State Of Michigan Lady Bird Deed Form Format

Description

Form popularity

FAQ

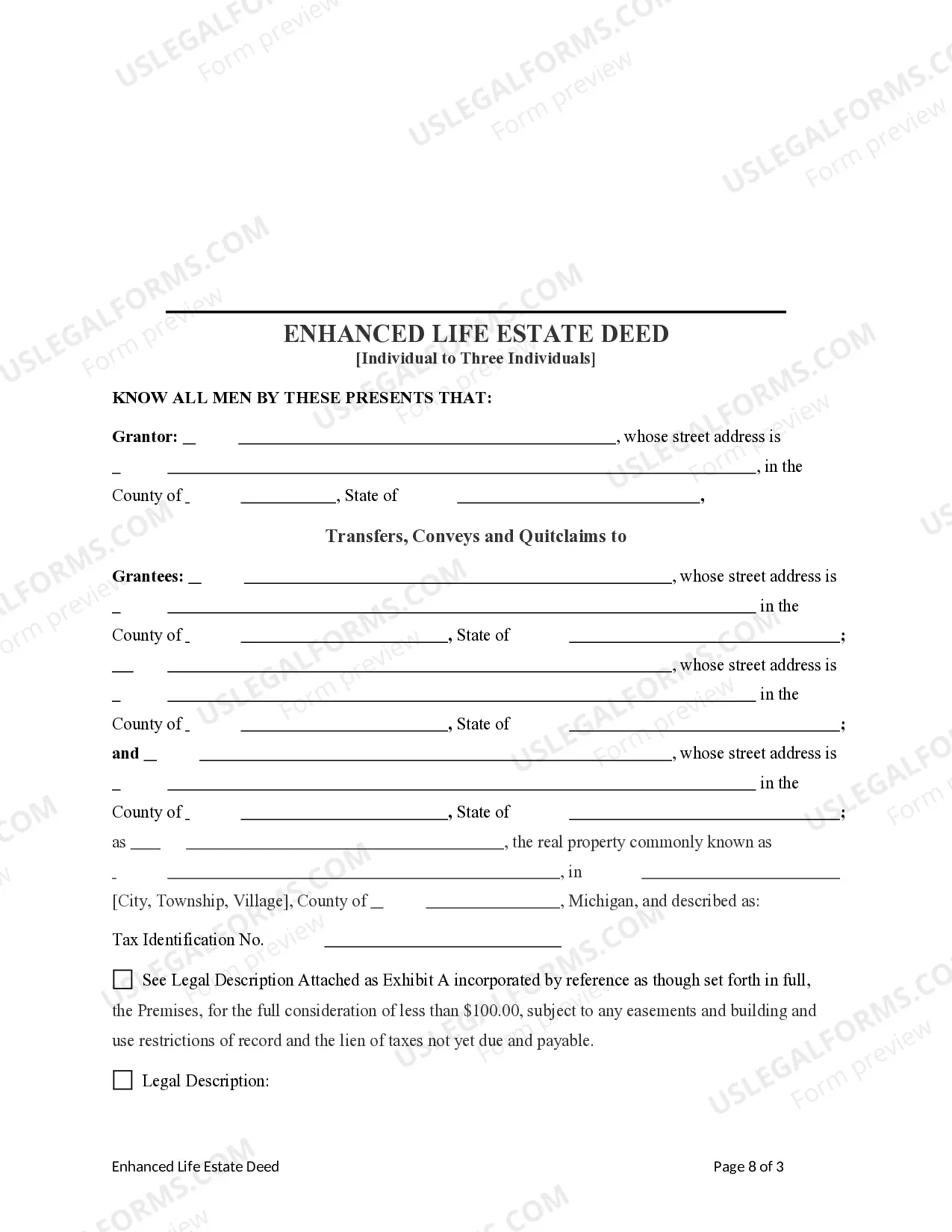

In Michigan, a Lady Bird Deed (also known as a Ladybird Deed or Enhanced Life Estate Deed) is a type of Quitclaim Deed that allows you, the creator, to transfer your property upon your death to a named beneficiary without having to go through the expensive and time consuming Probate process.

Each county's form requires the same basic information, including the names and addresses of the grantee and grantor, the property description (which you can get from a prior deed to the property or from the County Register of Deeds Office), and the amount of money being exchanged for the property.

