Owner Corporation Form With Two Points

Description

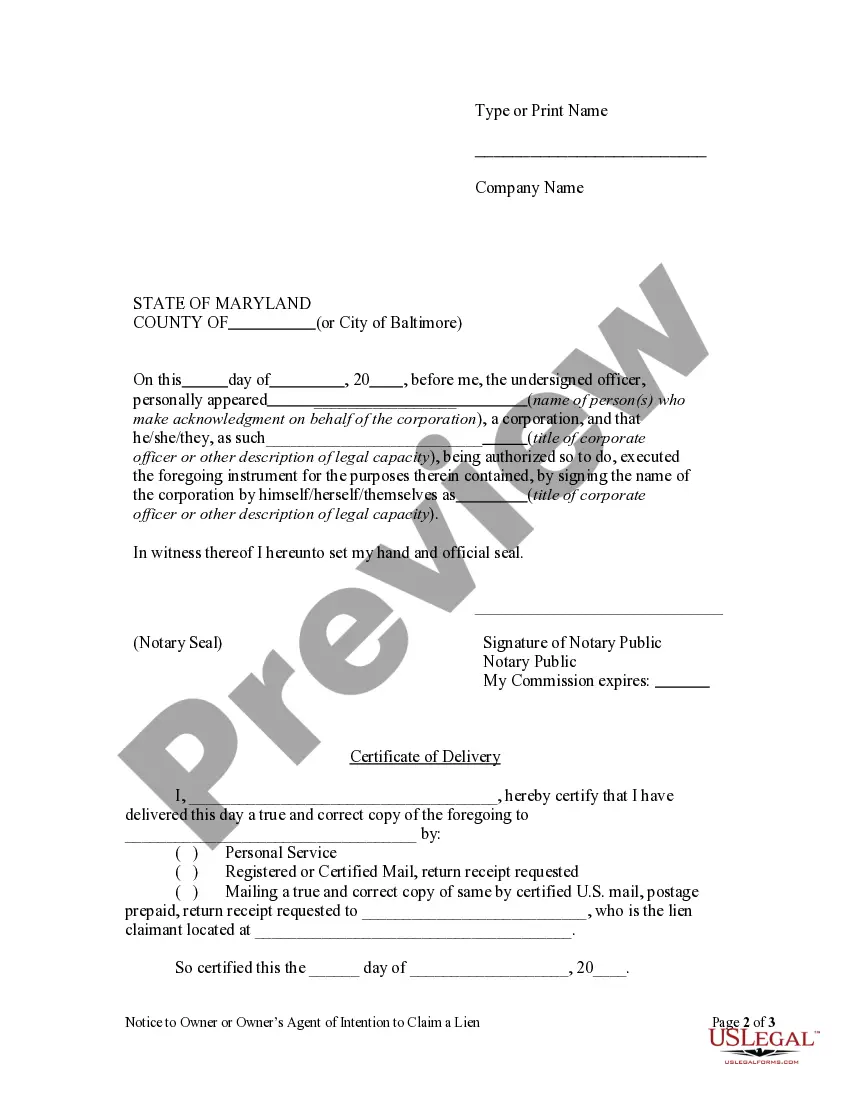

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

- If you are an existing user, simply log in to your account. Verify that your subscription is active and download the necessary form by clicking the Download button.

- For first-time users, begin by exploring the Preview mode of the form. Check its description to ensure it fits your requirements and complies with local regulations.

- If adjustments are needed, utilize the Search tab to find the correct template. Once confirmed, proceed to purchase.

- Click on the Buy Now button, select your desired subscription plan, and create an account for full access to the form library.

- Complete your purchase safely by entering your credit card information or using PayPal.

- Finally, download your completed form to your device and find it later in the My Forms section of your profile.

With access to over 85,000 legal forms and packages, US Legal Forms distinguishes itself by offering a robust collection at competitive prices. Additionally, users have the opportunity to consult with premium experts to ensure every document is completed accurately.

Start your legal documentation journey today by visiting US Legal Forms and experience the convenience of legally sound forms. Don't wait—take action now!

Form popularity

FAQ

The two common forms of ownership are sole ownership and shared ownership. Sole ownership means one person has complete control, while shared ownership involves multiple individuals collaborating. Each form has its benefits and challenges, depending on your goals. For shared ownership, an Owner corporation form with two points can define relationships and responsibilities.

To become a partial owner of a company, you generally need to invest in its stocks or shares. This investment requires a clear understanding of the company’s value and your potential role. By entering agreements that detail ownership stakes and liabilities, you can establish your position. An Owner corporation form with two points can streamline this process.

Partial ownership of a corporation means that an individual possesses a fraction of the company's total shares. This ownership does not confer complete control but provides a voice in significant company decisions. Understanding the implications of partial ownership can help avoid disputes and confusion. An Owner corporation form with two points can facilitate smoother interactions among owners.

A person becomes a part owner of a corporation mainly through the acquisition of shares, which represent ownership interest. This ownership grants certain rights, such as participating in votes and receiving dividends. It’s essential to understand the nature of ownership and how it affects your role in the company. An Owner corporation form with two points can help delineate ownership rights.

When there are two owners of a company, it is often referred to as co-ownership or partnership. This structure offers opportunities for shared decision-making and resources. However, it’s important to establish clear roles and responsibilities. An Owner corporation form with two points can help define these aspects.

If you own 50% of a company, you hold significant control over its operations and decisions. This stake allows you to influence major company decisions, including appointments and financial distributions. However, you may also face challenges if the other owner disagrees with your vision. It’s advisable to have an Owner corporation form with two points to outline decision-making processes.

To fill out a W-9 form correctly, start by entering your name and the business name, if applicable. Next, indicate your federal tax classification, checking the box that best describes your status. Provide your taxpayer identification number, which can be your Social Security number or an Employer Identification Number. Avoid mistakes by using the owner corporation form with two points to ensure clarity and compliance throughout the filling process.

Filling out a W9 for a two-member LLC involves listing the LLC’s name and the business's federal tax classification on the form. Each member should provide their taxpayer identification number, ensuring it matches the name they used when applying for the LLC. Take care to indicate that the LLC is classified as either a partnership or a corporation in the appropriate section. Utilizing the owner corporation form with two points makes the completion of tax documents easier for entities with shared ownership.

Yes, corporations can have multiple owners, often referred to as shareholders. This type of structure allows different individuals or entities to hold shares in the corporation, which grants them ownership and voting rights. When establishing an owner corporation form with two points, it's crucial to define ownership percentages clearly to avoid conflicts. Multiple owners can bring together various skills and resources, enhancing the corporation's success.

You only need one person or a minimum of two to start a corporation, depending on your state regulations. This flexibility allows for various business structures, whether you're launching as a sole owner or with a business partner. For those looking to establish their owner corporation form with two points, having clear agreements between the owners is essential for a successful launch.