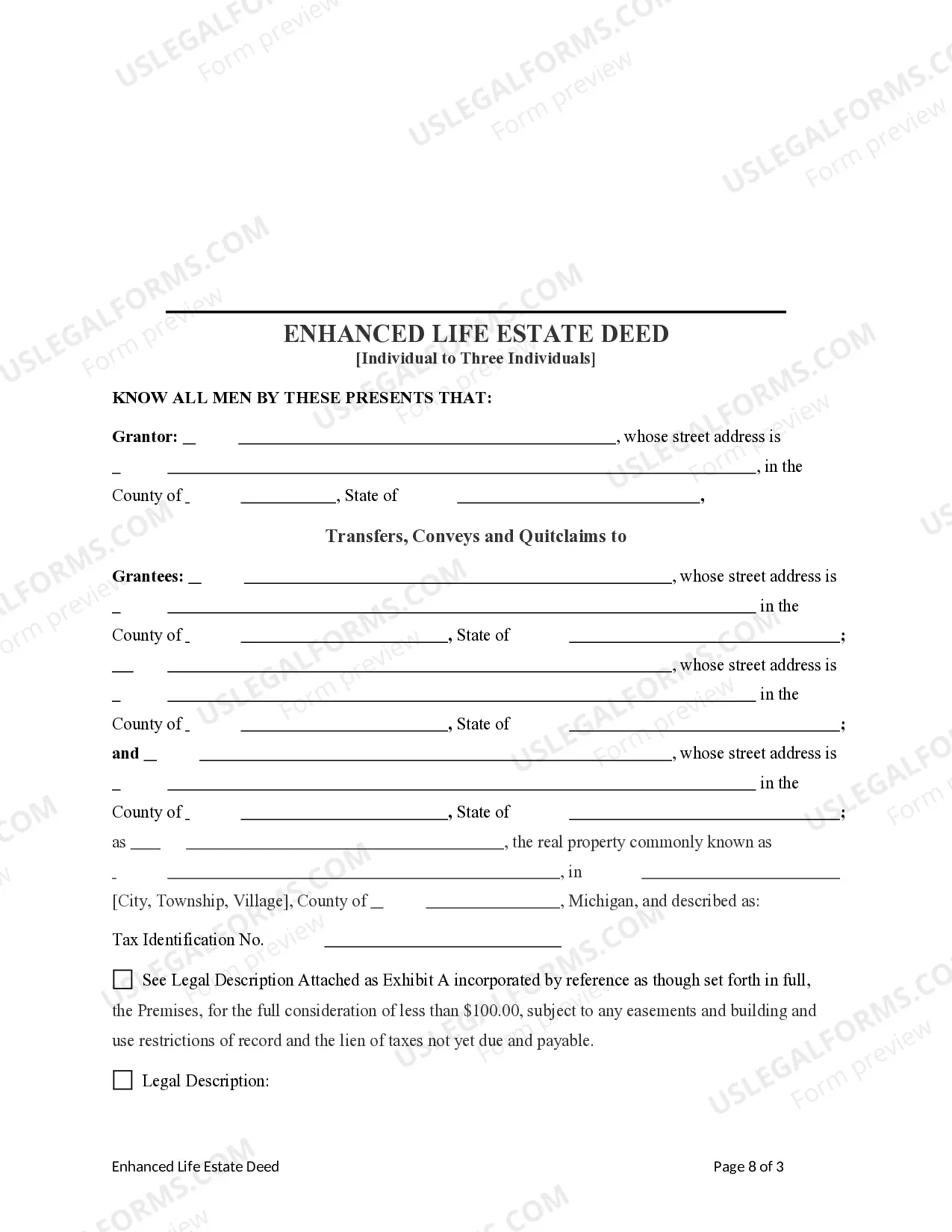

State Of Michigan Lady Bird Deed Form With Beneficiaries

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Three Individuals?

Whether for business purposes or for personal matters, everybody has to deal with legal situations at some point in their life. Filling out legal paperwork requires careful attention, starting with choosing the correct form template. For instance, if you pick a wrong version of the State Of Michigan Lady Bird Deed Form With Beneficiaries, it will be turned down once you submit it. It is therefore important to get a dependable source of legal papers like US Legal Forms.

If you have to obtain a State Of Michigan Lady Bird Deed Form With Beneficiaries template, stick to these easy steps:

- Get the template you need using the search field or catalog navigation.

- Examine the form’s information to ensure it fits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to locate the State Of Michigan Lady Bird Deed Form With Beneficiaries sample you require.

- Get the file if it matches your needs.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the account registration form.

- Choose your transaction method: use a bank card or PayPal account.

- Choose the file format you want and download the State Of Michigan Lady Bird Deed Form With Beneficiaries.