A Lady Bird did will not uncap or affect your property tax and does not increase your property's taxable value. The Lady Bird deed does not transfer until the owner's death and therefore, since there is no transfer until death, the property tax is not uncapped.

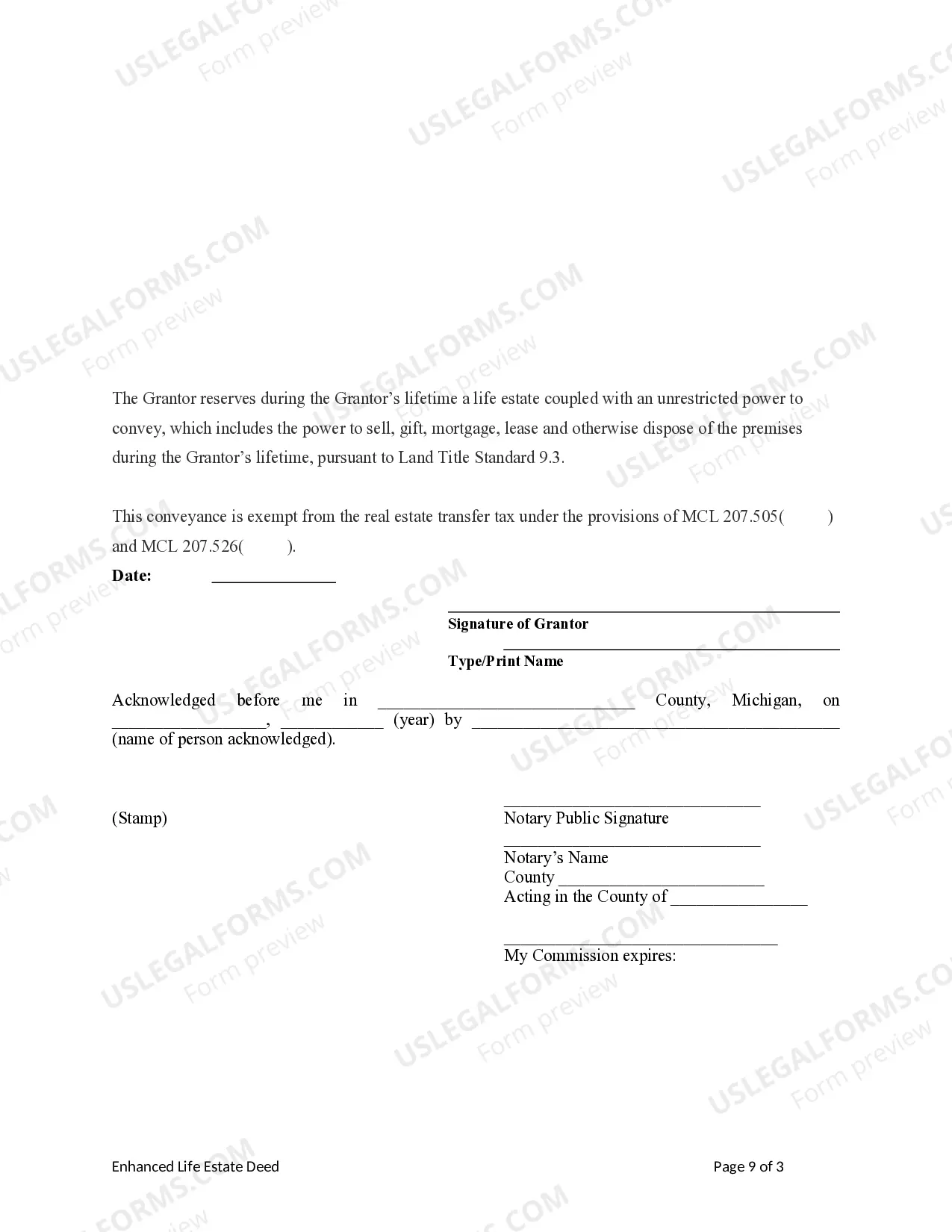

In a Michigan lady bird deed, a person retains the right to own property throughout their lifetime and automatically transfers it when they die - an enhanced life estate deed. Property transfers occur automatically upon previous owners' death, so that a person can avoid probate.

In Michigan, a Lady Bird Deed is very easy to use. You sign a deed giving your property to your chosen heirs, but you retain the right to use the property during your lifetime. You also retain the right to sell, give away, or mortgage the property.