Ma Divorce Law For Retirement

Description

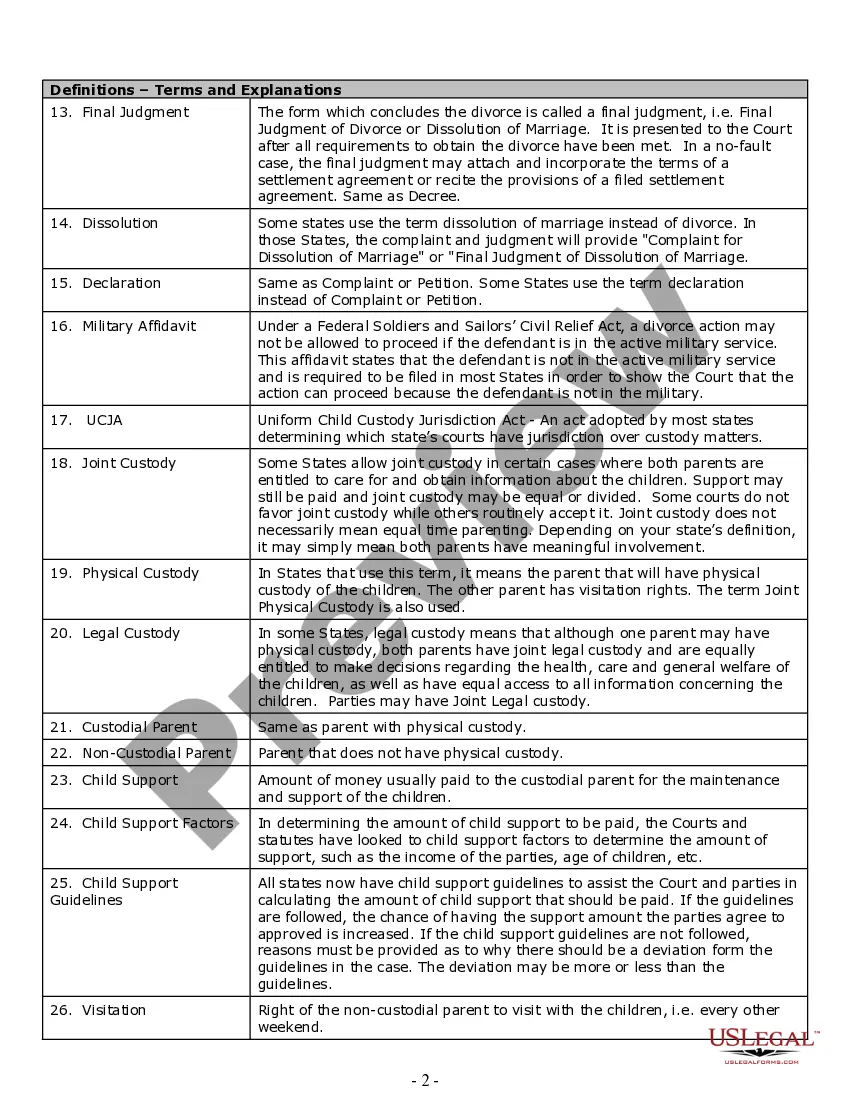

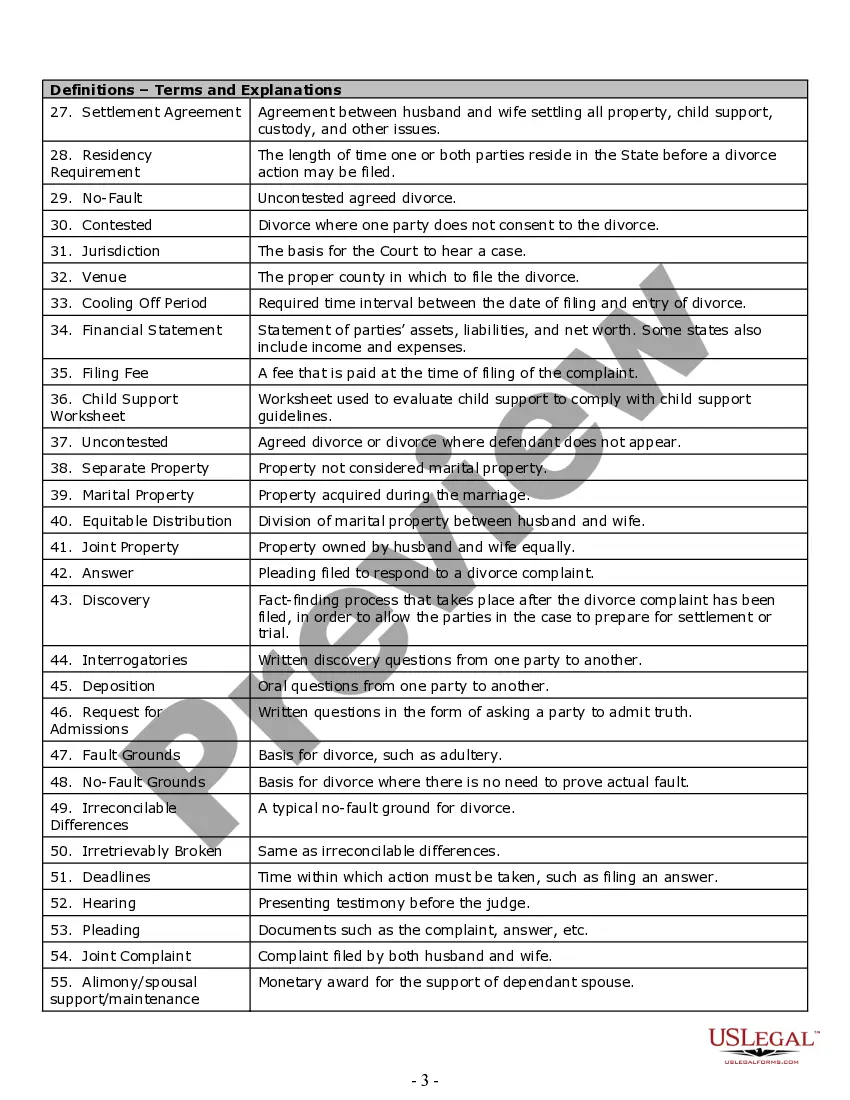

