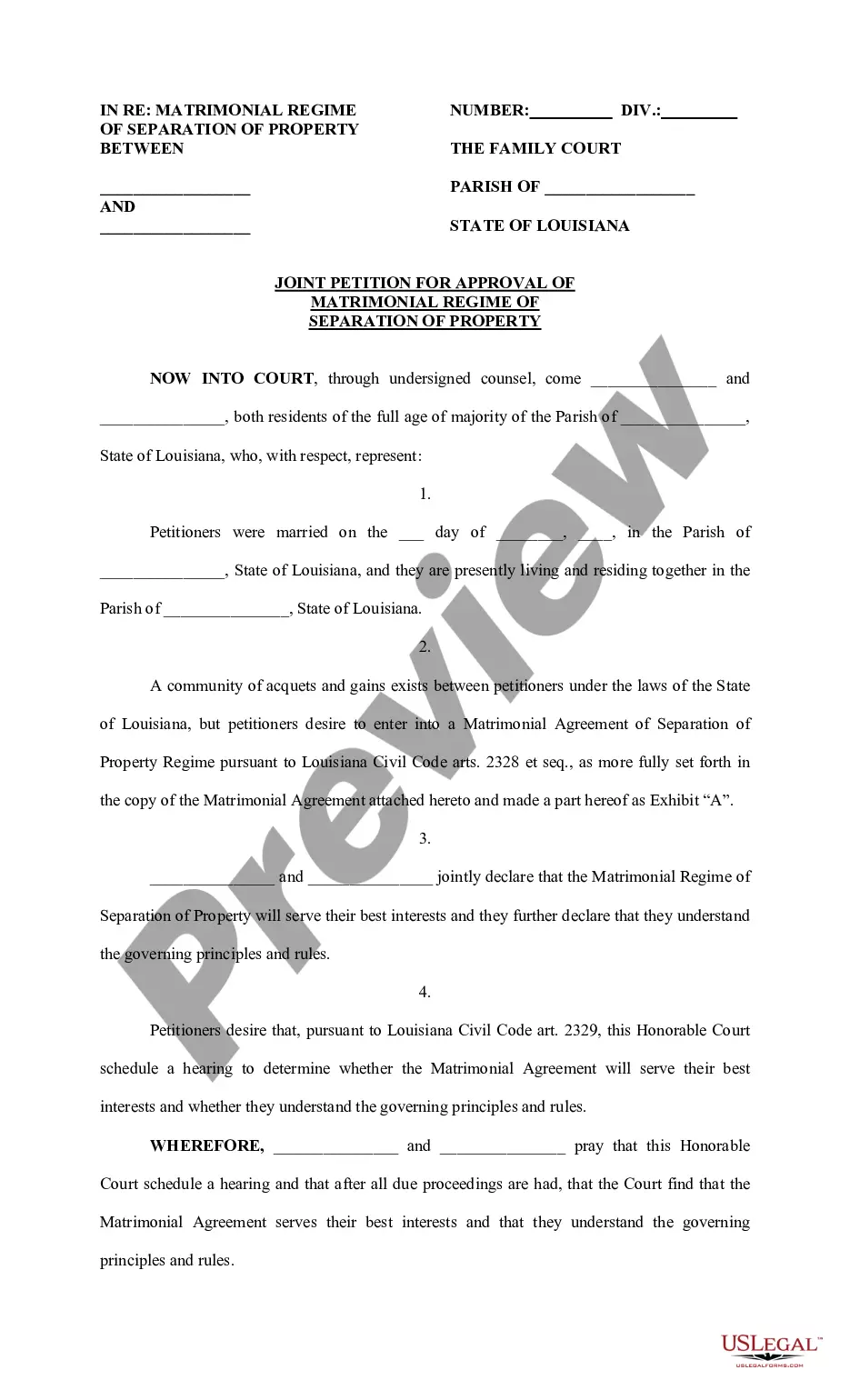

This is a joint petition and order ending the community of acquets and gains previously existing between petitioners upon their execution of the Matrimonial Agreement

Community Property Regime For Sale

Description

How to fill out Community Property Regime For Sale?

