Inheritance Tax Waiver Form Maryland Withholding

Description

Form popularity

FAQ

When reporting inheritance on your tax return, it is important to note that inherited assets are typically not subject to federal income tax. However, if you receive income-generating assets, you must report any income those assets produce. For Maryland, you may need to use the inheritance tax waiver form Maryland withholding, especially if there are estate taxes involved. Utilizing USLegalForms can provide you with the right documentation and guidance you need for your tax reporting.

To change your tax withholding in Maryland, start by completing a new Maryland Employee's Withholding Certificate, often referred to as Form MW507. This form allows you to adjust the amount of state income tax withheld from your paycheck. After completing the form, submit it to your employer for processing. Remember, if you need assistance with your inheritance tax waiver form Maryland withholding, consider using the resources available on USLegalForms for a seamless experience.

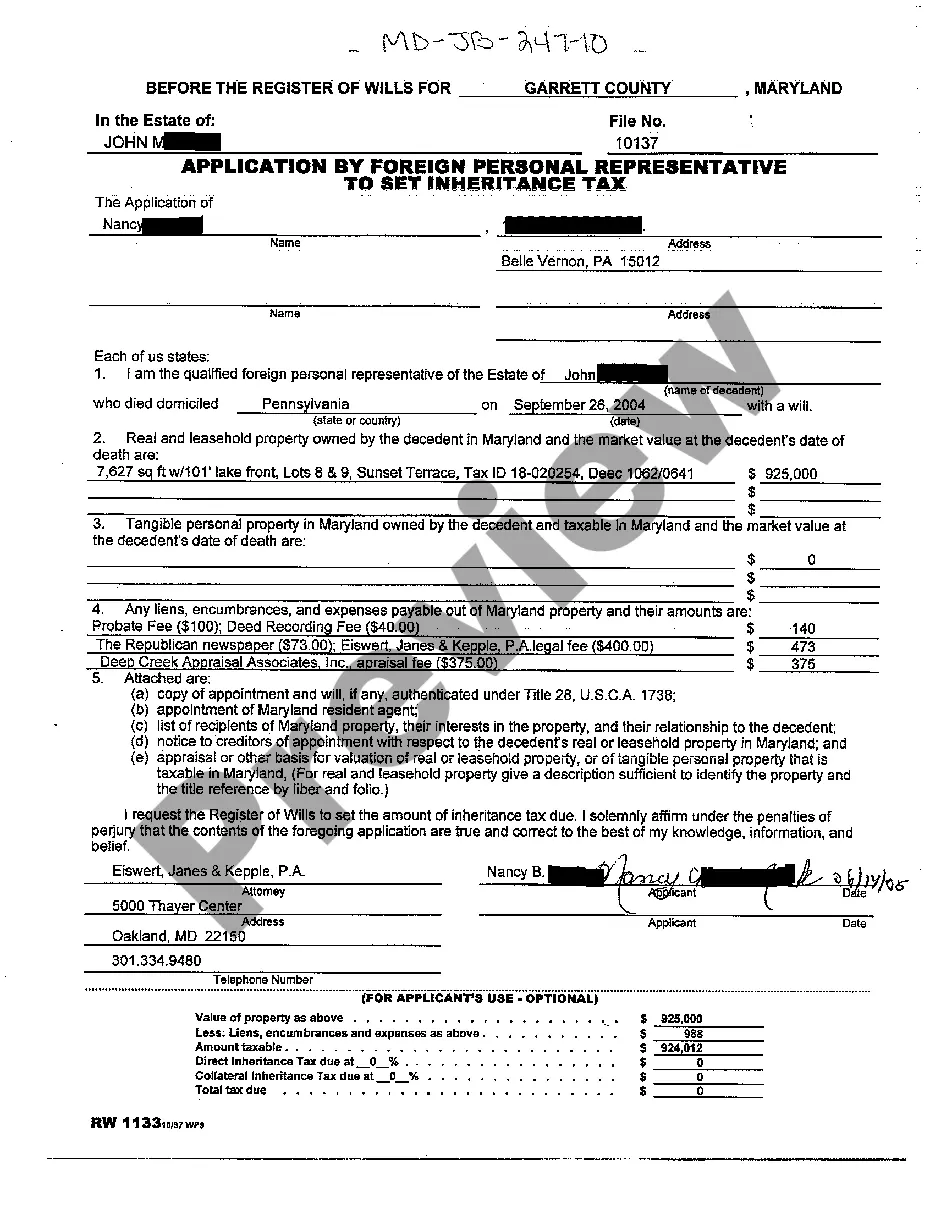

Yes, Maryland offers an inheritance tax waiver that can significantly assist heirs in alleviating tax burdens on inherited assets. This waiver can be critical in reducing or waiving taxes if specific criteria are met, especially when submitting the inheritance tax waiver form Maryland withholding. To benefit from this waiver, understanding eligibility and the application process is important. Utilizing resources like US Legal Forms can streamline the application and enhance your planning efforts.

To fill out a withholding exemption form, start by providing your personal information, including your name and Social Security number. Then, indicate your withholding allowances based on your tax situation and specify any additional details that may apply to your case. This form may be essential in terms of reducing your tax withholdings, and it's important to understand how it relates to the inheritance tax waiver form Maryland withholding. Accurate completion can lead to better tax management.

