Request Garnishment With Bank Account

Description

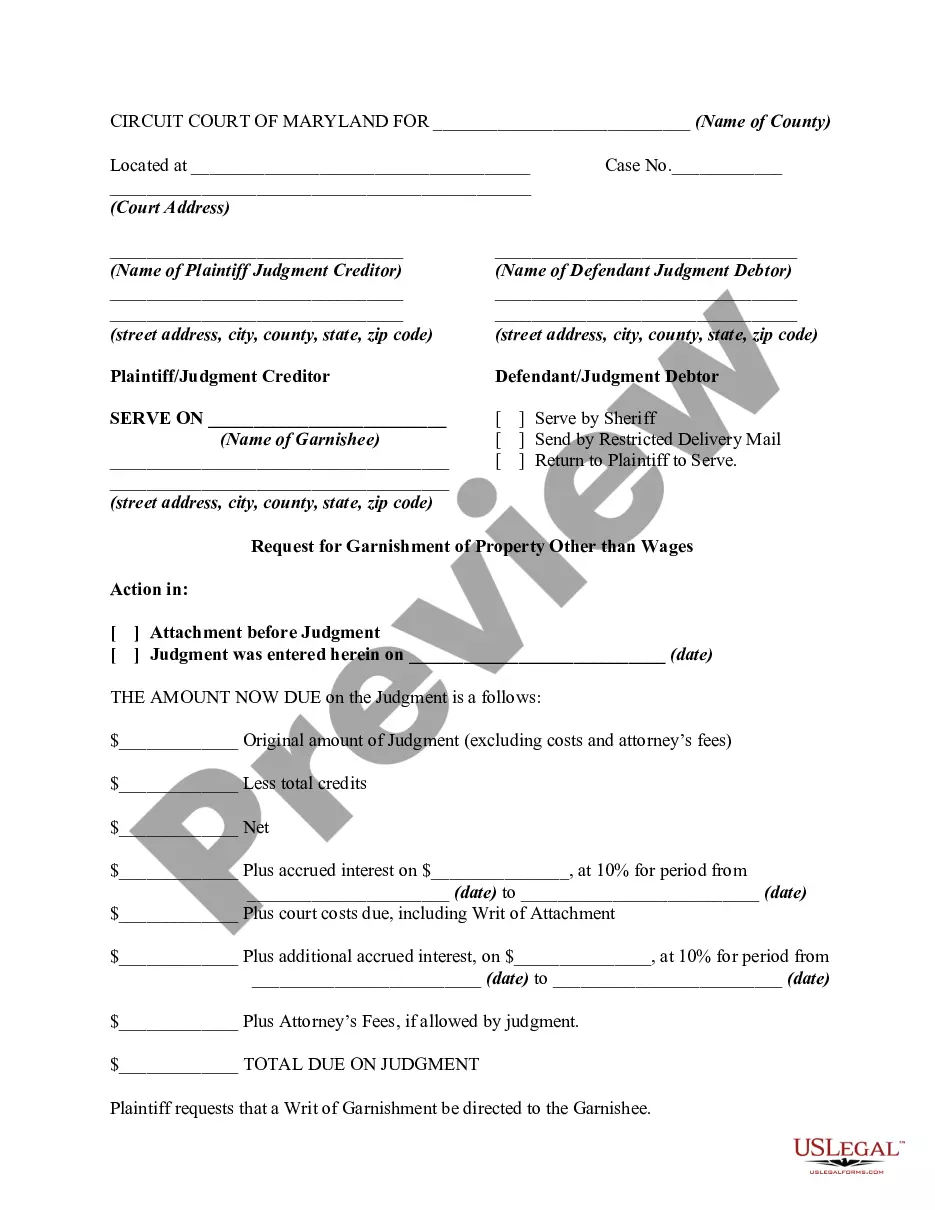

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

- If you're a returning user, log into your account to access previous forms. Ensure your subscription is active; renew it if required.

- For first-time users, browse the extensive online library of over 85,000 legal forms. Use the Preview mode to confirm that the selected form meets your jurisdiction's requirements.

- Should you require a different template, utilize the Search tab to find the appropriate document that fits your needs.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. Account registration is necessary to access the library.

- Enter your payment details through credit card or PayPal to finalize your subscription purchase.

- Once paid, download the form to complete it. You can easily access it later from the My Forms section.

US Legal Forms empowers individuals and attorneys alike to swiftly and accurately create legal documents. With a robust collection of forms, users can trust that they have access to more options than competitors at a similar cost.

Take advantage of our extensive legal library today and ensure your garnishment process is seamless. Sign up now!

