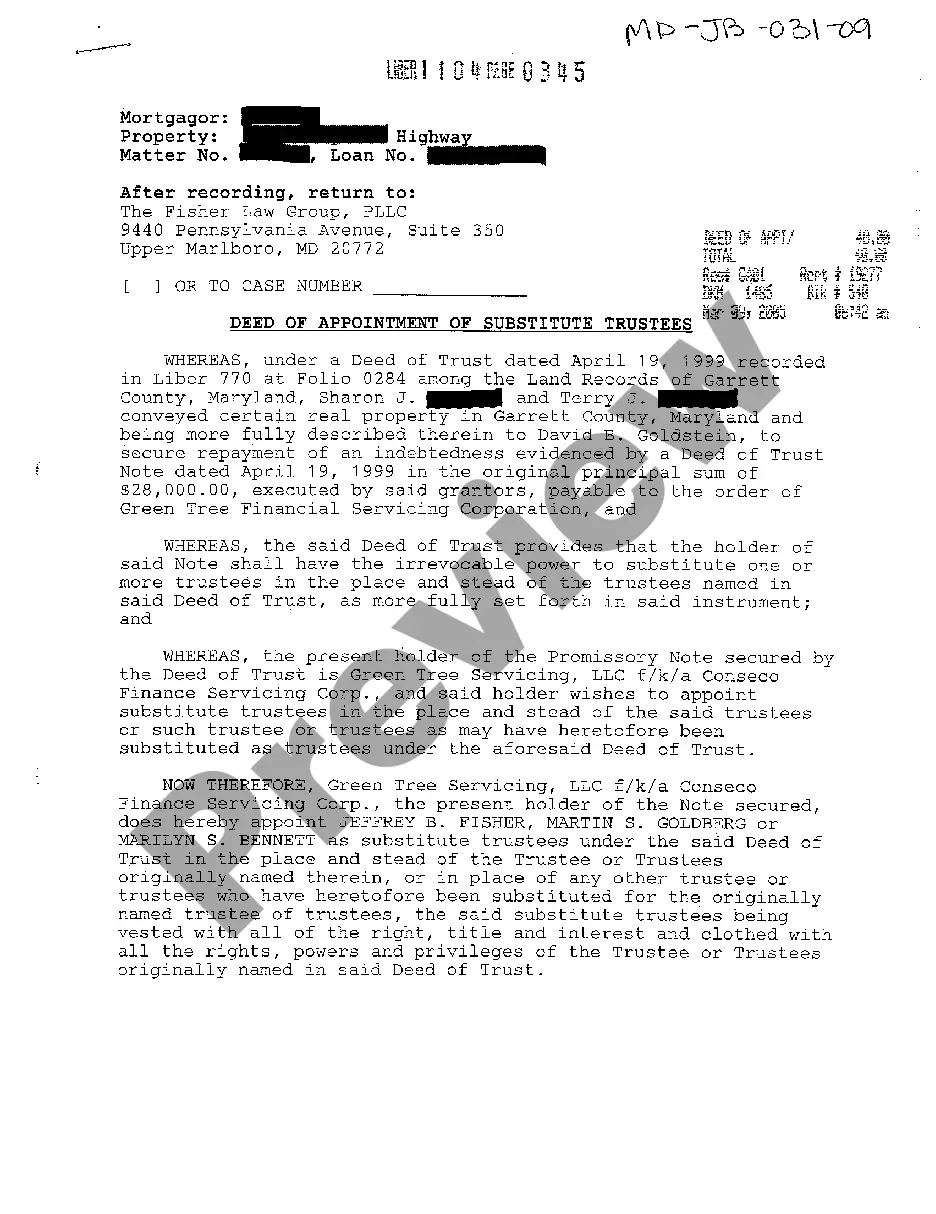

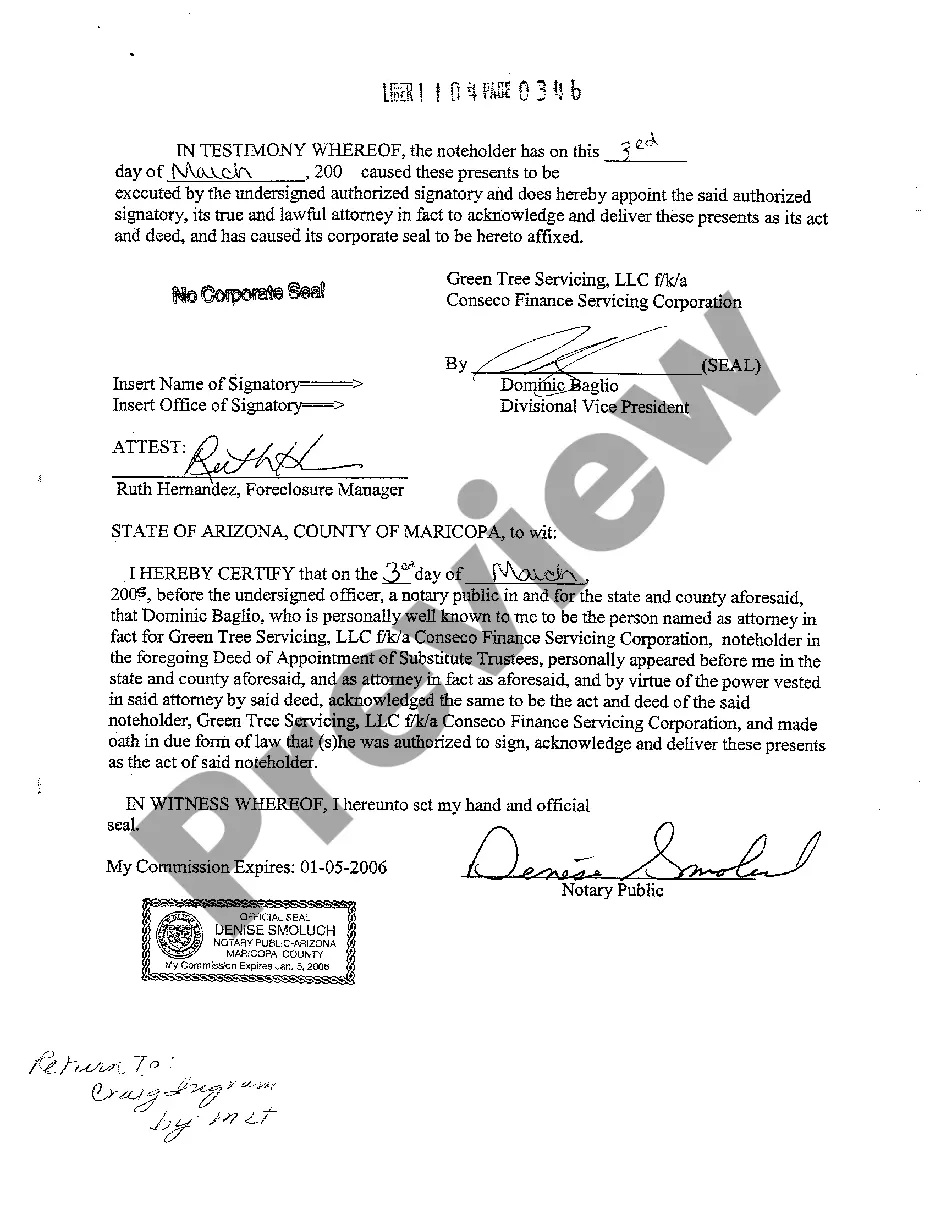

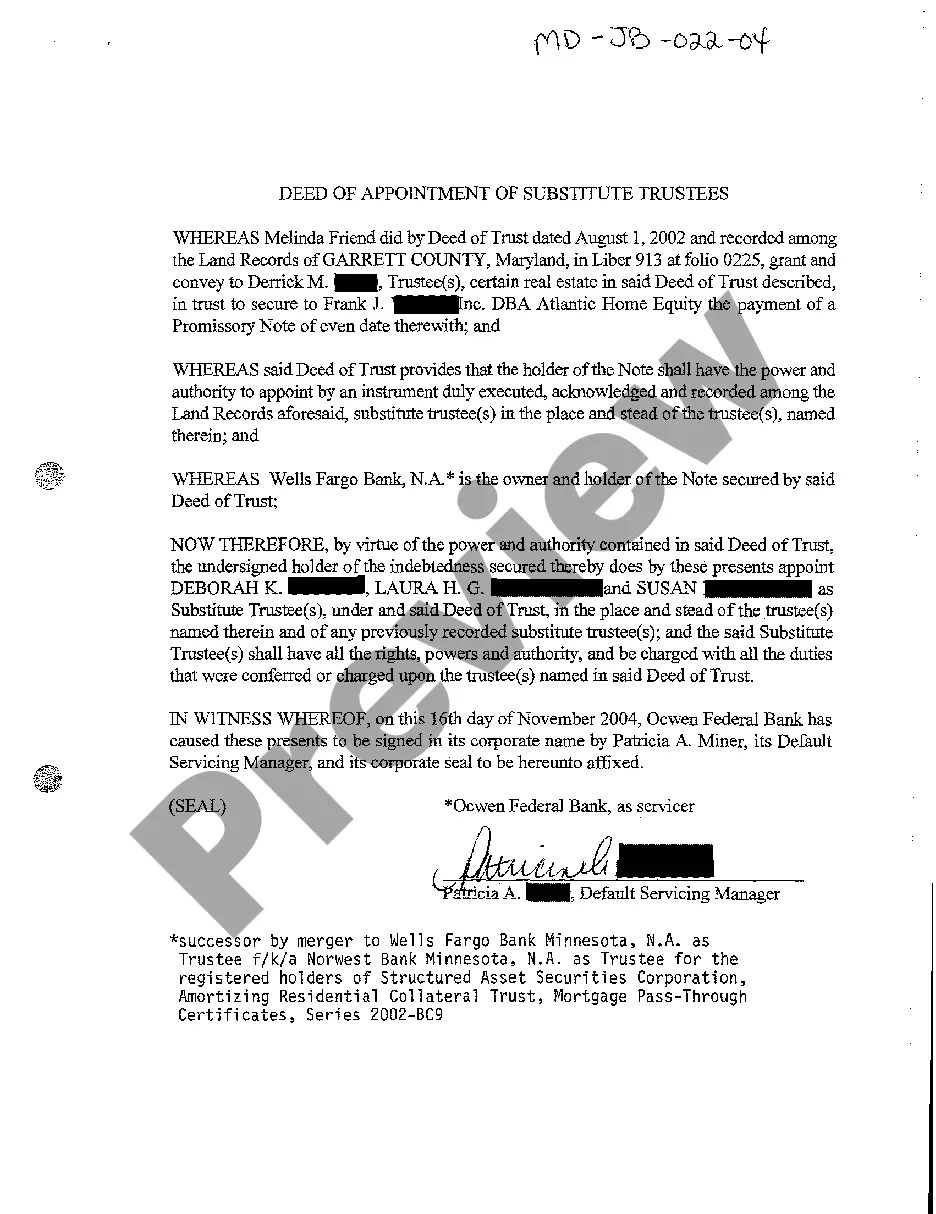

Deed Of Appointment For Property

Description

How to fill out Maryland Deed Of Appointment Of Substitute Trustees?

How to obtain professional legal documents that comply with your state's laws and prepare the Deed of Appointment for Property without hiring a lawyer.

Numerous online services provide templates to address different legal situations and requirements. However, it may require effort to determine which of the available samples satisfy both your use case and legal criteria.

US Legal Forms is a reliable platform that assists you in locating official documents created in line with the latest updates in state legislation and helps you save money on legal services.

If you do not have an account with US Legal Forms, follow the steps outlined below: Review the webpage you have accessed and verify whether the form meets your needs. Utilize the form description and preview options if available. Search for another template in the header specifying your state if necessary. Click the Buy Now button once you identify the appropriate document. Select the most suitable pricing plan, then Log In or create an account. Choose your payment method (by credit card or via PayPal). Select the file format for your Deed of Appointment for Property and click Download. The downloaded templates remain yours: you can always return to them in the My documents section of your profile. Register for our library and prepare legal documents independently like a seasoned legal expert!

- US Legal Forms is not a typical online repository.

- It's a compilation of over 85,000 verified templates covering a variety of business and life situations.

- All documents are categorized by area and state to streamline your search process.

- Moreover, it features powerful tools for PDF editing and electronic signatures, enabling users with a Premium subscription to complete their paperwork online with ease.

