Maryland Inheritance Tax Waiver Form For Estate

Description

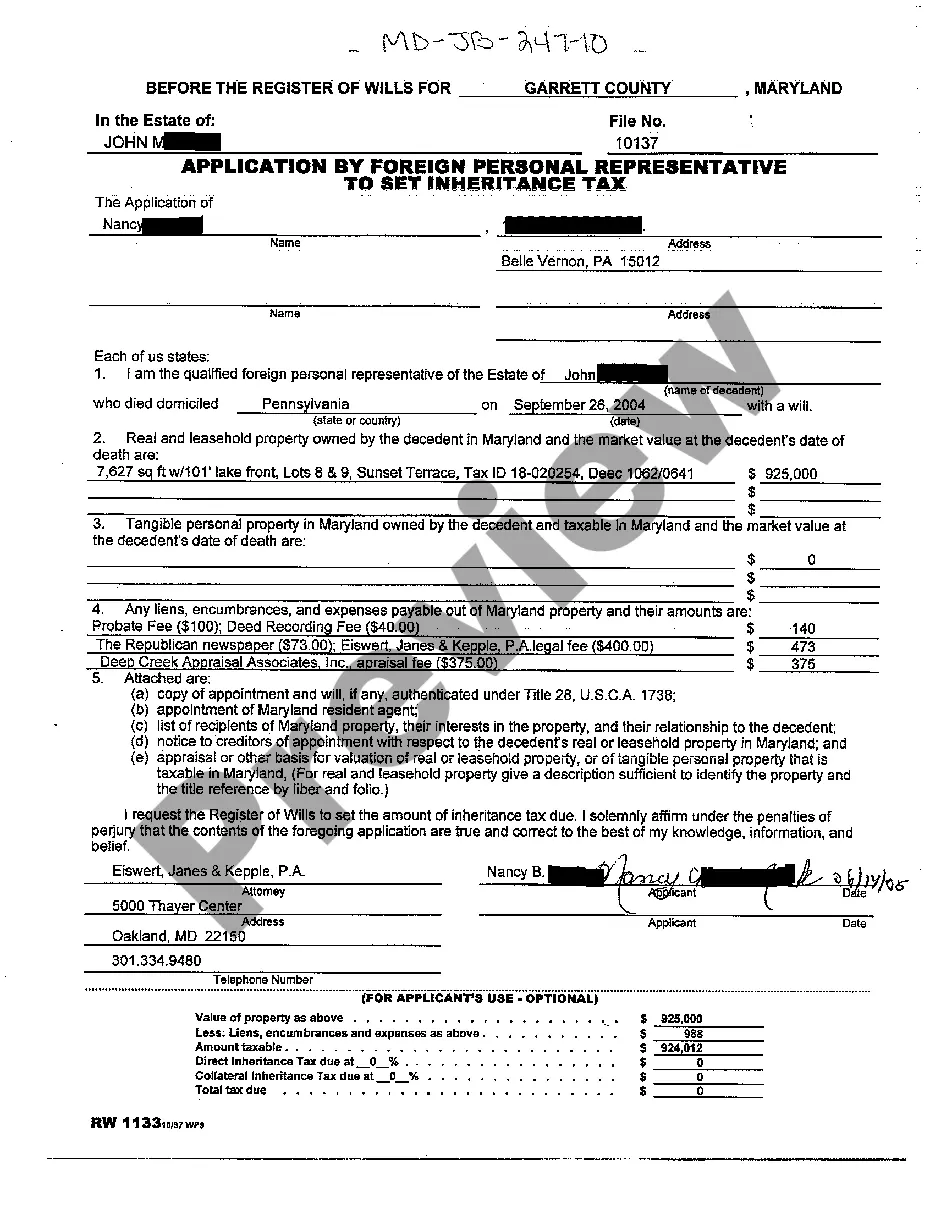

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

It’s clear that you cannot become a legal expert instantly, nor can you acquire the ability to swiftly prepare the Maryland Inheritance Tax Waiver Form For Estate without a specific skill set.

Creating legal documents is a lengthy process that demands special education and expertise. So why not entrust the development of the Maryland Inheritance Tax Waiver Form For Estate to those who specialize in it.

With US Legal Forms, one of the most extensive legal template collections, you can find everything from court documents to templates for office correspondence.

You can revisit your documents from the My documents section anytime. If you are a current client, you can simply Log In, and find and download the template from the same section.

No matter the aim of your forms, whether financial and legal or personal, our website has you covered. Try US Legal Forms now!

- Identify the document you require using the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if the Maryland Inheritance Tax Waiver Form For Estate is what you're looking for.

- If you require a different form, begin your search anew.

- Create a complimentary account and choose a subscription plan to obtain the form.

