Change Llc Name With Irs

Description

Form popularity

FAQ

Typically, if you only change your LLC's name and not its structure or ownership, you don’t need a new EIN. Just inform the IRS of the name change using Form 8822-B, and your existing EIN remains valid. Keeping your EIN intact simplifies your tax filings, so focus on informing the IRS properly to align your business records with your new LLC name.

To notify the IRS of your LLC name change, submit Form 8822-B to update your records. Make sure to include all necessary information, like your old name and new name, along with your LLC's EIN. This step ensures that the IRS has the most current information, making it easier for your business to operate without any interruptions.

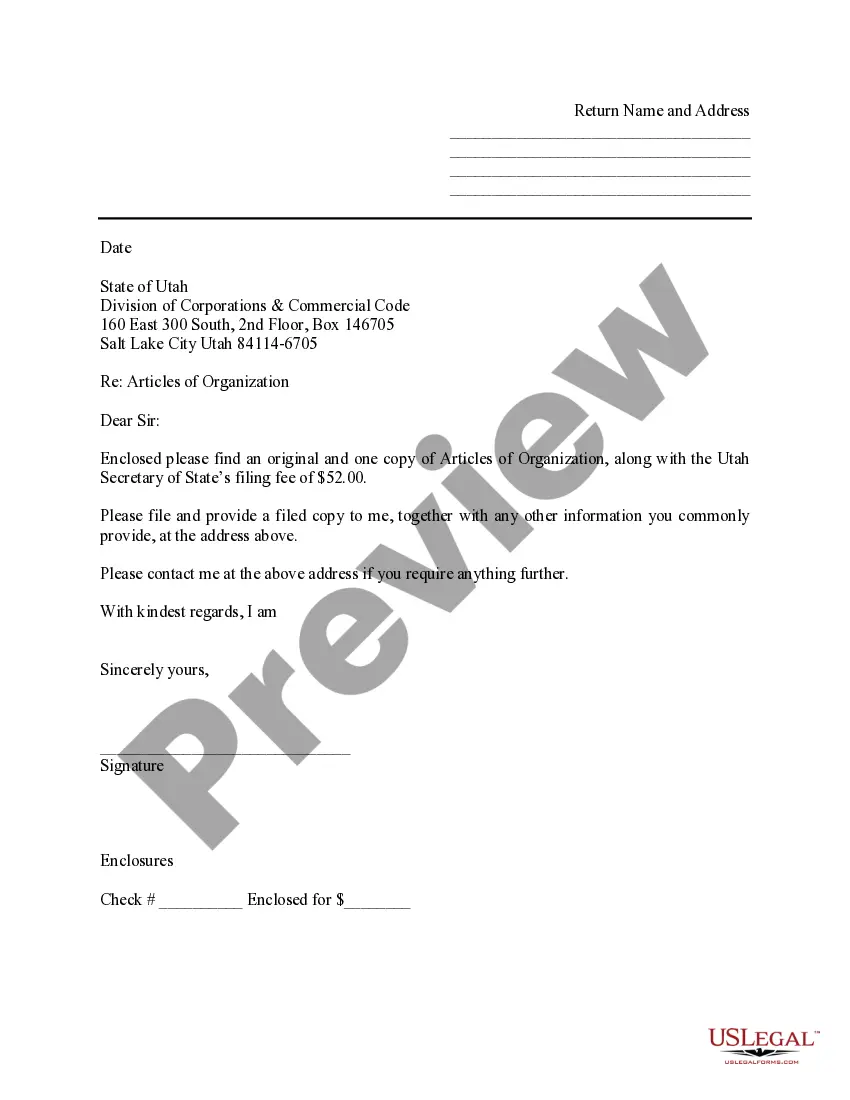

Changing your business name with the federal government requires you to notify the IRS after you legally change your LLC's name at the state level. You can do this by submitting Form 8822-B, which allows you to inform the IRS of the name change. It’s crucial to ensure that your new name matches the one you’ve registered with your state, so your change LLC name with IRS process runs smoothly.

To update LLC ownership with the IRS, you need to follow a specific process. First, ensure that you have legally documented the ownership changes in your LLC's operating agreement. After that, notify the IRS by either completing the appropriate forms or updating your information online. It's essential to keep your records accurate to avoid potential tax issues.

Changing ownership of an LLC in New York involves an amendment to your operating agreement and notifying the state. Update the membership records and report the change to the IRS. Using USLegalForms can simplify this process by providing the necessary forms and guidance.

To change the name of your small business, first check if the new name is available in your state. Once confirmed, file the appropriate paperwork with your state’s business authority, and don’t forget to update the IRS to change the LLC name with IRS records as well.

Yes, you can change your LLC name in New York. This requires filing a Certificate of Amendment with the Department of State. Ensure that your new name is available and does not conflict with existing businesses, and remember to update the IRS to maintain compliance.

To change your LLC name in Colorado, you must file a Statement of Change of a Limited Liability Company with the Secretary of State. Make sure the new name complies with the state's naming rules. After the change, update the IRS to officially reflect your new LLC name.

Yes, you can change your LLC address online in New York. To do this, you need to file a Certificate of Amendment with the New York Department of State. This process allows you to update your address conveniently without visiting the office, and it is essential to keep your business information accurate with the IRS.

Yes, you can change your business name in Colorado through a formal process. Start by checking the availability of your desired name on the Secretary of State's website. Once you have confirmed its availability, file the amendment to your LLC's articles of organization. Be sure to update your IRS records as well to successfully change LLC name with IRS to avoid any future complications.