Enhanced Bird Husband For The Future

Description

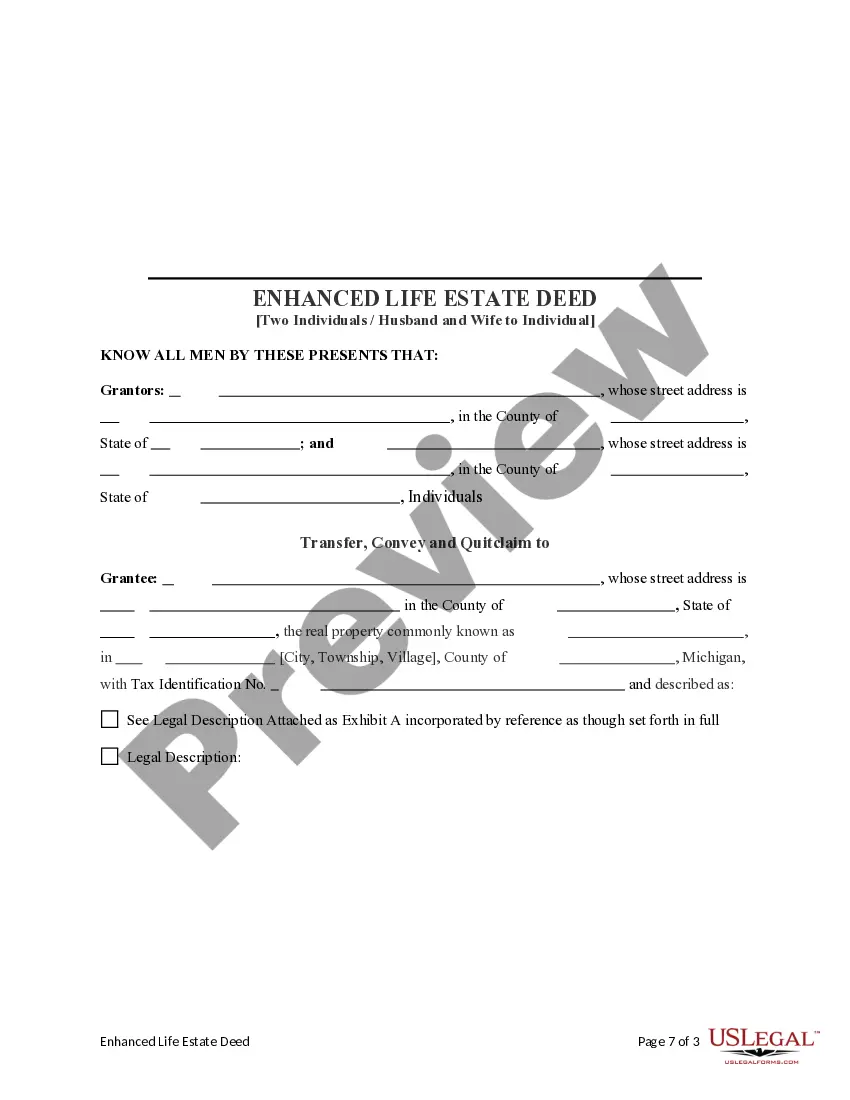

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Two Individuals / Husband And Wife To An Individual?

