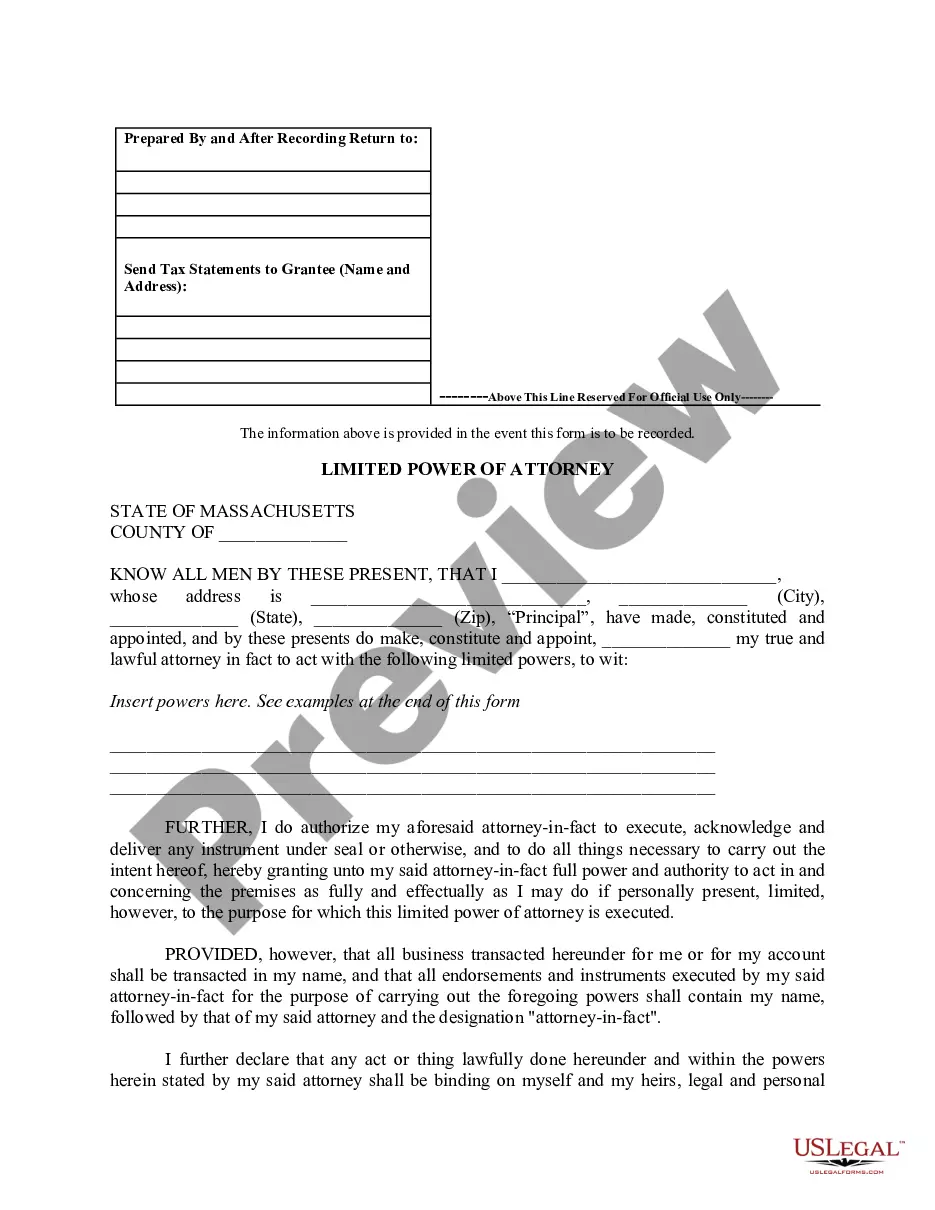

Massachusetts Power Of Attorney Limited Withholding

Description

How to fill out Massachusetts Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

How to locate professional legal documents that adhere to your state's regulations and create the Massachusetts Power Of Attorney Limited Withholding independently without consulting an attorney.

