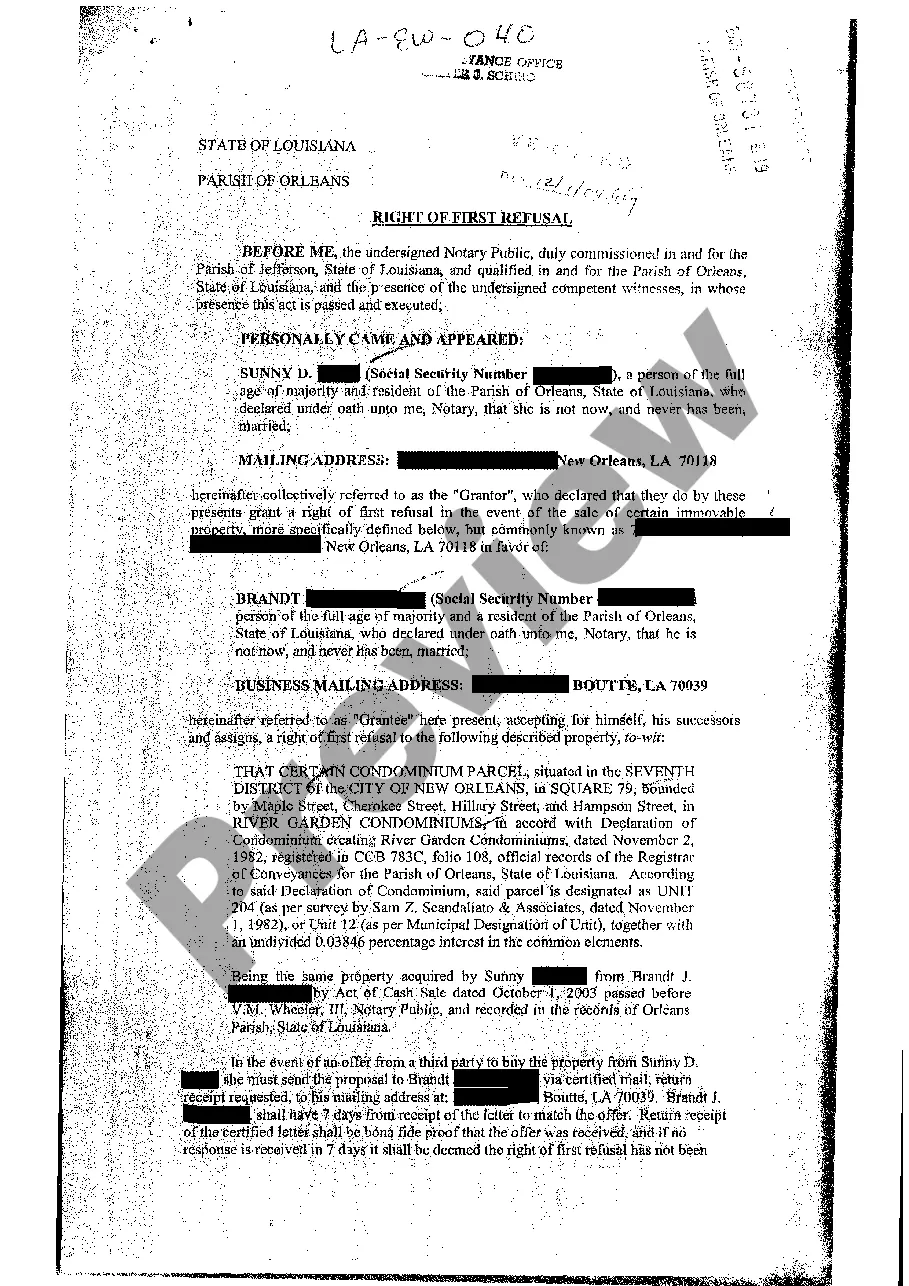

Right Of First Refusal For Shareholder

Description

Form popularity

FAQ

The first right of refusal for shareholder allows them to buy shares before the current owner sells to another party. This mechanism ensures that existing shareholders can maintain control and ownership within the company. When a shareholder intends to sell, they must first offer the shares to other shareholders, who can then accept or decline the offer.

The right of first refusal for shareholder does not legally require recording to be valid; however, documenting it can provide enforceability. By recording this right, you establish a clear ownership record, which can prevent future disputes. It’s wise to have a written agreement that outlines the specifics of the right of first refusal for shareholders to avoid misunderstandings.

Waiving the right of first refusal for shareholders can be done through a written agreement among the shareholders. Each party must agree to the waiver, which should then be documented to avoid future confusion. A legal service like uslegalforms can assist you in drafting this waiver to ensure proper legal standing and clarity.

To obtain a first right of refusal, start by discussing this option with your fellow shareholders. You can propose it in your company’s bylaws or shareholder agreement. If you're not sure how to properly document this, using a platform like uslegalforms can guide you through the legal requirements to secure your rights.

The first right of refusal process involves notifying existing shareholders about the intention to sell shares. Shareholders then have a specified time period to respond and express their interest in purchasing the offered shares. If they choose not to buy, the seller can proceed to sell to an external party, ensuring transparency and fairness throughout.

To establish a right of first refusal custody arrangement, you generally need to negotiate terms with your co-parent. After agreeing on the terms, you can formalize the arrangement through a legal document or a court order. It's beneficial to involve legal services like uslegalforms, which can help you draft necessary documents to solidify your rights.

The right of first refusal for shareholders is typically owned by the existing shareholders themselves. When included in the shareholder agreement, this right allows them to safeguard their interests regarding share transactions. Each shareholder holds the right to respond to any sale offers first, enhancing their control over company ownership.

The ROFR in a shareholder agreement outlines the conditions under which current shareholders can buy shares before they are offered to external buyers. This right protects the interests of existing shareholders while enhancing the company's stability and cohesiveness. Clearly defining the ROFR in the agreement is essential for smooth transactions within the shareholder community.

The right of first offer (RoFO) can pose challenges when shareholders struggle to establish a fair market value for shares. Unlike the right of first refusal, the RoFO does not guarantee that a shareholder will have the opportunity to buy; it only grants the first chance to negotiate. This can lead to disputes and affect the selling dynamics if the involved parties do not agree on the initial offer.

While the right of first refusal (ROFR) offers protection to shareholders, it can also restrict market activity and lead to dissatisfaction among interested buyers. Sellers may find it challenging to sell quickly due to the necessity of notifying other shareholders. Consequently, the ROFR can unintentionally diminish a share's overall value.