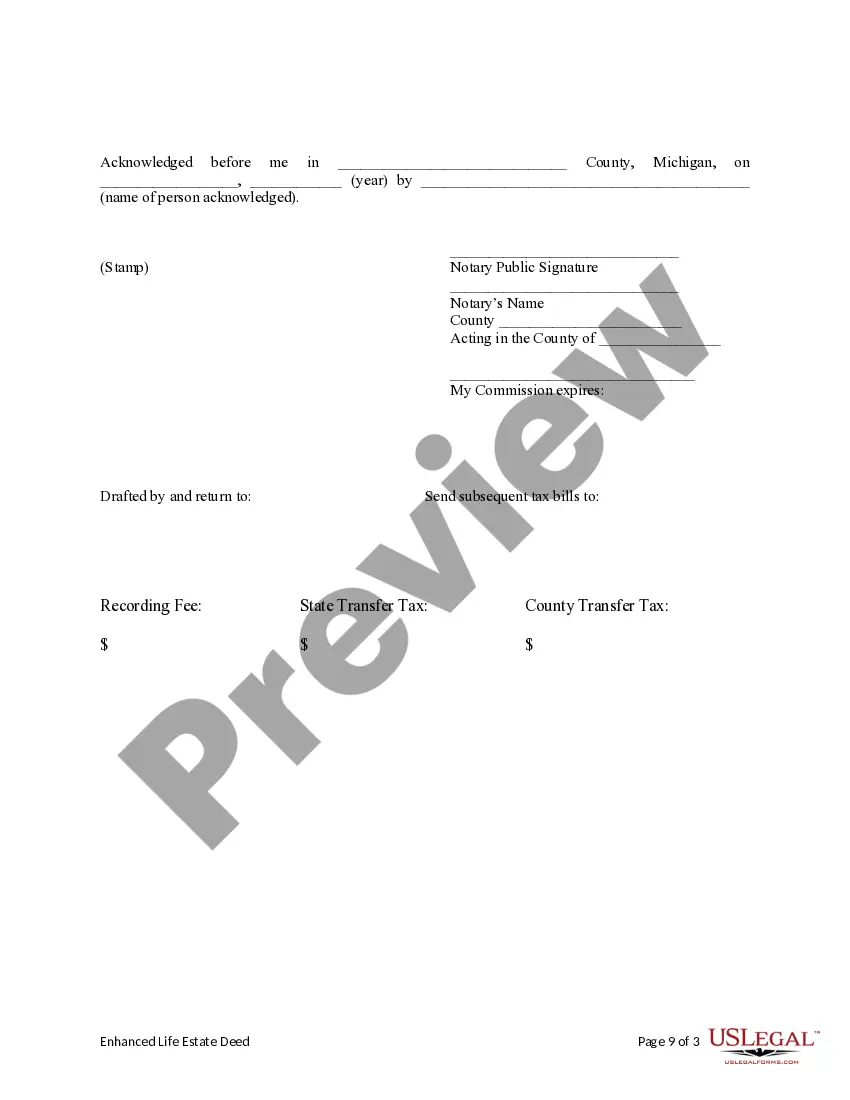

- Log in to your US Legal Forms account if you are a returning user and click the Download button to retrieve your necessary document. Make sure your subscription is active. If it's not, renew it based on your chosen payment plan.

- For first-time users, start by examining the Preview mode and form descriptions to ensure you select the most appropriate document according to your local jurisdiction.

- If needed, utilize the Search tab to find alternative templates. If your selection doesn't meet the criteria, look for others until you find the right one.

- Click the Buy Now button after identifying your document and select your preferred subscription plan. An account registration is required for access to the extensive library.

- Complete your purchase by entering your credit card information or opting for your PayPal account to finalize the subscription.

- Download your form to your device for completion. You can also access it later through the My Forms section in your account.

By following these straightforward steps, you can benefit from a service that not only offers a vast array of legal documents but also provides access to expert assistance, ensuring you complete your forms accurately and efficiently.

Don’t hesitate—explore US Legal Forms today and equip yourself with the right tools for a confident legal journey!

