Michigan Attorney For Withholding Tax

Description

How to fill out Michigan Revocation Of Do Not Resuscitate Order?

Drafting legal paperwork from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of preparing Michigan Attorney For Withholding Tax or any other forms without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of over 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-compliant templates diligently prepared for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can quickly locate and download the Michigan Attorney For Withholding Tax. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Michigan Attorney For Withholding Tax, follow these recommendations:

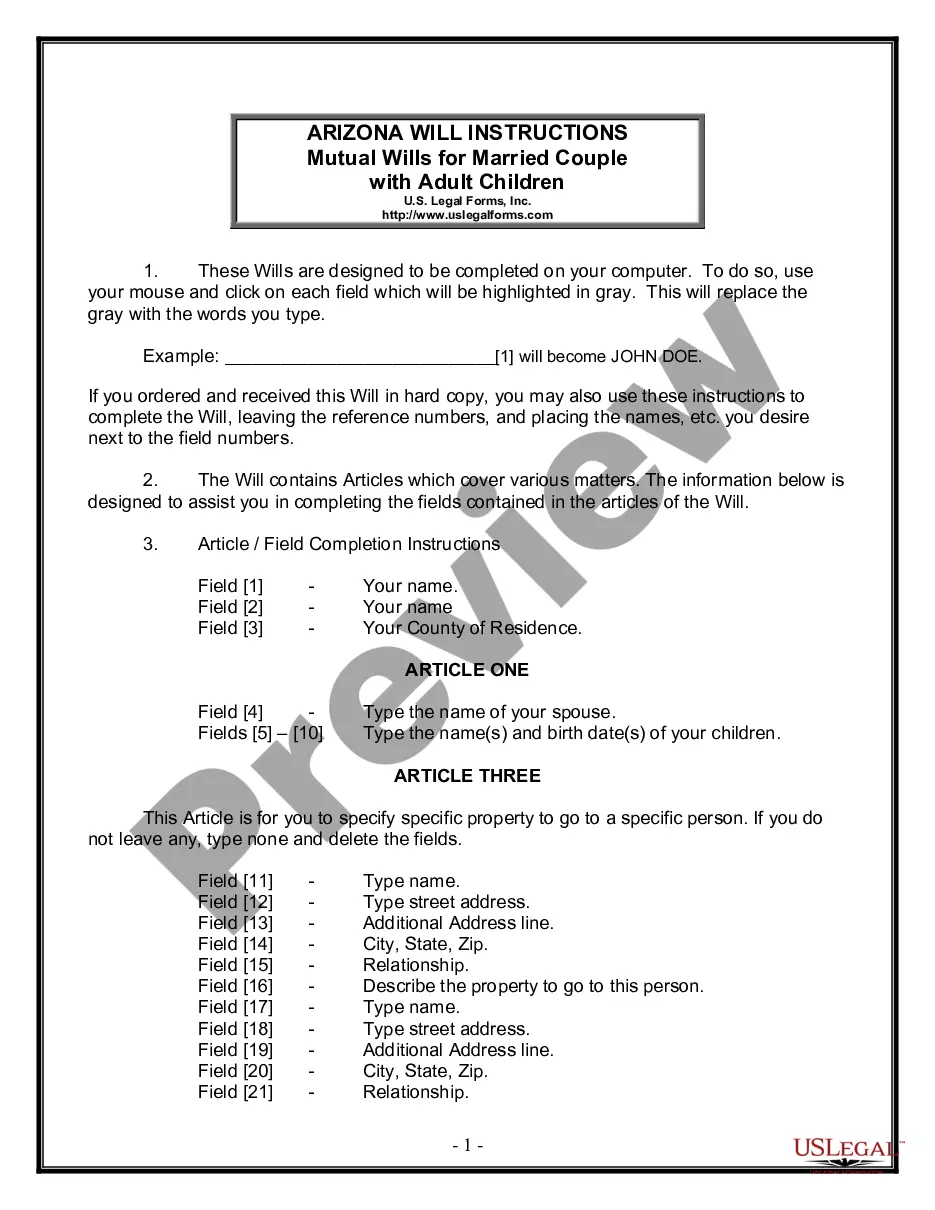

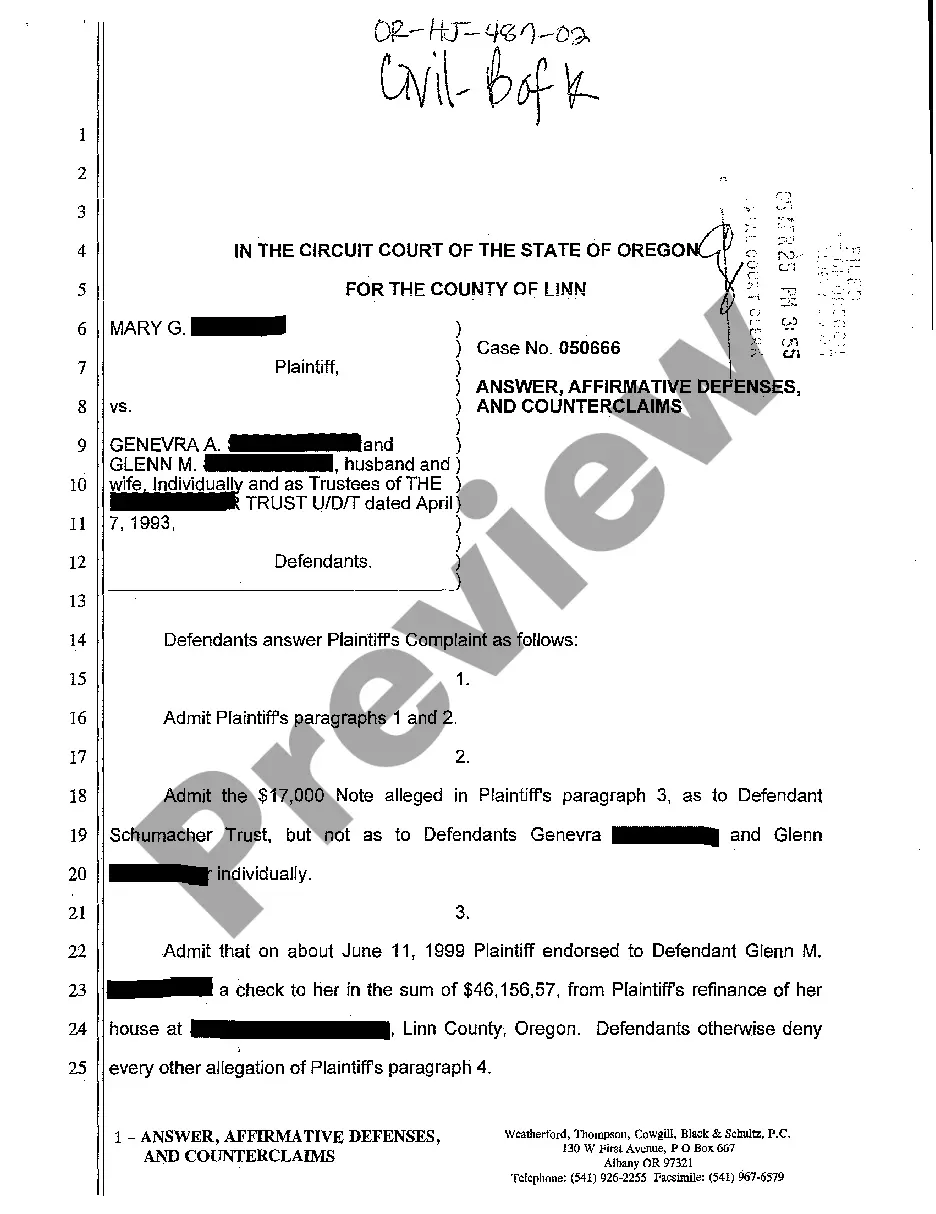

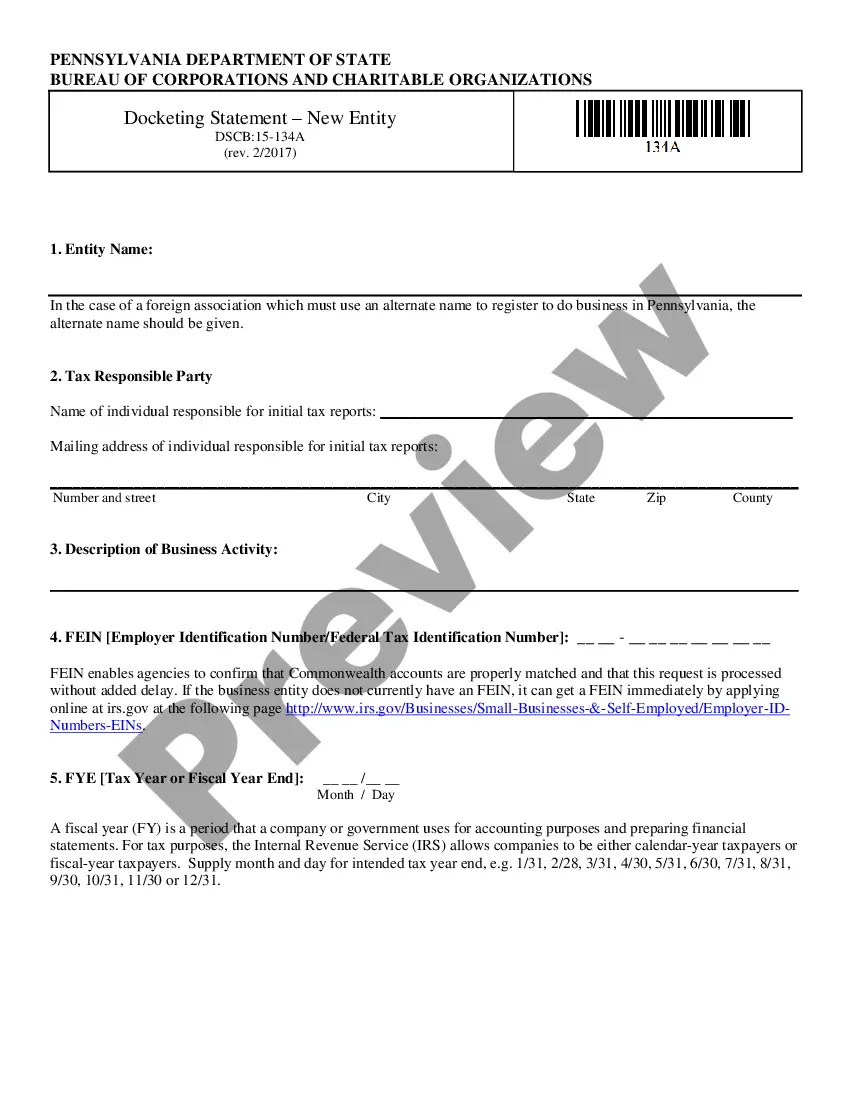

- Check the document preview and descriptions to ensure that you have found the form you are looking for.

- Make sure the template you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Michigan Attorney For Withholding Tax.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and turn form execution into something simple and streamlined!

Form popularity

FAQ

All businesses are required to file an annual return each year. Remit withholding taxes on or before the same day as the federal payments regardless of the amount due. Payment must be made by EFT using an EFT Credit or EFT Debit payment method.

You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions.

Line 8: You may claim exemption from Michigan income tax withholding ONLY if you do not anticipate a Michigan income tax liability for the current year because all of the following exist: a) your employment is less than full time, b) your personal and dependent exemption allowance exceeds your annual compensation, c) ...

The withholding amount equals the payment amount multiplied by 4.25 percent (0.0425).

Every employer in Michigan who is required to withhold federal income tax under the Internal Revenue Code, must also be registered for and withhold Michigan income tax.