Numerous online services offer templates for various legal situations and formalities. However, it might require time to identify which of the available examples satisfy both use case and legal requirements for you.

US Legal Forms is a trustworthy platform that aids you in finding official documents formulated in accordance with the latest updates of state laws and helps you save on legal support.

If you lack an account with US Legal Forms, then follow the instructions below: Review the webpage you've accessed and verify whether the form suits your requirements. Utilize the form description and preview options if they are available. Look for another sample in the header indicating your state if necessary. Click the Buy Now button upon discovering the appropriate document. Select the most fitting pricing plan, then sign in or pre-register for an account. Choose the payment option (by credit card or through PayPal). Change the file format for your Massachusetts Power Of Attorney Limited Withholding and click Download. The acquired templates are retained in your possession: you can always access them in the My documents section of your profile. Subscribe to our platform and create legal documents by yourself like a proficient legal expert!

- US Legal Forms is not a conventional online repository.

- It's a compilation of over 85,000 authenticated templates for diverse business and personal scenarios.

- All documents are categorized by area and state to expedite your searching experience.

- It also features powerful tools for PDF modification and electronic signatures, enabling users with a Premium subscription to swiftly finalize their documentation online.

- Acquiring the necessary paperwork necessitates minimal time and efforts.

- If you already possess an account, Log In to verify your subscription is active.

- Download the Massachusetts Power Of Attorney Limited Withholding using the related button adjacent to the file designation.

