Maryland Child Support Calculator Withholding

Description

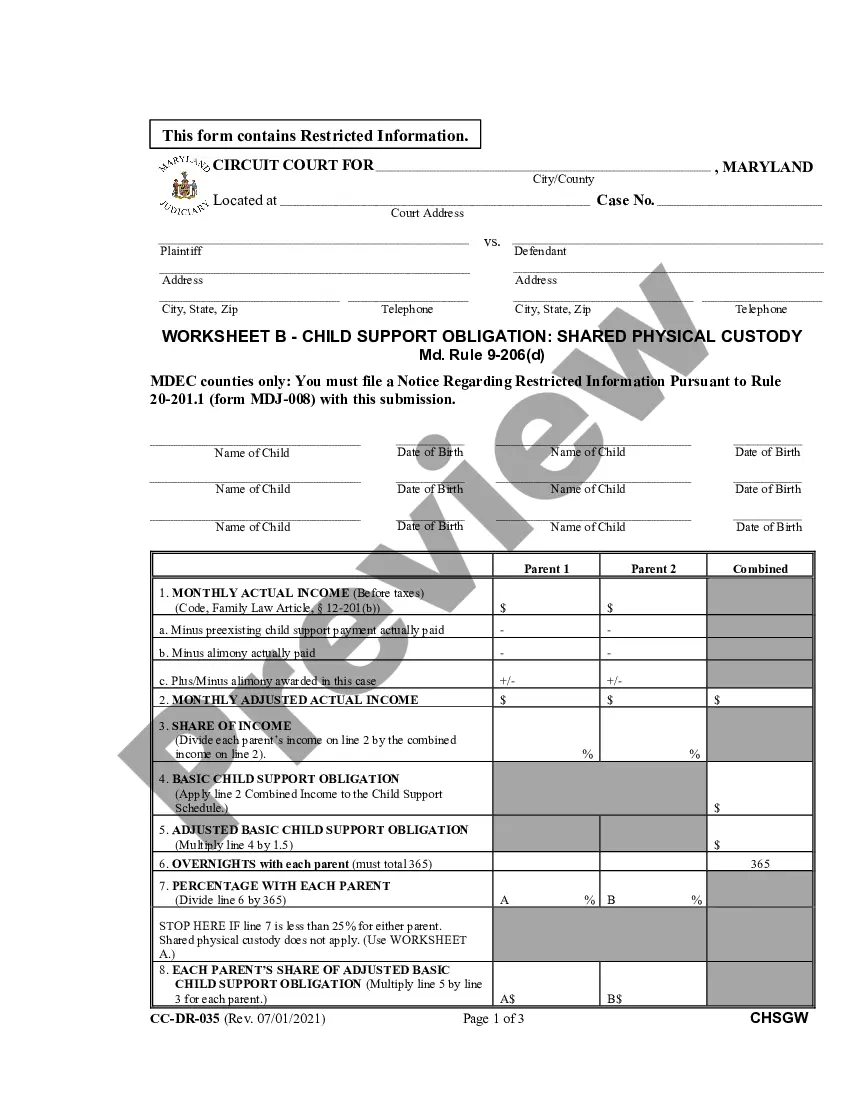

How to fill out Maryland Child Support Guidelines Worksheet A?

Well-prepared official paperwork is one of the essential safeguards against issues and legal disputes, but obtaining it without the help of an attorney might require some time.

Whether you need to swiftly access a current Maryland Child Support Calculator Withholding or other forms for employment, family, or business scenarios, US Legal Forms is always available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen document. Additionally, you can access the Maryland Child Support Calculator Withholding at any time later, as all the documents obtained on the platform are available in the My documents tab of your profile. Save time and money on preparing official paperwork. Experience US Legal Forms today!

- Ensure that the document is appropriate for your situation and location by reviewing the description and preview.

- Search for an alternative sample (if necessary) using the Search bar in the page header.

- Click on Buy Now once you find the correct template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX format for your Maryland Child Support Calculator Withholding.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Maryland law allows a maximum percentage of income to be withheld for child support payments. Generally, the maximum withholding for child support can reach up to 25% of the paying parent's disposable income. Utilizing a Maryland child support calculator withholding can clarify how much should be deducted from your paycheck. This ensures that both parents contribute fairly to their child's upbringing, while also considering the financial realities of each party.

In Maryland, child support guidelines set a cap to ensure fairness in calculations. The cap is based on the paying parent's income and can vary depending on the number of children involved. It is essential to use a reliable Maryland child support calculator withholding to determine the appropriate amount. This tool can help you navigate the complexities of child support and ensure that you meet your obligations without overextending your finances.

The biggest factor in calculating child support is the income of both parents. The Maryland child support calculator withholding takes into account each parent's gross income, which significantly impacts the support amount. Additionally, other factors like custody arrangements, medical expenses, and educational costs come into play, ensuring a comprehensive understanding of each unique situation.

In Mississippi, the minimum child support payment is set at a baseline level to cover essential needs. This amount can vary based on the paying parent's income and the number of children. While this answer comes from a different state, knowing your local regulations is essential; using a Maryland child support calculator withholding can help you understand your responsibilities better.

In Texas, the maximum child support amount is generally capped at a percentage of the paying parent's income. For example, the maximum is typically 20% for one child, increasing with additional children. Although this ruling doesn't directly relate to the Maryland child support calculator withholding, similar guidelines exist across states to ensure fairness in support obligations.

To calculate adjusted gross income for child support, begin with your total income from all sources, including wages, bonuses, and other earnings. Next, subtract eligible deductions, such as retirement contributions and health insurance. The Maryland child support calculator withholding then uses this figure to provide a more accurate assessment of your financial obligations.

Child support does not automatically stop at 18 in Maryland; it may extend if the child is still in high school. You must actively seek a termination of support through court. To manage these obligations effectively, utilize a Maryland child support calculator withholding to stay informed and prepared.

Recent updates to child support laws in Maryland include adjustments to income calculations and payment structures. These changes aim to provide a more equitable support system for families. It's beneficial to stay informed and consider using a Maryland child support calculator withholding to navigate these new laws effectively.

The amount taken from your paycheck for child support in Maryland varies based on your income and expenses. Generally, the state follows guidelines that suggest a percentage based on your total income. By using a Maryland child support calculator withholding, you can estimate the exact deduction from your check.

The maximum amount that may be withheld for child support in Maryland is 50% of disposable income for an obligor who is supporting another spouse or child. If no other spouse or child is supported, up to 60% can be withheld. A Maryland child support calculator withholding can help you determine how much may be withheld from your income.