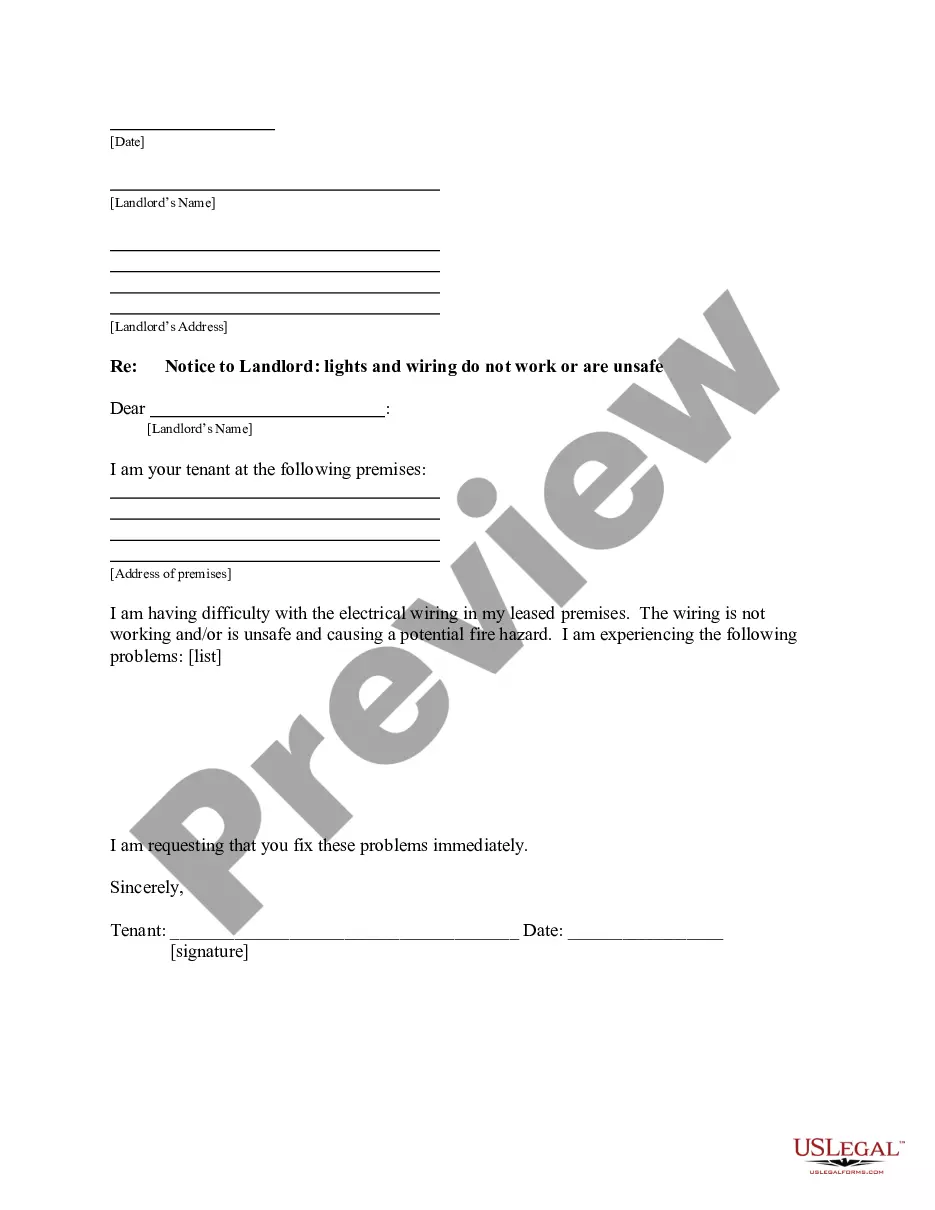

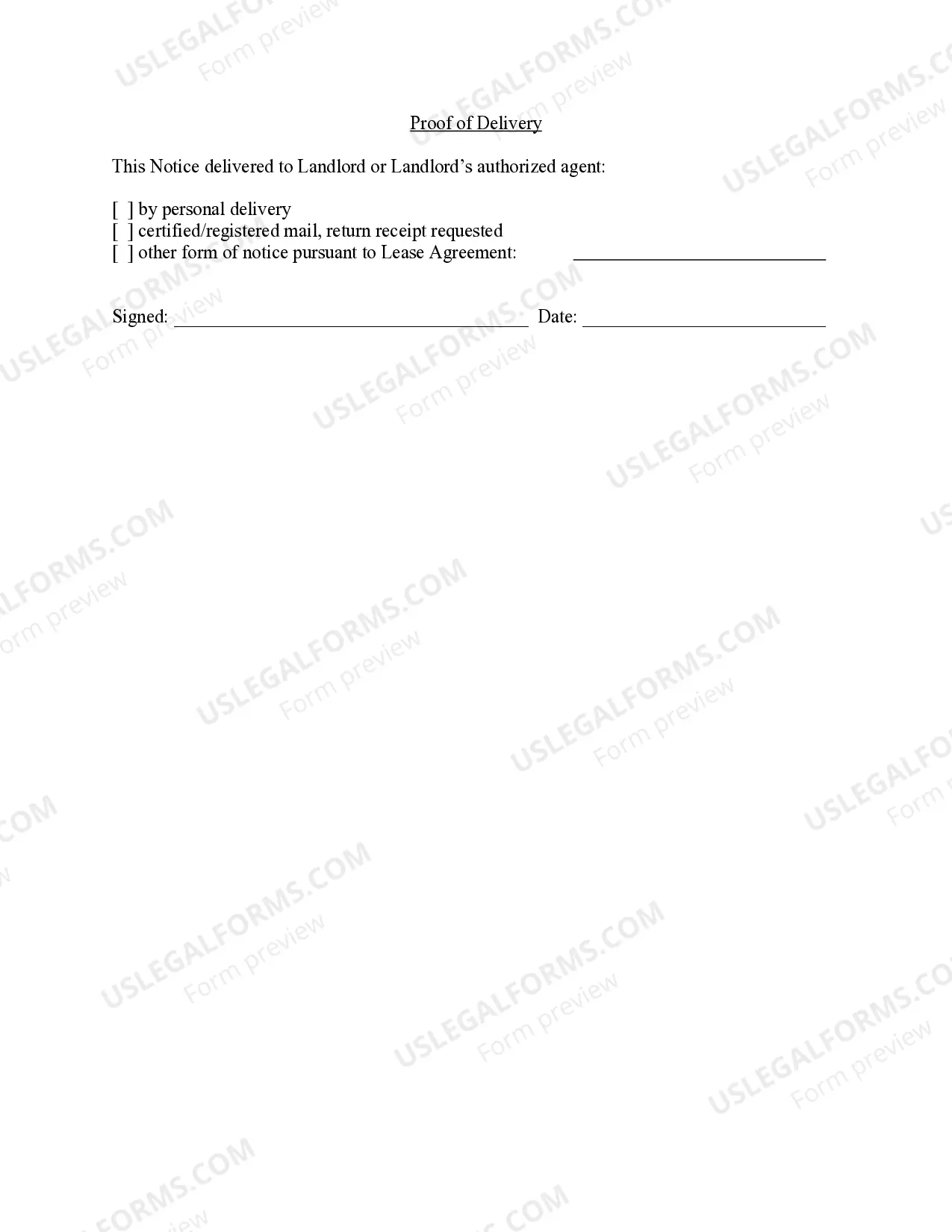

This form is used by a tenant to inform the landlord of a problem with the lease premises, specifically that the lights and wiring do not work and are unsafe. With this form, the tenant notifies the landlord that he/she/it has breached the statutory duty to maintain the property in tenantable condition and demands that immediate repairs be made.

Maine Letter Demand Withholding

Description

How to fill out Maine Letter From Tenant To Landlord With Demand That Landlord Repair Unsafe Or Broken Lights Or Wiring?