Form popularity

FAQ

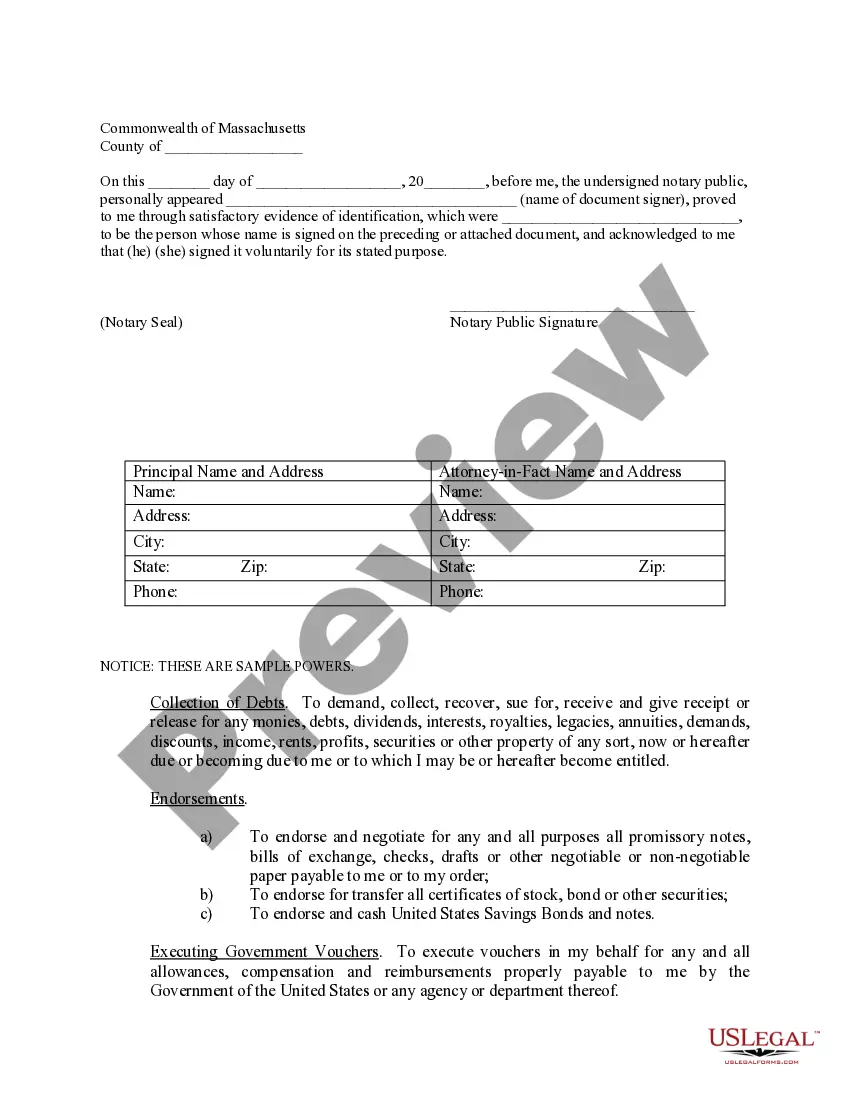

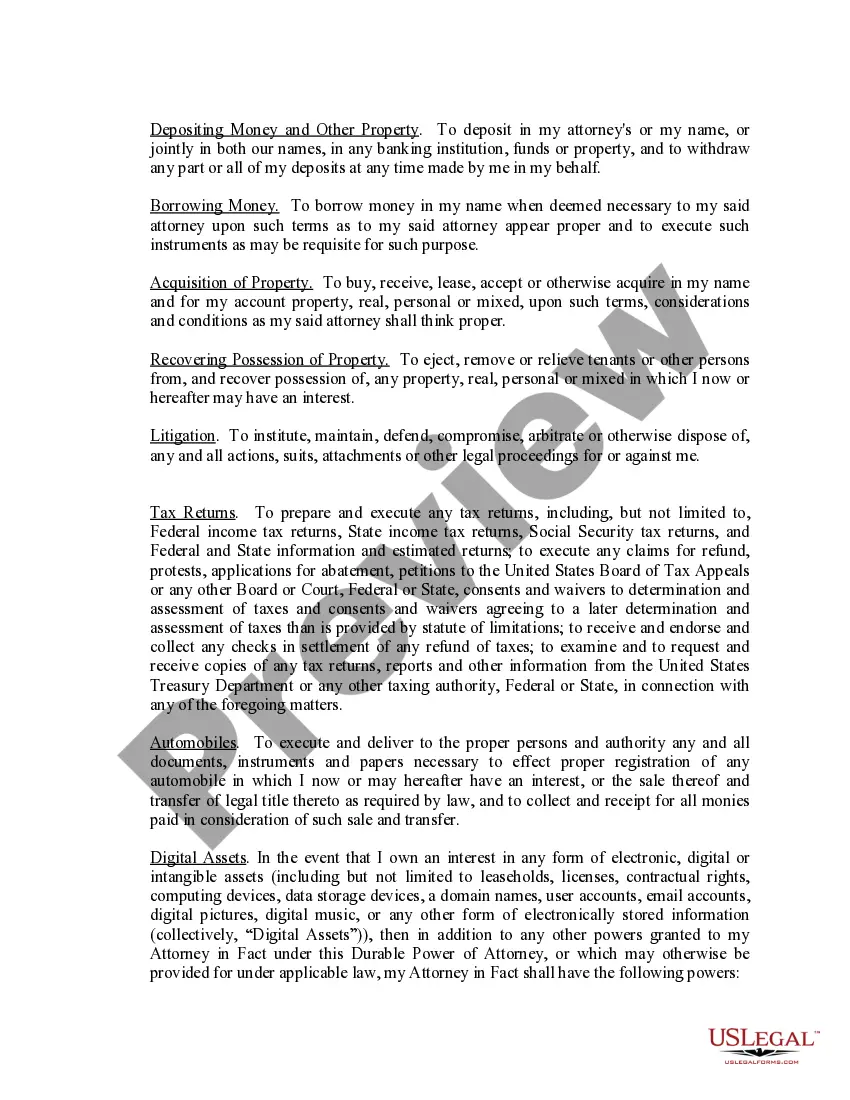

Under Years or Periods, be specific. Do not write all years. Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.

