Residential Real Estate Sales Disclosure Statement

Maine Revised Statutes

Title 33, Ch 7, SubCh 1-A

RESIDENTIAL REAL PROPERTY DISCLOSURES

§171. Definitions

§172. Applicability; exemptions

§173. Required disclosures

§174. Delivery and time of disclosure; cancellation of contract

§175. Change in circumstances

§176. Rights and duties of seller and purchaser

§177. Liability

§178. Effect on other statutes or common law

§179. Effective date

§171. Definitions

As used in this subchapter, unless the context otherwise

indicates, the following terms have the following meanings. [1999,

c. 476, §1 (new).]

1. Known defect. "Known defect" means a condition,

known by the seller, that has a significant adverse effect on the value

of property, significantly impairs the health or safety of future occupants

of the property or, if not repaired, removed or replaced, significantly

shortens the expected normal life of the premises. [1999, c. 476, §1

(new).]

2. Seller. "Seller" means the owner of the

residential real property that is for sale, exchange, sale under an installment

contract or lease with an option to buy. [1999, c. 476, §1 (new).]

3. Property disclosure statement. "Property

disclosure statement" means a written disclosure form prepared by a seller

pursuant to section 173. [1999, c. 476, §1 (new).]

4. Purchaser. "Purchaser" means a transferee

in any of the types of transactions described in section 172. [1999, c.

476, §1 (new).]

5. Real estate contract. "Real estate contract"

means a contract for the transfer of ownership of residential real property

by any of the ways described in section 172. [1999, c. 476, §1 (new).]

6. Residential real property. "Residential

real property" means real estate consisting of one or not more than 4 residential

dwelling units. [1999, c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).

§172. Applicability; exemptions

This subchapter applies to the transfer of any interest

in residential real property, whether by sale, exchange, installment land

contract, lease with an option to purchase or any other option to purchase,

when the transaction is without the assistance of a person licensed to

practice real estate brokerage. The following transfers are exempt from

this subchapter: [1999, c. 476, §1 (new).]

1. Court order. Transfers pursuant to court

order, including, but not limited to, transfers ordered by a court in the

administration of an estate, transfers pursuant to a writ of execution,

transfers by any foreclosure sale, transfers by a trustee in bankruptcy,

transfers by eminent domain and transfers resulting from a decree for specific

performance; [1999, c. 476, §1 (new).]

2. Default. Transfers to a mortgagee by a mortgagor

or successor in interest who is in default or transfers to a beneficiary

of a deed of trust by a trustor or successor in interest who is in default;

[1999, c. 476, §1 (new).]

3. Power of sale. Transfers by a sale under

a power of sale or any foreclosure sale under a decree of foreclosure after

default in an obligation secured by a mortgage or deed of trust or secured

by any other instrument containing a power of sale, or transfers by a mortgagee

or a beneficiary under a deed of trust who has acquired the residential

real property at a sale conducted pursuant to a power of sale under a mortgage

or deed of trust or a sale pursuant to a decree of foreclosure or who has

acquired the residential real property by a deed in lieu of foreclosure;

[1999, c. 476, §1 (new).]

4. Fiduciary. Transfers by a fiduciary in the

course of administration of a decedent's estate, guardianship, conservatorship

or trust; [1999, c. 476, §1 (new).]

5. Coowner. Transfers from one or more coowners

solely to one or more other coowners; [1999, c. 476, §1 (new).]

6. Testate; intestate succession. Transfers

pursuant to testate or intestate succession; [1999, c. 476, §1 (new).]

7. Consanguinity. Transfers made to a spouse

or to a person or persons in the lineal line of consanguinity of one or

more of the owners; [1999, c. 476, §1 (new).]

8. Divorce. Transfers between spouses resulting

from a judgment of divorce or a judgment of separate maintenance or from

a property settlement agreement incidental to such a judgment; [1999, c.

476, §1 (new).]

9. Government. Transfers or exchanges to or

from any governmental entity; [1999, c. 476, §1 (new).]

10. Relocation. Transfers from an entity that

has taken title to a residential real property to assist the prior owner

in relocating, as long as the entity makes available to the purchaser a

copy of the property disclosure statement furnished to the entity by the

prior owner; [1999, c. 476, §1 (new).]

