Limited Lianility

Description

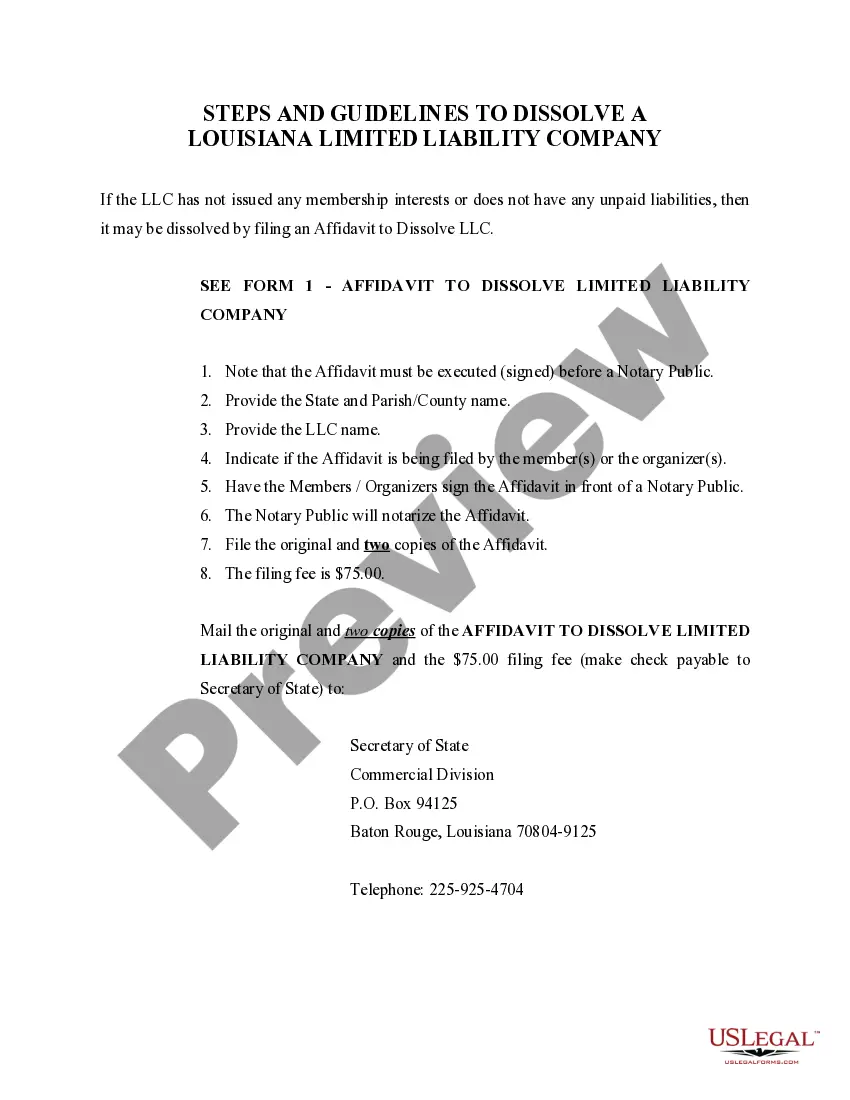

How to fill out Louisiana Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your existing account on US Legal Forms. Verify that your subscription is active and allows you access to the forms you need.

- Preview the available templates and read their descriptions carefully to ensure they align with your local jurisdiction requirements.

- If necessary, search for another template using the search function to find the right document that fits your needs.

- Select the required document by clicking on the 'Buy Now' button. Choose a subscription plan that works best for you, and create an account if you’re a new user.

- Complete your purchase by providing your payment information, either via credit card or PayPal.

- Once your payment is confirmed, download your document directly to your device and access it through the 'My Forms' section of your profile whenever needed.

In conclusion, US Legal Forms provides an extensive library of over 85,000 legal documents, ensuring you find exactly what you need for limited liability purposes. With access to premium experts for guidance, you can complete legal forms with confidence.

Start your journey today by exploring US Legal Forms and take control of your legal documentation!

Form popularity

FAQ

world example of limited liability can be seen when a limited liability company faces a lawsuit. For instance, if 'ABC Rentals LLC' is sued over property damage, the owners' personal assets, such as their home or car, typically remain protected from claims. This feature allows entrepreneurs to pursue business ventures without the fear of losing personal wealth due to businessrelated obligations. Limited liability is a powerful tool for anyone interested in safeguarding personal finances.

A limited liability company, often referred to as an LLC, is a business structure that combines the characteristics of a corporation and a partnership. LLCs provide limited liability protection to their owners, meaning personal assets are generally protected from the company’s debts and lawsuits. In essence, forming an LLC allows you to enjoy the benefits of both limited liability and pass-through taxation. This flexibility makes it a popular choice for many entrepreneurs.

An example of a limited company is 'XYZ Enterprises Ltd.' Unlike an LLC, a limited company can have shareholders and can issue shares, which often attracts investment. This structure allows the owners to limit their financial risk, protecting personal wealth while benefiting from business opportunities. Therefore, limited liability remains an essential aspect for many business owners.

known example of a limited liability company in the US is 'Smith & Sons LLC'. This company is formed to protect its owners from personal liability related to business debts. By choosing limited liability, the owners ensure that their personal assets remain safe in case of business failure. Thus, limited liability offers a crucial layer of protection, allowing entrepreneurs to operate with confidence.

Limited liability is best described as a legal provision that protects business owners from being personally liable for the company's debts and financial obligations. This ensures that members’ personal assets remain intact, which is crucial for risk management. Limited liability allows entrepreneurs to pursue their business goals with reduced financial anxiety. Overall, it offers a crucial layer of security for anyone looking to start a business.

A limited liability company is a flexible business structure that combines the characteristics of corporations and partnerships. It protects its owners from personal responsibility for business debts and liabilities while providing operational flexibility. LLCs can be managed by the members or designated managers, allowing for a customized approach to ownership and management. This adaptability makes limited liability companies appealing for various types of businesses.

Limited liability means that the financial risk of a business is confined to the amount invested in the company, protecting personal assets from legal claims. This concept is crucial for entrepreneurs who want to develop businesses without putting their personal wealth on the line. Limited liability creates a safety net, allowing business owners to take calculated risks. Thus, it encourages entrepreneurship and innovation.

An example of limited liability can be seen in a situation where an LLC faces a lawsuit for a business-related issue. If the business loses the case, only the assets of the LLC are at risk, not the personal assets of its owners. This principle protects the owners' homes, savings, and personal property. Limited liability is vital for providing security as you navigate the business landscape.

A limited liability company is a hybrid business entity that combines aspects of both corporations and partnerships. It provides personal liability protection while offering pass-through taxation, which avoids double taxation. This structure supports diverse business activities and allows for an unlimited number of members. In short, an LLC is designed to meet the needs of modern entrepreneurs seeking both protection and flexibility.

An LLC is best for small to medium-sized businesses that want to limit liability while enjoying tax flexibility. Entrepreneurs who seek personal asset protection and simpler tax filing often choose this structure. Additionally, an LLC can facilitate easier management and operation, which is advantageous for startups. It really allows business owners to focus on growth without constant legal concerns.