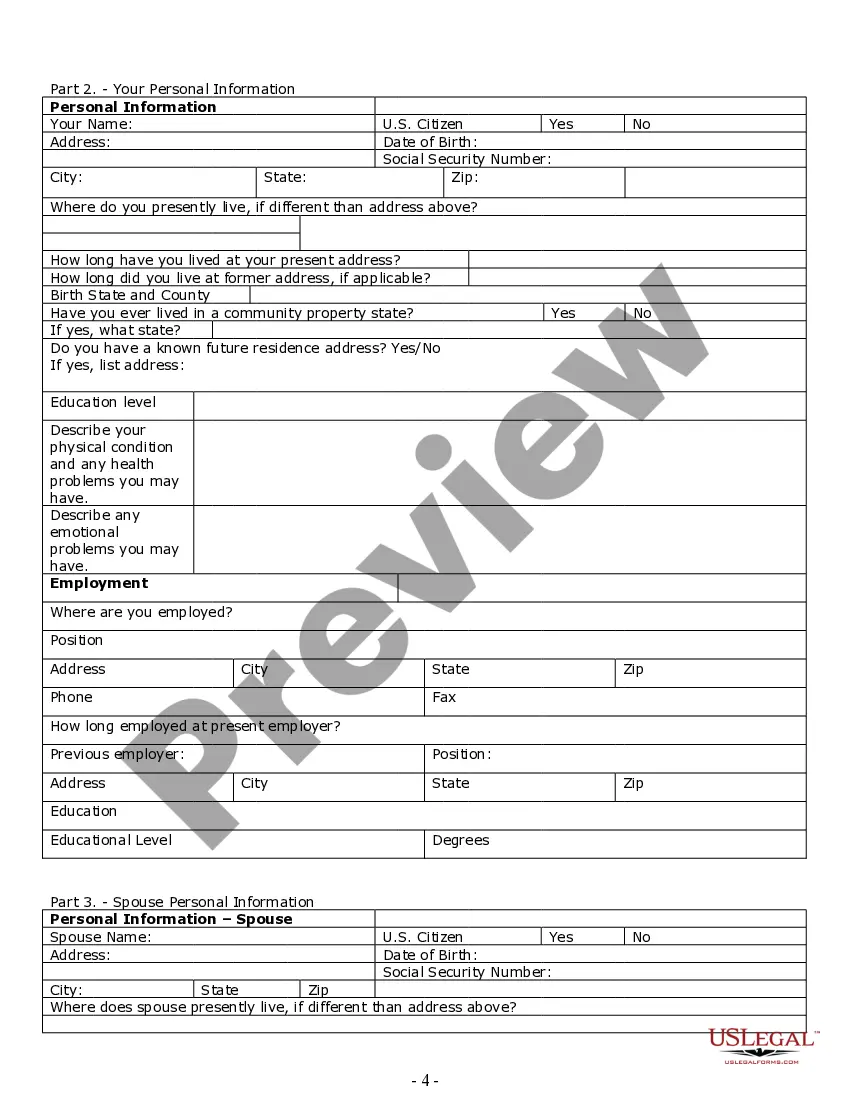

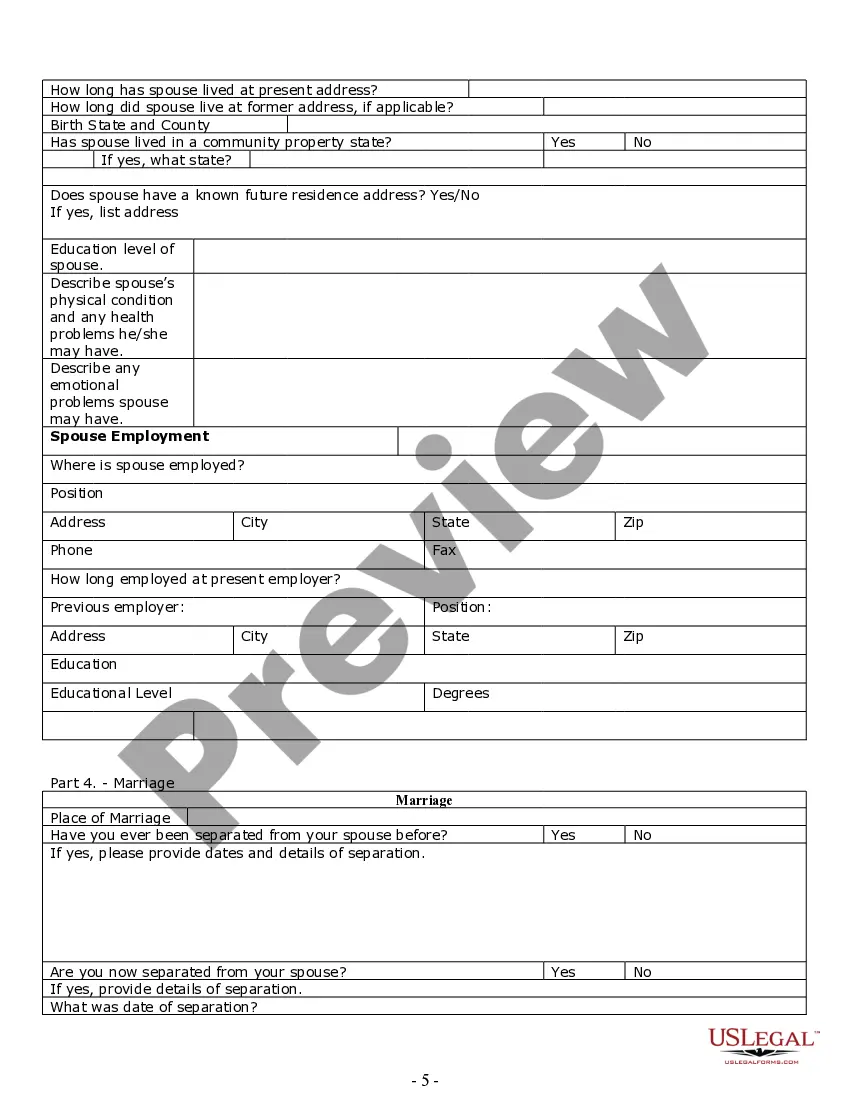

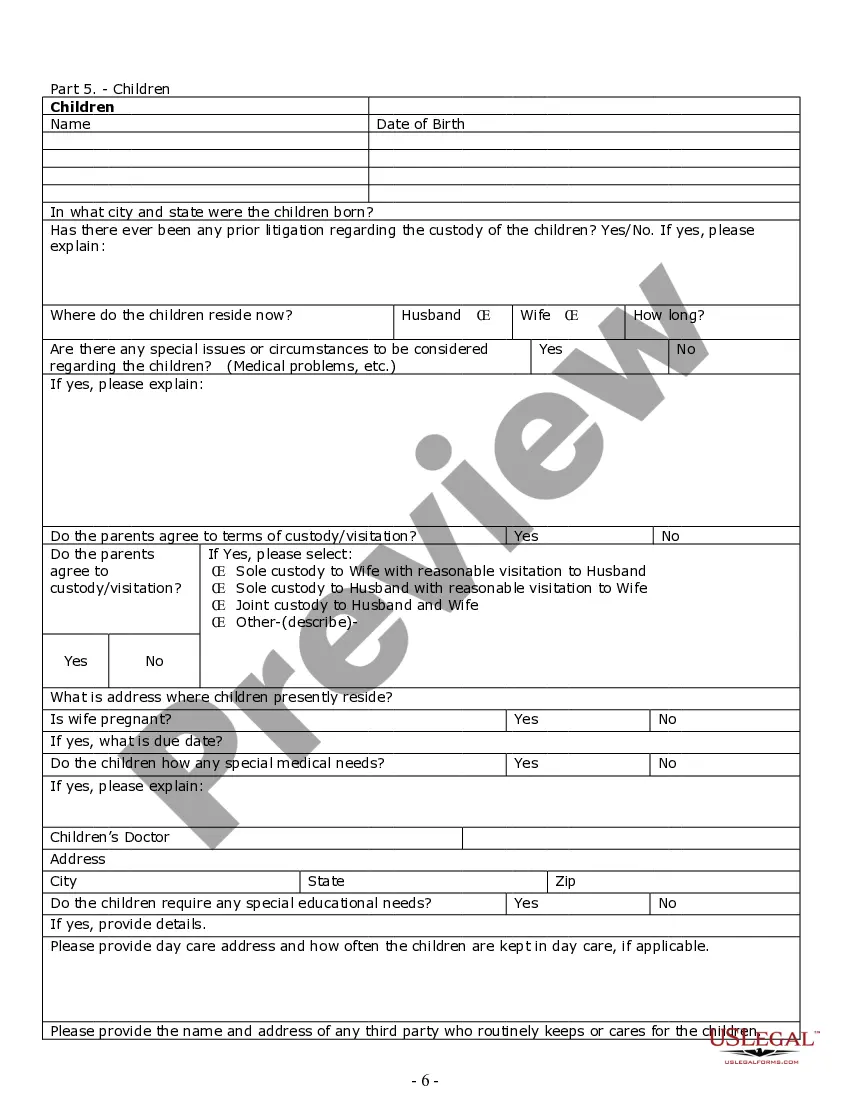