11. Living trust. Transfers to a living trust;

and [1999, c. 476, §1 (new).]

12. Corrective deed. Transfers that, without

additional consideration and without changing ownership or ownership interest,

confirm, correct, modify or supplement a deed previously recorded. [1999,

c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).

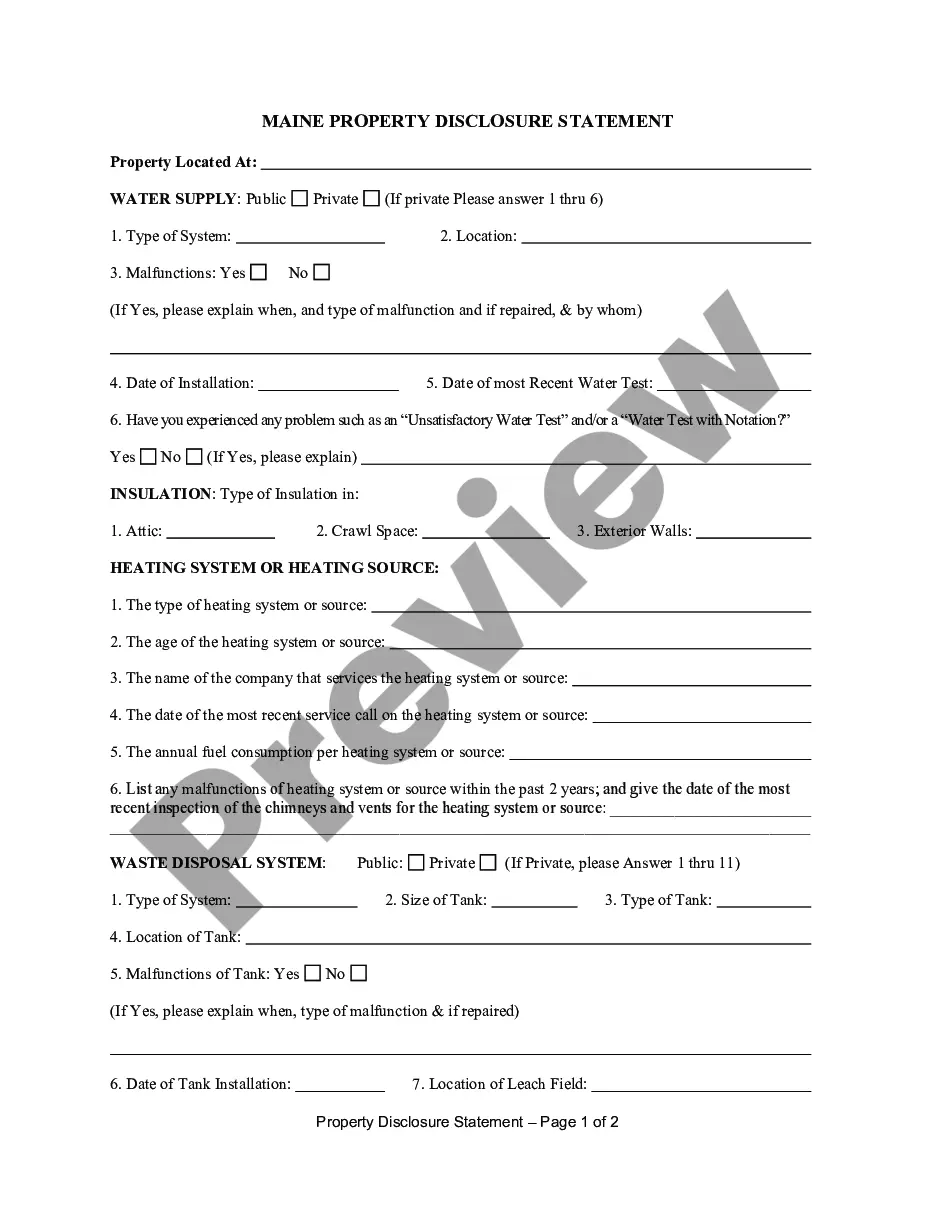

§173. Required disclosures

Unless the transaction is exempt under section 172,

the seller of residential real property shall provide to the purchaser

a property disclosure statement containing the following information:

[1999, c. 476, §1 (new).]

