Substitute Trustee Deed Foreclosure

Description

How to fill out Substitute Trustee Deed Foreclosure?

Steering through the red tape of official paperwork and forms can be daunting, particularly when one is not a professional in that area.

Even locating the appropriate form for a Substitute Trustee Deed Foreclosure can be a lengthy process, as it must be accurate and valid down to the last digit.

Nevertheless, you will have to invest considerably less time selecting a suitable template from a reliable source.

Obtain the correct template in a few simple steps: Enter the document title in the search box, select the appropriate Substitute Trustee Deed Foreclosure from the results, review the outline of the sample or check its preview, click Buy Now once the template fits your needs, choose your subscription plan, register with your email and create a password on US Legal Forms, select a credit card or PayPal for payment, and finally, save the template document on your device in your preferred format. US Legal Forms can help you save time and effort determining if the form you found online suits your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the task of finding the correct forms online.

- US Legal Forms is a one-stop destination for acquiring the latest document samples, learning about their usage, and downloading them for completion.

- It boasts a library of over 85,000 forms applicable to various domains.

- When searching for a Substitute Trustee Deed Foreclosure, you need not question its validity as all forms have been authenticated.

- Having an account with US Legal Forms will guarantee that you possess all necessary samples readily available.

- You can save them in your history or include them in your My documents catalog.

- Your stored forms can be accessed from any device by selecting Log In at the library site.

- If you currently lack an account, you can always search again for the template you require.

Form popularity

FAQ

The timeline to obtain a deed in lieu of foreclosure can vary based on the lender's policies and the specific circumstances of the case. Generally, it takes several weeks to a few months to complete the necessary paperwork and negotiations. It's essential to communicate openly with your lender and consider using resources like USLegalForms to navigate this process effectively. This can help streamline the steps involved in obtaining a Deed in Lieu of Foreclosure.

