Confirmatory deed Maryland withholding refers to a specific term used in real estate transactions in Maryland that involves the withholding of funds from the seller's proceeds during a property transfer. This is done to ensure compliance with the state's tax laws and to satisfy any unpaid taxes or obligations associated with the property. In Maryland, when a property is sold, the buyer's attorney or settlement agent is required to withhold a portion of the seller's proceeds and remit it to the Maryland State Department of Assessments and Taxation (SEAT). The amount withheld is typically 7% of the sales price, but may vary depending on the situation. The purpose of this withholding is to cover any potential outstanding Maryland income and nonresident withholding tax liabilities by the seller. This ensures that the state can collect any unpaid taxes before the seller receives the remaining funds from the property sale. It also protects the buyer from assuming any tax liability associated with the property. There are primarily two types of confirmatory deed Maryland withholding: 1. Full Withholding: In this type of withholding, the entire amount of 7% (or the applicable rate) is withheld from the seller's proceeds. This is generally the default type of withholding unless the seller qualifies for an exemption or reduction. 2. Reduced Withholding: In certain circumstances, the seller may be eligible for a reduced withholding rate or exemption. This can occur if the seller is a Maryland resident, has no Maryland income tax liability, or meets other qualifying criteria. In such cases, a reduced amount is withheld based on the applicable exemption or reduction. It is important to note that the confirmatory deed Maryland withholding requirements can be complex and may require expert advice from tax professionals or real estate attorneys. Failure to comply with the withholding obligations can lead to penalties or legal consequences. Therefore, both buyers and sellers should be aware of these requirements and ensure proper compliance during the property transfer process. In summary, Confirmatory deed Maryland withholding refers to the retention of a portion of the seller's proceeds during a real estate transaction in Maryland to satisfy any potential unpaid taxes. The two main types of withholding are full withholding and reduced withholding, with the latter available to sellers who meet specific exemption or reduction criteria.

Confirmatory Deed Maryland Withholding

Description

How to fill out Confirmatory Deed Maryland Withholding?

It’s obvious that you can’t become a legal professional overnight, nor can you figure out how to quickly prepare Confirmatory Deed Maryland Withholding without the need of a specialized background. Creating legal forms is a long process requiring a specific training and skills. So why not leave the preparation of the Confirmatory Deed Maryland Withholding to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court papers to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the form you require in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether Confirmatory Deed Maryland Withholding is what you’re searching for.

- Begin your search over if you need a different template.

- Set up a free account and choose a subscription plan to purchase the template.

- Pick Buy now. Once the payment is complete, you can get the Confirmatory Deed Maryland Withholding, complete it, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

To change names on a deed in Maryland, complete a new deed form that includes the correct names of the parties. After you fill out and sign the new deed in front of a notary, file it with the local land records office. Keep in mind the rules around confirmatory deeds and Maryland withholding, as these can affect proper completion.

In Maryland, a confirmatory deed is specifically designed to affirm the ownership interests in a property, often used to address discrepancies. It can help clarify ownership when a prior deed does not fully express the intent of the parties. This deed can be crucial in managing Maryland withholding issues effectively.

Yes, you can change a deed without a lawyer in Maryland, provided you understand the requirements and legal implications. While many individuals successfully navigate this process independently, using a service like US Legal Forms can ensure you have the right documents. A confirmatory deed related to Maryland withholding may be particularly useful in your case.

To fill out a quit claim deed, start with the names of the parties involved, including the granter and grantee. Clearly describe the property being transferred, ensuring it matches records, and then sign the deed in front of a notary. Once completed, submit the quit claim deed to your local land records office for official processing and consider the implications of confirmatory deeds regarding Maryland withholding.