Navigating through the red tape of official paperwork and forms can be challenging, especially when one does not engage in that on a professional level.

Even selecting the correct template for the Community Property Regime For Sale will take considerable time, as it has to be valid and accurate to the very last numeral.

Nevertheless, you will find that you will invest significantly less time picking an appropriate template from the resource you can trust.

Obtain the correct form in a few simple steps: Enter the document name in the search box. Locate the suitable Community Property Regime For Sale from the results list. Review the sample description or preview it. When the template aligns with your needs, click Buy Now. Choose your subscription plan. Use your email to create a secure password to register for an account at US Legal Forms. Select a credit card or PayPal payment option. Save the template document on your device in your preferred format. US Legal Forms will save you time and effort in determining if the form you found online fits your requirements. Create an account to gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of finding the right documents online.

- US Legal Forms serves as a one-stop shop where you can locate the most up-to-date document samples, confirm their usage, and download them for completion.

- It boasts a library of over 85K forms applicable in various professional fields.

- When searching for a Community Property Regime For Sale, there will be no doubt about its usability as all the forms are authenticated.

- An account at US Legal Forms guarantees you access to all the necessary samples at your fingertips.

- You can either save them in your history or add them to your My documents collection.

- Access your saved forms from any device simply by clicking Log In on the library site.

- If you do not have an account yet, you can always search for the template you require.

Form popularity

FAQ

Another example of community property is joint bank accounts established during the marriage. Funds deposited into these accounts by either spouse are usually considered joint assets. Knowing how assets fall under the community property regime for sale can guide you through financial discussions as you deal with asset division.

A typical example of community property includes the family home purchased during the marriage. Both spouses generally share equal ownership, regardless of who holds the title. Understanding this can be crucial when navigating through the community property regime for sale, especially during a divorce or separation.

Certain assets, like personal inheritances and pre-marital assets, may be protected from division in a divorce. Additionally, if one spouse can prove that an asset was gifted to them individually, it typically remains their separate property. Familiarizing yourself with your state's community property regime for sale can help clarify which assets can be safeguarded.

Items acquired before marriage, inheritances, or gifts directed to one spouse specifically are not considered community property. Additionally, any assets specifically labeled as separate property, even if acquired during the marriage, typically fall outside the community property regime for sale. Understanding these distinctions can aid in asset division during a divorce.

Community property income generally includes earnings from both spouses during the marriage. This can cover wages, salaries, bonuses, and even income from shared investments. When dealing with community property regime for sale, it's important to properly classify these income sources, as they often impact divorce settlements and tax returns.

To file a Married Filing Separately (MFS) status in a community property state, you first need to determine the community property rules specific to your state. Each spouse usually reports half of the community income, and you must account for any separate income or deductions. Utilizing resources like the US Legal Forms platform can simplify this process, helping you file correctly while ensuring compliance with your local community property regime for sale.

Asking a spouse to leave the house can be challenging and should be approached with care. It’s important to communicate your feelings clearly and consider their perspective. If the property falls under the community property regime for sale, you may want to consult with a legal professional about your rights and options. This step can ensure that the discussion is constructive and respectful.

When one partner wants to sell while the other does not, it can create tension within the relationship. Under the community property regime for sale, both must agree to the sale for it to proceed. If an agreement cannot be reached, legal action may be necessary to resolve the dispute. Engaging with legal advice can offer solutions to reach a fair outcome.

The community property rule in California states that any assets or debts acquired during marriage are owned equally by both spouses. This principle applies to most couples under the community property regime for sale. Therefore, upon divorce, all shared property is typically divided evenly. Knowing your rights under this rule can help in making informed decisions.

In California, you do not need to be married for a specific duration to qualify for half of the community property. As soon as a couple marries, all acquired property during the marriage falls under the community property regime for sale. Upon divorce, both spouses have equal rights to the community property. Understanding these laws can help in planning effectively.