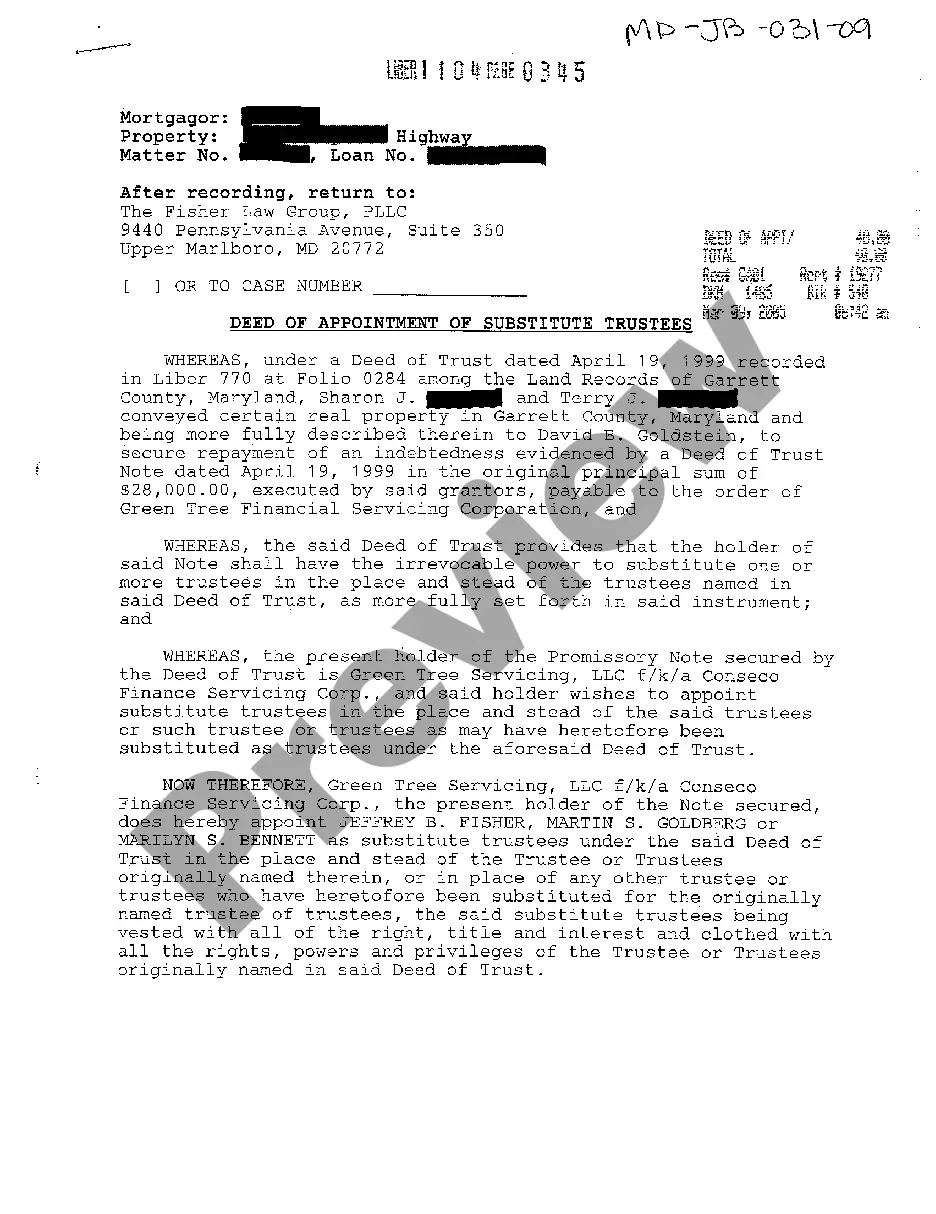

Deed Of Appointment Within 2 Years

Description

How to fill out Deed Of Appointment Within 2 Years?