1. Water supply system. The type of system

used to supply water to the property. If the property has a private water

supply, the seller shall disclose:

A. The type of system; [1999, c. 476, §1 (new).]

B. The location of the system; [1999, c. 476, §1 (new).]

C. Any malfunctions of the system; [1999, c. 476, §1 (new).]

D. The date of the most recent water test, if any; and [1999,

c. 476, §1 (new).]

E. Whether the seller has experienced a problem such as an unsatisfactory

water test or a water test with notations; [1999, c. 476, §1

(new).]

[1999, c. 476, §1 (new).]

2. Insulation. The type and location of insulation

used on the property; [1999, c. 476, §1 (new).]

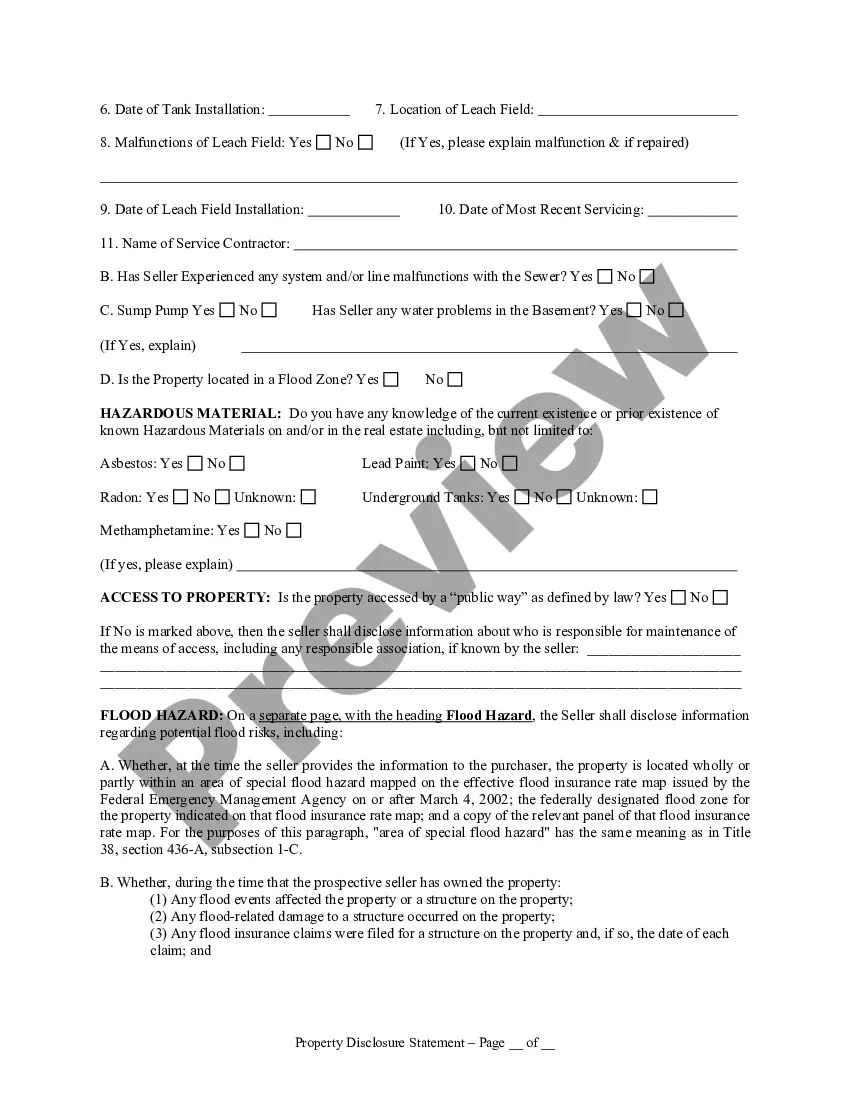

3. Waste disposal system. The type of waste

disposal system used on the property. If the property has a private waste

disposal system, the seller shall disclose:

A. The type of system; [1999, c. 476, §1 (new).]

B. The size and type of the tank; [1999, c. 476, §1 (new).]

C. The location of the tank; [1999, c. 476, §1 (new).]

D. Any malfunctions of the tank; [1999, c. 476, §1 (new).]

E. The date of installation of the tank; [1999, c. 476, §1

(new).]

