Maine Probate Forms For Executors

Description

Form popularity

FAQ

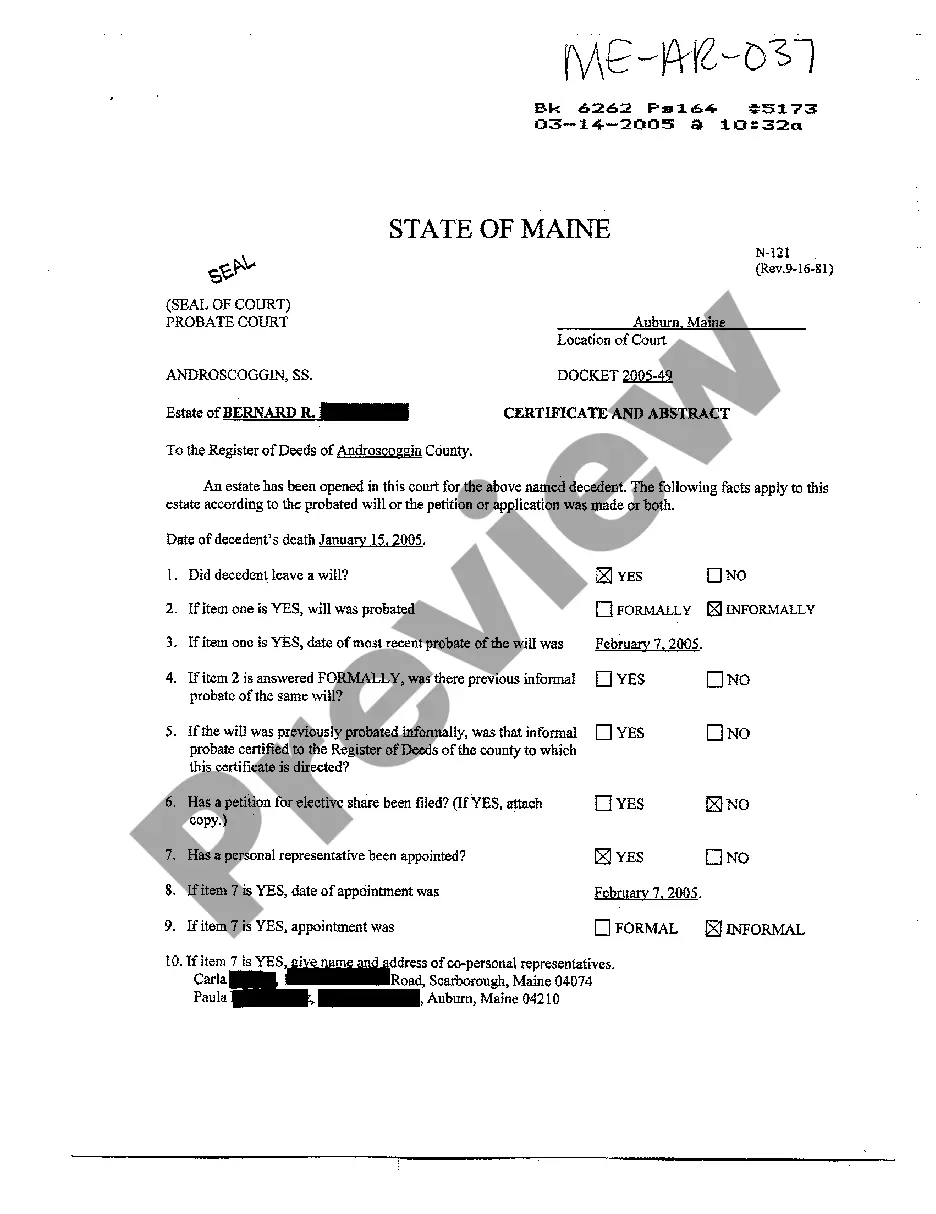

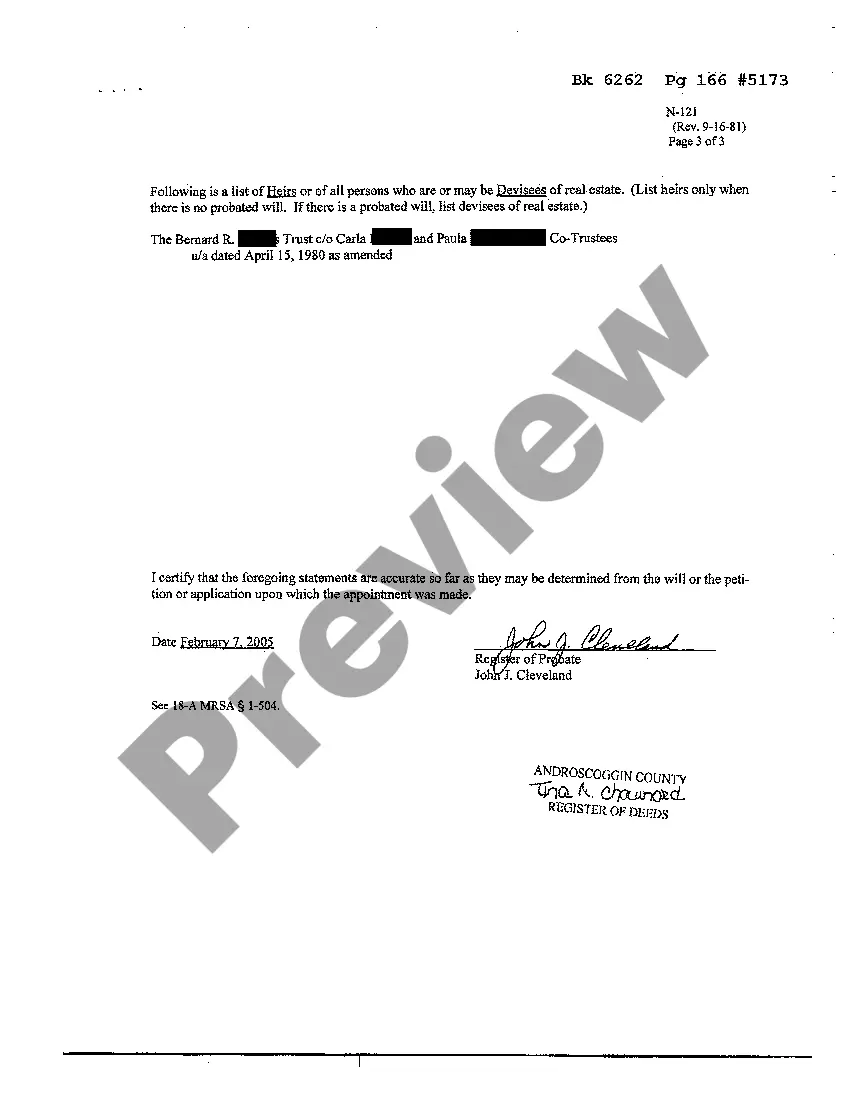

To file as the executor of an estate in Maine, you must gather the necessary documents, which include the deceased's original will, death certificate, and any required Maine probate forms for executors. You will also need to provide information about the assets and debts of the deceased. Make sure to check with the local probate court for specific requirements in your county. Utilizing a platform like USLegalForms can simplify the process by providing the correct Maine probate forms for executors tailored to your needs.

To find probate records in Maine, you can start by contacting the local probate court in the county where the deceased resided. Each county maintains its own records, so it is essential to know the specific county. You can also visit the Maine Judicial Branch website, which offers resources for accessing various probate documents. Additionally, if you are looking for Maine probate forms for executors, using platforms like US Legal Forms can simplify the process, providing you with the necessary documentation to fulfill your executor duties efficiently.

In Maine, probate is generally required when an estate's value exceeds $40,000, not including joint assets. Exceeding this threshold necessitates formal probate proceedings. Using Maine probate forms for executors can help navigate this requirement effectively. If you're unsure about the value or process, seeking legal advice may be beneficial.

In Maine, a small estate typically includes assets valued at $40,000 or less, excluding any property held jointly. This streamlined classification allows for simpler administration, often bypassing formal probate. For such small estates, you may benefit from using Maine probate forms for executors to facilitate the process with ease. It's crucial to understand the specifics of your situation, so consult a professional as needed.

Not all wills require probate in Maine. If the estate falls under a certain value or if assets are jointly owned with rights of survivorship, probate may not be necessary. However, when dealing with significant assets or certain estate planning preferences, probate serves an essential purpose. Utilizing Maine probate forms for executors can guide you through the process effectively if probate is needed.

