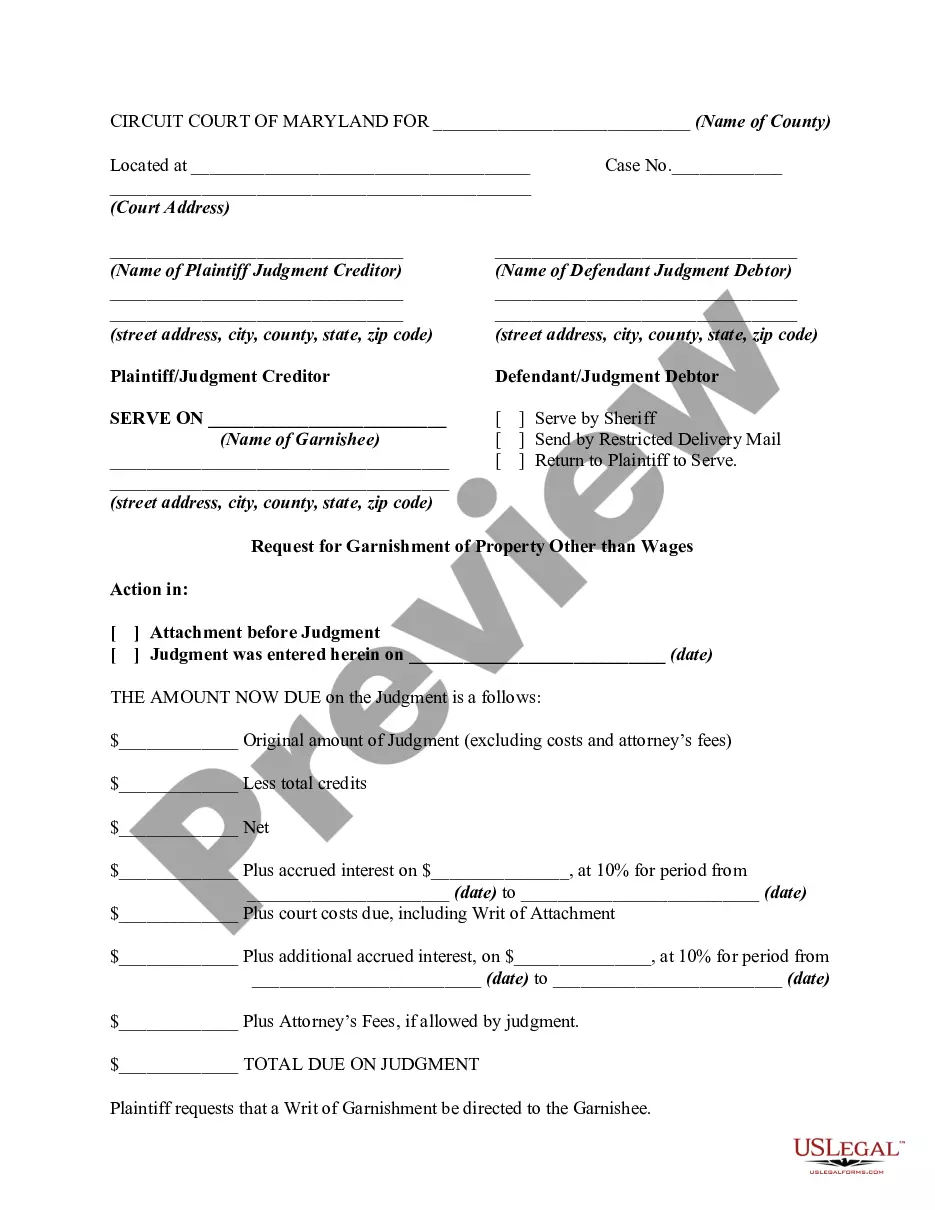

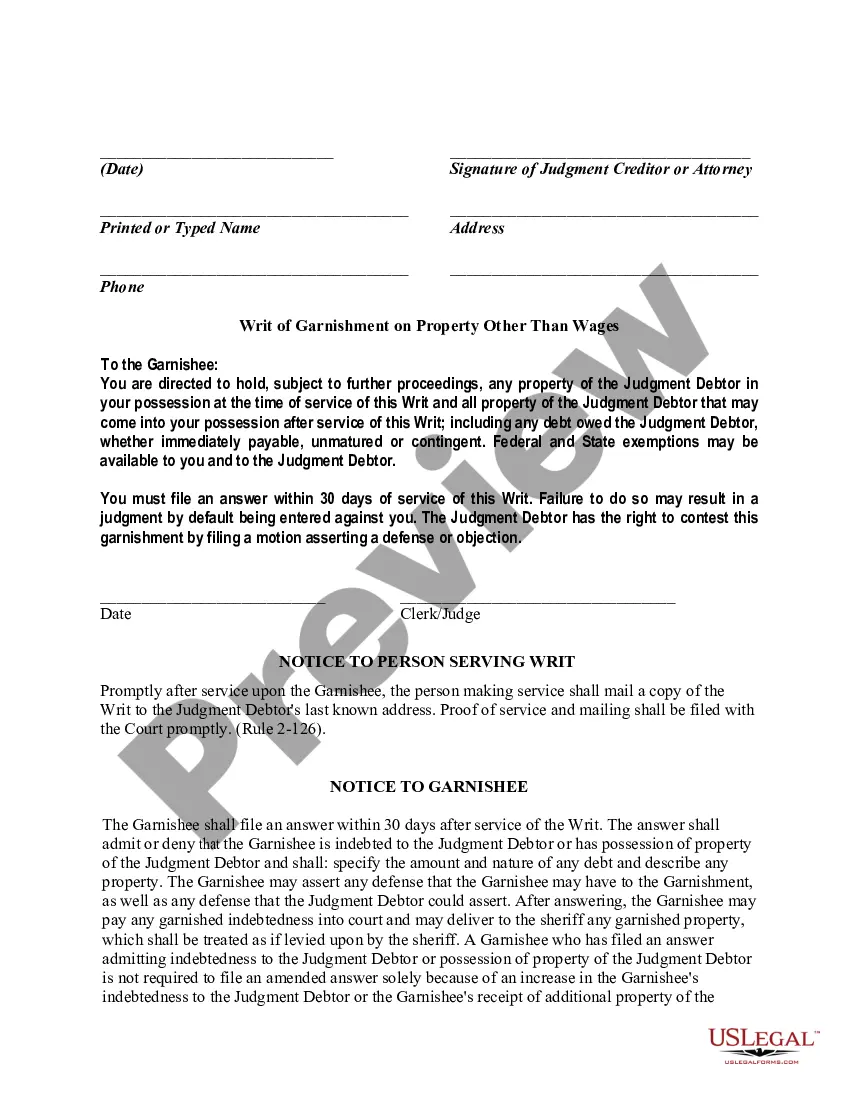

The judgment creditor may obtain issuance of a writ of garnishment by filing in the same action in which the judgment was entered a request that contains (1) the caption of the action, (2) the amount owed under the judgment, (3) the name and last known address of each judgment debtor with respect to whom a writ is requested, and (4) the name and address of the garnishee. Upon the filing of the request, the clerk shall issue a writ of garnishment directed to the garnishee.

Maryland Wage Garnishment Form With Payment Plan

Description

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

It’s obvious that you can’t become a legal expert overnight, nor can you grasp how to quickly draft Maryland Wage Garnishment Form With Payment Plan without having a specialized set of skills. Creating legal documents is a long process requiring a particular training and skills. So why not leave the creation of the Maryland Wage Garnishment Form With Payment Plan to the specialists?

