Michigan Probate Small Estate Form

Description

Form popularity

FAQ

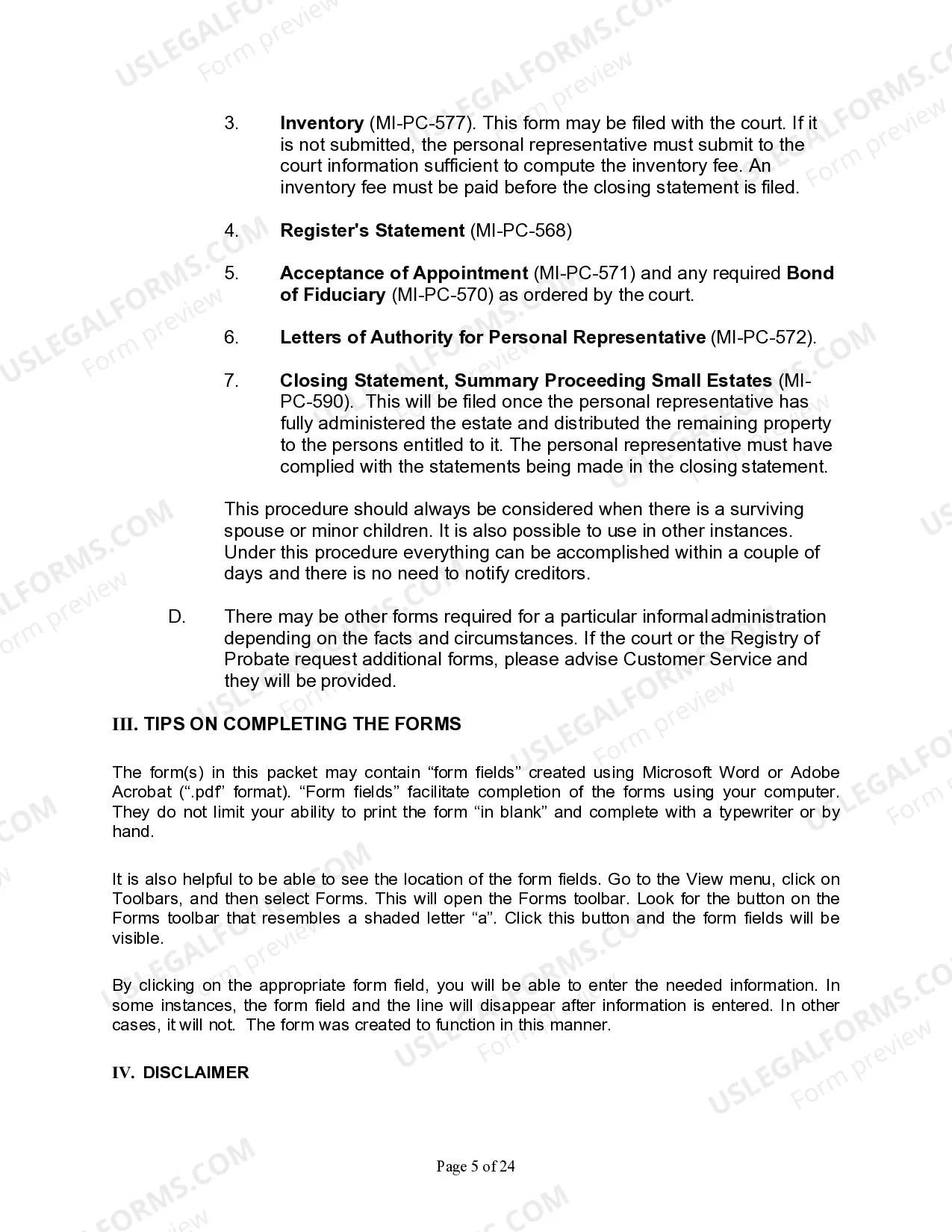

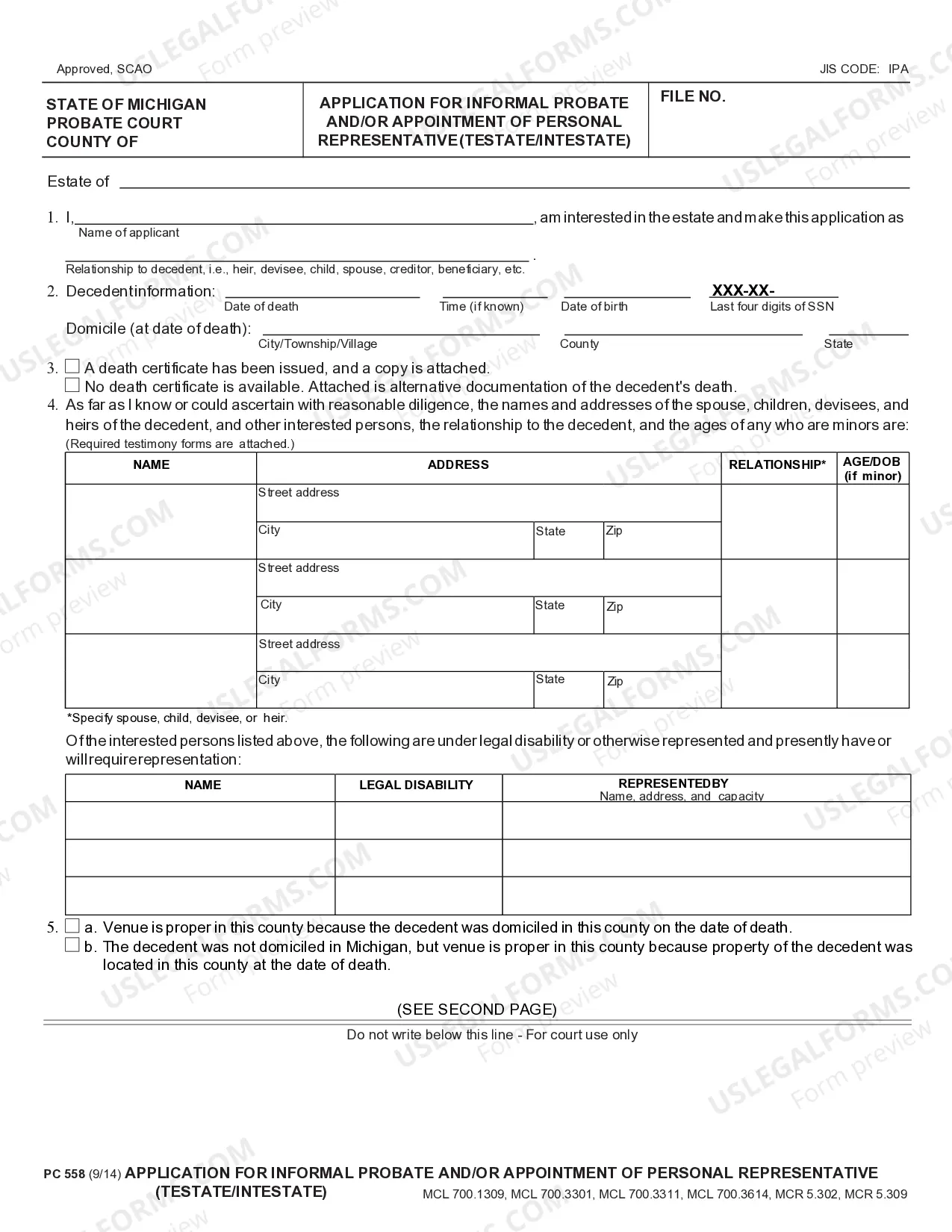

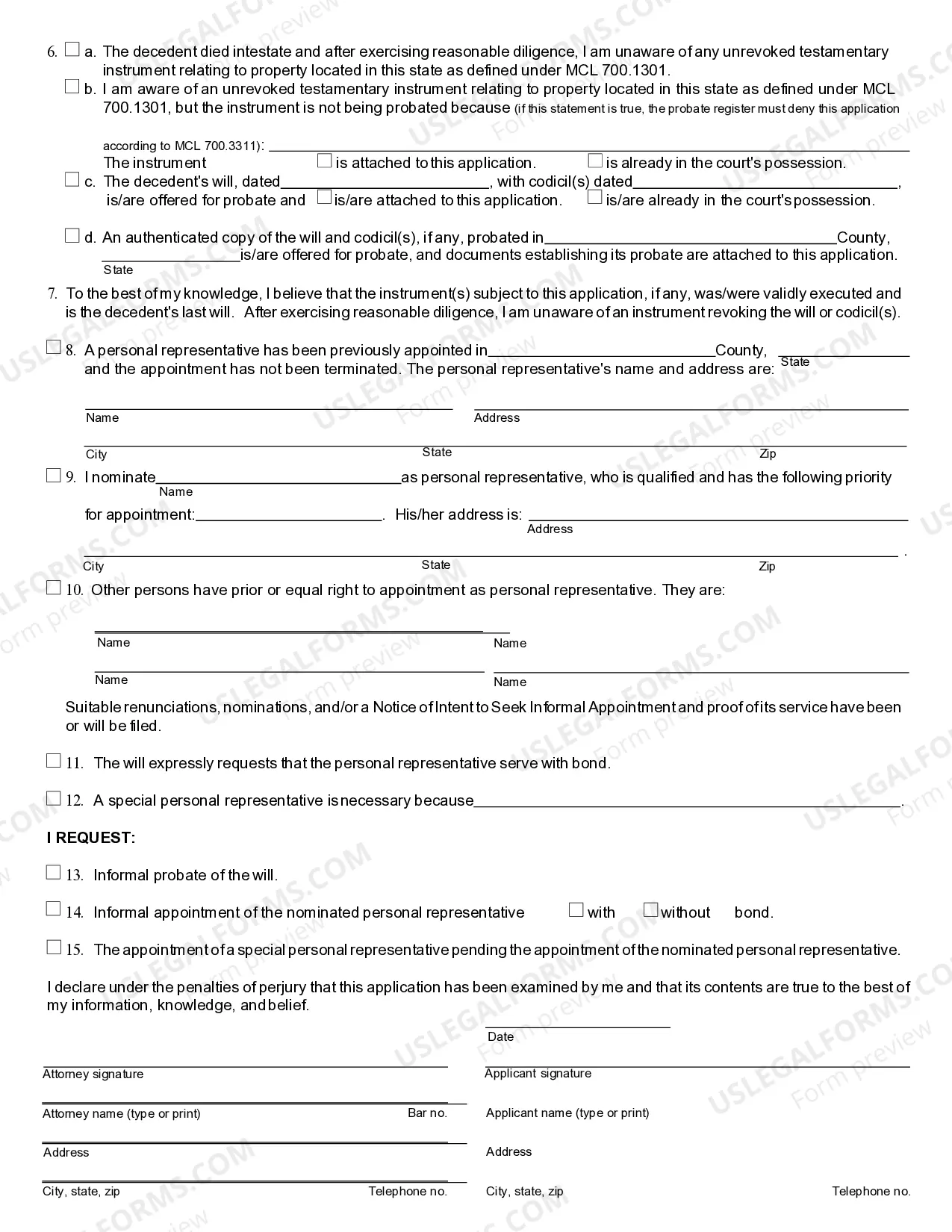

To fill out the Michigan probate small estate form, begin by gathering the necessary information regarding the deceased's estate. You'll need details about assets, their value, and any outstanding debts. Clearly follow the instructions provided in the form, ensuring all sections are completed accurately. Using a reliable platform like US Legal Forms can simplify the process, making it easier for you to navigate the requirements and submit your affidavit correctly.