That mailing address or fax number depends on the state in which you live. You can find the address and fax number for your state in the 'Where to File Chart' included with the IRS Instructions for Form 2848. An IRS power of attorney stays in effect for seven years, or until you or your representative rescinds it.

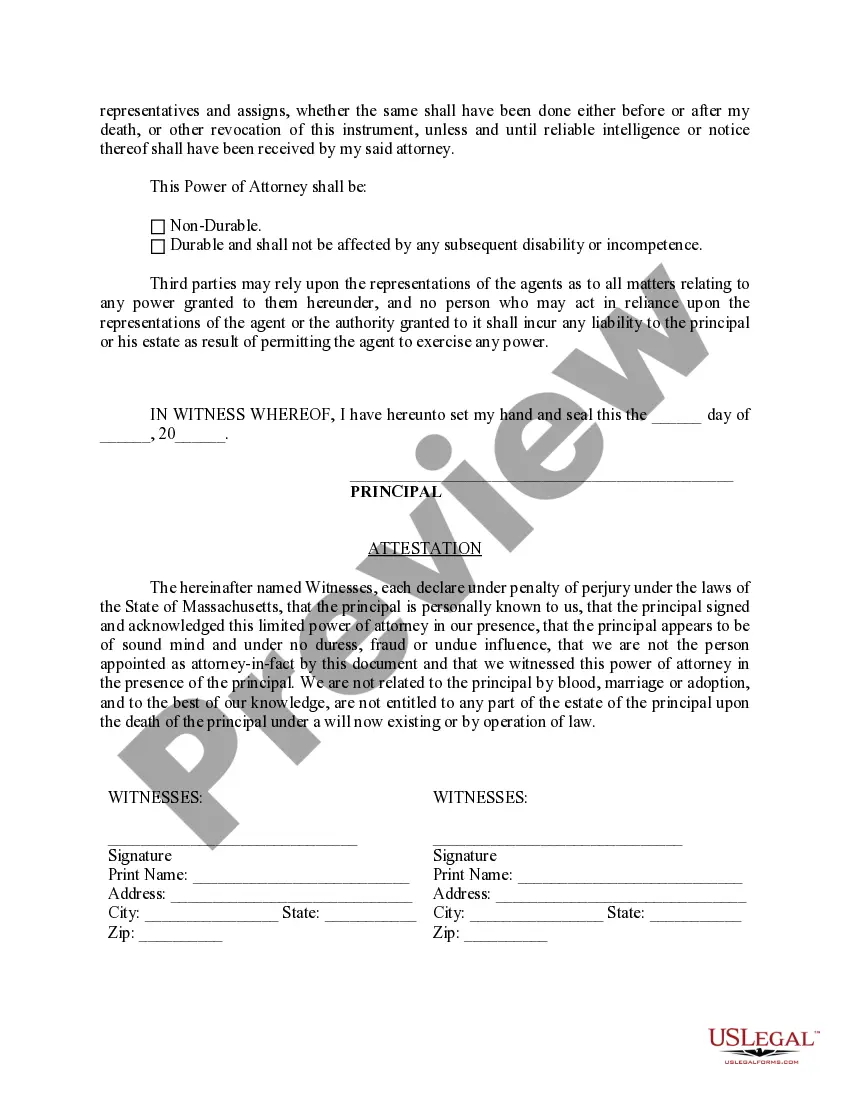

How to Get Power of Attorney in MassachusettsThe POA document must list the: name, SSN, and address of the principal. name and full contact information of the agent(s) date of the agreement.Witness Requirements: The POA document must be signed by the principal and either a notary public or two disinterested witnesses.

You may also upload the completed and signed form through MassTaxConnect or submit it by fax to 617-660-3995. Allow 2 business days for the POA to be attached to the taxpayer's account.

IRS Definition A Power of Attorney (POA) allows a third party to represent you before the IRS. The authorized individual can advocate, negotiate, and sign on your behalf. They can argue facts and the application of law. POAs can receive copies of notices and transcripts of your account.