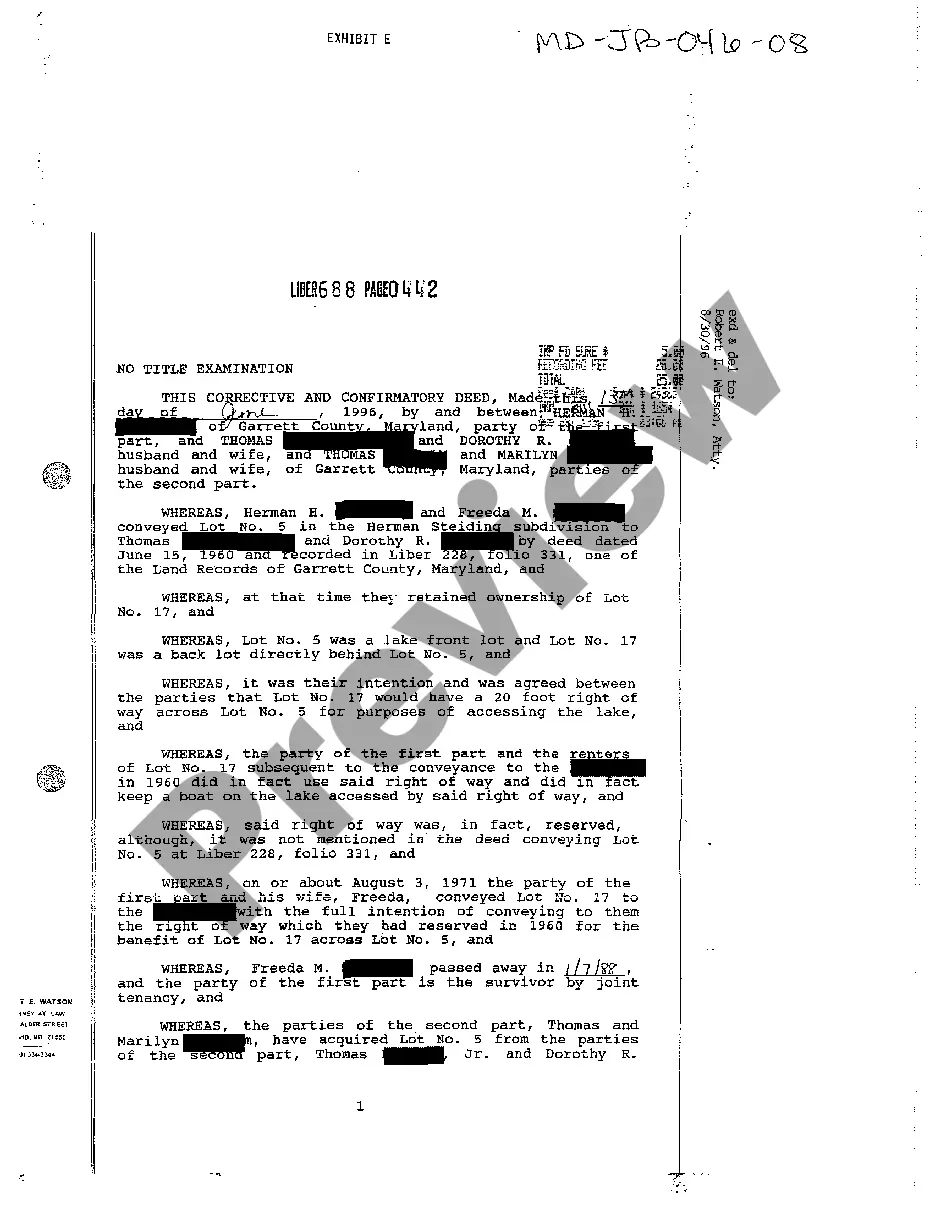

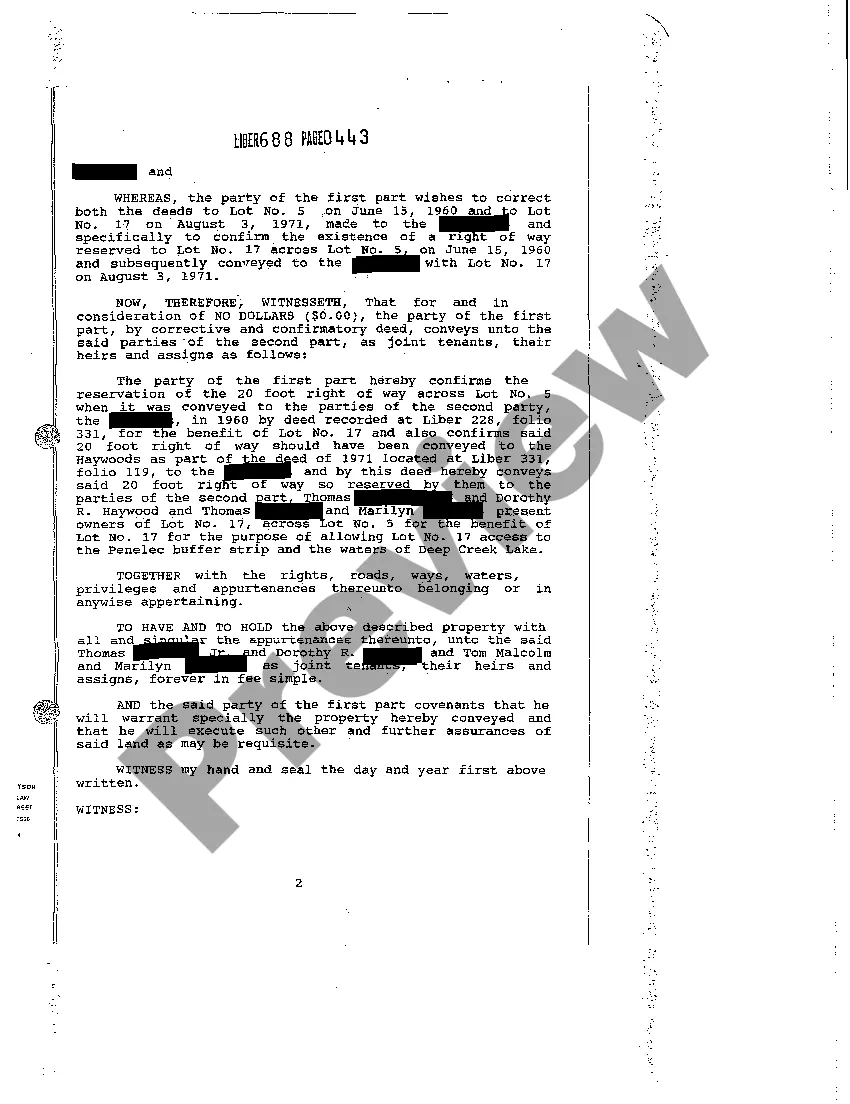

A confirmatory deed is a document used to confirm or clarify the information in an existing deed. This deed serves to reinforce the intentions of the parties involved, ensuring all records reflect current ownership. It plays an important role in the context of Maryland withholding, solidifying the title's accuracy.

Updating your deed in Maryland involves creating a new deed that details the updated information. You should gather all necessary details, sign the document in the presence of a notary, and then file it with the local land records office. Utilizing resources on confirmatory deeds related to Maryland withholding can help clarify any legal requirements.

To update a deed in Maryland, you need to complete a new deed form that reflects the desired changes. After filling out the form, you must sign it in front of a notary public. Next, submit the deed to the local land records office along with any required fees. Understanding the role of a confirmatory deed in Maryland withholding can simplify this process.

In Maryland, a deed must include several key elements to be valid, including the names of the grantor and grantee, a legal description of the property, and proper notarization. Additionally, the deed should be recorded with the local land records office to ensure public access and transparency. If you are dealing with confirmatory deed Maryland withholding, adhering to these requirements is essential for confirming ownership.

The purpose of a deed of confirmation is to clarify any uncertainties related to a prior property deed. It serves to reinforce the original intent and can address mistakes or omissions in earlier documents. By utilizing a deed of confirmation, especially in situations involving confirmatory deed Maryland withholding, you can secure clear property rights moving forward.

In Maryland, a deed can often take precedence over a will if the deed explicitly transfers property ownership. When a property is transferred via a deed, it typically does not revert back to the estate, effectively overriding any instructions left in a will. This is particularly important when considering confirmatory deed Maryland withholding, as it ensures that ownership is clear and enforceable.