Michigan Estate Laws For Non Residents

Description

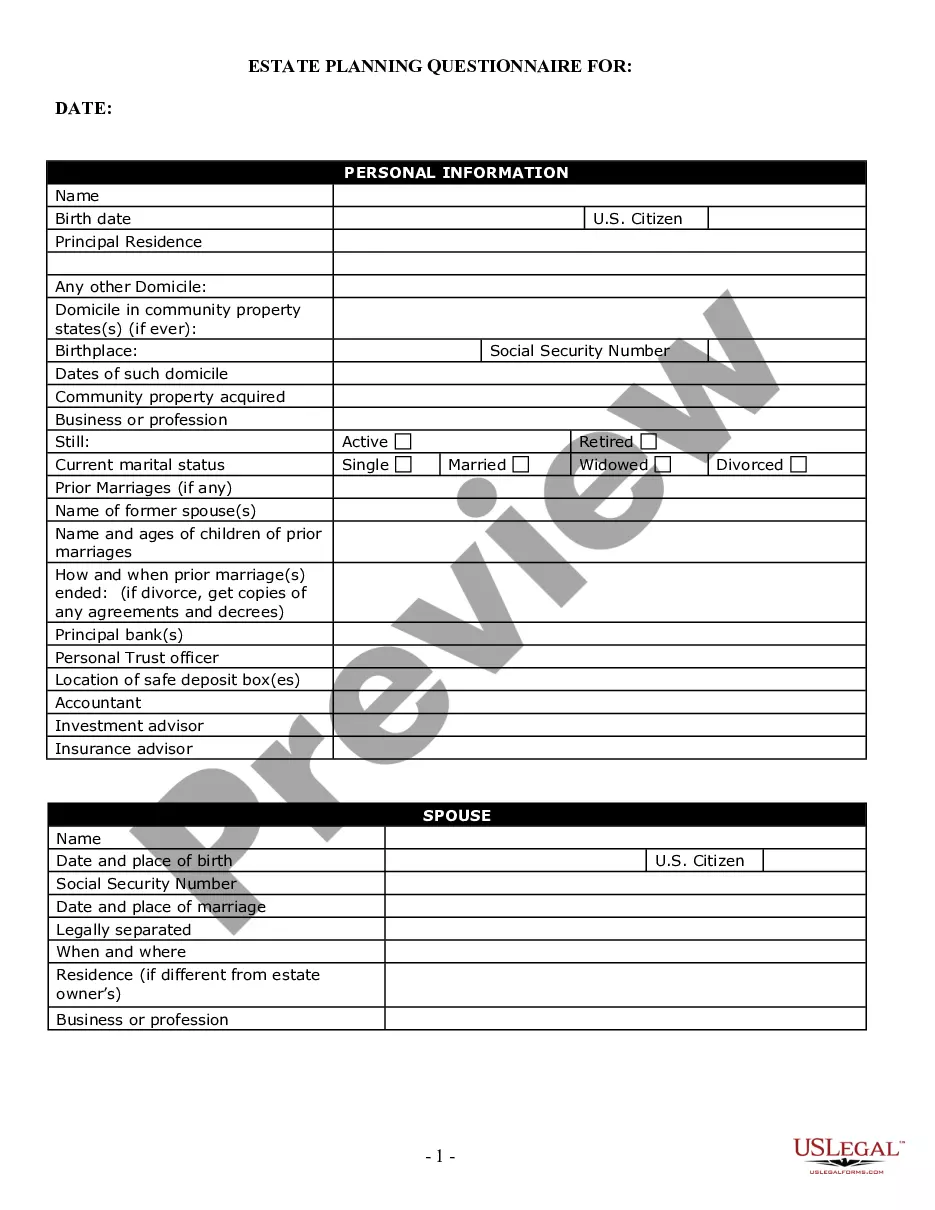

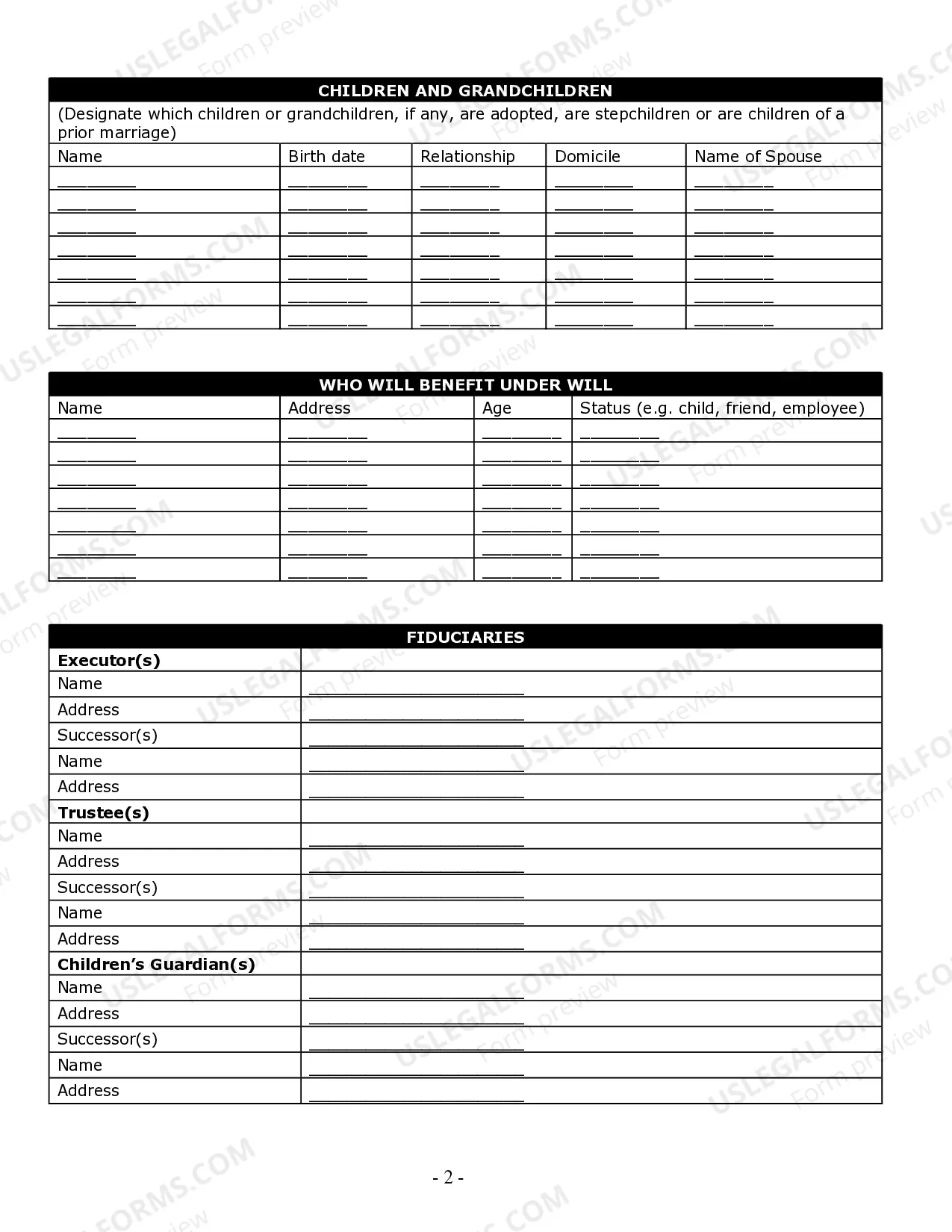

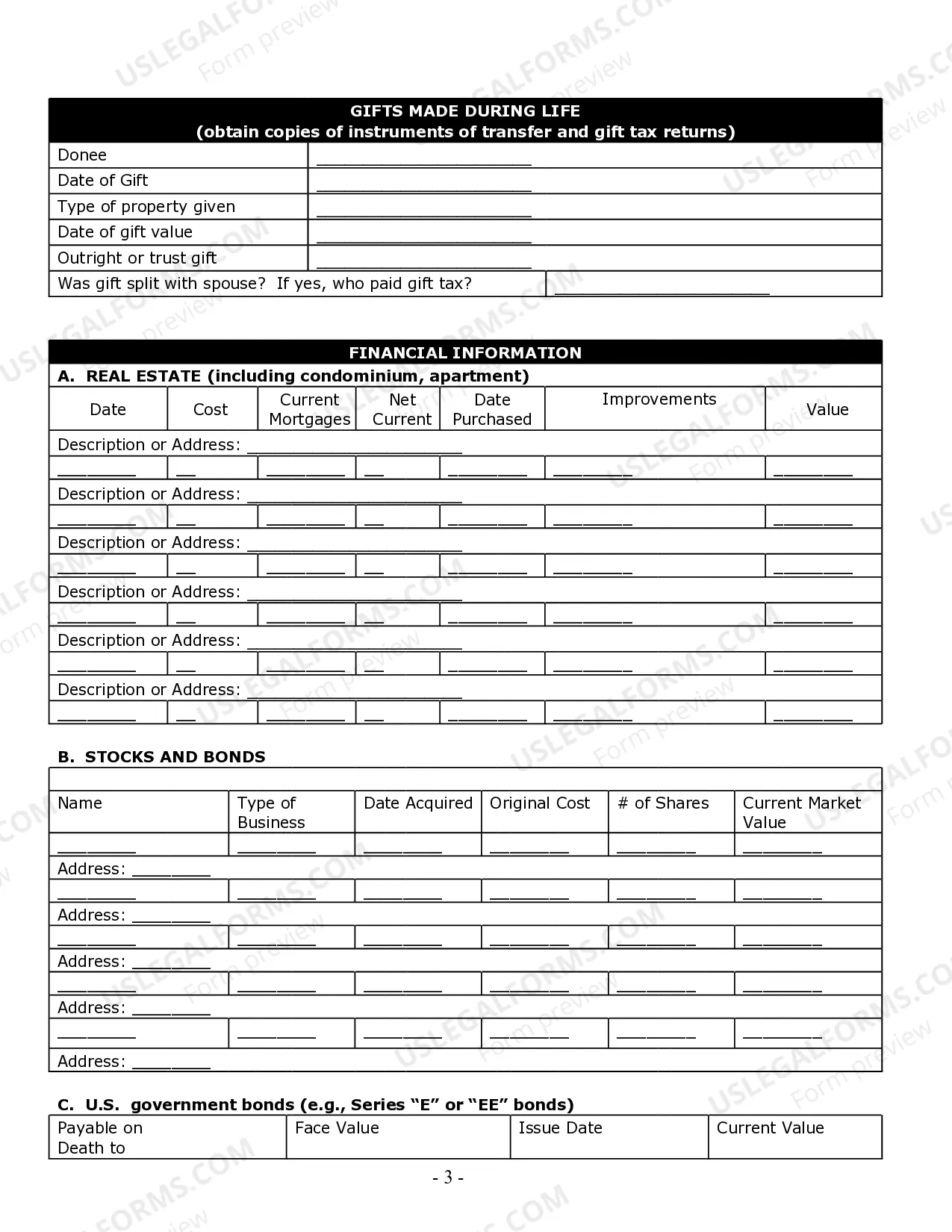

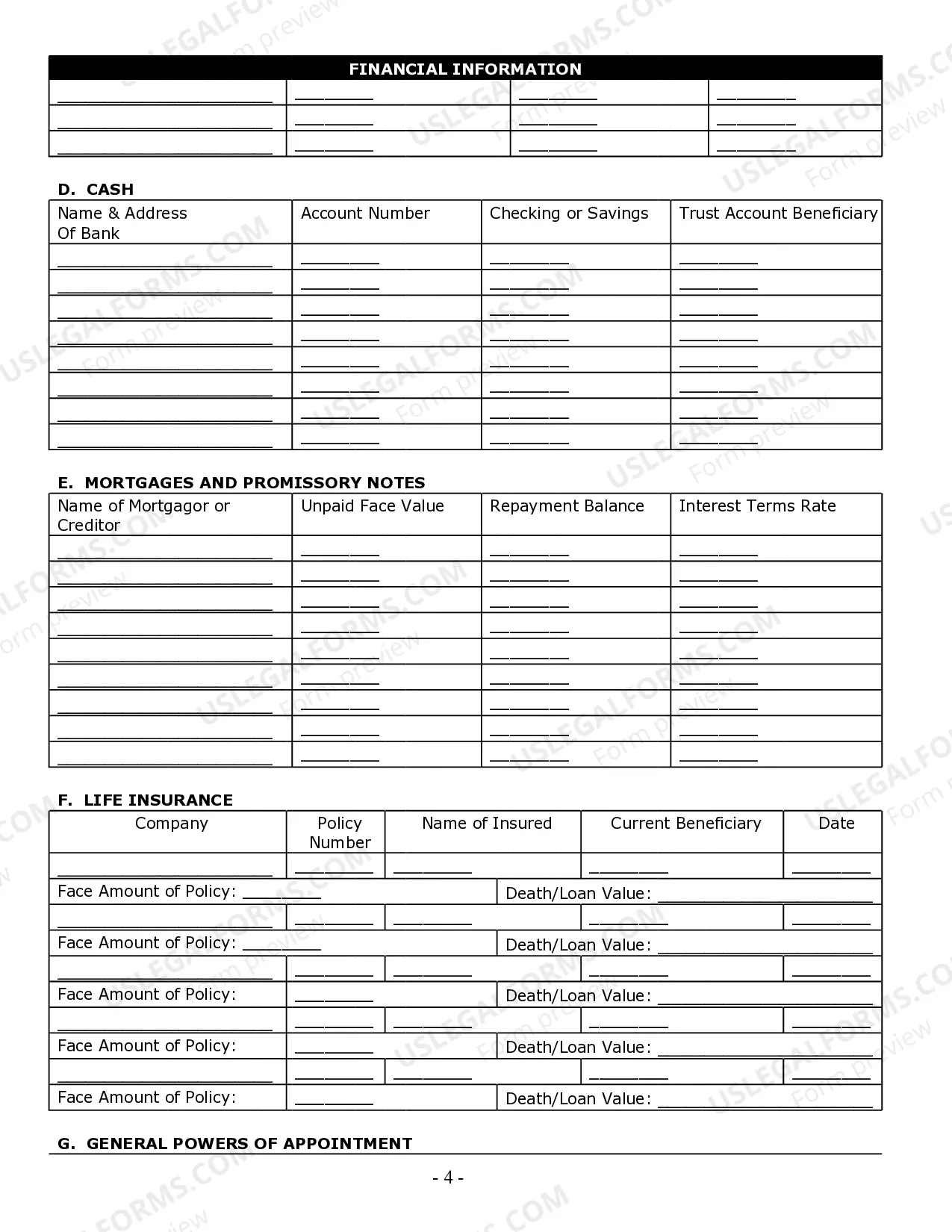

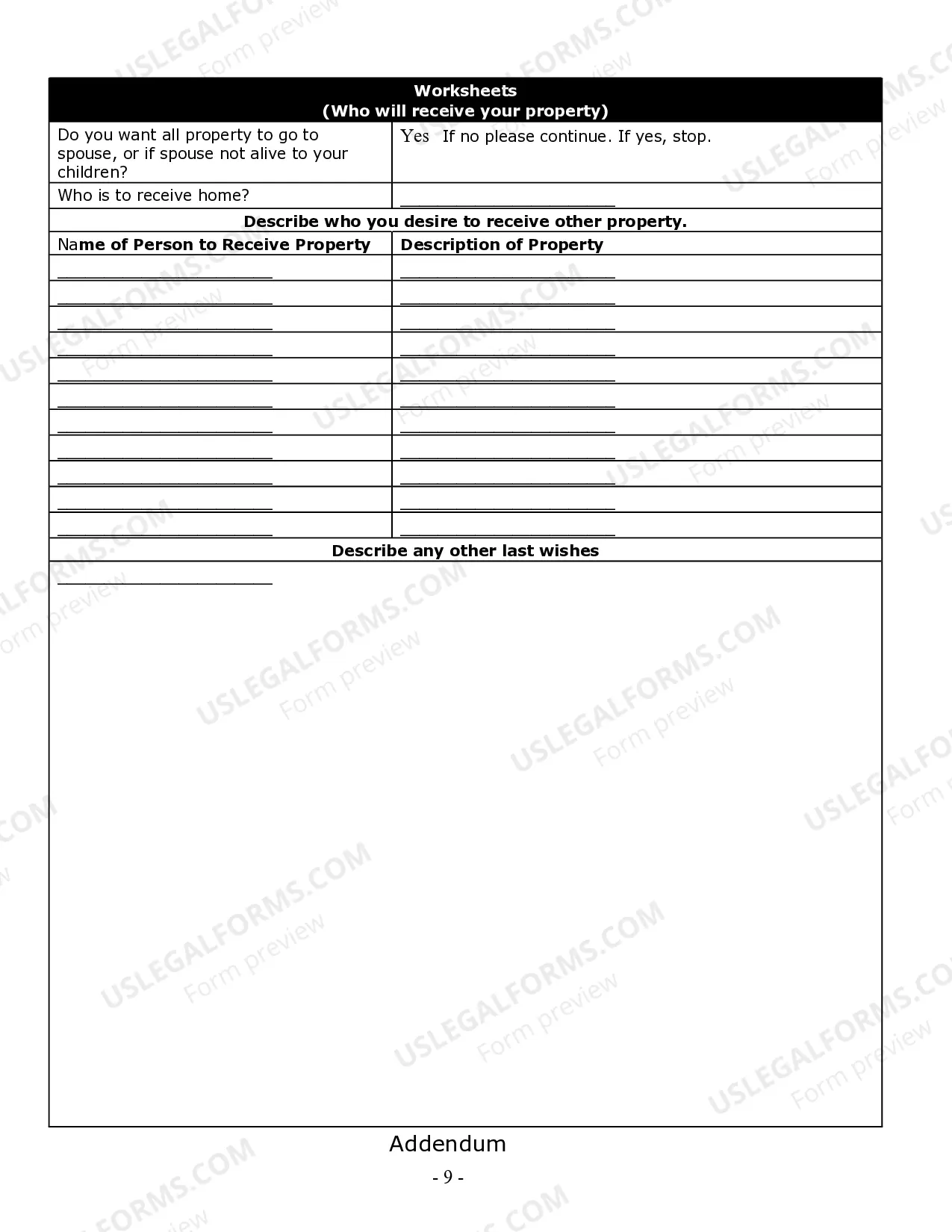

How to fill out Michigan Estate Planning Questionnaire And Worksheets?

Getting a go-to place to access the most recent and relevant legal templates is half the struggle of dealing with bureaucracy. Finding the right legal papers calls for precision and attention to detail, which is the