Massachusetts Quitclaim Deed With A Mortgage

Description

How to fill out Massachusetts Quitclaim Deed With A Mortgage?

Individuals frequently link legal documentation with something complex that only an expert can handle.

In a particular sense, this is accurate, as crafting Massachusetts Quitclaim Deed With A Mortgage necessitates in-depth knowledge of subject requirements, including state and county guidelines.

Nonetheless, with US Legal Forms, the process has become simpler: pre-prepared legal documents for any life or business circumstance tailored to state regulations are assembled in a singular online repository and are now accessible to everyone.

Pay for your subscription using PayPal or a credit card. Select the format for your document and click Download. Print your document or upload it to an online editor for quicker completion. All documents in our library are reusable: once acquired, they are stored in your profile. You can access them anytime via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current forms categorized by state and purpose, making the search for Massachusetts Quitclaim Deed With A Mortgage or any other specific template take only moments.

- Former users with an active subscription must sign in to their account and click Download to access the form.

- Users who are newcomers to the platform will first need to sign up for an account and subscribe before they can obtain any documents.

- Here is the step-by-step guide on how to obtain the Massachusetts Quitclaim Deed With A Mortgage.

- Review the page content thoroughly to make sure it meets your requirements.

- Look over the form description or check it out through the Preview option.

- If the previous sample doesn't meet your needs, find another example via the Search bar above.

- Click Buy Now when you locate the appropriate Massachusetts Quitclaim Deed With A Mortgage.

- Choose a subscription plan that aligns with your needs and financial situation.

- Create an account or sign in to move to the payment page.

Form popularity

FAQ

When a property is being financed, a quitclaim deed allows the current owner to transfer their interest in the property to another party without guaranteeing the title's quality. In this case, it's essential to take note of any existing mortgage obligations. The new owner effectively takes on the risk associated with the property, which can complicate financing arrangements. Utilizing US Legal Forms can provide you with templates and guidance on handling quitclaim deeds in financing scenarios, ensuring all parties understand their responsibilities.

The best deed to transfer property often depends on your unique situation and goals. Generally, a warranty deed provides the most protection for the buyer, as it guarantees a clear title without encumbrances. However, if you are transferring property within family or similar scenarios, a Massachusetts quitclaim deed with a mortgage may suffice, simplifying the transfer process. Tools offered by platforms like US Legal Forms can guide you in selecting the most suitable deed for your needs.

The primary beneficiaries of a quitclaim deed are individuals looking to transfer property quickly, often without monetary exchange. This type of deed is especially helpful for family members or friends who want to simplify ownership transfers, particularly with properties that may already have a mortgage. Moreover, it allows both the grantor and grantee to avoid the lengthy process typical with traditional deeds while still addressing financial obligations. When using resources like US Legal Forms, you can make this process seamless and straightforward.