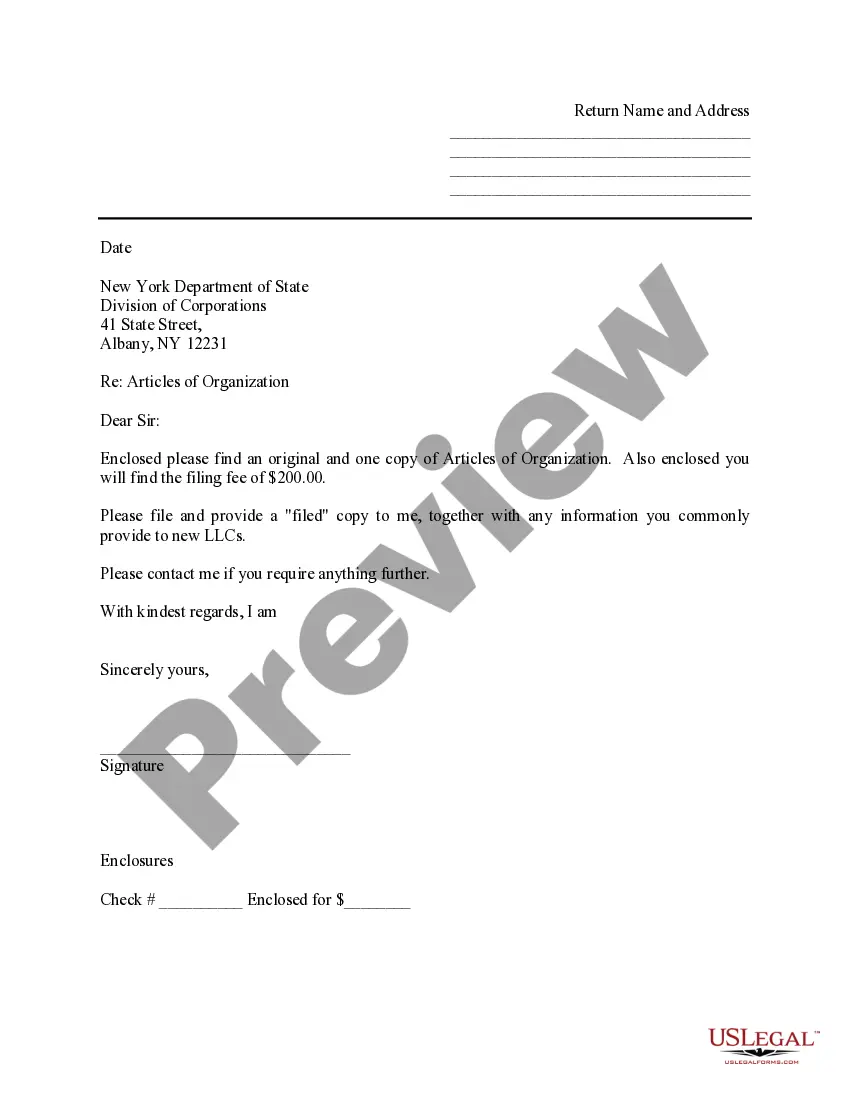

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court paperwork to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our website and obtain the form you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Maryland Wage Garnishment Form With Payment Plan is what you’re searching for.

- Begin your search over if you need any other form.

- Set up a free account and select a subscription option to buy the template.

- Choose Buy now. Once the payment is through, you can get the Maryland Wage Garnishment Form With Payment Plan, complete it, print it, and send or send it by post to the designated people or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your paperwork-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

After you obtain a judgment, you file a Request for Writ of Garnishment of Wages (DC-CV-065). To complete the form, you need to know the name and address of the debtor's employer, the amount of the judgment and any additional money owed (such as court costs and interest.)

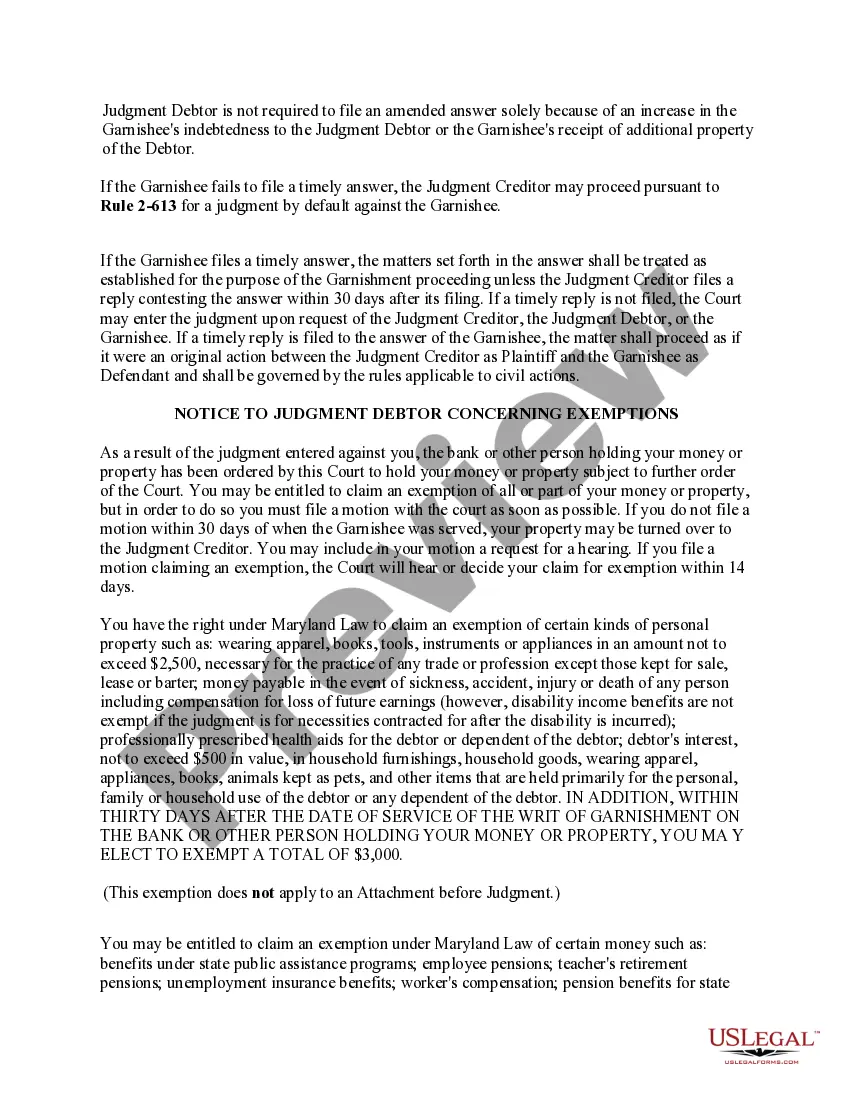

A creditor may not garnish more than 25% of your wages per pay period. For individuals earning minimum wage or near minimum wage, you must be left with an amount equal to 30 times the Maryland minimum hourly wage.

10 days following the judgment, the creditor becomes a judgment creditor and can begin the wage garnishment process. Under Md. Rule 3-646, the judgment creditor must file a Request for Writ of Garnishment in the case, which is served upon the judgment debtor.

Wages cannot be garnished if the judgment debtor's disposable wages are less than 30 times the State minimum hourly wage multiplied by the number of weeks during which the wages due were earned. In any event, no more than 25% of your disposable wages for a week can be garnished.

You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).