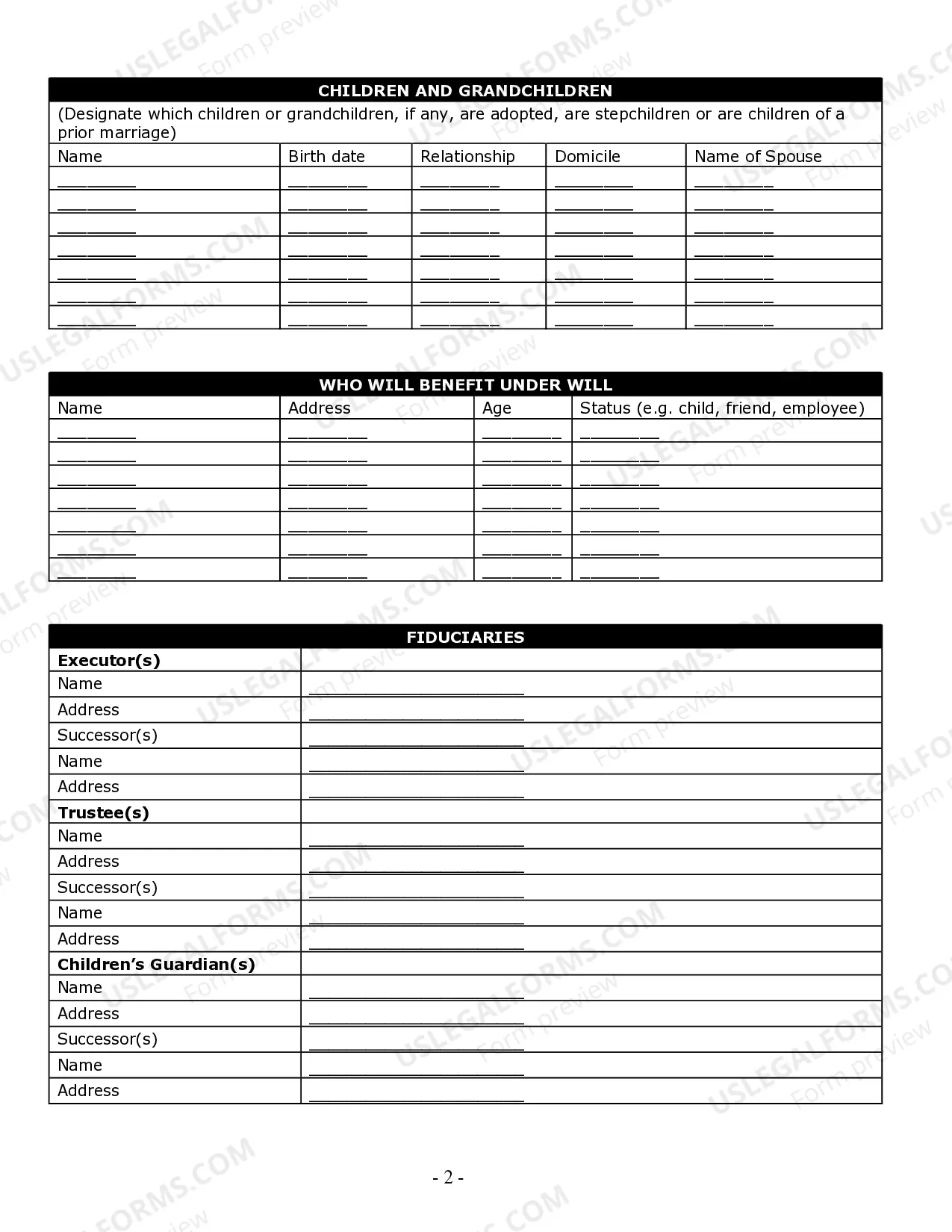

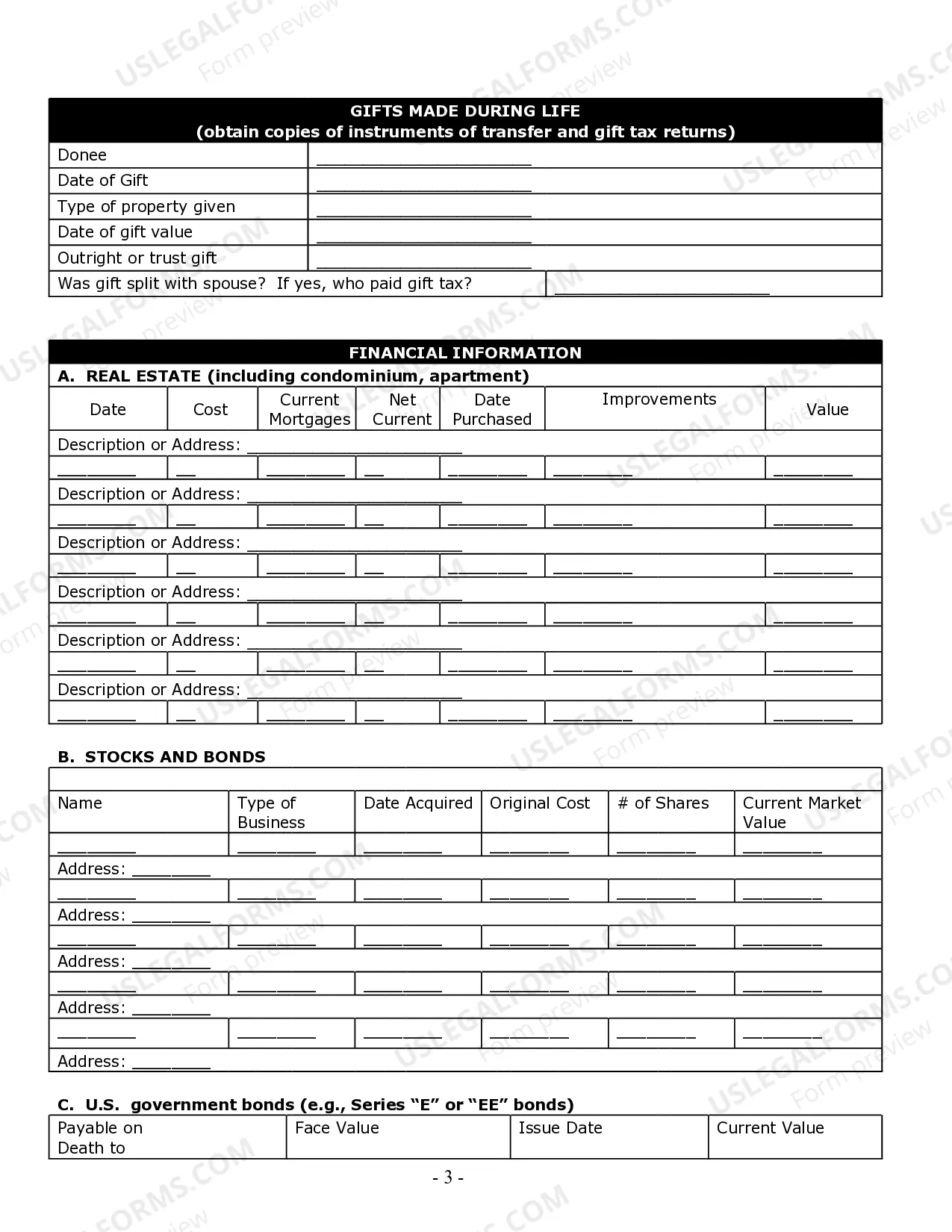

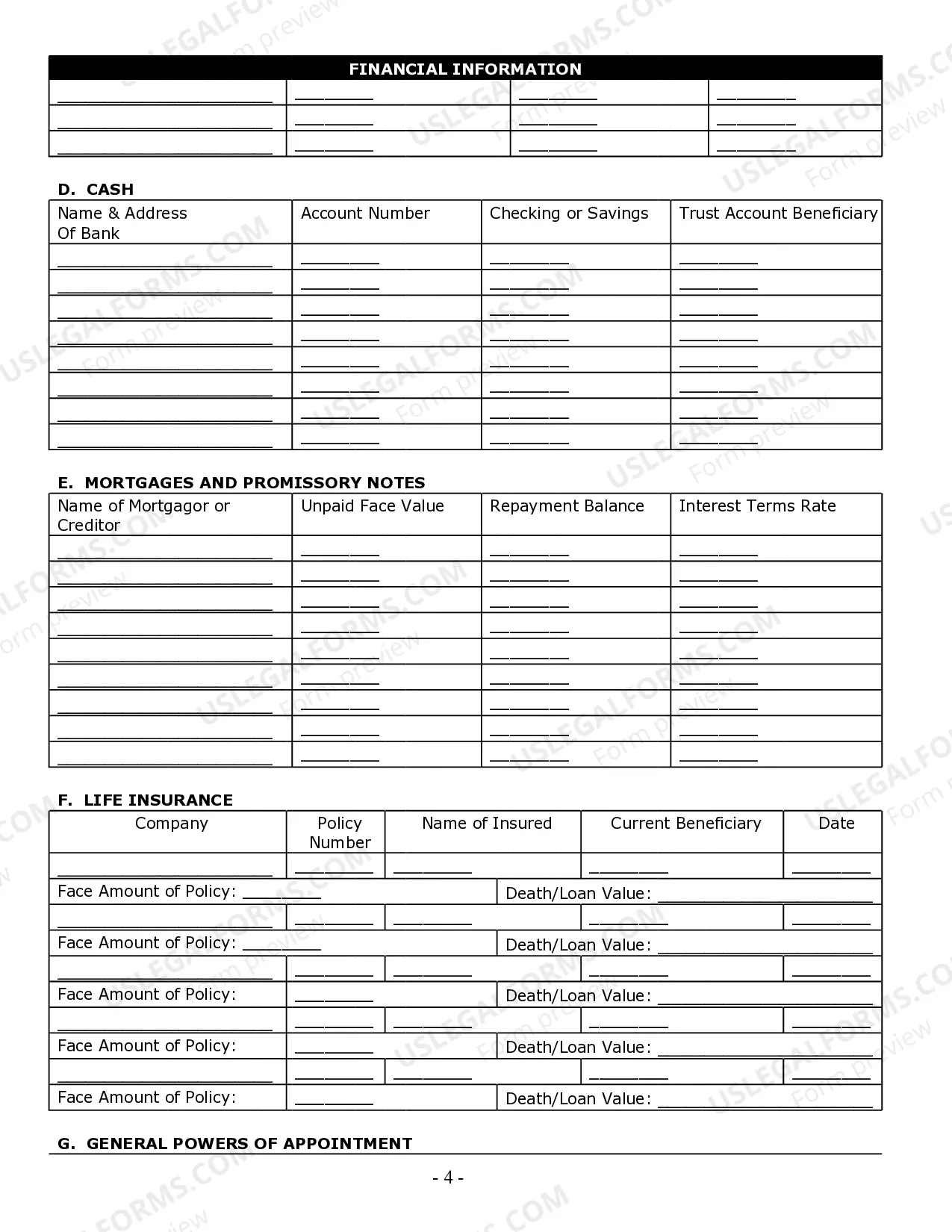

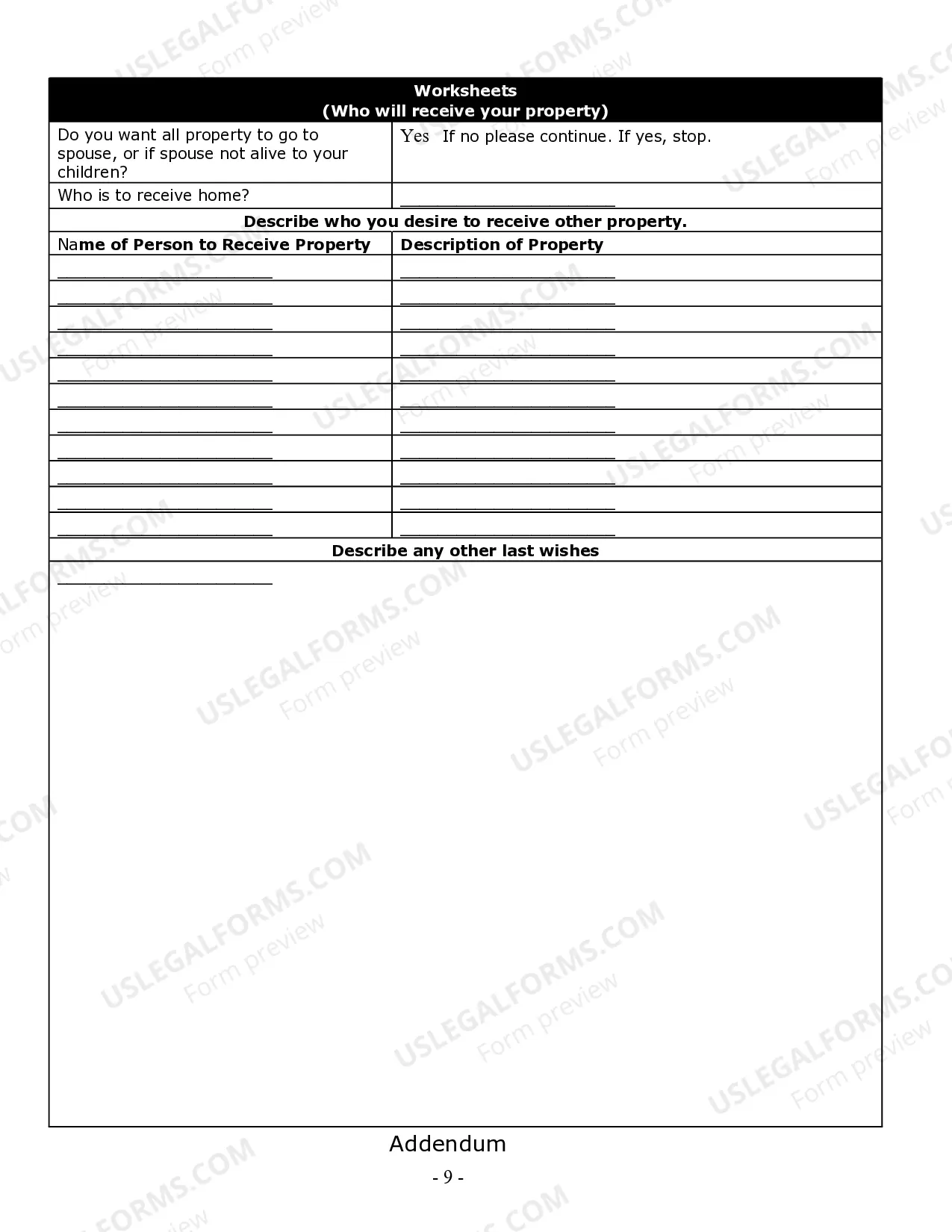

How to fill out Michigan Estate Planning Questionnaire And Worksheets?

Accessing legal document samples that meet the federal and local regulations is a matter of necessity, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the right Michigan Executor Laws sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life situation. They are simple to browse with all papers collected by state and purpose of use. Our professionals stay up with legislative updates, so you can always be confident your paperwork is up to date and compliant when obtaining a Michigan Executor Laws from our website.

Obtaining a Michigan Executor Laws is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the instructions below:

- Analyze the template utilizing the Preview option or via the text outline to ensure it fits your needs.

- Locate a different sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Michigan Executor Laws and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

The executor may have to settle debts with the deceased's creditors. Only after creditors receive what the testator owed can the beneficiaries receive their due. Also, the executor may need to file the deceased personal income taxes. The deceased might owe federal estate taxes if not below the exemption amount.

Basic Requirements for Serving as a Michigan Executor Michigan statutes provide no specific requirements an executor must meet, and you are free to name any adult that you trust as your executor.

Before the executor can finalize probate and close the estate, they must provide a final accounting that includes: An itemized list of the estate's assets. Any funds or property received by the estate during its administration.

This will help justify their requested compensation, especially if disputes arise among the heirs or beneficiaries. Even without a statutory guideline on executor fees in Michigan, the common understanding among legal professionals suggests that an executor can expect to receive about 2-5% of the estate's value.