Letter Of Guarantee With

Description

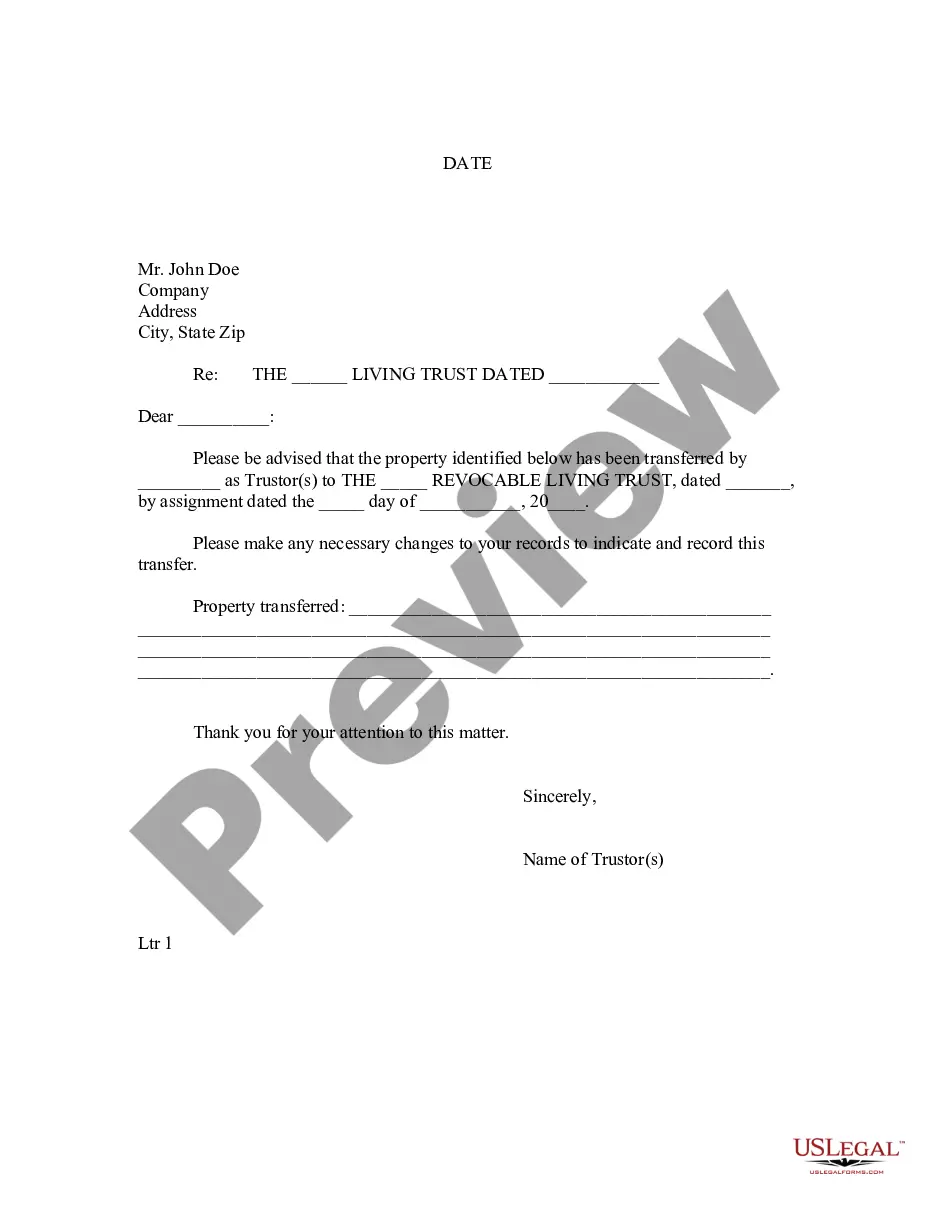

How to fill out Louisiana Letter To Lienholder To Notify Of Trust?

Managing legal paperwork can be exasperating, even for seasoned professionals.

When you need a Letter Of Guarantee With but lack the time to devote to finding the correct and current version, the process can be stressful.

With US Legal Forms, you can.

Access legal and business forms specific to your state or county. US Legal Forms caters to all your needs, from personal to business documents, in a single location.