Form popularity

FAQ

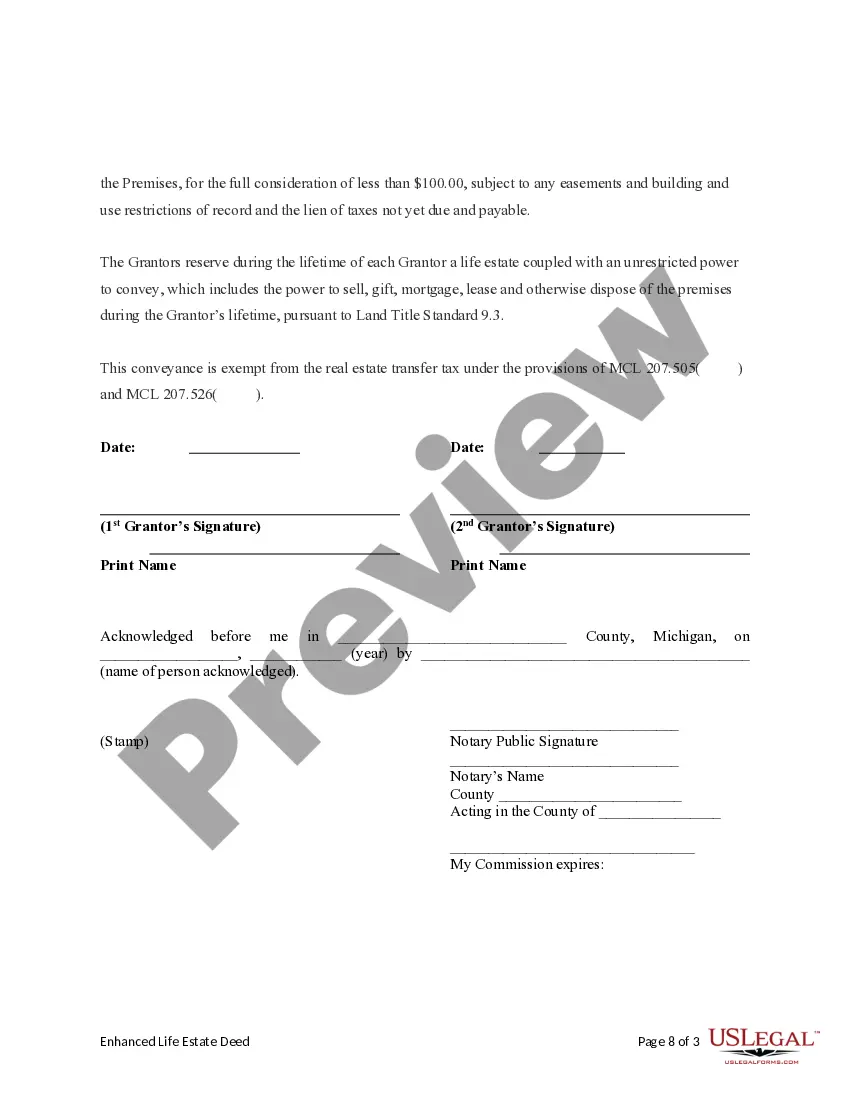

Some disadvantages of the ladybird deed include potential state-specific limitations and that it may not fully protect against creditors. Furthermore, if not executed properly, it can create confusion regarding ownership and assets. Being aware of these aspects is crucial for your estate planning. Ensuring clarity is key for securing your enhanced bird husband for the future.

Writing about your future husband can be a fulfilling experience. Focus on the qualities that drew you to him and what your dreams together entail. Share anecdotes that highlight your relationship's journey, emphasizing joy and love. Such expressions contribute to the narrative of your enhanced bird husband for the future.

Choosing a future husband involves considering shared values, goals, and mutual respect. Ensure you communicate openly and discuss your visions for life together. Look for qualities that resonate with your ideals, such as integrity and kindness. Making these careful choices lays a strong foundation for your enhanced bird husband for the future.

The ladybird deed can help reduce capital gains tax exposure when the property transfers. Because the property receives a stepped-up basis on the beneficiary's death, any appreciation during the owner's life may not incur taxes. However, individual circumstances can vary, so consulting a tax professional is wise. Planning wisely supports your enhanced bird husband for the future.

When writing to your future husband, consider expressing your excitement and dreams for your shared life. Use heartfelt messages that reflect your love and commitment, such as your shared goals for a beautiful future together. This creates a personal touch that he will cherish for a long time. In fostering these connections, you are nurturing the essence of your enhanced bird husband for the future.

Yes, Medicaid can potentially take your house if you hold a ladybird deed. While this deed allows for easy transfer upon death, it does not exempt your property from Medicaid estate recovery. Thus, it is important to consult with a legal advisor to understand how this might impact your benefits. This knowledge is vital for ensuring an enhanced bird husband for the future.

One potential downside of the ladybird deed is that it may not be recognized in all states, leading to confusion and complications. Additionally, if you are receiving Medicaid benefits, the property may still be counted as an asset in some cases. Keep in mind that the ladybird deed does not provide protection from creditors. Therefore, careful planning is essential for your enhanced bird husband for the future.

A ladybird deed does not outright trump a will; rather, it complements estate planning. This deed allows property to automatically transfer to a designated beneficiary upon the owner’s death, bypassing probate. When drafting a will, you should consider how a ladybird deed impacts your overall estate plan. Thus, combining both tools often provides the best strategy for your enhanced bird husband for the future.

In most cases, adding a spouse to a deed can be viewed as a gift, particularly when it transfers property rights. This transfer may have tax implications, so it's wise to consult with a legal expert. Embracing this practice aligns with establishing an enhanced bird husband for the future, promoting transparency and shared responsibility in your relationship.

Adding your husband to the deed can strengthen your partnership and provide shared ownership of your property. This step is vital in solidifying your commitment and is essential for enhancing your future together. Consider using uslegalforms to navigate this process, ensuring all legal aspects are covered for the best outcome.