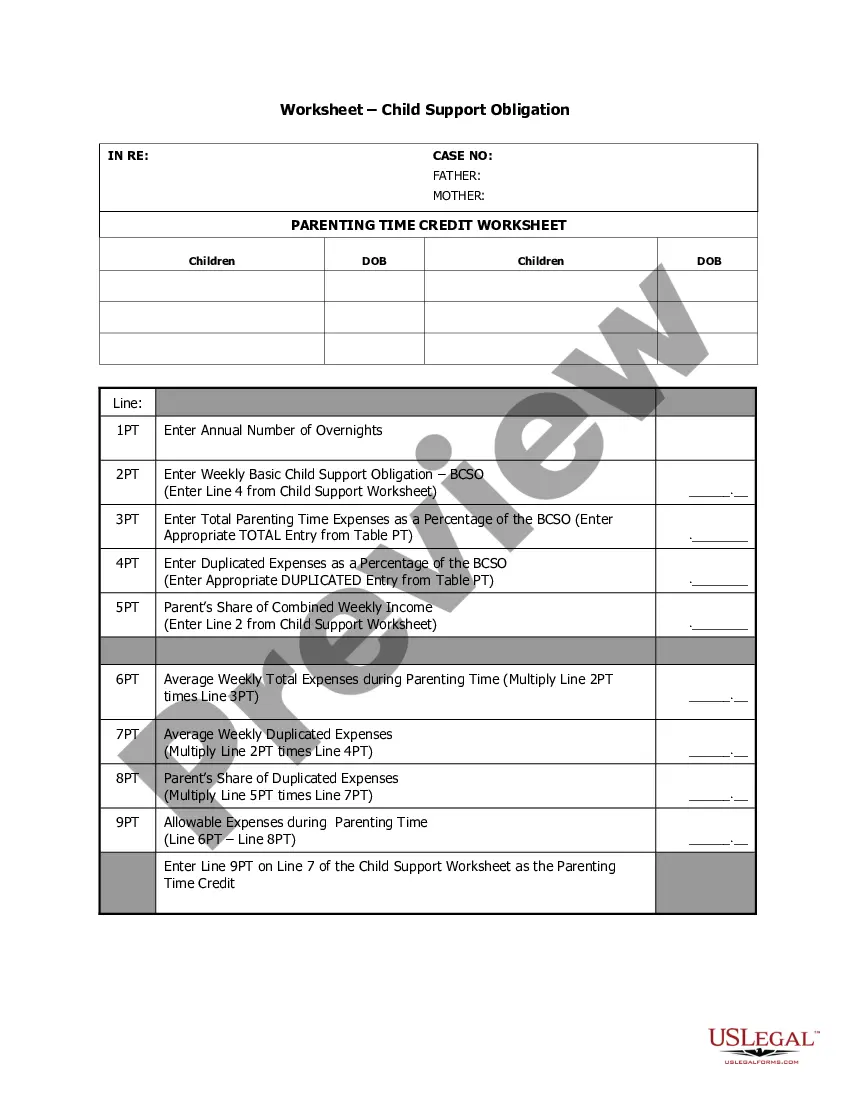

This is a Child Support Worksheet. It is used to calculate the correct amount of child support to be paid by the non custodial parent.

Child Support Calculator Hourly Wage

Description

How to fill out Maine Child Support Worksheet?

It's clear that you cannot transform into a legal expert in a single night, nor can you swiftly learn how to create Child Support Calculator Hourly Wage without possessing a specialized skill set.

Generating legal documents is a labor-intensive task that necessitates specific training and expertise. So why not entrust the development of the Child Support Calculator Hourly Wage to the experts.

With US Legal Forms, one of the largest collections of legal documents, you can find everything from judicial forms to templates for workplace communication. We understand how essential it is to comply with federal and local regulations. Thus, all templates on our platform are region-specific and current.

You can access your documents again from the My documents tab at any time. If you are an existing customer, you can simply Log In, and find and download the template from the same section.

Regardless of the purpose of your documentation—be it financial, legal, or personal—our platform is here to assist you. Experience US Legal Forms today!

- Discover the document you need using the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Child Support Calculator Hourly Wage meets your requirements.

- If you require a different form, initiate your search again.

- Sign up for a free account and choose a subscription plan to acquire the form.

- Select Buy now. After payment is completed, you can obtain the Child Support Calculator Hourly Wage, fill it out, print it, and send or deliver it to the relevant parties or organizations.

Form popularity

FAQ

In Mississippi, child support calculations consider both parents' incomes, including hourly wages. The state uses guidelines to determine the baseline child support obligation, which varies depending on the parent's earnings. By utilizing a child support calculator based on hourly wage, parents can better understand their potential financial responsibilities. This tool allows for accurate estimates and helps ensure fair support arrangements that benefit the child's well-being.

In Oregon, child support calculations typically consider all forms of income, including wages, bonuses, and self-employment earnings. The state's child support calculator hourly wage can assist in estimating payments based on your financial situation accurately. This includes various income sources that may count toward child support, ensuring a fair determination. Utilizing tools like US Legal Forms can guide you through these calculations seamlessly.

The minimum wage for child support varies by state, as different jurisdictions have their own definitions and calculations. Many states use a child support calculator hourly wage to help determine the minimum contributions based on the non-custodial parent's earnings. It is essential to check local regulations, as these rules will provide clarity on how minimum wage affects child support obligations. Understanding this can help you navigate your responsibilities effectively.

In Canada, child support calculations generally rely on federal guidelines and the income of the paying parent. The method includes a child support calculator which simplifies the process using the person’s annual income. Factors like shared custody and additional expenses can also influence the calculations. This approach ensures that children receive appropriate financial support regardless of parental arrangements.

The biggest factor in calculating child support typically involves the income of both parents. Parents must consider their earnings, including bonuses and other sources of income, when using a child support calculator hourly wage. Additionally, the number of children needing support and the specific needs of each child have significant impacts on the final calculation. Therefore, understanding these elements is crucial for accurate results.

In North Dakota, child support calculations begin with determining both parents' gross incomes, adjusting for specific deductions. The state employs a formula that factors in the child's needs, including healthcare and educational expenses, along with the number of nights the child spends with each parent. You can use a child support calculator hourly wage tool to get a clearer estimate of what your contributions might be. This calculator makes the process easier by providing a clearer picture of financial obligations that reflect your income and work hours.

For a hypothetical example, if two parents have one child and jointly earn $1,000 per week, then the non-custodial parent must pay $233 in child support each week. If these parents had two children, the non-custodial parent would pay $257 per week.

Using one state's guidelines, the total basic support obligation is estimated at $794 for one child.

For one child, you take 17% of the parents' combined income, for two children you take 25%, for three children you take 29%, for four children you take 31% and for five children you take no less than 35% of the parents' combined income and this percentage amount represents the basic child support obligation.

There is no minimum amount of child support in Texas. Instead, the amount of child support ordered depends on the specific details of your case. An attorney can help you to understand what a child support agreement should look like in your case.