Minutes A Corporation With The Irs

Description

How to fill out Sample Annual Minutes For A Maryland Professional Corporation?

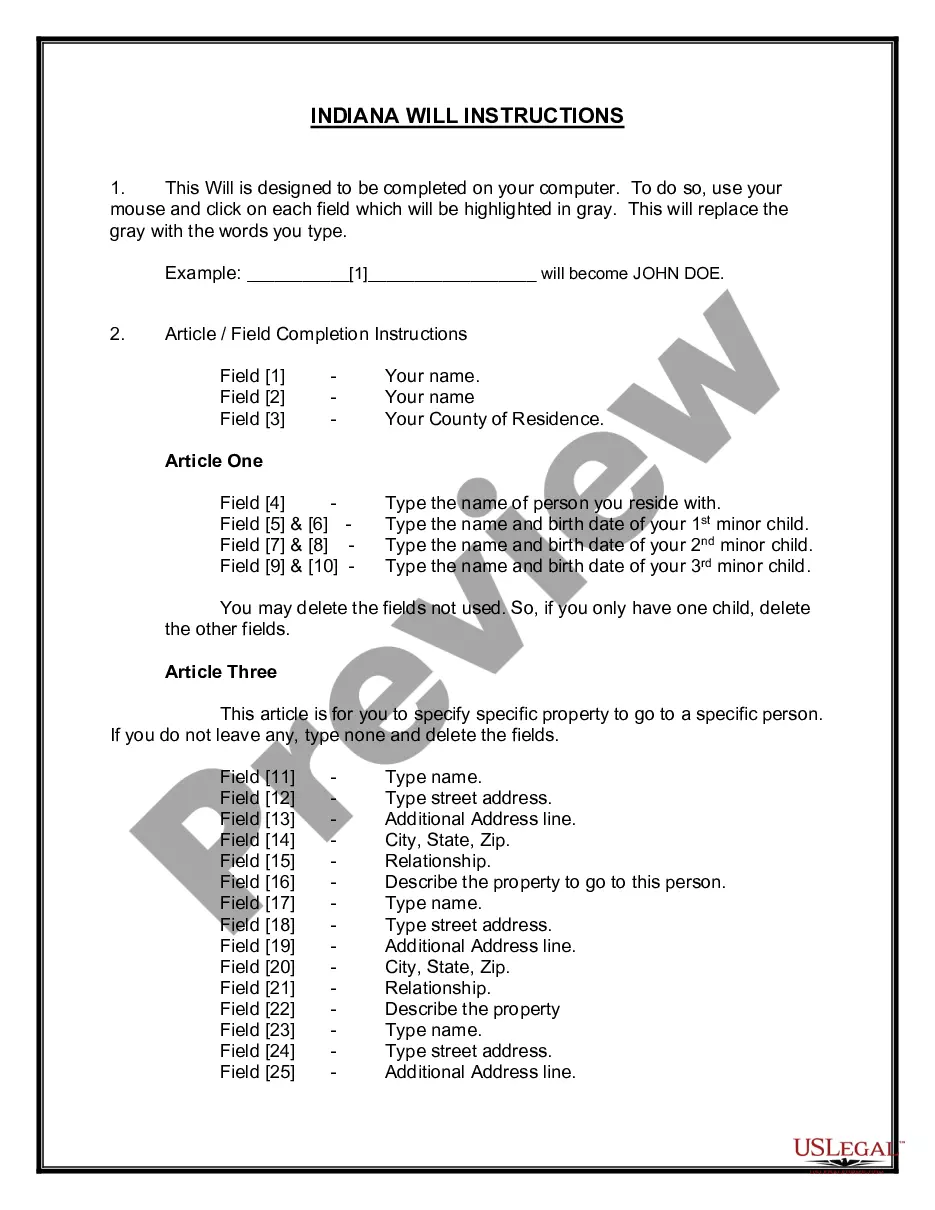

The Minutes A Corporation With The Irs you see on this page is a multi-usable formal template drafted by professional lawyers in line with federal and state regulations. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Minutes A Corporation With The Irs will take you only a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to verify it satisfies your needs. If it does not, utilize the search option to find the right one. Click Buy Now once you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Minutes A Corporation With The Irs (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your papers again. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