Bureaucracy necessitates accuracy and exactness.

If you aren’t regularly engaged in completing paperwork such as the Deed Of Appointment Within 2 Years, it can result in various misconceptions.

Choosing the correct sample from the outset will guarantee that your document submission proceeds smoothly and avoid the hassles of having to re-submit a document or redo the same task from the beginning.

Avoid the uncertainties of bureaucracy and simplify your document dealings.

- Acquire the most recent version of the Deed Of Appointment Within 2 Years by simply searching on the website.

- Discover, organize, and save templates within your account or consult the description to ensure you possess the right one available.

- With an account at US Legal Forms, you can amass, organize them in one location, and browse the templates you store to reach them in just a few clicks.

- While on the site, click the Log In button to authenticate.

- Then, navigate to the My documents section, where your documents are listed.

- Review the description of the forms and save those you require at any time.

- If you are not a registered user, locating the necessary template will entail a few extra steps.

- Utilize the search bar to find the template.

Form popularity

FAQ

The deed of appointment and retirement of trustees refers to the process by which a trustee is either appointed or removed within a trust. This document provides a formal mechanism for changes in trust management. It's vital to understand how a deed of appointment within 2 years facilitates these transitions smoothly, ensuring that the trust continues to operate effectively.

A trust is a legal arrangement for managing assets for the benefit of others, while a trust deed is the document that creates and governs that arrangement. Essentially, the trust carries the intentions, and the trust deed spells out the details of how those intentions will be carried out. When you engage with a deed of appointment within 2 years, you address specific operational aspects laid out in the trust deed.

A trust deed is a legal document that establishes a trust and outlines the rules for managing its assets. This deed defines the roles of the trustee, the beneficiaries, and the terms of asset distribution. Knowing how to navigate a deed of appointment within 2 years can help you ensure compliance with the outlined conditions in the trust.

A discretionary trust allows the trustee to make choices about how to distribute income and assets to beneficiaries. In contrast, a power of appointment gives a trustee the authority to decide who will receive trust assets, but within set parameters. Understanding this distinction is crucial when dealing with a deed of appointment within 2 years, which focuses on the timeline for making these decisions.

An example of a trust deed is a living trust, where assets are placed into the trust during the grantor's lifetime. This arrangement ensures that the assets are managed for the benefit of designated beneficiaries. When discussing a deed of appointment within 2 years, it often refers to the process by which a trustee is appointed to manage these assets effectively.

A trust deed serves to create a legal arrangement where one party holds property on behalf of another. This document outlines the terms of the trust and identifies the trustee's responsibilities. Specifically, when considering a deed of appointment within 2 years, it is essential to understand how this mechanism allows for the distribution of assets according to the trust's terms.