- Obtaining the necessary paperwork requires minimal time and effort.

- If you already possess an account, Log In and ensure your subscription is active.

- Download the Deed of Appointment for Property using the button adjacent to the file name.

Form popularity

FAQ

The power of appointment in a life estate deed allows the holder to determine who will receive the property after their death. This feature provides significant control over estate planning and ensures that your wishes are honored. Using a deed of appointment for property within a life estate can simplify future transitions for your heirs.

A trust deed outlines the terms and conditions under which a trust operates. It specifies the roles of trustees and beneficiaries, along with distribution guidelines. By incorporating a deed of appointment for property within the trust deed, you can tailor the management of your assets according to your unique preferences.

One downside of a discretionary trust is the lack of guaranteed benefits for beneficiaries. Since distributions depend on the trustee's discretion, beneficiaries may not receive funds when they expect them. Understanding the implications of a deed of appointment for property in this context can help you make informed decisions when establishing such a trust.

The power of appointment over income grants a person or entity the authority to decide how income from a property or trust should be distributed. This gives flexibility in managing the income based on the needs of beneficiaries. Utilizing a deed of appointment for property ensures that the appointed individual can allocate resources effectively.

The power to appoint beneficiaries refers to the authority granted typically within a trust deed to designate who will receive the assets. This power ensures that the trust creator can include or exclude individuals based on their wishes. By properly drafting a deed of appointment for property, you can manage changes in beneficiaries easily, reflecting life's varying circumstances.