F. The location of the leach field; [1999, c. 476, §1 (new).]

G. Any malfunctions of the leach field; [1999, c. 476, §1

(new).]

H. The date of installation of the leach field; [1999, c. 476,

§1 (new).]

I. The date of the most recent servicing of the system; [1999,

c. 476, §1 (new).]

J. The name of the contractor who services the system; and [1999,

c. 476, §1 (new).]

K. For systems within shoreland zones, disclosures on septic systems

required by Title 30-A, section 4216; [1999, c. 476, §1 (new).]

[1999, c. 476, §1 (new).]

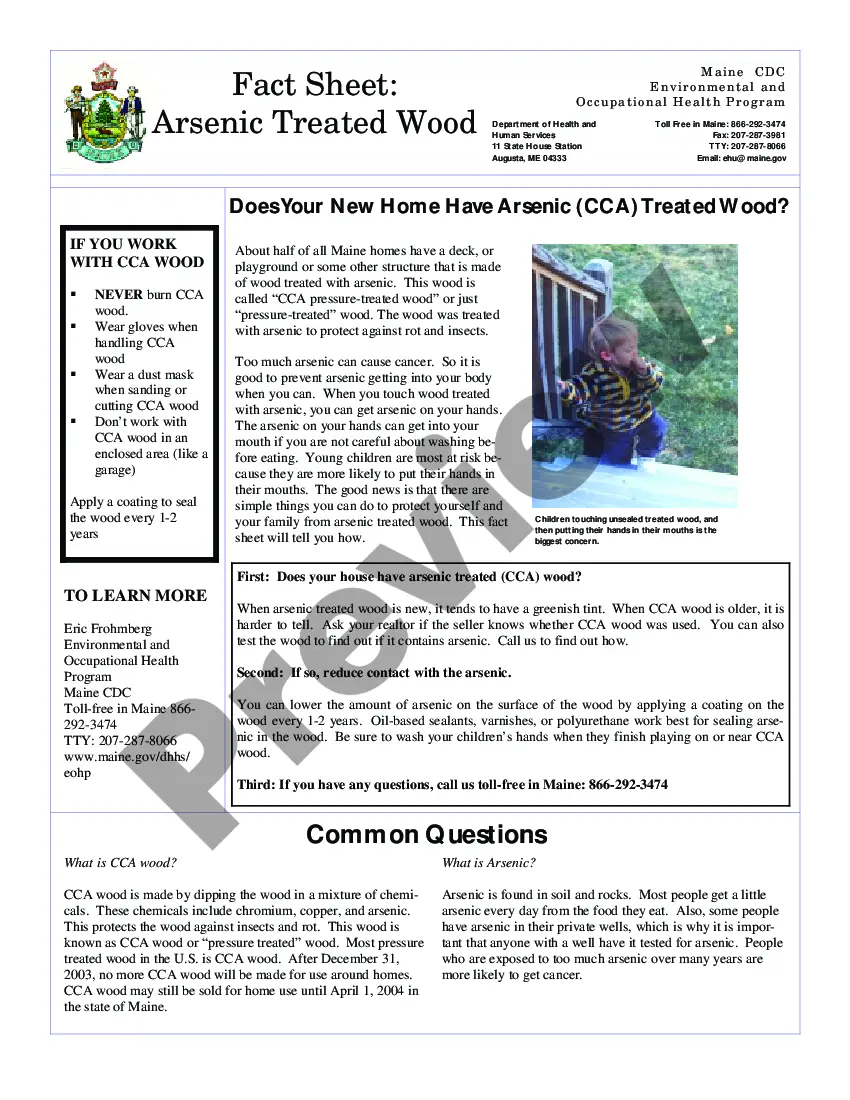

4. Hazardous materials. The presence or prior

removal of hazardous materials or elements on the residential real property,

including, but not limited to:

A. Asbestos; [1999, c. 476, §1 (new).]

B. Lead-based paint for pre-1978 homes in accordance with federal regulations;

[1999, c. 476, §1 (new).]

C. Radon; and [1999, c. 476, §1 (new).]

D. Underground oil storage tanks as required under Title 38, section

563, subsection 6; and [1999, c. 476, §1 (new).]