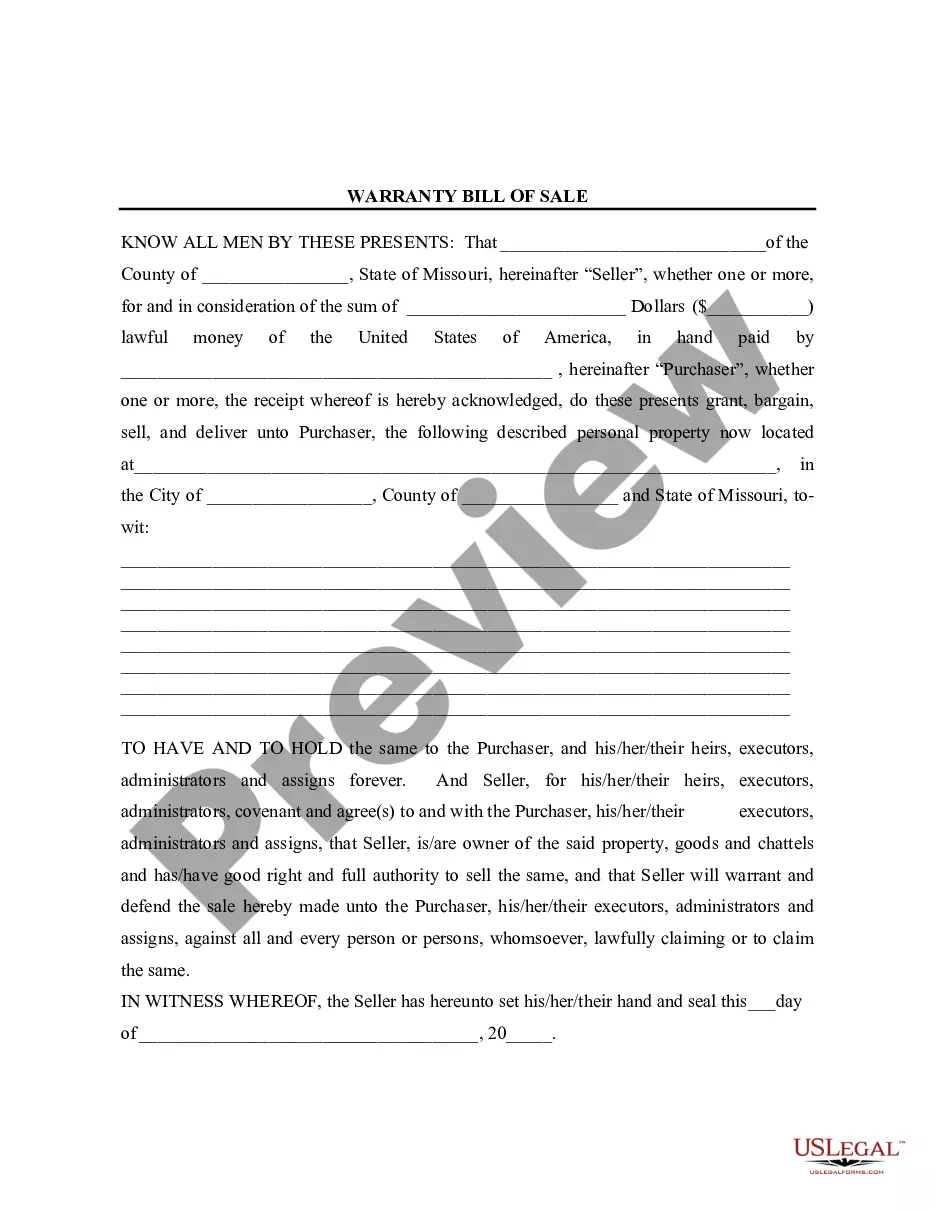

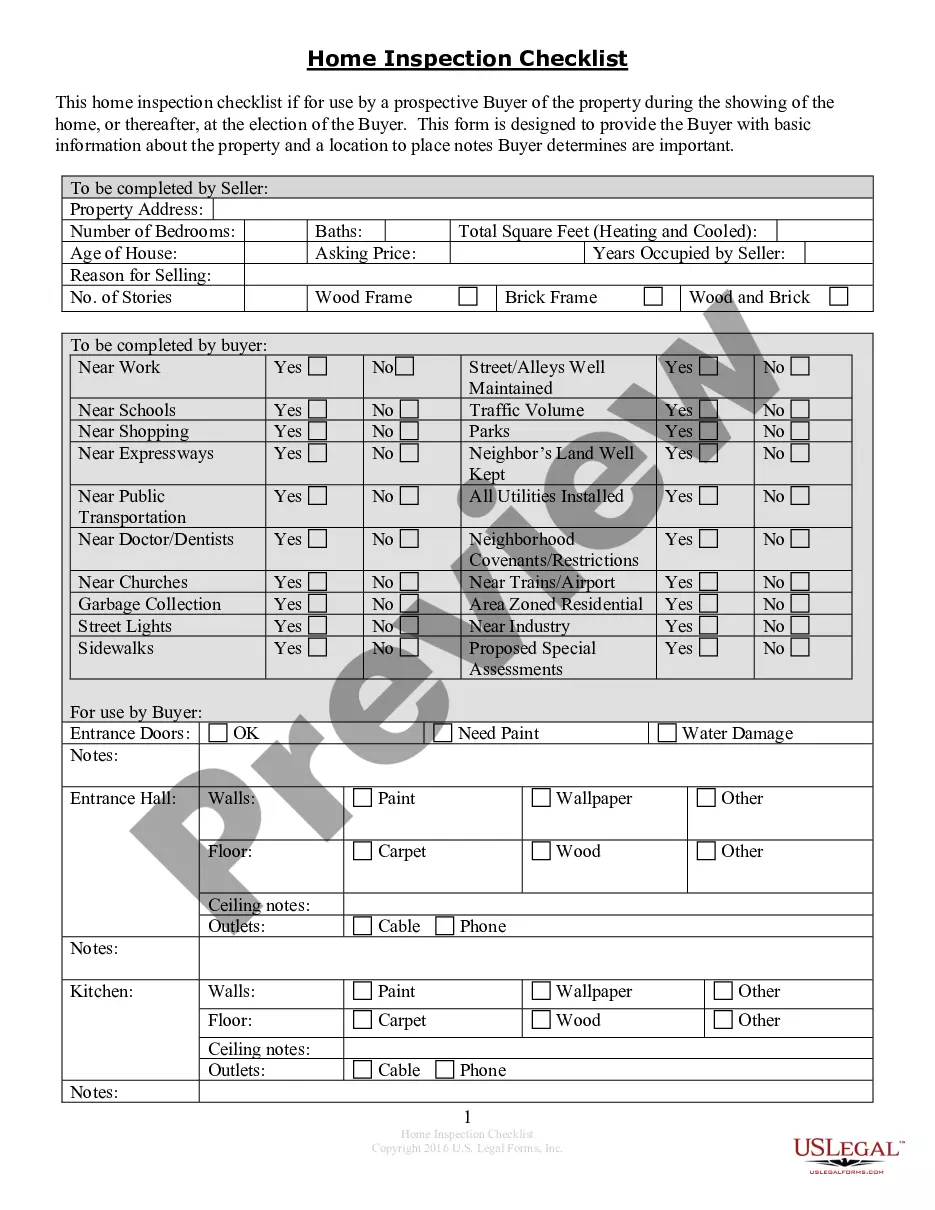

There’s no additional reason to waste time searching for legal paperwork to meet your local state regulations. US Legal Forms has gathered all of them in one location and made them easily accessible.

Our site features over 85,000 templates for any business and individual legal situations categorized by state and purpose. All documents are professionally drafted and verified for accuracy, allowing you to be assured of acquiring an up-to-date Maine Letter Demand Withholding.

If you are accustomed to our platform and already possess an account, ensure your subscription is current before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all saved documents whenever necessary by accessing the My documents tab in your profile.

Print your form to complete it in writing or upload the template if you prefer to use an online editor. Creating official documents under federal and state regulations is quick and efficient with our library. Try US Legal Forms today to keep your paperwork organized!

- If you have never utilized our platform previously, the process will take a few more steps to finalize.

- Examine the page text thoroughly to confirm it includes the template you require.

- Use the form description and preview options if available.

- Use the Search field above to look for another template if the previous one was unsuitable.

- Click Buy Now next to the template title once you find the appropriate one.

- Select the most appropriate subscription plan and create an account or Log In.

- Make a payment for your subscription with a credit card or via PayPal to proceed.

- Choose the file format for your Maine Letter Demand Withholding and download it to your device.

Form popularity

FAQ

To obtain a Maine withholding account number, you must register your business with the Maine Revenue Services. You can complete the registration process online or submit a paper form. Once you have your account, you can effectively manage your Maine letter demand withholding, ensuring you meet your obligations and avoid penalties.

An EAN, or Employer Account Number, is a unique identifier assigned to businesses for tax purposes in Maine. This number is crucial for managing withholding taxes and other payroll-related responsibilities. If you are involved in Maine letter demand withholding, you will need your EAN to report accurately and comply with state law.