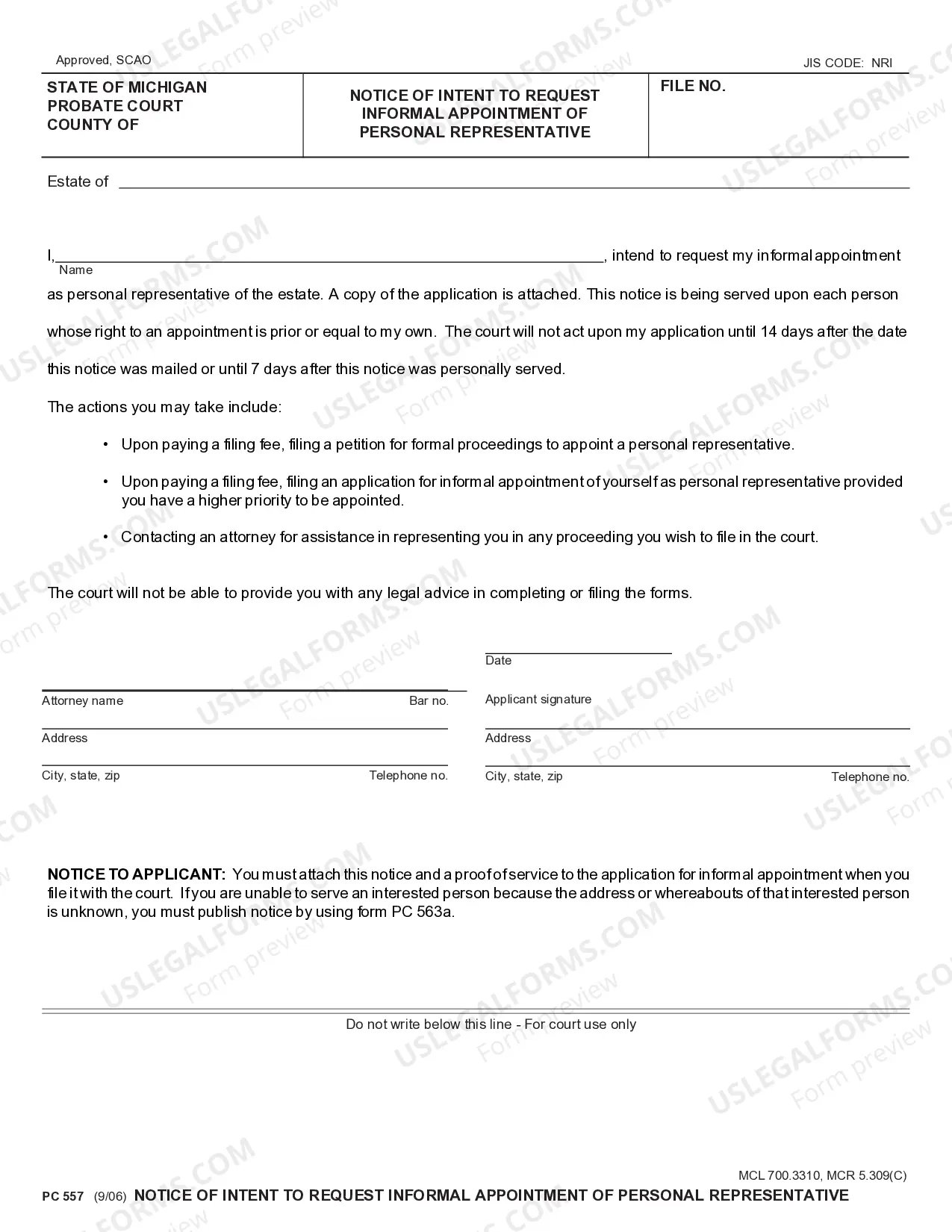

While you don’t necessarily need a lawyer to file for probate in Michigan, having legal guidance can help streamline the process. If your case involves a small estate, utilizing the Michigan probate small estate form may reduce the need for legal advice. However, if you feel uncertain, consulting a professional can provide peace of mind.

To obtain a small estate affidavit in Michigan, you need to complete the Michigan probate small estate form. This document allows heirs to collect the deceased person's assets without going through full probate. You can find this form online or through local probate court resources to ensure compliance with Michigan laws.

In Michigan, an estate encompasses all the assets and liabilities left by a deceased person. This includes real estate, bank accounts, personal belongings, and any outstanding debts. Understanding what constitutes an estate is crucial for effectively utilizing the Michigan probate small estate form to manage these assets.

To begin the probate process in Michigan, you should file the necessary documents with the local probate court. If the estate qualifies as a small estate, you may use the Michigan probate small estate form to streamline this process. Gathering an inventory of the deceased's assets can also help you prepare for the filing.

A small estate in Michigan is defined as having a total value of no more than $25,000. This limit allows families to bypass more complex probate procedures. By using the Michigan probate small estate form, individuals can expedite the transfer of assets without significant legal fees.

In Michigan, a small estate generally refers to estates valued at $25,000 or less for individuals. This amount applies to the total value of assets owned by the deceased. Utilizing the Michigan probate small estate form can help simplify the process for qualifying estates, allowing heirs to claim assets more easily.

Various assets are exempt from probate in Michigan, including life insurance policies with designated beneficiaries and retirement accounts. Additionally, assets held in joint tenancy or those placed in a living trust generally do not require probate. If you’re dealing with a small estate, the Michigan probate small estate form can simplify the process, allowing you to quickly transfer the exempt assets without the lengthy probate procedures. Always check with an expert to ensure compliance.

In many cases, a car owned solely by the deceased will need to go through probate in Michigan. However, if the vehicle is jointly owned or if there is a beneficiary designation, it may bypass probate altogether. Utilizing the Michigan probate small estate form can help streamline the process for vehicles and other assets, making it easier for heirs to settle the estate. It’s wise to consult with a legal professional to understand the best approach.

In Michigan, you generally have to file for probate within 42 days after the death of the individual. Failing to file in this timeframe can lead to complications, so it’s important to act promptly. Using Michigan probate small estate form can expedite the process if the estate meets the criteria for small estates. This form helps ensure that the estate is settled efficiently and in accordance with state laws.