[1999, c. 476, §1 (new).]

5. Known defects. Any known defects. [1999,

c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).

§174. Delivery and time of disclosure; cancellation of contract

1. Delivery and time of disclosure. The seller

of residential real property under this subchapter shall deliver or cause

to be delivered the property disclosure statement to the purchaser no later

than the time the purchaser makes an offer to purchase, exchange or option

the property or exercises the option to purchase the property pursuant

to a lease with an option to purchase. [1999, c. 476, §1 (new).]

2. Terminate contract. If the property disclosure

statement is delivered to the purchaser after the purchaser makes an offer,

the purchaser may terminate any resulting real estate contract or withdraw

the offer no later than 72 hours after receipt of the property disclosure

statement. [1999, c. 476, §1 (new).]

3. Withdrawal without penalty. If the purchaser

terminates a real estate contract or withdraws an offer in compliance with

this section, the termination or withdrawal of offer is without penalty

to the purchaser and any deposit must be promptly returned to the purchaser.

[1999, c. 476, §1 (new).]

4. Rights waived. Any rights of the purchaser

to terminate the real estate contract provided by this section are waived

conclusively if not exercised prior to settlement or occupancy, whichever

is earlier, by the purchaser in the case of a sale or exchange, or prior

to settlement in the case of a purchase pursuant to a lease with option

to purchase. Any rights of the purchaser to terminate the real estate contract

for reasons other than those set forth in this section are not affected

by this section. [1999, c. 476, §1 (new).]

5. Invalidated. A transfer subject to this

subchapter is not invalidated solely because of the failure of any person

to comply with this subchapter. [1999, c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).

§175. Change in circumstances

1. Inaccurate information. If information disclosed

in accordance with this subchapter becomes inaccurate as a result of any

action, occurrence or agreement after the delivery of the property disclosure

statement, the resulting inaccuracy does not constitute a violation of

this subchapter. [1999, c. 476, §1 (new).]

2. Supplemental disclosure. If prior to settlement

or occupancy a seller has actual knowledge of an error, inaccuracy or omission

in the disclosure after delivery of the property disclosure statement to

purchaser, the seller shall supplement the property disclosure statement

with a written supplemental disclosure. [1999, c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).

§176. Rights and duties of seller and purchaser

1. Seller's rights and duties. A property disclosure

statement and any supplement to a property disclosure statement are not

a warranty by the seller. The information in the disclosure statement is

for disclosure only and is not intended to be a part of any contract between

the purchaser and the seller.

If, at the time the disclosures are required

to be made, an item of information required to be disclosed under this

subchapter is unknown or unavailable to the seller, the seller may comply

with this subchapter by advising the purchaser of the fact that the information

is unknown.

The information provided to the purchaser is

based upon the best information available to the seller. The seller is

not obligated under this subchapter to make any specific investigation

or inquiry in an effort to complete the property disclosure statement.

[1999, c. 476, §1 (new).]

2. Purchaser's rights and duties. The property

disclosure statement and any supplement to the property disclosure statement

may not be used as substitutes for any inspections or warranties that the

purchaser or seller may obtain. Nothing in this subchapter precludes the

obligation of a purchaser to inspect the physical condition of the property.

[1999, c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).

§177. Liability

A seller is not liable for any error, inaccuracy

or omission of any information required to be delivered to the purchaser

under this subchapter if: [1999, c. 476, §1 (new).]

1. Without actual knowledge. The error, inaccuracy

or omission was not within the actual knowledge of the seller or was based

on information provided by a public agency or by another person with a

professional license or special knowledge who provided a written or oral

report or opinion that the seller reasonably believed to be correct; and

[1999, c. 476, §1 (new).]

2. Without negligence. The seller was not negligent

in obtaining information from a 3rd party and transmitting that information

to the purchaser. [1999, c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).

§178. Effect on other statutes or common law

This subchapter is not intended to limit or modify

any obligation to disclose created by any other statute or that may exist

in common law in order to avoid fraud, misrepresentation or deceit in the

transaction. [1999, c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).

§179. Effective date

This subchapter takes effect January 1, 2000.

[1999, c. 476, §1 (new).]

Section History:

PL 1999, Ch. 476, §1 (NEW).