Utma Account In Massachusetts

Description

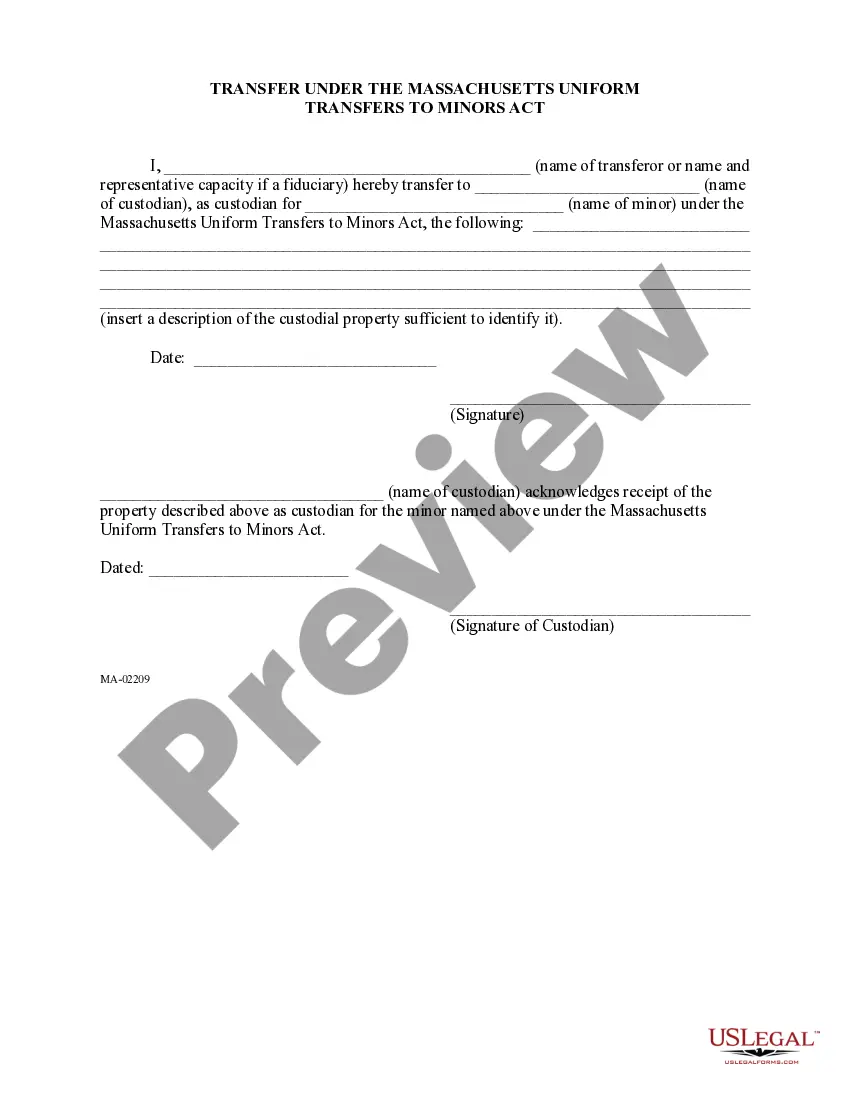

How to fill out Transfer Under The Massachusetts Uniform Transfers To Minors Act?

It’s well-known that you cannot transform into a legal expert instantly, nor can you quickly learn how to prepare an Utma Account in Massachusetts without having a specialized background.

Assembling legal documents is a lengthy undertaking that necessitates particular training and abilities. So why not allow the experts to handle the creation of the Utma Account in Massachusetts.

With US Legal Forms, one of the largest libraries of legal documents, you can discover anything from court papers to templates for office correspondence.

If you need another form, restart your search.

Establish a free account and choose a subscription plan to acquire the form.

- We recognize how crucial compliance and observance of federal and state regulations are.

- That’s why, on our platform, all documents are location-specific and current.

- Let’s get started with our service and secure the document you need in just a few minutes.

- Find the document you are looking for by utilizing the search bar at the top of the page.

- Preview it (if this option is offered) and read the supporting information to determine if the Utma Account in Massachusetts is what you’re seeking.

Form popularity

FAQ

To set up an UTMA account in Massachusetts, begin by selecting a bank or financial institution that offers UTMA accounts. You will need to provide the child's Social Security number, as well as your own information as the custodian. After gathering the necessary information, complete the application process, ensuring that you understand the rules governing the UTMA account in Massachusetts. For further assistance, you can explore the resources available on USLegalForms, which can guide you through the steps effectively.

The age limit for UTMA accounts in Massachusetts is generally 21 years old, as that is when the beneficiary gains complete control over the account. This age limit provides a structured approach to custodianship, ensuring that young adults have time to learn about financial management. Meanwhile, custodians operate the account until the beneficiary is ready to assume responsibility. If you want to set up a UTMA account in Massachusetts, UsLegalForms provides excellent tools and information to assist you.

In Massachusetts, UTMA accounts typically transfer to the beneficiary when they reach 21 years old. This age is critical as it marks the time when the individual is legally recognized as an adult, enabling them to manage their finances. Understanding this transfer process is vital for custodians to prepare the beneficiary for this responsibility. For detailed assistance on UTMA accounts in Massachusetts, consider checking out UsLegalForms.

When a child turns 18 in Massachusetts, they gain legal control over the UTMA account, but it remains in the custodian's control until they reach the age of 21. The custodian has a responsibility to manage the account until the child is ready to handle it independently. This transition gives the child a sense of financial responsibility while still ensuring their welfare. For more information on managing UTMA accounts in Massachusetts, explore resources available on UsLegalForms.

In Massachusetts, the UTMA age to take full control of an account is 21 years old. Until this age, a custodian manages the account on behalf of the minor. This age limit ensures that the funds are used wisely for the child's benefit until they are more mature. You can learn more about UTMA accounts in Massachusetts through platforms like UsLegalForms, which offer guidance on establishing these accounts.

Starting a UTMA account in Massachusetts for your child begins with identifying a suitable bank or brokerage that provides UTMA accounts. Gather the necessary documents, such as your identification and your child's Social Security number. After setting up the account, you can contribute funds or other assets on behalf of your child. Consider using reputable platforms like uslegalforms to guide you through the process and ensure compliance with state regulations.

To open a UTMA account in Massachusetts, you first need to choose a financial institution that offers this type of account. Next, complete the required application with your personal details and information about the minor. You will also need to designate a custodian who will manage the account until the child reaches the age of majority. Once your application is approved, you can fund the account and start investing for your child's future.

While UTMA accounts offer benefits, they do have some drawbacks to consider. One significant disadvantage is that once the minor reaches the age of majority, they gain full access to the funds, which may not align with your intentions for their use. Additionally, assets in an UTMA account can affect a child's eligibility for financial aid. To better understand these implications, consider consulting resources available through uslegalforms.

In Massachusetts, anyone can open an UTMA account as long as they are a custodian for a minor. A custodian can be a parent, relative, or even a friend. However, it's important to remember that the funds held in the account belong to the minor. The custodian must manage the account responsibly until the minor is old enough to take control.

To set up an UTMA account in Massachusetts, you need a few basic components. First, select a reputable financial institution that offers UTMA accounts. Next, you will need to provide the required identification information for both the donor and the minor. After that, you can deposit funds into the account, and the custodian will oversee the account until the minor reaches the age of majority.