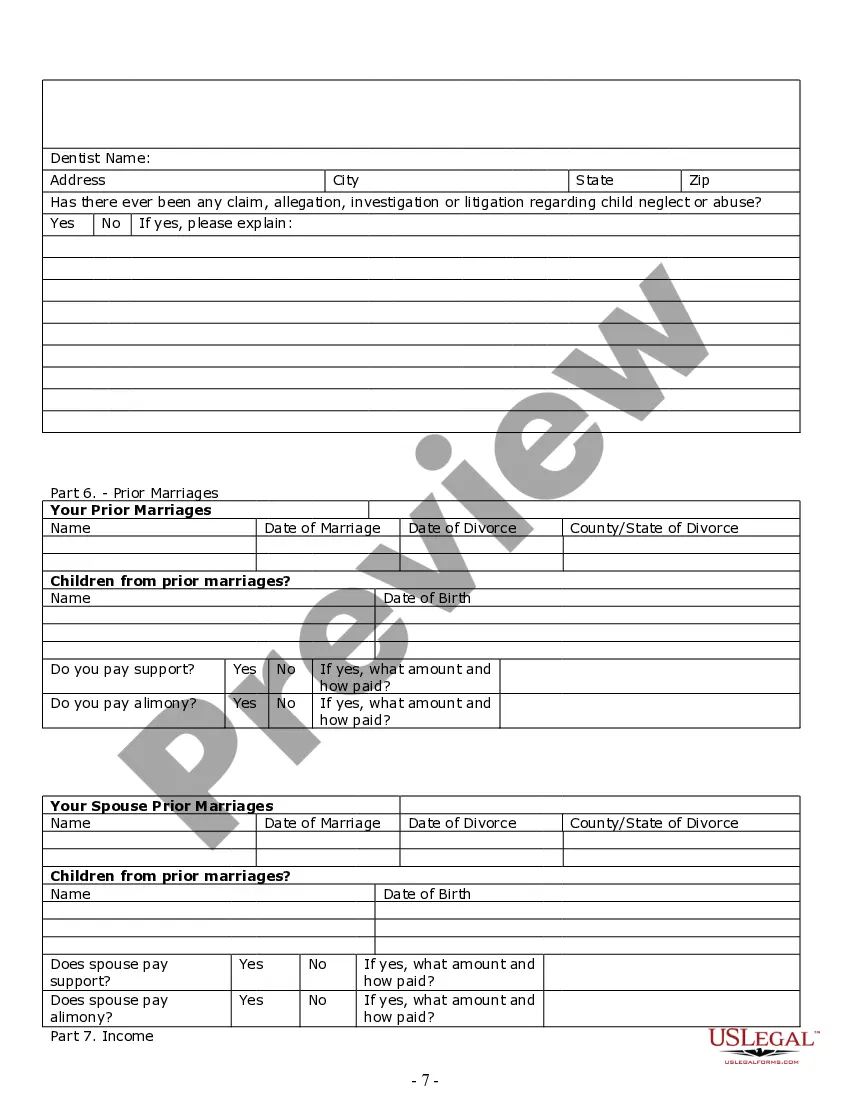

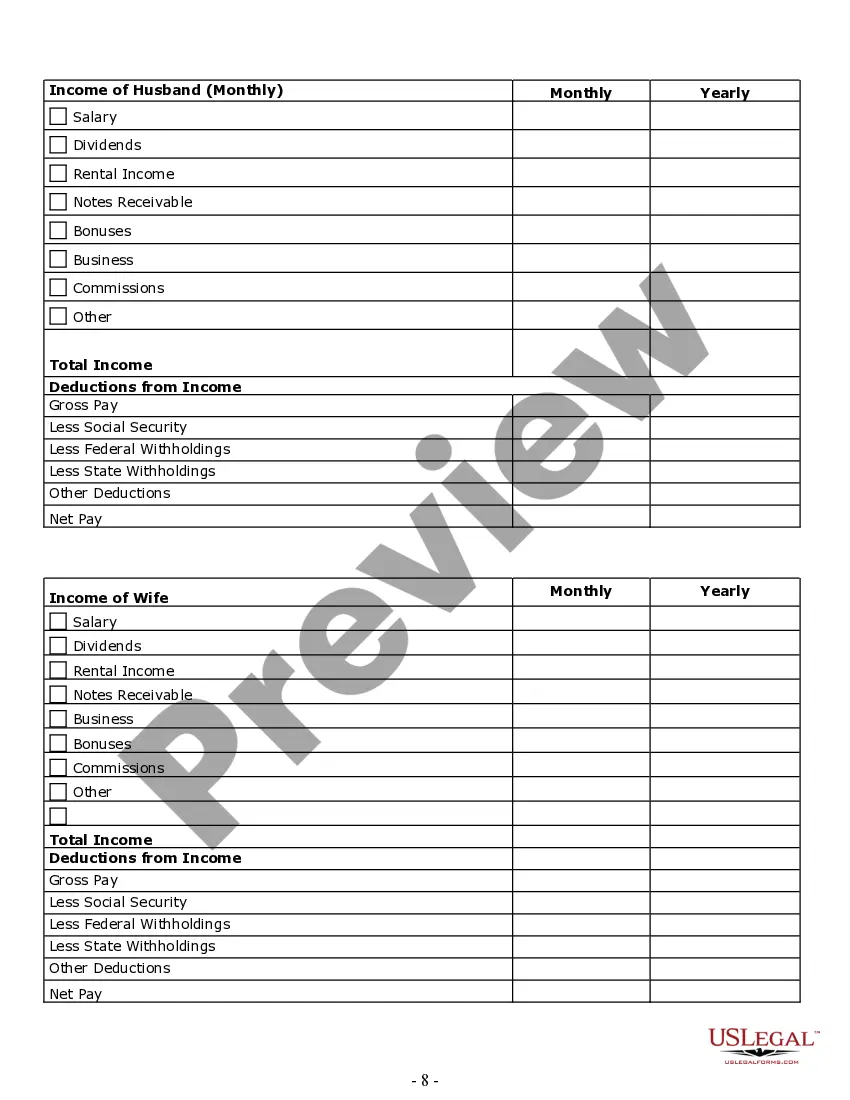

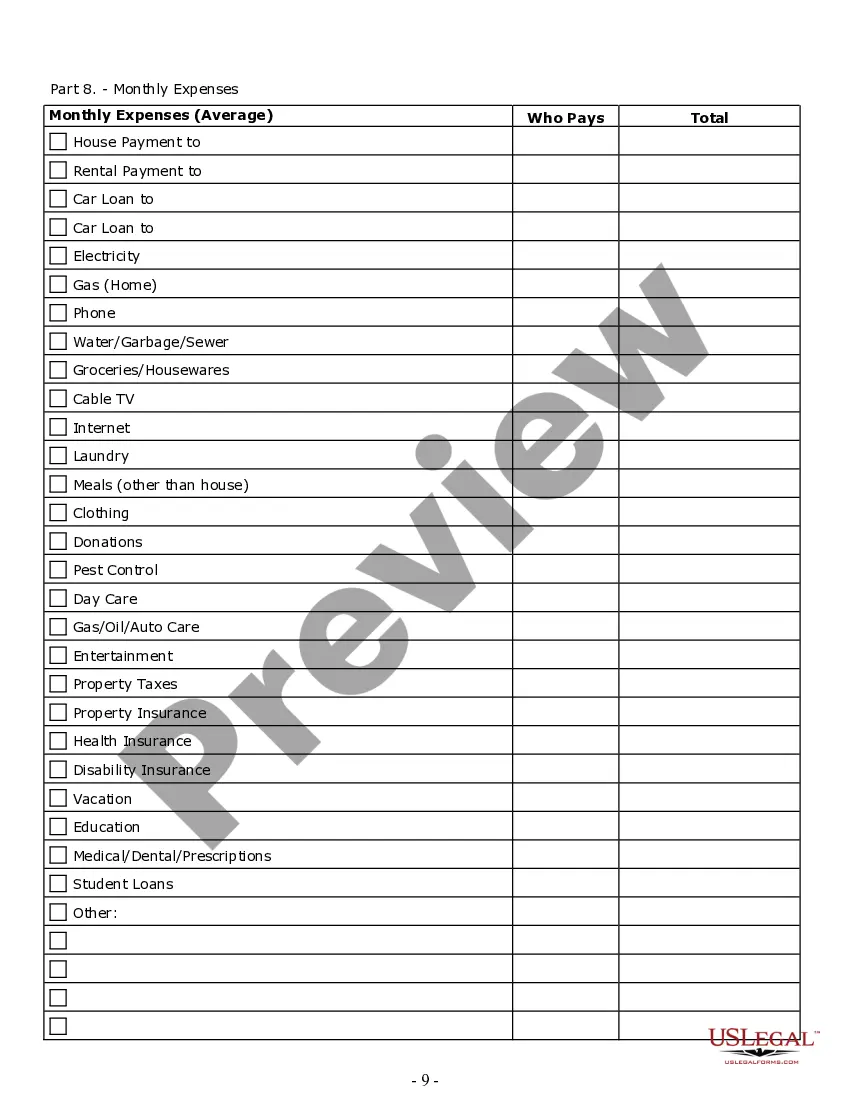