- After it is saved, you are able to fill out the form with the help of editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time searching for the right template across the internet. Utilize the library’s easy navigation to get the right form for any situation.

Form popularity

FAQ

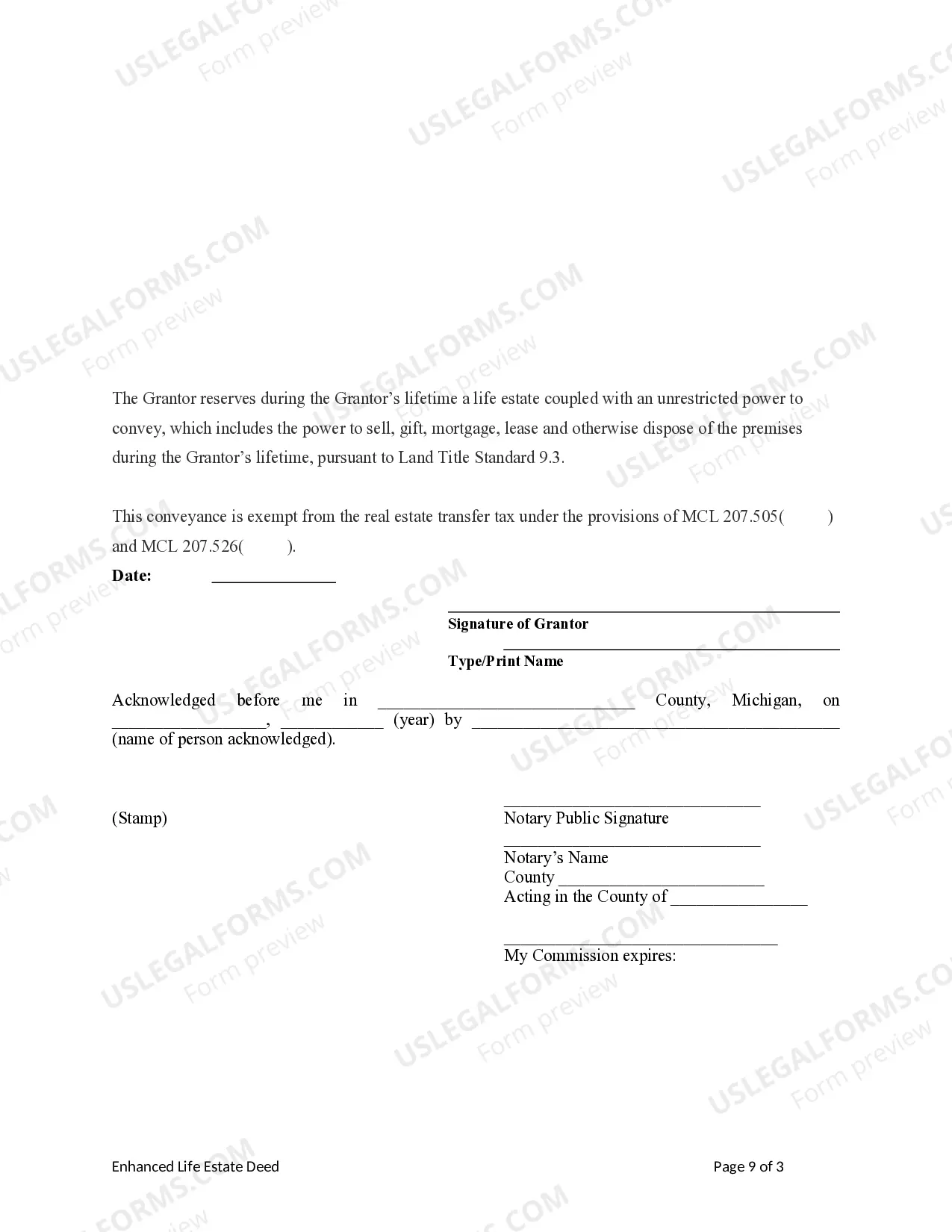

A Lady Bird Deed is a tool used to pass real property, such as your home or land, to your heirs upon your death. A Lady Bird Deed avoids probate. Meaning, the real property passes to your named heirs automatically?without court involvement.

Benefits of Michigan Lady Bird Deeds There is no due on sale or acceleration of the mortgage note with a lady bird deed. A married couple retains tenancy by the entireties protection. You can use it to avoid probate, including the legal fees, court cost, and time involved.

A Lady Bird did will not uncap or affect your property tax and does not increase your property's taxable value. The Lady Bird deed does not transfer until the owner's death and therefore, since there is no transfer until death, the property tax is not uncapped.

In Michigan, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

Under Michigan law, a ladybird deed transfers ownership of real property at death and avoids probate court too. One of the most time-consuming probate process issues deals with houses, land, and other forms of property. Using the lady bird deed will help you avoid that.