Filling out the Maryland MW507 form requires accurate information about your income and withholding allowances. When completing the form, make sure to provide your name, address, and Social Security number, along with the relevant details about your income tax withholding preferences. If you have specific exemptions, ensure you reference those correctly, as this form relates to the withholding exemption, not the inheritance tax waiver form Maryland withholding. Review the instructions carefully to avoid errors that could affect your tax situation.

Maryland's inheritance laws dictate how estate assets are distributed among heirs and beneficiaries following a person's death. Generally, these laws can result in the imposition of inheritance taxes unless proper planning is in place, such as filing the inheritance tax waiver form Maryland withholding. Understanding these laws helps you navigate your obligations and protect your estate. It’s wise to familiarize yourself with the laws to ensure compliance and optimize distribution.

To avoid inheritance taxes in Maryland, you can utilize specific strategies such as establishing trusts, gifting assets during your lifetime, and making use of tax exemptions. It’s essential to understand the details of the inheritance tax waiver form Maryland withholding, as it can help reduce the tax burden for your heirs. Consulting with a financial advisor or estate planning attorney can guide you in creating an optimal plan. Being proactive is key to minimizing tax liabilities.

The Maryland real estate withholding tax exemption form allows sellers to claim an exemption from the withholding tax if certain criteria are met. By submitting this form, you can potentially avoid delays in receiving the proceeds from your sale. If you're navigating this process, it's wise to review the requirements for the inheritance tax waiver form Maryland withholding to ensure all necessary documentation is submitted accurately and on time.

Whether to have taxes withheld from your inheritance often depends on your overall tax situation and the specifics of the estate. Withholding may help cover any potential tax liabilities you might face later. It can be helpful to discuss your options with a financial advisor or use the inheritance tax waiver form Maryland withholding to clarify your position with the state and understand your withholding options better.

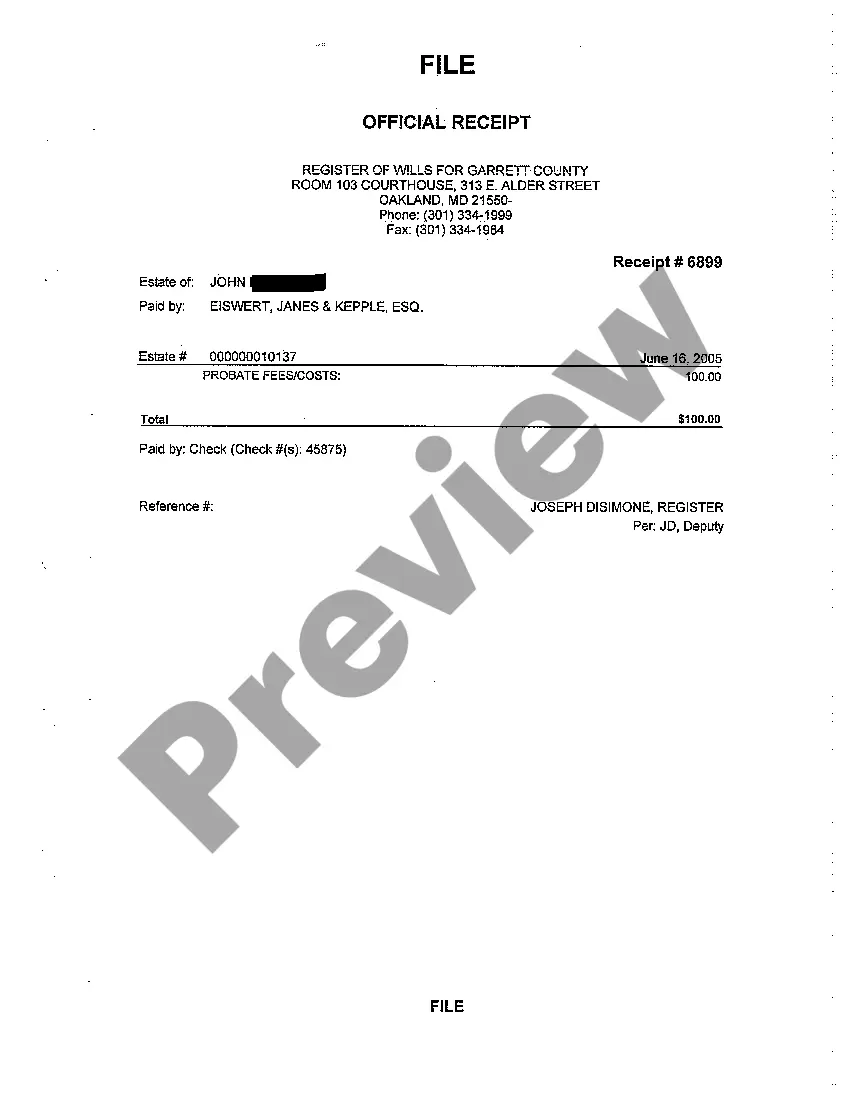

In certain situations, Maryland requires an inheritance tax waiver to ensure that any taxes owed are properly handled before assets are transferred. This waiver provides assurance that all tax obligations have been addressed. If you're dealing with an inheritance, completing the appropriate inheritance tax waiver form Maryland withholding is essential to meet state requirements and facilitate the process.