reason it is important to take samples of Michigan Estate Laws For Non Residents only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the information regarding the document’s use and relevance for your circumstances and in your state or county.

Consider the listed steps to complete your Michigan Estate Laws For Non Residents:

- Utilize the catalog navigation or search field to locate your sample.

- Open the form’s information to ascertain if it suits the requirements of your state and region.

- Open the form preview, if available, to make sure the template is the one you are searching for.

- Go back to the search and look for the right template if the Michigan Estate Laws For Non Residents does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Select the pricing plan that suits your preferences.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Select the document format for downloading Michigan Estate Laws For Non Residents.

- When you have the form on your gadget, you can modify it using the editor or print it and complete it manually.

Get rid of the inconvenience that accompanies your legal documentation. Explore the extensive US Legal Forms catalog where you can find legal templates, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Closing the Estate The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing.

Here are a few common instances where assets do not require probate in the State of Michigan: Assets owned under ?joint tenancy.? Beneficiary designation assets (i.e. retirement accounts with a listed beneficiary) When the decedent has assets named within a trust.

If the estate is not settled within a year of the first personal representative's appointment, file a Notice of Continued Administration with the court stating why the estate must remain open.

Since Michigan is not a state that imposes an inheritance tax, the inheritance tax in 2023 is 0% (zero). As a result, you won't owe Michigan inheritance taxes.

There is no estate tax in Michigan. No matter the size of your estate, you won't owe money to the Wolverine State. You might owe taxes to the federal government through the federal estate tax, depending on the size of your estate.