If it's your initial experience with US Legal Forms, create an account and enjoy unlimited access to all the benefits of the library. Here are the steps to follow after downloading the desired form: Validate that it is the correct form by previewing and reviewing its description. Ensure the template is acceptable in your state or county. Click Buy Now when you are ready. Select a monthly subscription plan. Choose the format you desire, and Download, complete, sign, print, and submit your document. Leverage the US Legal Forms online catalog, backed by 25 years of experience and dependability. Transform your daily document management into a straightforward and user-friendly process today.

- Utilize advanced resources to prepare and manage your Letter Of Guarantee With.

- Access a wealth of articles, tutorials, and manuals tailored to your situation and needs.

- Save time and energy searching for the necessary documents and employ US Legal Forms’ sophisticated search and Review tool to find the Letter Of Guarantee With and obtain it.

- If you hold a subscription, Log In to your US Legal Forms account, locate the form, and obtain it.

- Check your My documents tab to view the documents you have previously downloaded and to organize your folders as desired.

- A comprehensive online form database can revolutionize the way individuals handle these situations.

- US Legal Forms is a foremost provider in online legal forms, offering over 85,000 state-specific legal documents accessible at your convenience.

Form popularity

FAQ

To create an effective letter of guarantee, you need to include the names of all parties involved, the obligations to be guaranteed, and any relevant conditions or terms. Make sure to specify the amount and the duration of the guarantee. It is also wise to include signatures from both the guarantor and the beneficiary. Using a template from USLegalForms can streamline incorporating these elements.

A letter of guarantee can be issued by individuals or businesses willing to take responsibility for another party's obligations. Typically, banks and financial institutions issue formal letters of guarantee as part of financing arrangements. However, you can also write a personal letter of guarantee with careful consideration of the responsibilities involved. USLegalForms provides templates that cater to various scenarios.

A letter of guarantee is generally considered legally binding when it meets specific criteria, such as having clear terms and signatures from all parties involved. To ensure that your letter of guarantee with necessary details is enforceable, it's vital to follow applicable laws and regulations. It is advisable to consult a legal expert or utilize resources from USLegalForms for proper drafting.

To write a letter of guarantee with specific terms, start by clearly stating your intention to guarantee the obligations of the person in question. Include relevant details such as the date, the guaranteed amount, and any conditions tied to the guarantee. Make sure to provide your full name, address, and contact information. Using a template from USLegalForms can simplify this process.

The length of time a letter of guarantee takes can depend on various factors. Generally, it can be expected to take from several days to a couple of weeks to finalize. Elements such as the complexity of provided information and the responsiveness of involved parties can influence this timeline. Always verify with your bank for the most accurate time frame.

To get a letter of guarantee, start by identifying your need and the financial institution that can assist you. Gather necessary documentation that outlines your request and the transaction details. After submitting your request to the bank, they will review it and process the necessary paperwork, leading to the issuance of the letter once approved. Platforms like US Legal Forms can help streamline this process with ready-made templates.

A letter of guarantee with an example can clarify its use in real-world situations. For instance, suppose a contractor needs assurance that a client will fulfill their payment obligations. The contractor can request a letter of guarantee from their bank, which assures the client’s payment, thereby securing the contractor's financial interests. Such letters serve to facilitate trust in business agreements.

The time required to obtain a letter of guarantee can vary based on the institution and the specifics of your request. Typically, the process takes anywhere from a few days to a couple of weeks. Factors such as the complexity of the request and the institution’s policies can impact the timeline. Always consult your financial provider for a more accurate estimate.

The process of obtaining a letter of guarantee involves several straightforward steps. First, a requestor contacts a financial institution or bank to discuss their needs. Next, you will need to provide necessary documentation and details about the transaction. Once approved, the bank will issue the letter of guarantee, ensuring that financial commitments are secured.

A guarantor letter should include the date, the parties involved, and a detailed description of the obligations being guaranteed. Clearly state the nature of the letter of guarantee with any financial terms, the limits of the guarantee, and the duration. It is essential to include the guarantor’s personal details and signatures to make the letter official. Additionally, adding any relevant documentation strengthens your position.