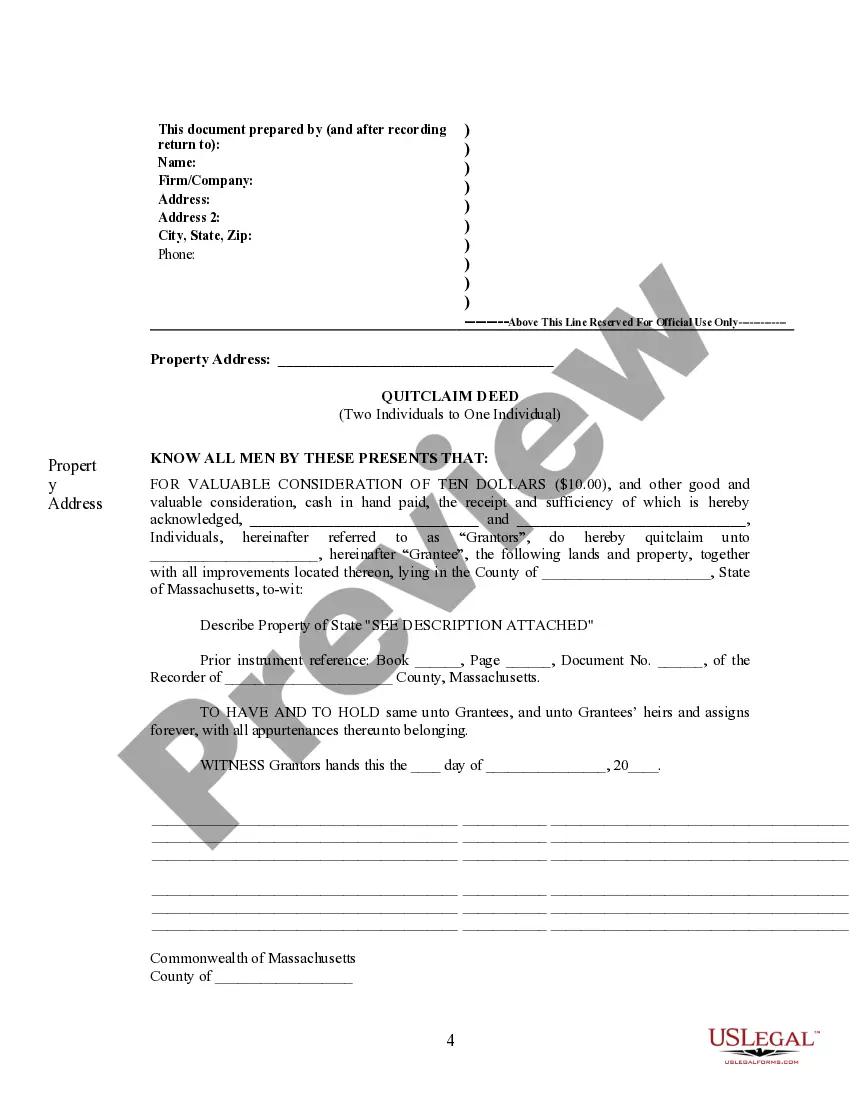

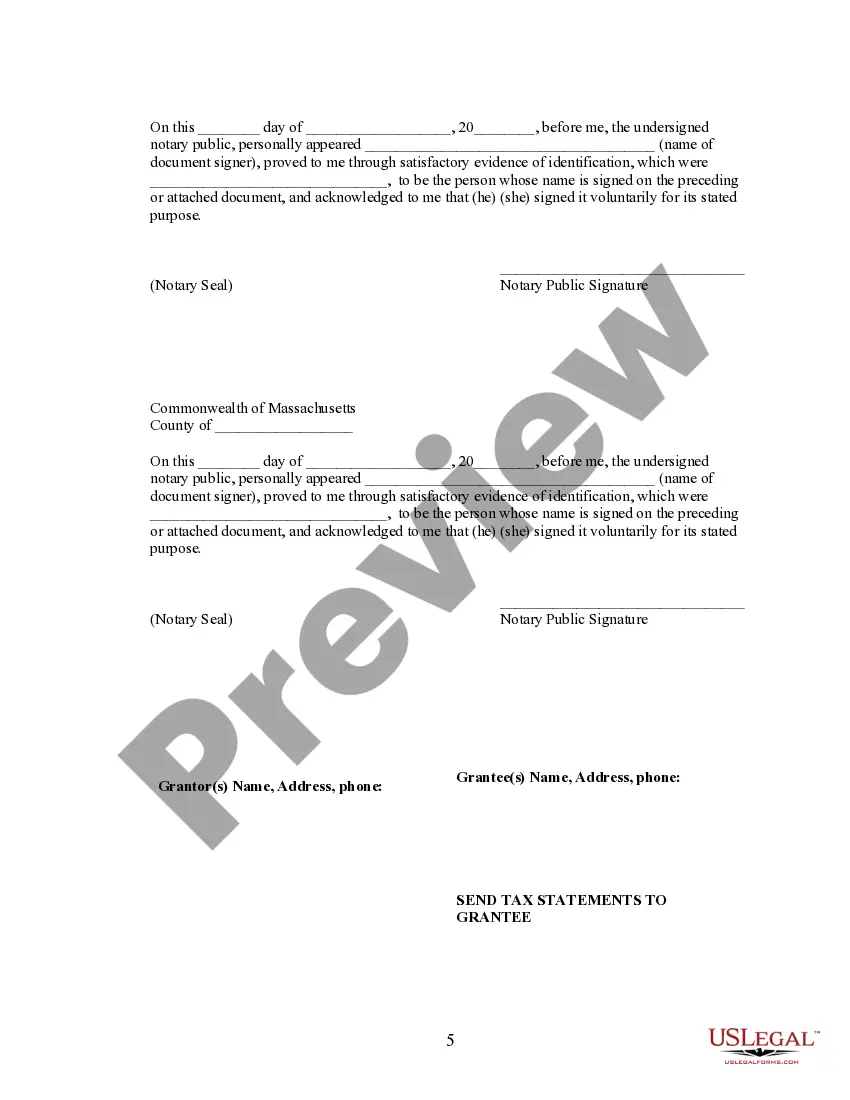

In Massachusetts, a quitclaim deed must include the names of the grantor and grantee, a description of the property, and the date of the transaction. Additionally, the quitclaim deed with a mortgage needs to indicate whether the property has an existing mortgage. All parties must sign the document, and you should consider having it notarized. Using legal platforms like US Legal Forms can streamline this process and ensure that you meet all necessary requirements.

Massachusetts uses quitclaim deeds for several practical reasons, including their simplicity and speed of transfer. These deeds are particularly useful in cases of real estate transactions between family members or known parties, where trust is inherent. However, when considering a Massachusetts quitclaim deed with a mortgage, be sure to seek out resources and support, like US Legal Forms, to navigate the complexities involved.

The main difference between these two types of deeds in Massachusetts is the level of buyer protection each offers. A warranty deed guarantees the buyer clear title and protects against claims, while a quitclaim deed simply relinquishes whatever interest the grantor may have. When engaging with a Massachusetts quitclaim deed with a mortgage, remember that this type of deed poses more risks and offers fewer protections.

Yes, a quitclaim deed can give you ownership of a property in Massachusetts, but it is important to understand the limitations. It transfers the interest that the grantor has, which might not be complete ownership. If you are relying on a Massachusetts quitclaim deed with a mortgage, ensure you understand what rights you are receiving, as any existing claims on the property may also transfer.

The strongest form of deed in Massachusetts is the warranty deed. This type of deed provides the highest level of protection for the buyer, as it guarantees clear ownership. When using a Massachusetts quitclaim deed with a mortgage, always consider the potential risks, as it does not provide the same assurances regarding the title to the property.

In Massachusetts, the key difference lies in the level of protection provided to the buyer. A quitclaim deed transfers whatever interest the grantor has in the property without any guarantees, while a warranty deed ensures that the grantor holds clear title to the property and will defend against any claims. Therefore, if you are considering a Massachusetts quitclaim deed with a mortgage, be aware that it offers less security compared to a warranty deed.

To complete a Massachusetts quitclaim deed with a mortgage, you need several key requirements. First, the deed must clearly identify the property being transferred, including a legal description. Second, both the grantor, or the person transferring the property, and the grantee, or the person receiving the property, must be properly named, along with their signatures. Lastly, it’s essential to record the quitclaim deed at the local registry of deeds, especially when a mortgage is involved, to protect all parties involved.