Form popularity

FAQ

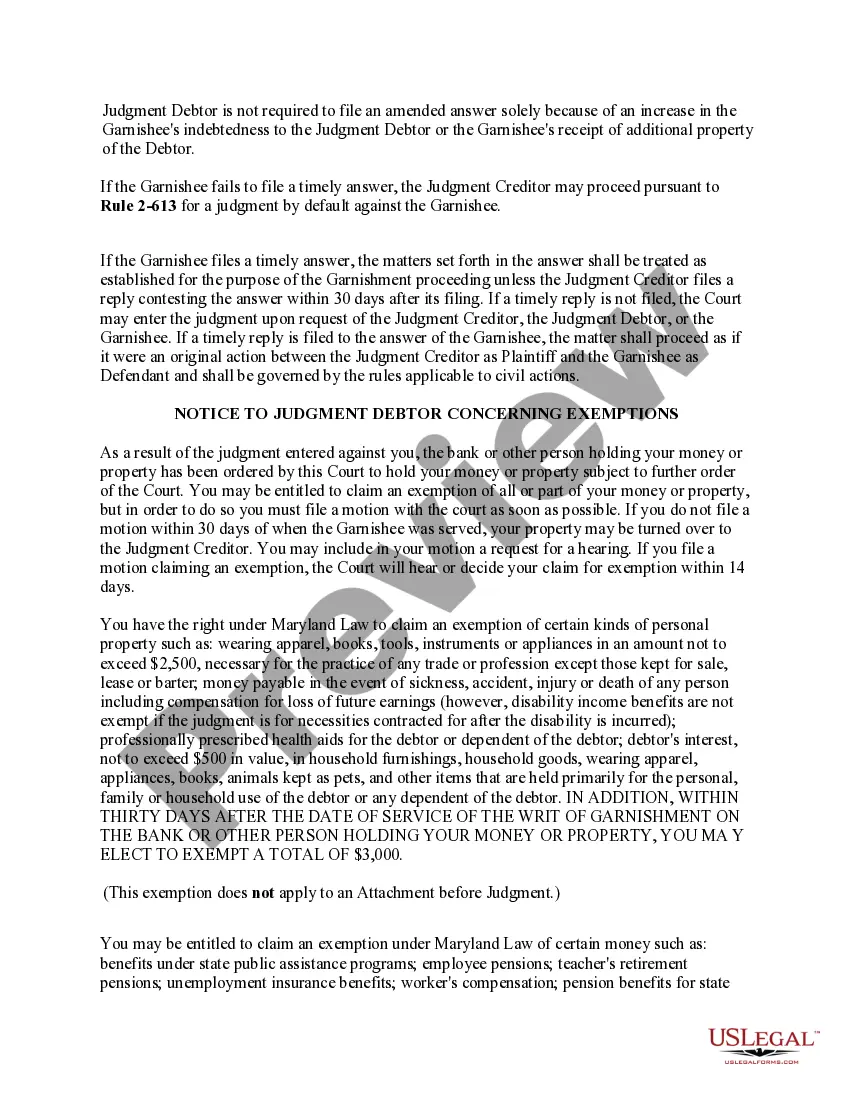

Certain types of accounts are generally exempt from garnishment. For instance, accounts containing government benefits, such as social security or retirement funds, may not be subject to garnishment. It's essential to consult your local laws to understand what protections apply to your specific situation. Additionally, you can utilize US Legal Forms to explore options and understand how to effectively request garnishment with your bank account.

To protect your bank account from garnishment, first, consider setting up protected accounts. Many states offer laws that allow specific funds, such as social security or disability benefits, to remain safe from garnishment. You can also reach out to your bank and verify their policies on garnishment. Additionally, using US Legal Forms can help you navigate the legal requirements and make a request for garnishment with your bank account more manageable.

Several bank accounts are protected from creditors, including accounts that hold government benefits and certain retirement accounts. Additionally, some states have laws that safeguard personal bank accounts from creditors under specific conditions. Familiarizing yourself with these protections is vital in financial planning. When you understand how to request garnishment with a bank account, you can better prepare for potential creditor actions.

Yes, a checking account can be garnished under certain conditions. Creditors may pursue account garnishments if they secure a court judgment against you. Always monitor any legal actions involving you to prevent unexpected garnishments. If you want to know more about how to request garnishment with a bank account, seeking professional advice can be beneficial.

To fill out a challenge to garnishment form, you must include your personal information and details about the garnishment. Clearly state your reasons for contesting the garnishment, such as exemptions or lack of notice. Ensure you submit the form within the specific time frame set by your state laws. Learning how to effectively request garnishment with your bank account can empower you in this process.

The IRS has limitations on certain accounts, such as qualified retirement accounts, which are generally protected from garnishment. Health savings accounts and educational savings accounts also typically enjoy exemptions. If you face IRS actions, it's wise to consult with a tax professional to ensure compliance while securing your funds. Understanding how to request garnishment with a bank account can provide insight into what protections apply.

You cannot completely hide your bank account from garnishment, but you can take steps to protect it. Consider transferring your funds into exempt accounts, like your retirement account or certain trust accounts. Additionally, consulting with a legal professional can help you explore valid strategies. Understand how to request garnishment with a bank account, knowing the limitations can help you safeguard your assets.

Certain types of checking accounts are protected from garnishment. For example, accounts that hold government benefits, such as Social Security or unemployment payments, are often exempt. It is vital to understand your state’s specific laws to determine the protections available to you. If you want to protect your funds, consider how to request garnishment with a bank account carefully.

The timeline for a creditor to garnish your bank account can vary widely. Generally, after securing a court judgment, a creditor can initiate garnishment proceedings, which may take a few weeks to finalize. Once in motion, the actual garnishment can begin quickly. For those facing potential garnishment, services like USLegalForms can help you understand your options and navigate the process.

The amount that can be garnished from your paycheck largely depends on your income and the type of debt owed. Generally, federal law allows creditors to take up to 25% of your disposable earnings or the amount exceeding 30 times the federal minimum wage, whichever is less. Understanding these limits can empower you to take action if faced with a request garnishment with bank account. If you're unsure, consider seeking advice from a financial advisor.