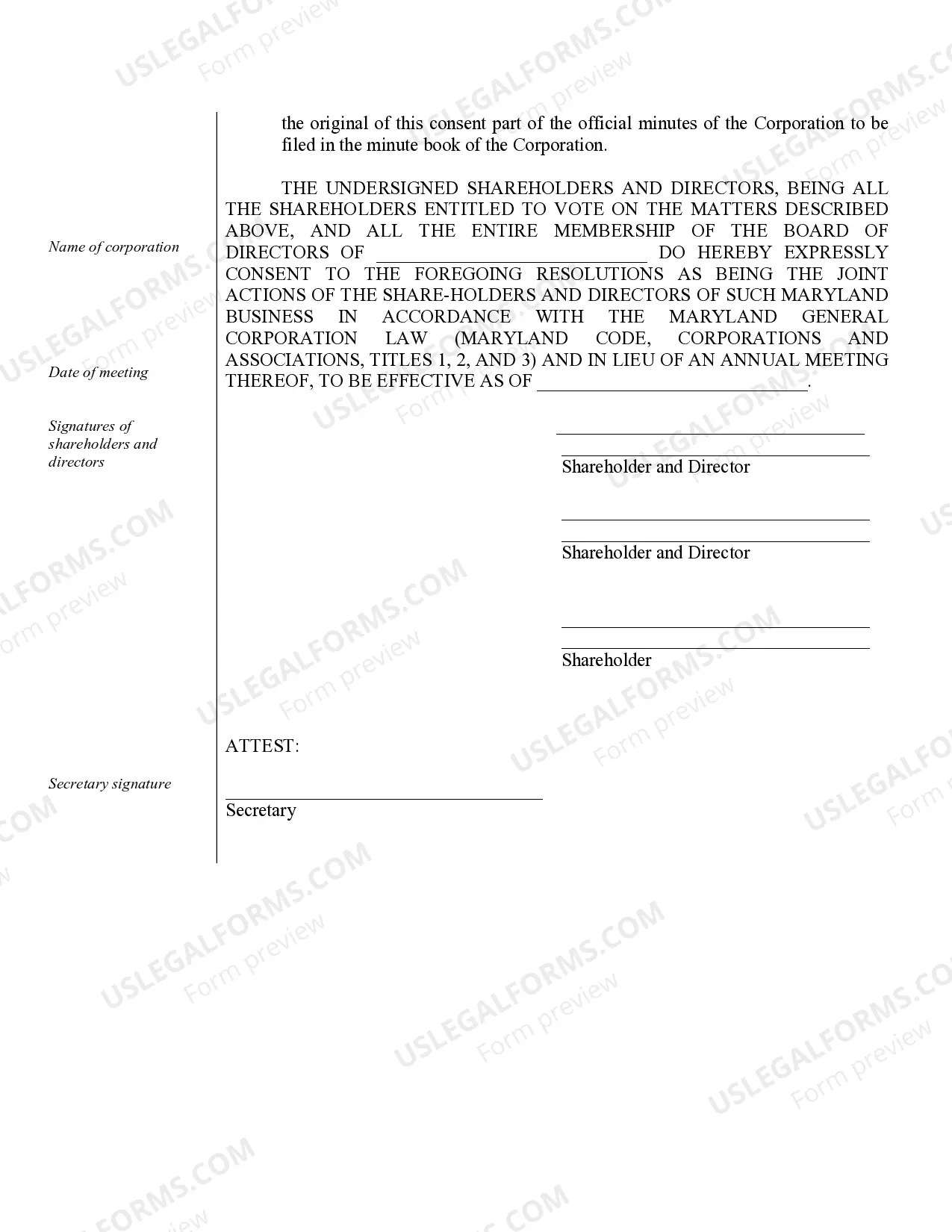

Filing minutes for safekeeping Once reviewed, approved, and signed, meeting minutes should be printed and stored in a file folder or binder for that purpose and stored electronically. This allows past discussions to be referenced as needed when related issues come up again in the future.