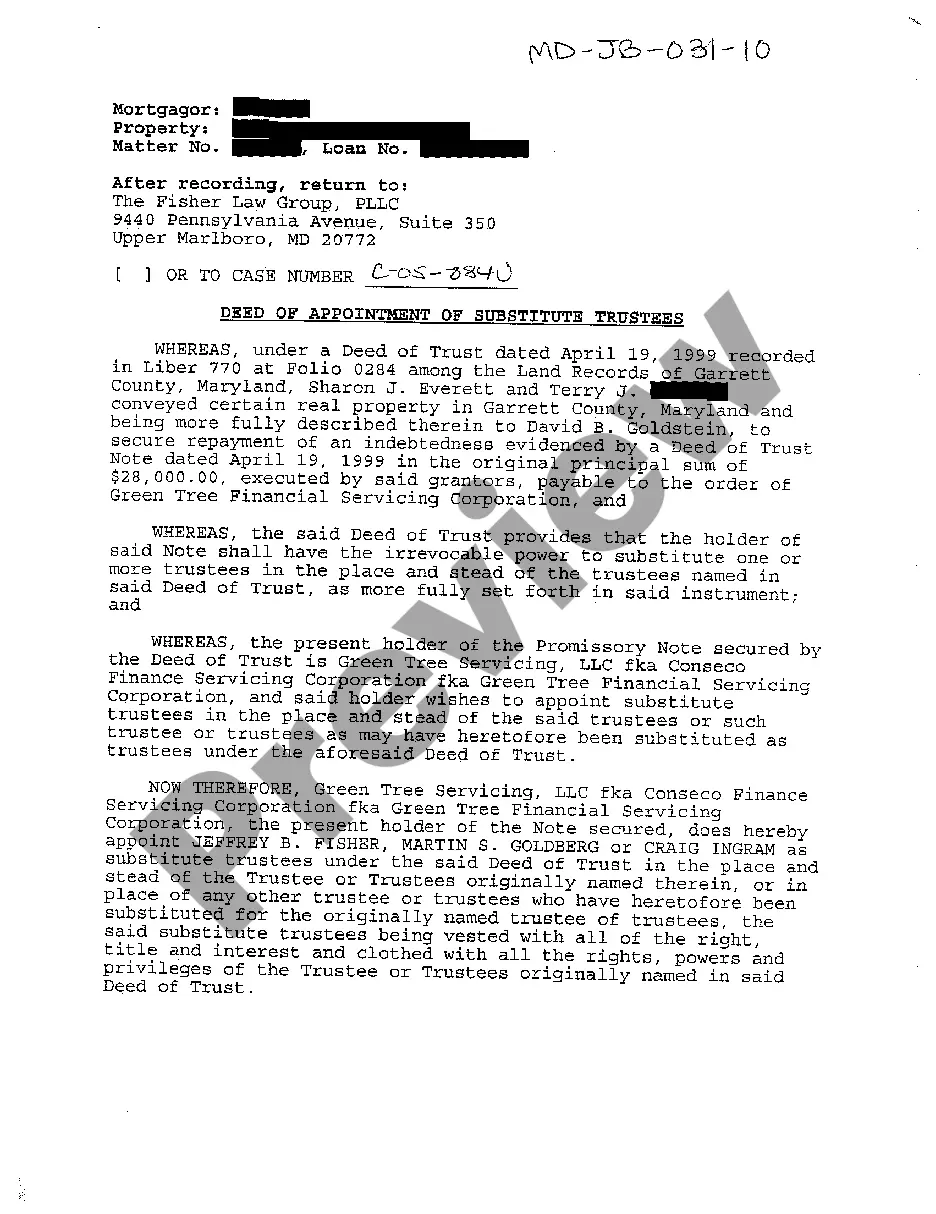

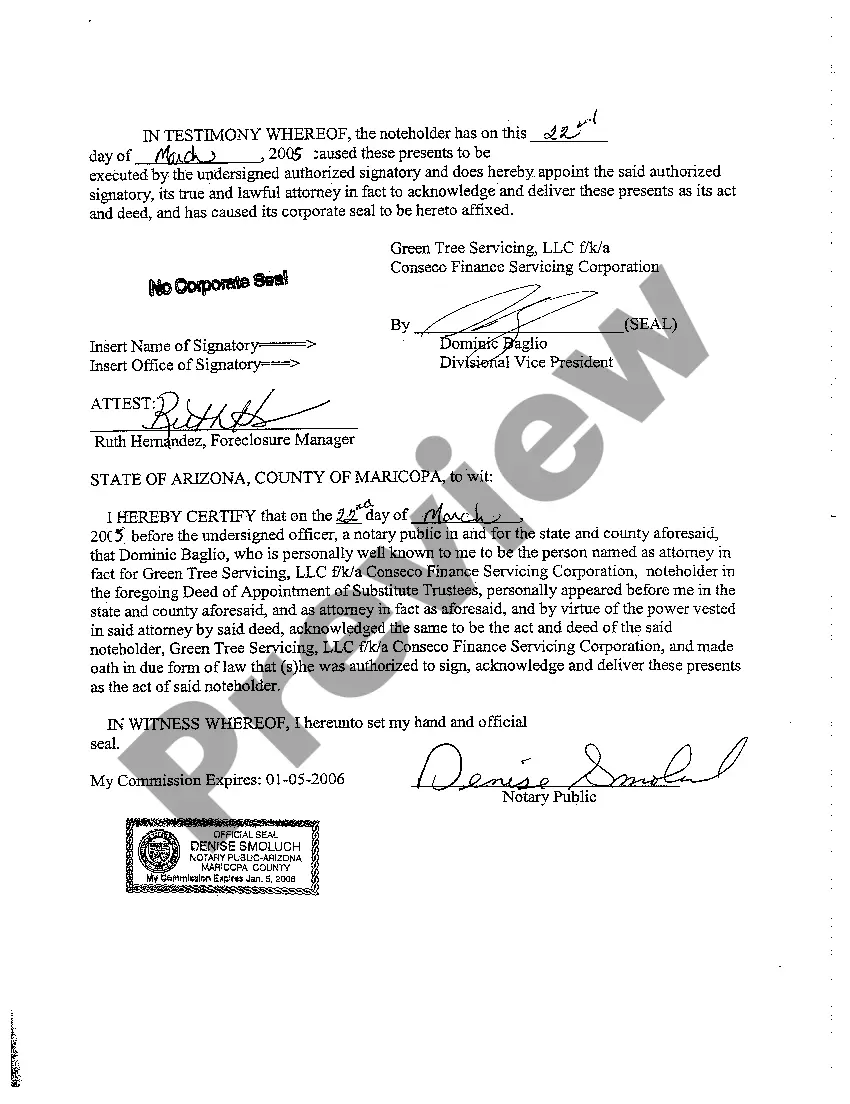

A substitution of Trustee is a legal process where one trustee is replaced by another in a deed of trust. This action often occurs when the original trustee cannot fulfill their duties or has been removed by the lender. Understanding the role of a substitute trustee is crucial, especially during the Substitute Trustee Deed Foreclosure process. This ensures that the new trustee can effectively manage the foreclosure proceedings.

In a foreclosure, the primary individuals who suffer are the homeowners. They face significant emotional distress and financial loss, as they may lose their home and investment. Additionally, their credit scores take a major hit, making future borrowing more difficult. The Substitute Trustee Deed Foreclosure process can impact the homeowner's ability to recover and rebuild from this unfortunate situation.

One disadvantage of a deed in lieu of foreclosure is that it may negatively affect your credit score, just like a foreclosure would. Additionally, the lender might impose tax liabilities or other fees, depending on the terms of your mortgage. It's essential to carefully evaluate these potential consequences when considering options like a substitute trustee deed foreclosure.

Filing a deed in lieu of foreclosure involves several steps. First, you must reach an agreement with your lender about the terms and conditions of the deed. Next, complete the deed form accurately, and submit it with the necessary documentation to the appropriate county office or register of deeds. Utilizing platforms like US Legal Forms can help ensure that you have the correct documents and guidance throughout this process.

To write an effective foreclosure letter, start by addressing the lender or mortgage servicer with your account information. Clearly explain your situation, and express your willingness to discuss any options, including a deed in lieu of foreclosure. This approach may facilitate a more favorable outcome during the substitute trustee deed foreclosure process.

A deed in lieu of foreclosure is a legal document where the borrower voluntarily transfers property ownership to the lender to avoid foreclosure. This process allows homeowners to relinquish their rights to the property while settling their mortgage debt. It serves as an alternative to the lengthier substitute trustee deed foreclosure proceedings, potentially easing the burden for homeowners facing financial distress.

The purpose of a substitution of trustee is to ensure that the foreclosure process continues uninterrupted when the original trustee cannot fulfill their role. This is particularly necessary in cases of substitute trustee deed foreclosure, where timely action can significantly impact outcomes for both lenders and borrowers. Utilizing resources like US Legal Forms can help streamline this process.

The substitution of trustee involves appointing a new trustee while a full conveyance transfers ownership of a property. While the two concepts are related, they serve different purposes in real estate transactions. During substitute trustee deed foreclosure, being clear on these distinctions can prevent legal complications.

The deed of change of trustee is a legal document that updates the trustee on a deed of trust when there is a need for a new trustee. This situation can arise for various reasons, such as retirement or inability to serve. It’s important to manage these changes properly, especially during substitute trustee deed foreclosure cases.