Maryland Inspection Checklist For Historic Vehicles

Description

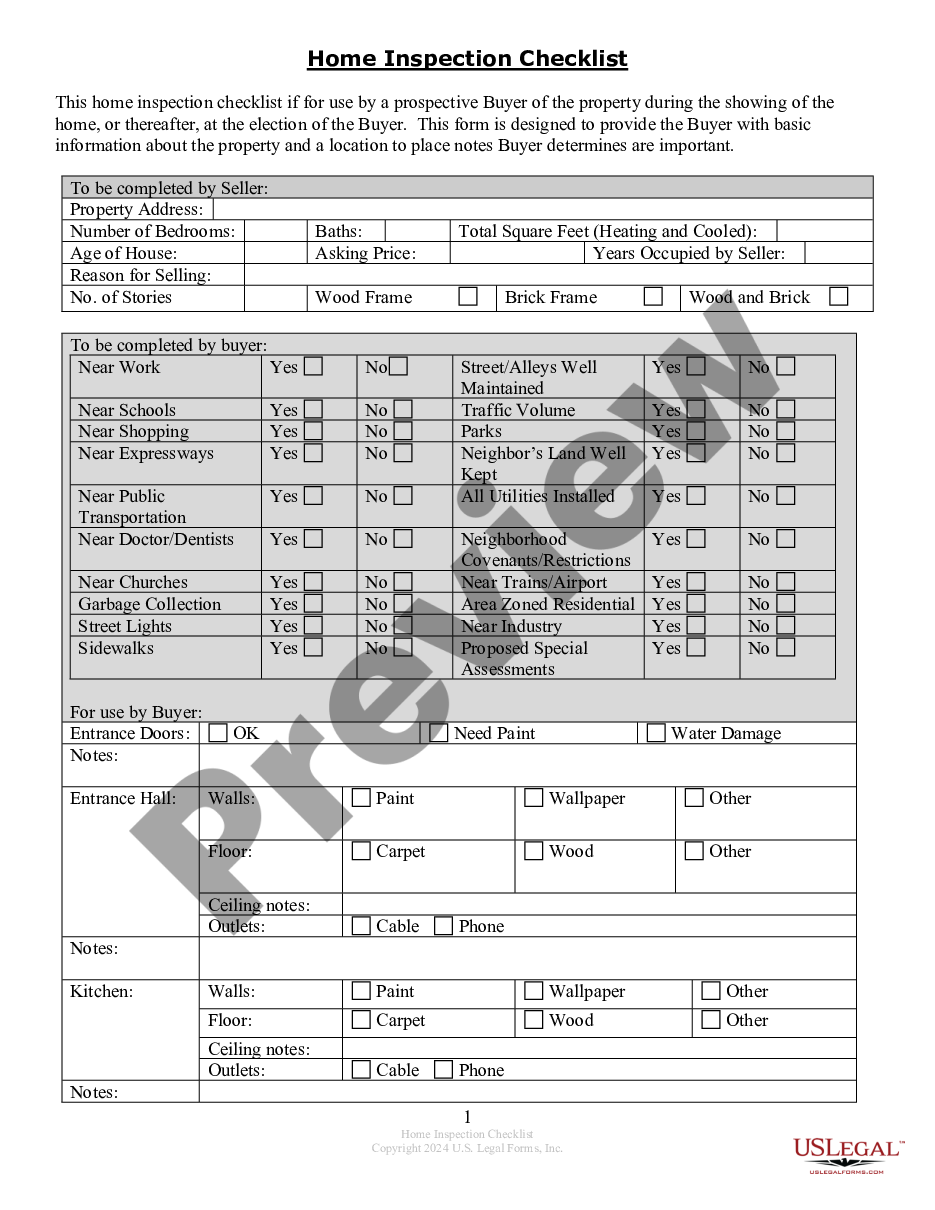

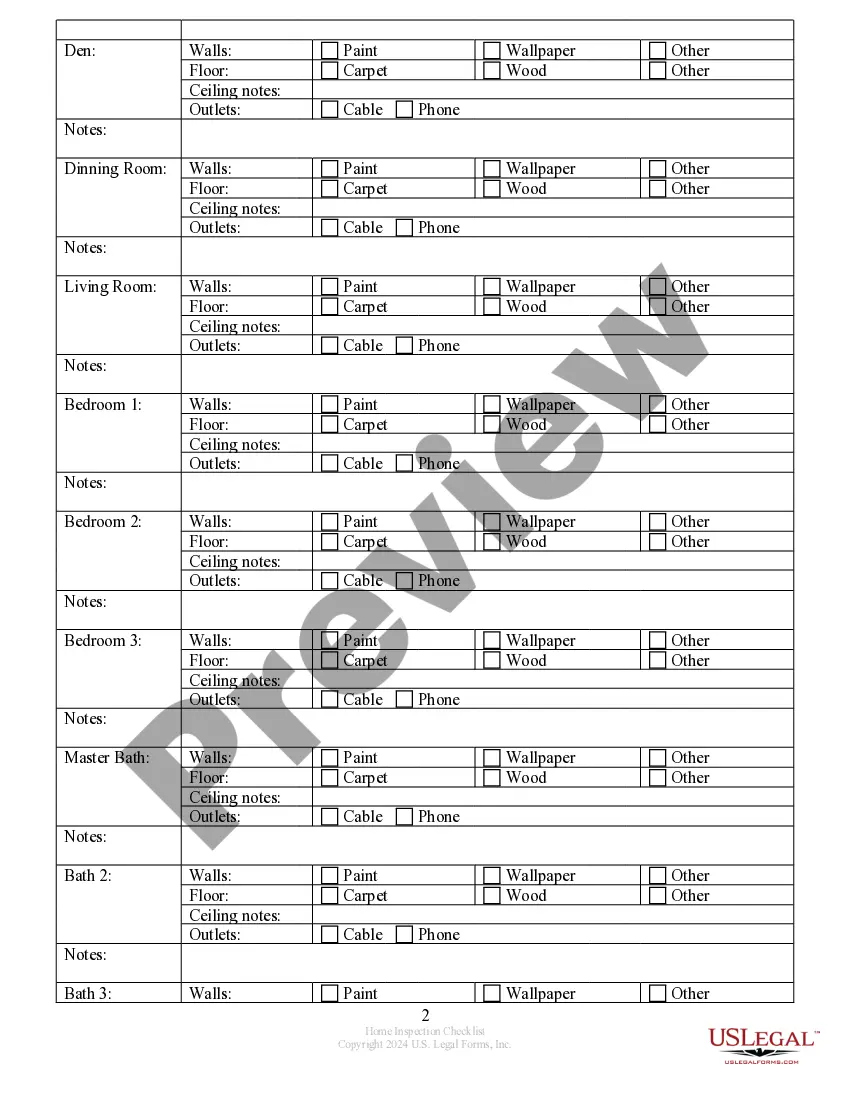

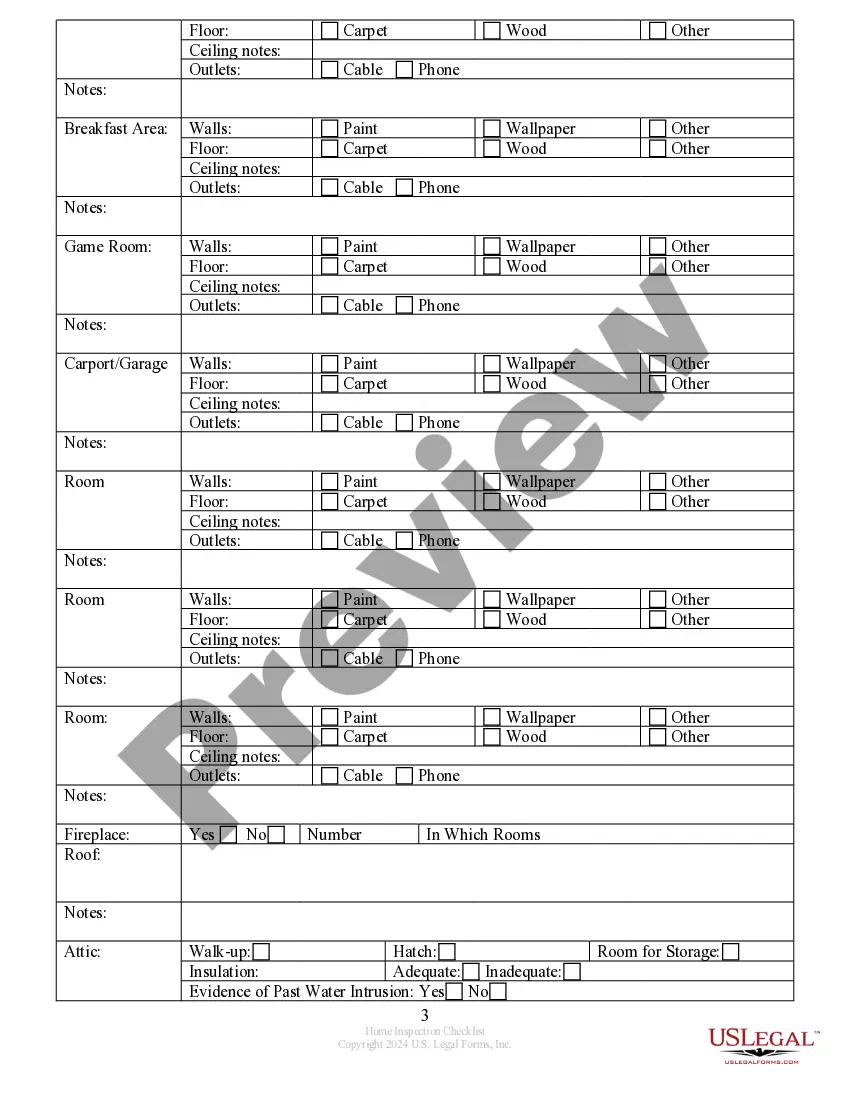

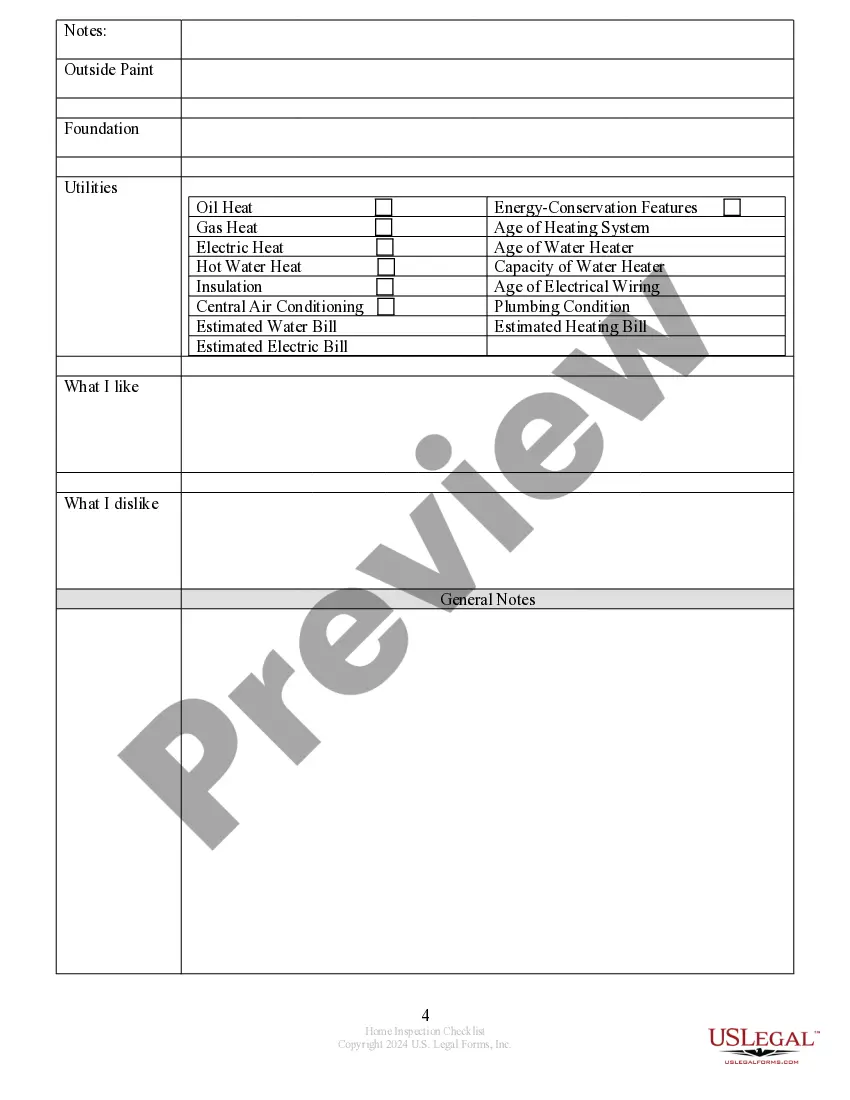

How to fill out Maryland Buyer's Home Inspection Checklist?

It’s widely known that you cannot instantly become a legal authority, nor can you determine how to rapidly assemble the Maryland Inspection Checklist For Historic Vehicles without a specific set of expertise.

Compiling legal documents is a time-consuming task that demands particular training and abilities.

So why not entrust the assembly of the Maryland Inspection Checklist For Historic Vehicles to the professionals.

You can revisit your forms from the My documents section at any time. If you’re a current customer, you can simply Log In, and find and download the template from the same section.