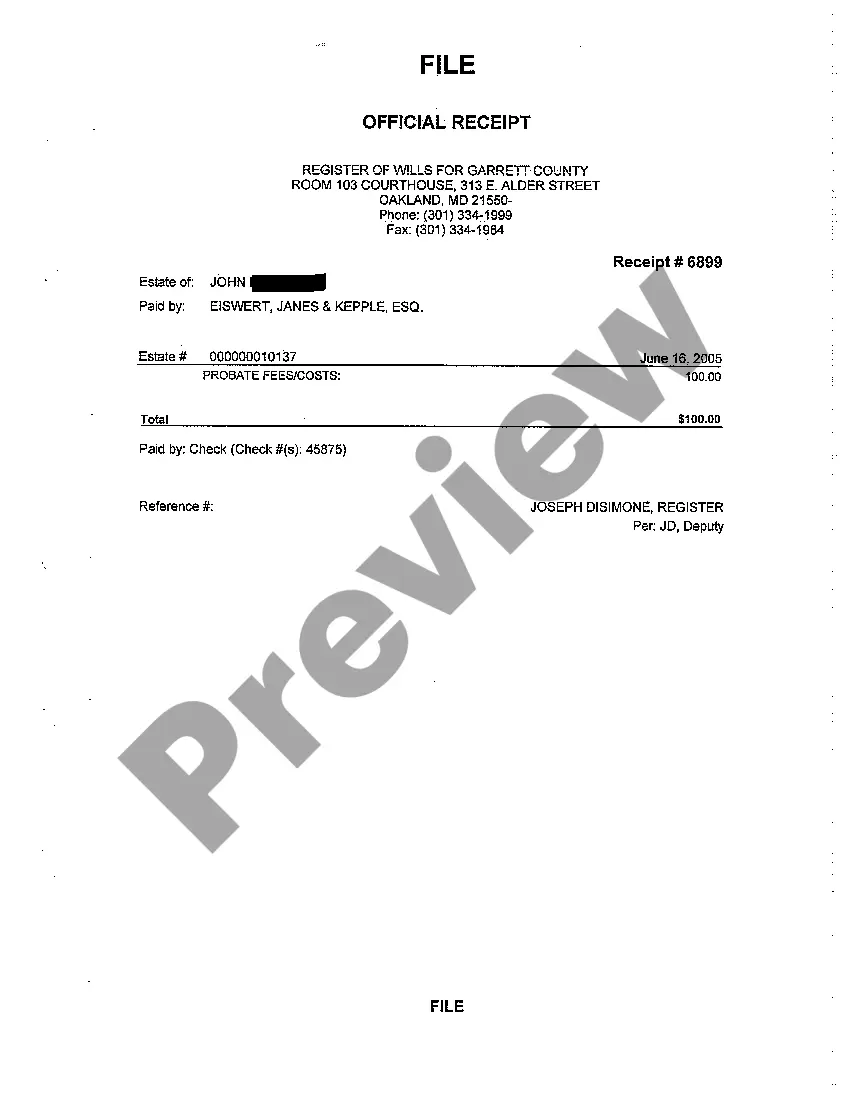

- Click Buy now. Once the payment is completed, you can download the Maryland Inheritance Tax Waiver Form For Estate, complete it, print it, and send or mail it to the appropriate parties.

Form popularity

FAQ

Maryland's inheritance laws dictate how assets are distributed after a person’s death and the taxes associated with that distribution. Generally, heirs must file the Maryland inheritance tax waiver form for estate to navigate their tax obligations properly. Laws also specify exemptions and rates, so it is vital to familiarize yourself with them to avoid unexpected liabilities. Seek professional guidance to ensure compliance with the local laws and optimize the inheritance process.

Certain individuals are exempt from the Maryland inheritance tax, including surviving spouses, siblings, parents, and children of the deceased. Moreover, charities and certain government entities can also qualify for exemptions. To understand your potential exceptions better, consider filling out the Maryland inheritance tax waiver form for estate, which can clarify your tax obligations. It is advisable to discuss your circumstances with a legal expert to explore all available exemptions.

Reducing inheritance tax in Maryland requires smart planning and understanding the laws governing estate taxes. You can make use of tax exemption limits and potentially qualify for deductions through the Maryland inheritance tax waiver form for estate. Engaging with tax or legal professionals can help you identify strategies specific to your assets, ensuring you minimize your tax liabilities effectively.

To avoid paying Maryland inheritance tax on property, consider placing assets in a revocable trust during your lifetime. This strategic move can help protect your property from being taxed upon your death. Additionally, look into utilizing the Maryland inheritance tax waiver form for estate, which can allow for exemptions under specific circumstances. Consulting with an estate planning professional can offer you valuable insights tailored to your situation.

Yes, Maryland offers an inheritance tax waiver under certain conditions. This waiver allows heirs to bypass paying a portion of the inheritance tax on particular types of property. To utilize this waiver effectively, you will need to fill out the Maryland inheritance tax waiver form for estate. It is essential to consult with a legal expert to ensure you meet the eligibility requirements.

Yes, the executor is responsible for ensuring that all tax obligations are met for the estate. This includes filing the appropriate tax returns, such as the final return for the deceased, as well as any estate-related returns. Utilizing a service like uslegalforms can guide you through the necessary forms, including the Maryland inheritance tax waiver form for estate, to ensure compliance.

As an executor of an estate, you must report any income generated during the estate administration on IRS Form 1041. This includes any interest and dividends earned from estate assets. Don't forget that if you are dealing with local tax obligations, having the Maryland inheritance tax waiver form for estate can help simplify the process.

To file taxes on behalf of an estate, you will need to obtain a tax identification number for the estate and complete IRS Form 1041. This form is specifically designed for estates and trusts, allowing you to report income generated by the estate. If the estate is subject to Maryland inheritance tax, consider also submitting the Maryland inheritance tax waiver form for estate to fulfill state requirements.

Filing a tax return for someone who has died requires you to gather all necessary documentation, including the deceased's income statements and previous tax returns. You should use IRS Form 1040 to file their final tax return. Additionally, if there is a Maryland inheritance tax waiver form for estate involved, ensure you complete that form to address any state tax obligations.

To avoid Maryland inheritance tax, you can utilize the Maryland inheritance tax waiver form for estate. This form allows you to exempt certain beneficiaries and reduce the taxable estate value. Additionally, consider making use of allowable deductions and exemptions that can lower the overall tax burden. Engaging with a knowledgeable estate planner can further optimize your approach and ensure compliance with state regulations.