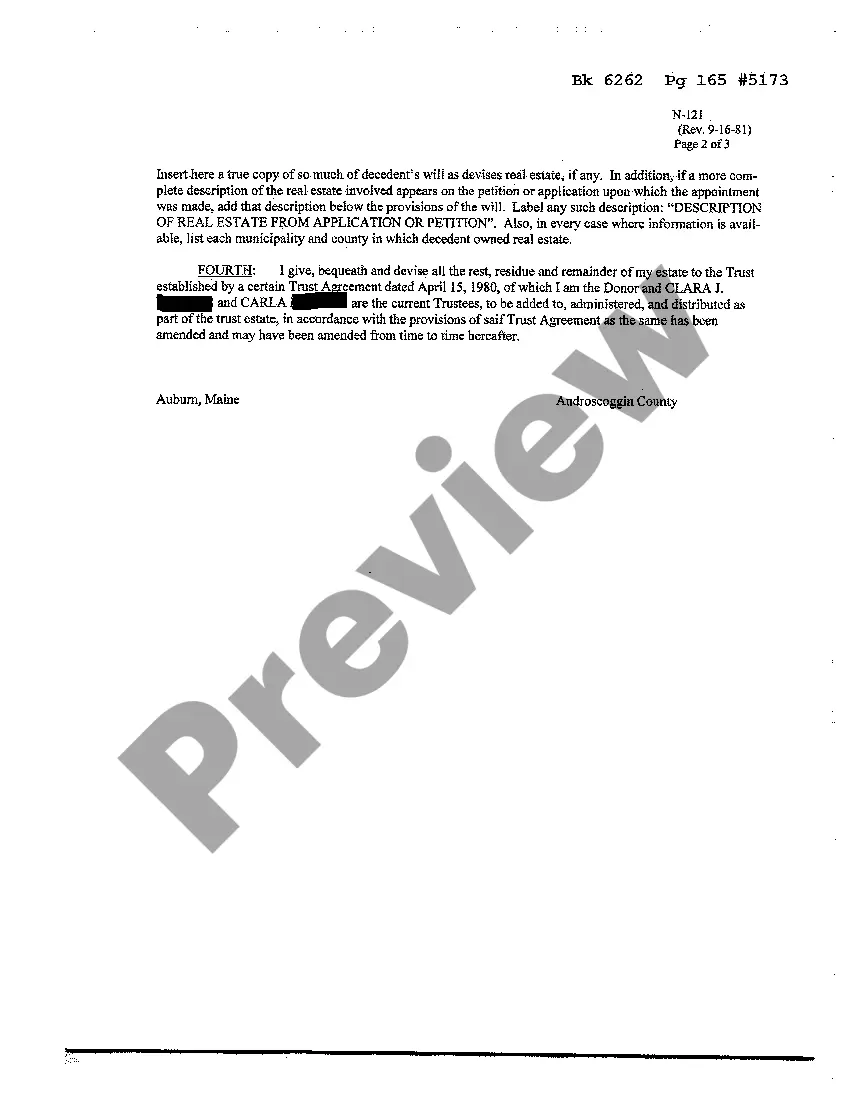

To avoid probate in Maine after death, consider using tools like living trusts, joint ownership, or beneficiary designations. These methods help transfer assets outside of probate court. Additionally, establishing a well-structured estate plan can minimize probate complications. Using Maine probate forms for executors can streamline processes if probate is necessary.

In Maine, certain assets may be exempt from probate, including jointly owned properties and accounts with designated beneficiaries, like life insurance policies. Additionally, assets held in a living trust generally avoid the probate process. Understanding what qualifies can simplify your responsibilities, and utilizing accurate Maine probate forms for executors can help clarify these details during estate management.

To file for executor of an estate in Maine, begin by gathering the required documents, including the death certificate and the will. Complete the necessary Maine probate forms for executors, which detail your authority and intent to act on behalf of the estate. After preparing these documents, submit them to the appropriate probate court to obtain official permission to carry out your duties.

The best executor is someone trustworthy, organized, and capable of managing finances and legal processes. Ideally, this person should be familiar with the deceased's wishes and have a good relationship with family members. Selecting someone with the skills to handle Maine probate forms for executors can make the process smoother and reduce potential conflicts within the family.

While it is not legally required to have a lawyer to file probate in Maine, enlisting legal assistance often aids in navigating the complexities. A lawyer can help you understand the requirements and ensure you complete your Maine probate forms for executors correctly. However, many people choose to file on their own, especially with resources available online, such as those provided by US Legal Forms.