You can find your withholding number on your tax documents, specifically in the upper right corner of your Maine income tax form. Additionally, this number may appear on any official correspondence from the Maine Revenue Services. If you cannot locate it, consider visiting the Maine Revenue Services website or contacting their office directly for assistance with Maine letter demand withholding.

To calculate how much to withhold for Maine taxes, start by checking the state tax brackets for your income level. As a rule of thumb, many individuals withhold between 5.8% and 7.15%. Accurate calculations align your withholding with your Maine letter demand withholding goals, ensuring you aren't left with unexpected tax bills.

The best number for your tax withholding is personal to your financial situation. Use the IRS Form W-4 to assess your number of allowances or deductions. Opting wisely here can simplify your Maine letter demand withholding process and improve your overall tax experience.

Choosing 0 on your tax withholding means you want the maximum amount withheld from your paycheck, while selecting 1 allows for less withholding. If you're unsure of your tax circumstances, starting with 0 can prevent underpayment issues. Always consider your financial goals when deciding your Maine letter demand withholding.

Your withholding tax rate should reflect your estimated tax obligation for the year. Many individuals opt for a flat percentage based on general guidelines or use tax software for estimated calculations. By understanding your financial situation better, you can set an appropriate Maine letter demand withholding rate.

The number you use for tax withholding is typically based on your filing status and the number of allowances you claim. Refer to the IRS Form W-4 to accurately fill in this section. This number directly influences your Maine letter demand withholding, so it’s crucial to get it right.

For state taxes in Maine, the withholding percentage generally ranges from 5.8% to 7.15%, depending on your income bracket. It’s vital to review the latest state tax guidelines, as they can change. By calculating the right percentage for your Maine letter demand withholding, you can avoid surprises during tax time.

The percentage of taxes you should withhold depends on your income level and personal circumstances. Typically, employees choose a percentage based on the IRS guidelines, which recommend withholding around 10% to 25%. However, you must tailor your Maine letter demand withholding to fit your specific financial situation.