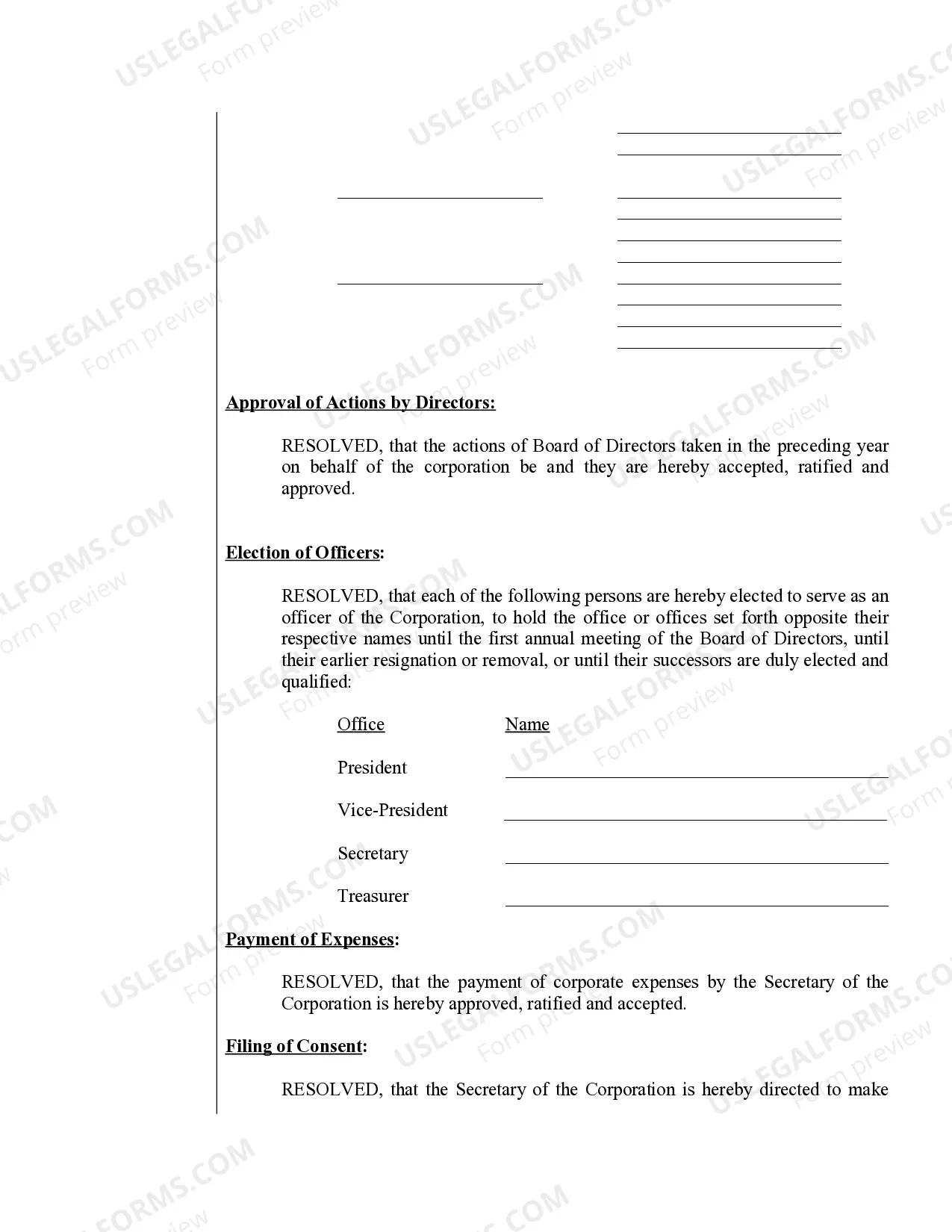

What should you include in corporate meeting minutes? Date, time, and location of the meeting. Meeting purpose. If quorum requirements are satisfied. Attendance. Approval of the previous meeting's minutes. All appointments of officers and staff. Election of board members. Loan or credit applications.

As for content, in general, your S corporation's meeting minutes should contain the following information: date and place of the meeting. who was present and who was absent from the meeting. details about the matters discussed at the meeting. results of votes taken, if any.

A business should keep its minutes for at least seven years, and make them available to members of the corporation (e.g., shareholders, directors, and officers) who make a reasonable request to review them. There is no requirement to file annual stockholder meeting minutes with the state or other government agencies.

How to Write Corporate Minutes Date and Time of the Meeting. Start by documenting the date and time of the meeting. ... Names of Meeting Participants. Next, list the names of the attendees. ... Purpose of the Meeting. Include a statement defining the reason for the corporate meeting. ... Meeting Notes. ... Action Items.