Land Contract With Balloon Payment

Description

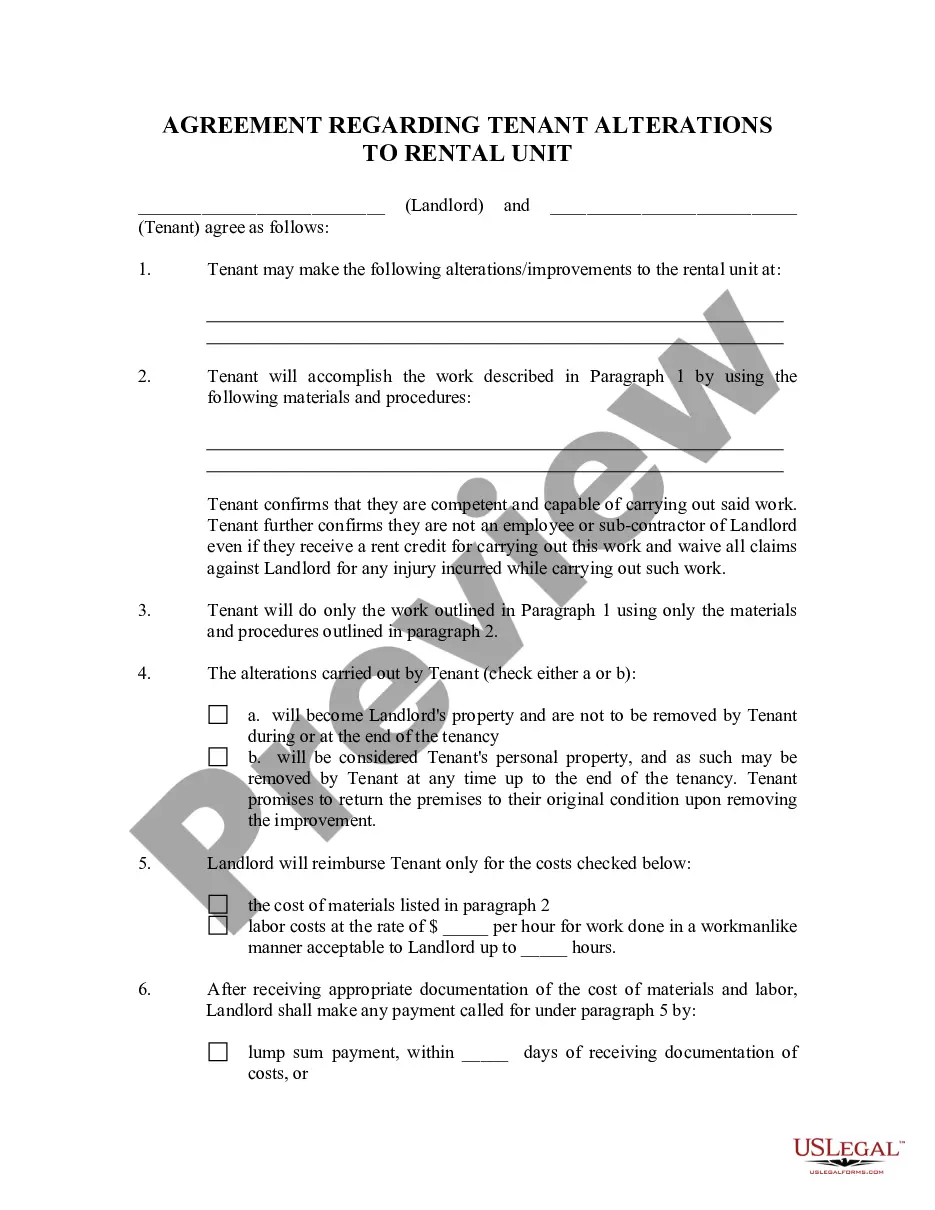

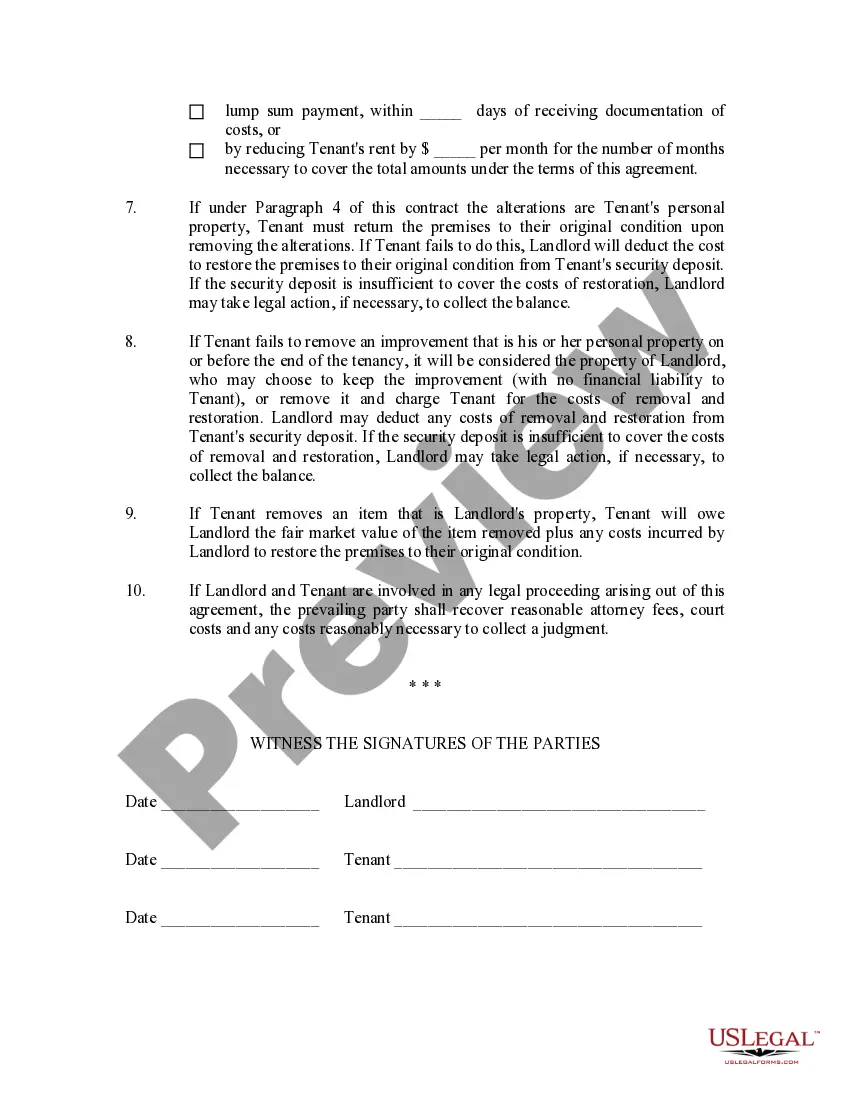

How to fill out Michigan Landlord Agreement To Allow Tenant Alterations To Premises?

Maneuvering through the red tape of official paperwork and forms can be challenging, particularly when one does not engage in that professionally.

Selecting the appropriate template for a Land Contract With Balloon Payment will also take considerable time, as it must be valid and precise to the very last numeral.

However, you will undoubtedly save a significant amount of time locating a suitable template if it originates from a dependable source.

Obtain the correct form in a few simple steps: Enter the document title in the search box, find the appropriate Land Contract With Balloon Payment from the results, review the sample's description or view its preview. If the template meets your requirements, click Buy Now, choose your subscription plan, register an account at US Legal Forms using your email and create a password, select a payment method via credit card or PayPal, and save the template file to your device in your preferred format. US Legal Forms can conserve your time and energy in researching whether the form you found online is suitable for your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the task of finding the correct documents online.

- US Legal Forms is a singular location where one can access the latest examples of paperwork, verify their usage, and download these examples for completion.

- It serves as a repository with over 85K forms applicable in diverse fields.

- While searching for a Land Contract With Balloon Payment, you won’t have to doubt its validity as all the templates are verified.

- Having an account on US Legal Forms ensures you have all the necessary documents at your fingertips.

- Organize them in your history or add them to the My documents repository.

- You can access your saved documents from any device by simply clicking Log In on the library's website.

- If you do not currently possess an account, you can always search for the template you require.

Form popularity

FAQ

Parties who only extend financing for the purchase of real estate under land contracts to be licensed. parties who extend financing for the purchase of real estate to be licensed. What is the most prevailing disadvantage of a land contract to the seller? the loan period.

The most significant disadvantage of a land contract is the amount of risk both parties take on.

The parties will also agree on the interest rate. However, in Michigan the interest rate cannot be above 11%. It is possible for the interest rate to change over time, but the average interest rate has to be 11% or less.

That would allow the payments to be added to your credit report. But, more often than not, individuals who act as creditors in a land contract arrangement do not report payment history because they have to pay a fee to register with the reporting agencies and report payments. Consider negotiating with the seller.

To calculate the interest payment, multiply the amount financed by the interest rate, and divide the result by the number of installments in a year. For example, the monthly interest payment on a $200,000 land contract home with an 8% interest rate after a 10% down payment would be $1,200.