A trust deed is important because it creates a legally binding agreement that governs asset management and distribution. It ensures that your intentions regarding property are clear and enforceable. Employing a deed of appointment for property not only protects your beneficiaries but also helps in avoiding disputes, making it a vital part of comprehensive estate planning.

The primary objective of a trust deed is to outline how property should be managed and distributed. It provides legal clarity and protection for assets, ensuring that your wishes are honored. By utilizing a deed of appointment for property, you can define who will benefit from the trust, fostering security for your heirs.

A trust deed is not strictly required for everyone, but it serves important purposes for property management. You might choose a deed of appointment for property if you want to specify the distribution of assets or title specifics. It can provide clarity and protection for your beneficiaries, which can be critical in estate planning.

A trust deed for property may limit certain freedoms, like controlling assets directly. It can also involve ongoing administrative tasks and costs for maintaining the trust. Additionally, a deed of appointment for property may require legal assistance to ensure compliance with local laws, which can create an extra layer of complexity.

The power of appointment in the UK refers to the legal authority granted to a trustee or individual to allocate property or benefits to specific beneficiaries. This power typically arises from trust documents, allowing the appointed individual to exercise discretion based on the needs and circumstances of beneficiaries. It is an essential feature for ensuring the flexibility and adaptability of a trust's operations.