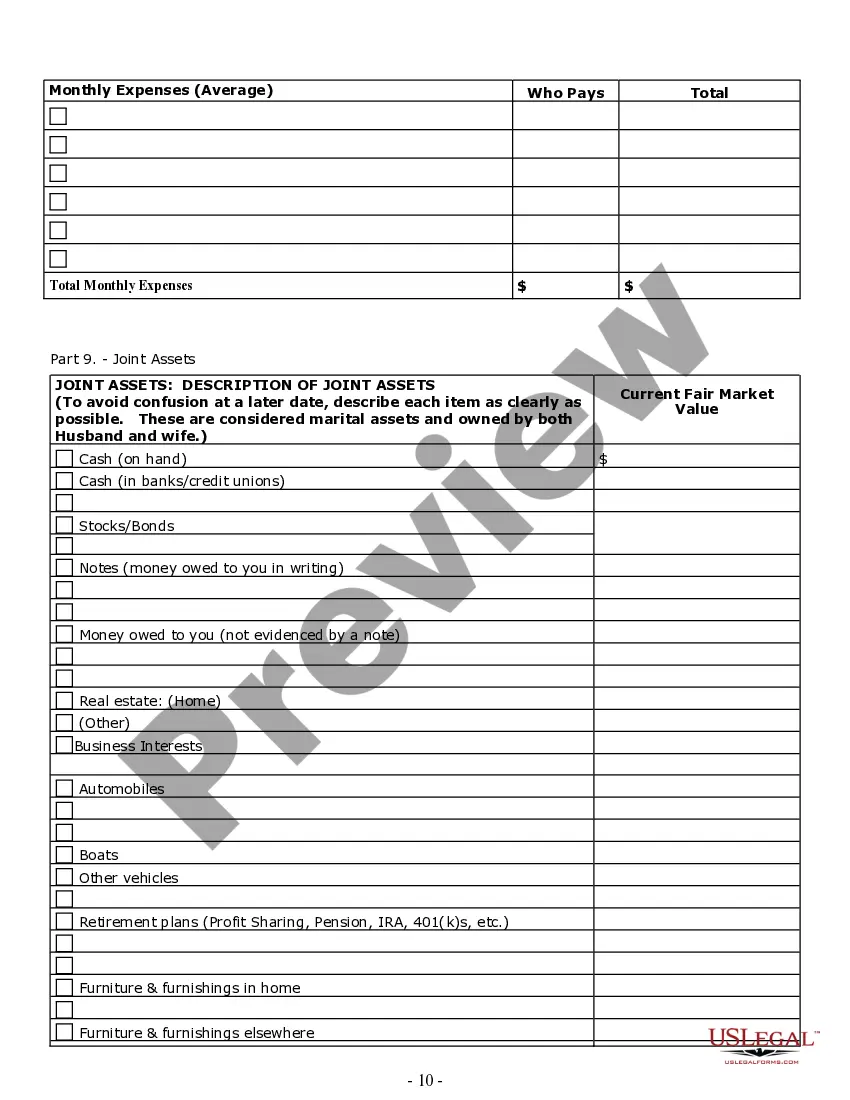

How to fill out Massachusetts Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Dealing with legal documents and processes can be a laborious addition to your day.

Ma Divorce Law For Retirement and similar forms typically necessitate you to locate them and comprehend how to fill them out correctly.

Consequently, whether you are managing financial, legal, or personal affairs, having an extensive and user-friendly online directory of forms readily available will be immensely beneficial.

