A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Guarantee Of Payment Form For Business

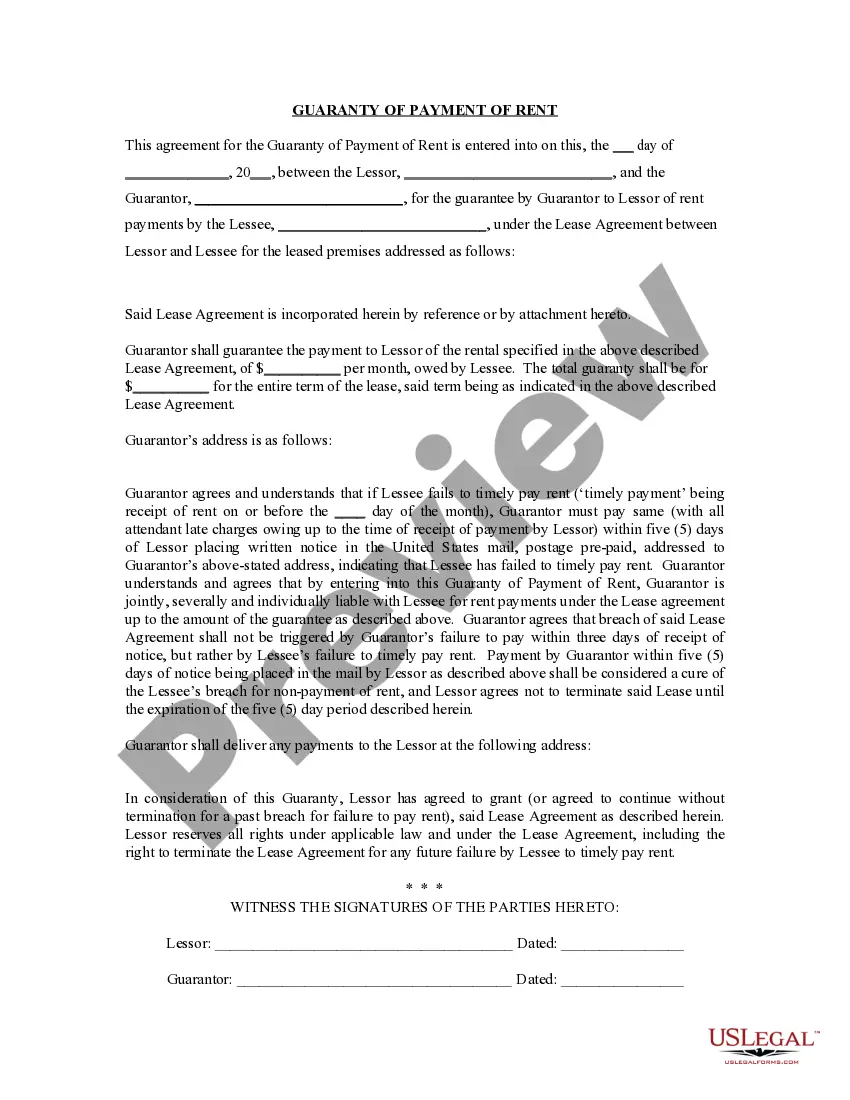

Description

How to fill out Guarantee Of Payment Form For Business?

There's no longer a necessity to squander time searching for legal documents to adhere to your local state rules.

US Legal Forms has assembled all of them in one location and enhanced their availability.

Our platform offers over 85k templates for any business and personal legal situations organized by state and area of use All forms are properly crafted and verified for accuracy, so you can be confident in acquiring an updated Guarantee Of Payment Form For Business.

Select the preferred pricing plan and register for an account or Log In. Pay for your subscription with a credit card or via PayPal to proceed. Choose the file format for your Guarantee Of Payment Form For Business and download it to your device. Print your form to complete it in writing or upload the sample if you prefer utilizing an online editor. Preparing official documents under federal and state laws and regulations is quick and easy with our collection. Try US Legal Forms today to keep your paperwork organized!

- If you are accustomed to our platform and already possess an account, ensure your subscription is active before downloading any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever needed by accessing the My documents tab in your profile.

- If you've never engaged with our platform before, the procedure will require a few more actions to finalize.

- Here’s how new users can obtain the Guarantee Of Payment Form For Business in our collection.

- Review the page content carefully to verify it includes the sample you need.

- To do so, use the form description and preview options if available.

- Utilize the search bar above to find another template if the previous one was not appropriate.

- Click Buy Now next to the template name once you identify the correct one.

Form popularity

FAQ

Yes, a company can issue a personal guarantee, often through an executive or business owner. This personal commitment can reassure lenders or vendors by demonstrating that an individual is willing to take personal responsibility for the company's obligations. However, utilizing a guarantee of payment form for business formalizes this commitment and provides crucial legal protection.

To give a corporate guarantee, a business must draft a formal document detailing the obligations it is guaranteeing. This document should clearly specify the terms, conditions, and time frame for which the guarantee applies. Using a guarantee of payment form for business can streamline this process, ensuring all necessary information is included and legally binding.

Typically, a letter of guarantee remains valid for a specified period, which can range from a few months to several years, depending on the agreement. The duration is usually stated clearly in the document. To avoid confusion, it's essential to carefully review the terms of the guarantee of payment form for business before entering into contracts.

A letter of guarantee serves as a formal document that commits a party to meet their financial obligations, ensuring that payments are made as promised. It helps to mitigate risks associated with non-payment in business dealings. With a guarantee of payment form for business, companies can enhance their credibility and streamline operations seamlessly.

The primary purpose of a guarantee is to provide a safety net for financial transactions. By issuing a guarantee, a business assures another party that it will fulfill its financial commitments. This peace of mind is crucial when negotiating contracts, as it fosters trust and encourages collaboration between businesses.

A letter of guarantee is often issued to reassure a third party that financial obligations will be met. For example, if a business needs suppliers to trust that payments will be made on time, a company might issue this letter. By utilizing a guarantee of payment form for business, companies can build stronger relationships with vendors and secure better terms.

A letter of credit is a financial document issued by a bank that guarantees a buyer's payment to a seller. In contrast, a payment guarantee assures that a party will fulfill its monetary obligations towards another, but it may not involve a bank. Understanding these distinctions can help you choose the right financial tools for your transactions. For peace of mind, always consider a guarantee of payment form for business.

A letter of guarantee for a business is a document issued by one party, assuring another party of payment or performance. This letter serves as an important tool in financial negotiations, providing confidence and clarity. It reinforces the commitment to meet obligations, fostering positive business relationships. By integrating a guarantee of payment form for business, you exemplify professionalism and reliability.

The three types of guarantees typically include performance guarantees, payment guarantees, and bank guarantees. Each type offers a different level of security based on the obligations being fulfilled. Performance guarantees ensure that contract terms are met, while payment guarantees focus on financial commitments. When structuring your agreements, using a guarantee of payment form for business can empower your transactions.

A form of guarantee refers to a specific type of document that provides assurance regarding the performance of a commitment. In the business context, it ensures that payment or service delivery will occur as specified. This form is vital for establishing trust and accountability in commercial relationships. To better protect your business interests, consider a guarantee of payment form for business.