No matter the purpose of your forms—be it financial, legal, or personal—our website has everything you need. Experience US Legal Forms today!

- Find the form you require by utilizing the search bar at the top of the site.

- Examine it (if this option is available) and review the accompanying description to confirm whether the Maryland Inspection Checklist For Historic Vehicles is what you are looking for.

- Commence your search again if you need any additional form.

- Create a complimentary account and select a subscription plan to purchase the template.

- Select Buy now. Once the payment is finalized, you can obtain the Maryland Inspection Checklist For Historic Vehicles, fill it out, print it, and send or mail it to the required individuals or organizations.

Form popularity

FAQ

When is bankruptcy removed from your credit report? A Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the date the bankruptcy was filed, while a Chapter 13 bankruptcy will fall off your report seven years after the filing date.

Collect Your Louisiana Bankruptcy Documents. ... Take a Credit Counseling Course. ... Complete the Bankruptcy Forms. ... Get Your Filing Fee. ... Print Your Bankruptcy Forms. ... File Your Forms With the Louisiana Bankruptcy Court. ... Mail Documents to Your Trustee. ... Take a Debtor Education Course.

Certain debts will remain on your account when you file for Chapter 7 bankruptcy. You will still be responsible for alimony and child support. Tax liens, student loans, and personal injury debts caused by intoxicated drivers are still on the docket, as well.

One key difference between Chapter 13 and Chapter 7 bankruptcy is that Chapter 7 allows people to completely eliminate their unsecured debt after a specific period. In contrast, Chapter 13 allows people to reorganize their debts while paying back some portion of what they owe.

The docket sheet and docket information will remain available to the general public via PACER. Any party that has filed a notice of appearance in an individual case will have CM/ECF access to all filings in that case. All documents will remain accessible at the clerk's offices, except those under seal.

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.

Filing for bankruptcy in any form will have an adverse impact on your credit rating for as long as it appears on your credit report. However, filing under Chapter 13 if you have the ability to reorganize your finances may cause less damage than filing under Chapter 7 and allow you to regroup faster.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.