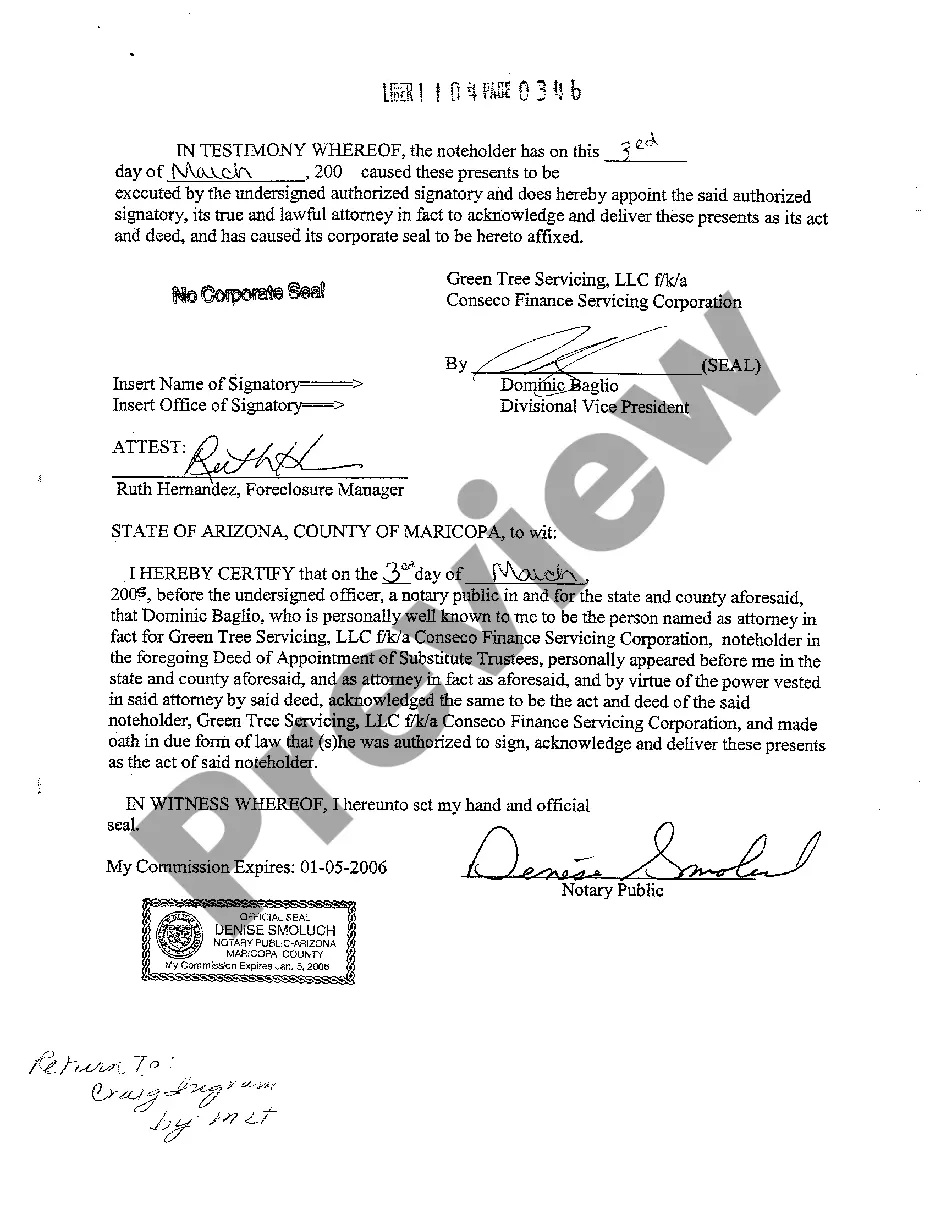

The deed of appointment for L&G is a legal document that allows you to appoint or change trustees within a specified period. It is crucial to complete this process within 2 years to ensure compliance with legal requirements. If you miss this timeframe, you may face complications in managing your trust. Platforms like UsLegalForms can assist you in drafting and finalizing your deed of appointment efficiently.

The deed of appointment of a new beneficiary is a legal document that formally adds a new beneficiary to a trust. This deed ensures that the added individual has the right to receive benefits from the trust fund. Implementing this deed within 2 years can be particularly advantageous, as it helps to avoid complications later on. USLegalForms provides useful resources and templates to facilitate this process seamlessly.

A discretionary trust deed of appointment within 2 years of death allows the trustees to decide how to distribute assets among beneficiaries based on the deceased's intentions. This flexibility benefits families dealing with changing financial situations or personal needs. By opting for this deed, you ensure that your loved ones receive support in a manner that aligns with your wishes. For assistance, consider USLegalForms to access reliable templates and expert advice.

A deed of appointment for a discretionary will trust is a legal document that allows the trustee to allocate assets to designated beneficiaries. This deed is particularly crucial when you want to specify who will benefit from the trust. By executing a deed of appointment within 2 years, the trustee can make changes that reflect the deceased's wishes more accurately. You can explore USLegalForms for templates and guidance to help streamline this process.