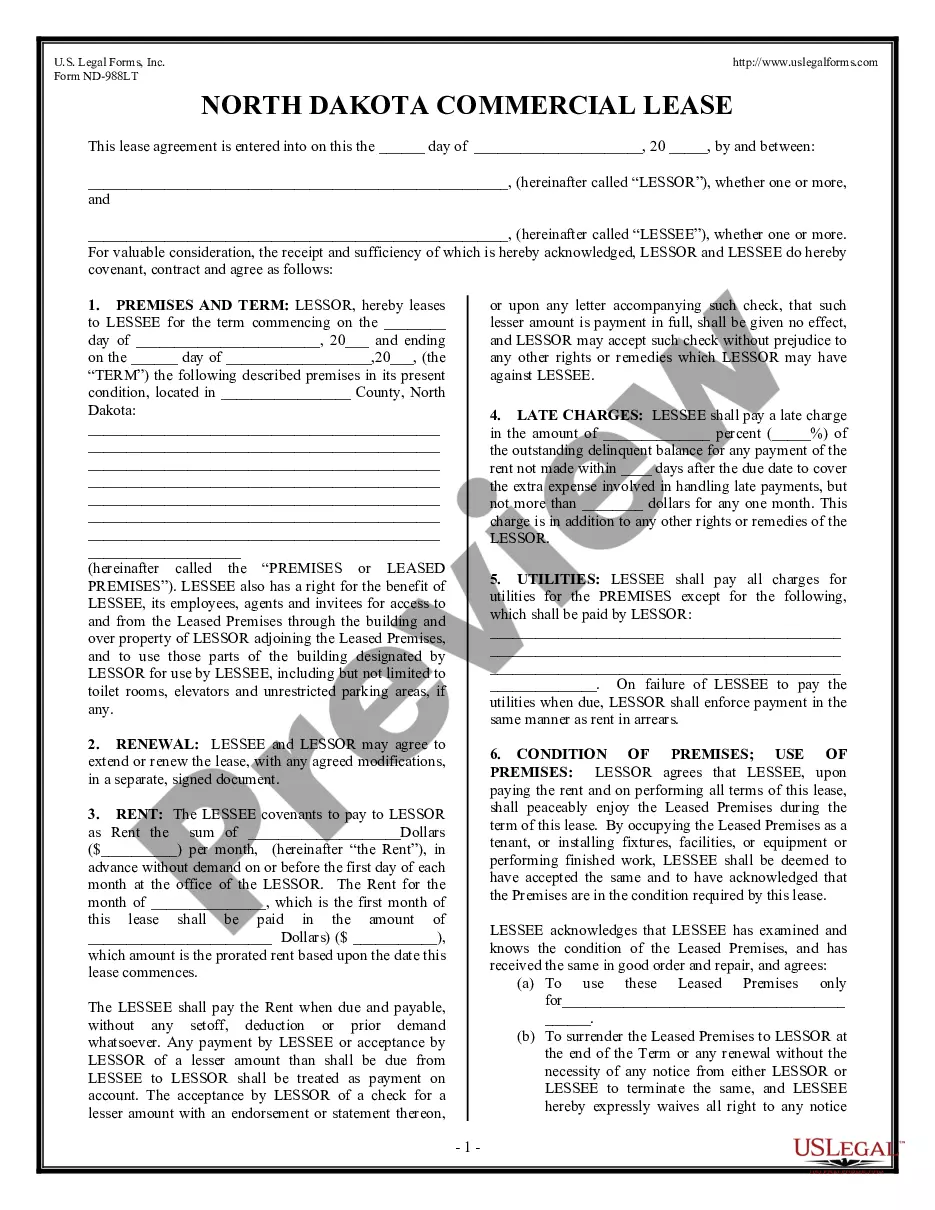

US Legal Forms is the premier online resource for legal templates, boasting over 85,000 state-specific forms and numerous resources to aid you in completing your documents with ease.

If this is your first experience with US Legal Forms, sign up and create a free account in just a few minutes to gain access to the form directory and Ma Divorce Law For Retirement. Then, follow these steps to finalize your form: Check that you have the correct form using the Review option and examining the form description. Select Buy Now when ready, and choose the subscription plan that suits your requirements. Click Download and subsequently complete, eSign, and print the form. US Legal Forms has 25 years of experience assisting users with their legal documents. Discover the form you need today and simplify any procedure without hassle.

- Browse the selection of pertinent documents accessible to you with a single click.

- US Legal Forms provides state- and county-specific forms that are available for download at any moment.

- Safeguard your document management processes using a high-quality service that enables you to create any form in just minutes with no additional or concealed charges.

Form popularity

FAQ

In a Massachusetts divorce, the court deems all assets acquired during marriage as marital property, including your retirement accounts.

In California, all types of retirement benefits are considered community property, which allows CalPERS benefits to be divided upon a dissolution of marriage or registered domestic partnership or legal separation.

In India wife is entitled to pension of husband from government job only if the family pension option was available and opted by the government employee husband . The name of wife added in the official record for the purpose of family pension. Consult your attorney and review the provisions in the divorce decree.

In most cases, the money in a retirement account is treated as marital property in a divorce. If a spouse had money in his or her 401(k) or a similar tax-deferred savings program when the couple married, those funds would be considered separate property. This means they would not be included in the division of assets.

A typical strategy would be to look at the value of the account on the date of marriage, subtract that from the value at the date of divorce, and divide by two. That's how much the spouse gets as part of the overall settlement agreement. Some employers still offer traditional pensions, known as defined benefit plans.