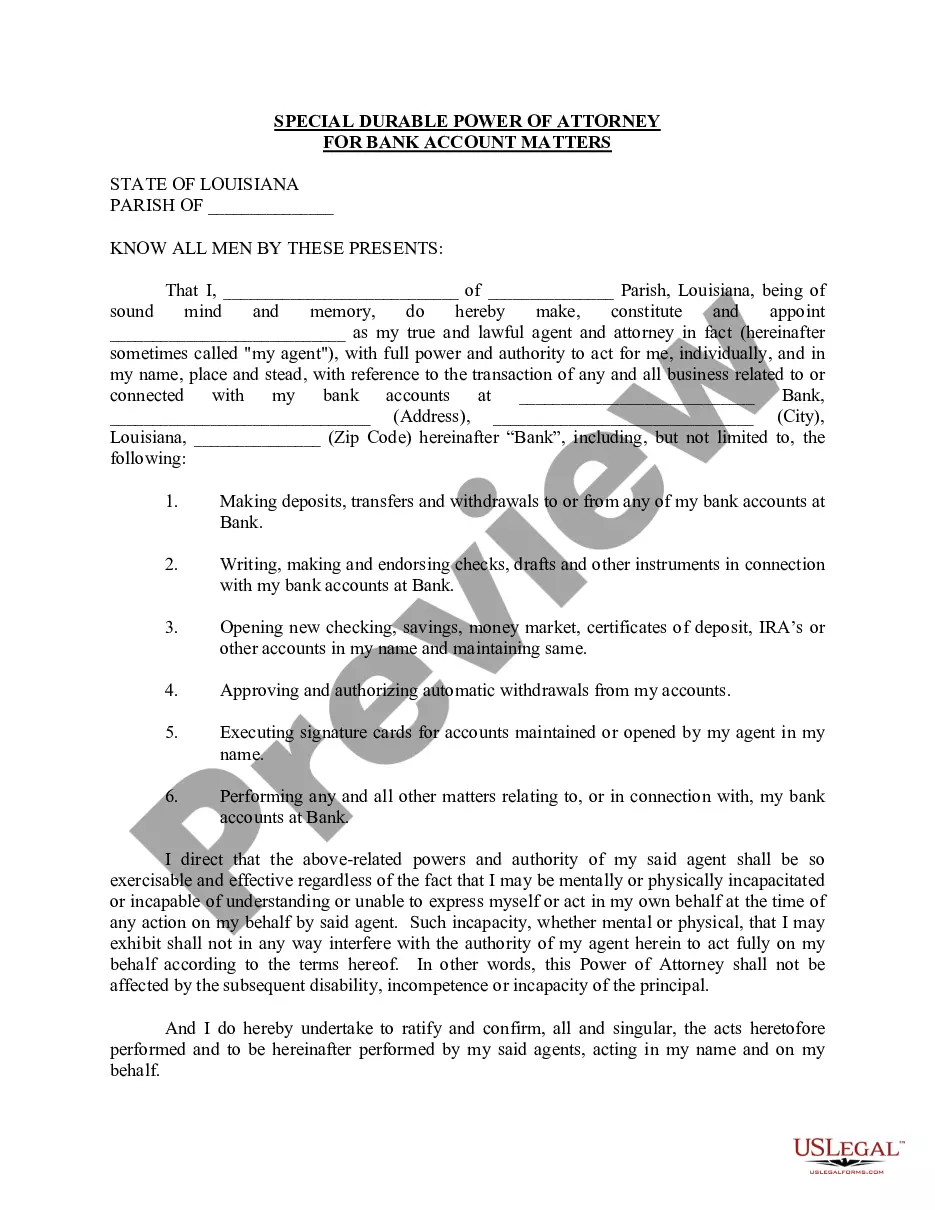

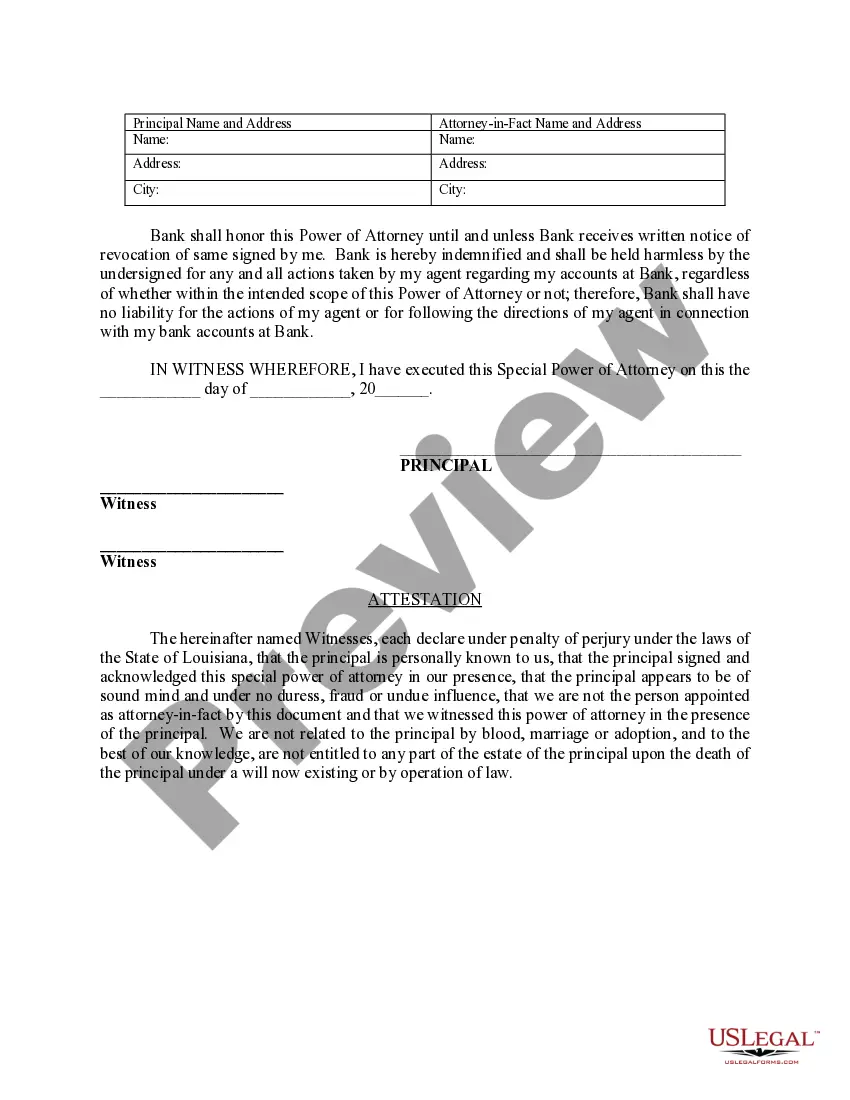

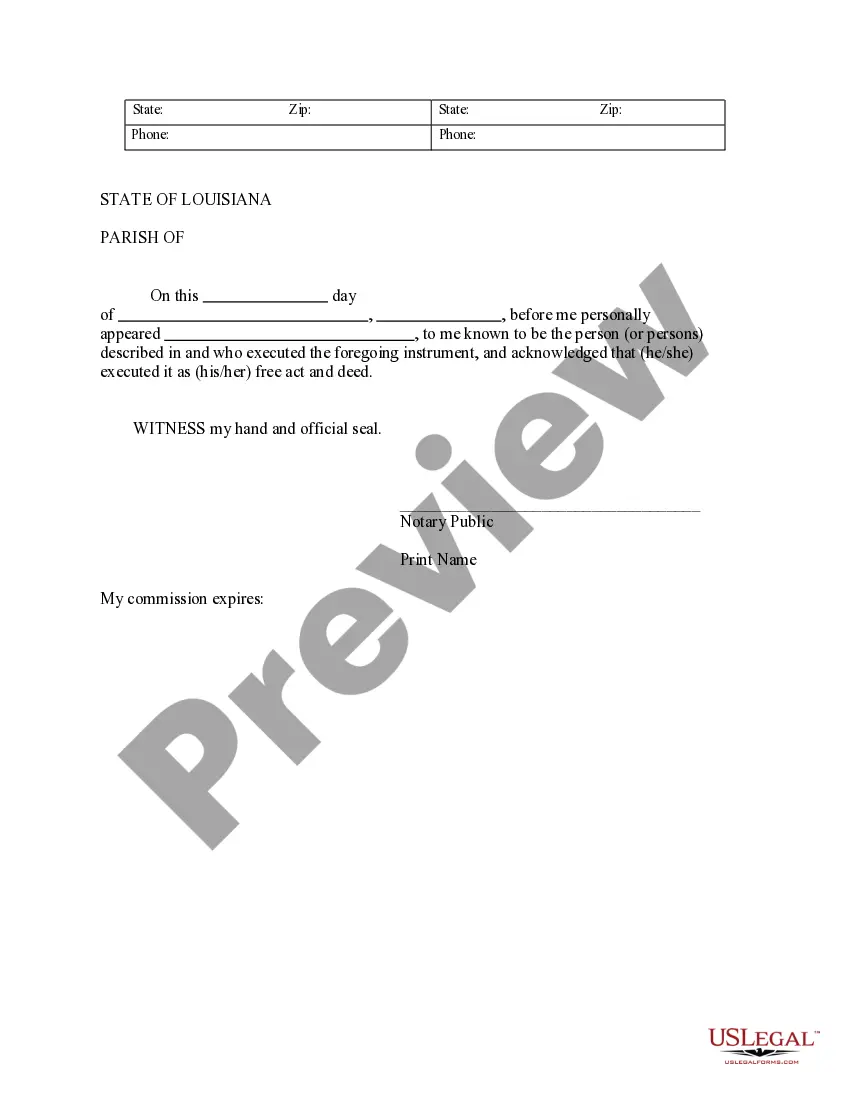

Bank Power Of Attorney Form With Two Agents

Description

How to fill out Louisiana Special Durable Power Of Attorney For Bank Account Matters?

Bureaucracy demands exactness and correctness.

Unless you regularly manage the completion of documents like the Bank Power Of Attorney Form With Two Agents, it can lead to some misunderstandings.

Choosing the right version from the outset will guarantee that your document submission proceeds smoothly and avoids the hassle of re-submitting a document or repeating the entire process from the beginning.

If you are not a subscribed user, finding the necessary sample may require a few additional steps.

- You can always access the right sample for your documentation through US Legal Forms.

- US Legal Forms is the largest online collection of forms, offering over 85 thousand templates across various sectors.

- You can acquire the most current and relevant edition of the Bank Power Of Attorney Form With Two Agents by simply searching for it on the platform.

- Find, store, and save templates within your account or check the description to confirm you have the right one.

- Having an account with US Legal Forms allows you to gather, keep in a single location, and easily navigate the templates you've saved to access them quickly.

- When on the site, click the Log In button to sign in.

- Next, visit the My documents page, where your document history is maintained.

- Review the descriptions of the forms and save those you need whenever you like.