Usufruct Form With Beneficiaries

Description

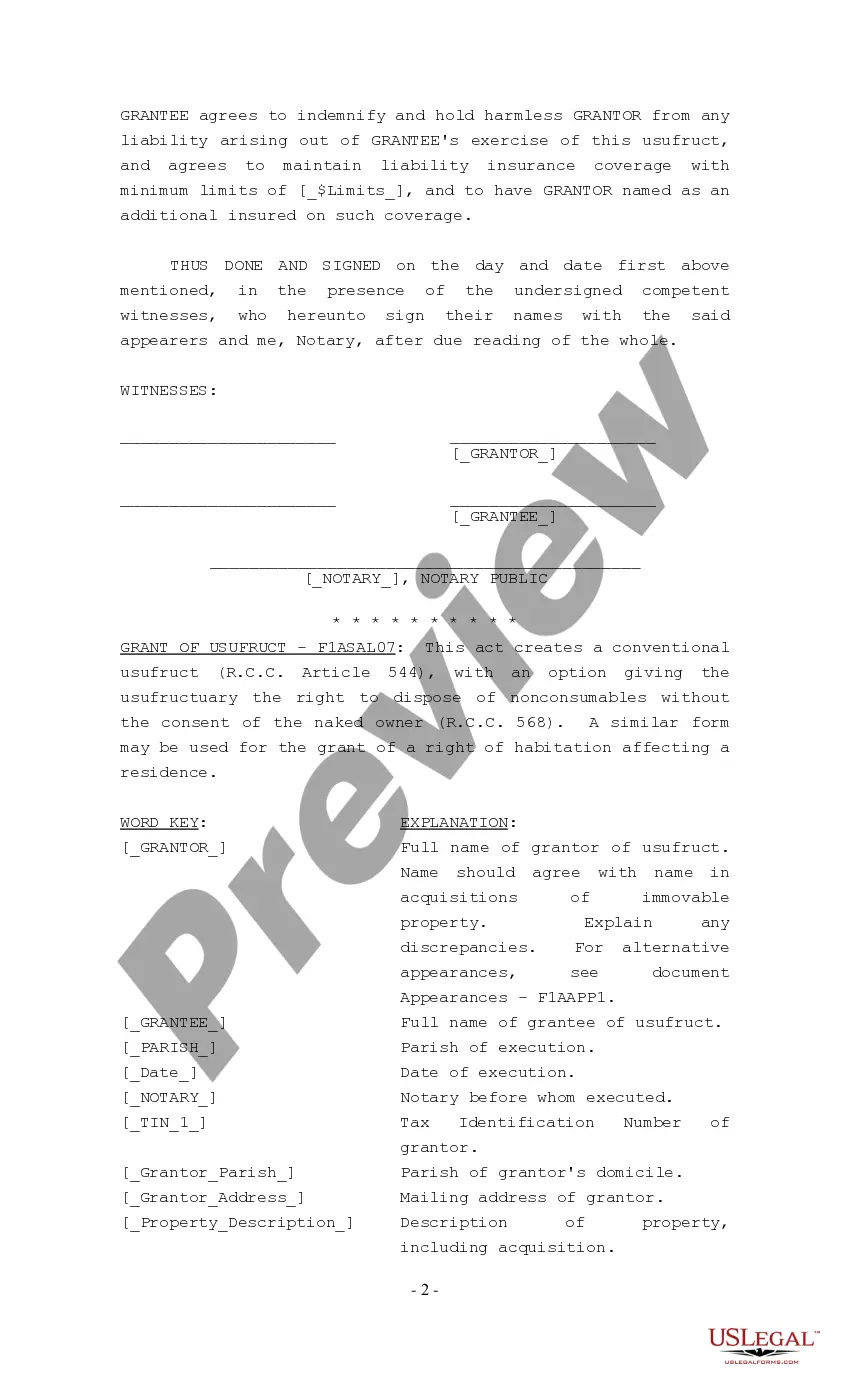

How to fill out Louisiana Grant Of Usufruct?

Acquiring legal documents that adhere to federal and local laws is crucial, and the internet provides numerous alternatives to select from.

However, what’s the use of spending time searching for the appropriately drafted Usufruct Form With Beneficiaries template online when the US Legal Forms digital library has already gathered such documents in one location.

US Legal Forms is the premier online legal library featuring over 85,000 customizable templates created by lawyers for any business or personal need.

Review the template using the Preview feature or via the text outline to ensure it satisfies your needs. Search for another template using the search option at the top of the page if required. Click Buy Now once you’ve found the correct form and choose a subscription plan. Create an account or Log In and complete the payment using PayPal or a credit card. Select the appropriate format for your Usufruct Form With Beneficiaries and download it. All documents you find through US Legal Forms are reusable. To re-download and finalize previously saved forms, access the My documents section in your account. Enjoy the most comprehensive and user-friendly legal document service!

- They are easy to navigate with all files categorized by state and intended use.

- Our experts stay informed on legislative changes, ensuring your documentation is current and compliant when obtaining a Usufruct Form With Beneficiaries from our platform.

- Acquiring a Usufruct Form With Beneficiaries is swift and straightforward for both existing and new users.

- If you possess an account with an active subscription, sign in and save the document template you need in the appropriate format.

- If you are new to our site, follow the instructions below.

Form popularity

FAQ

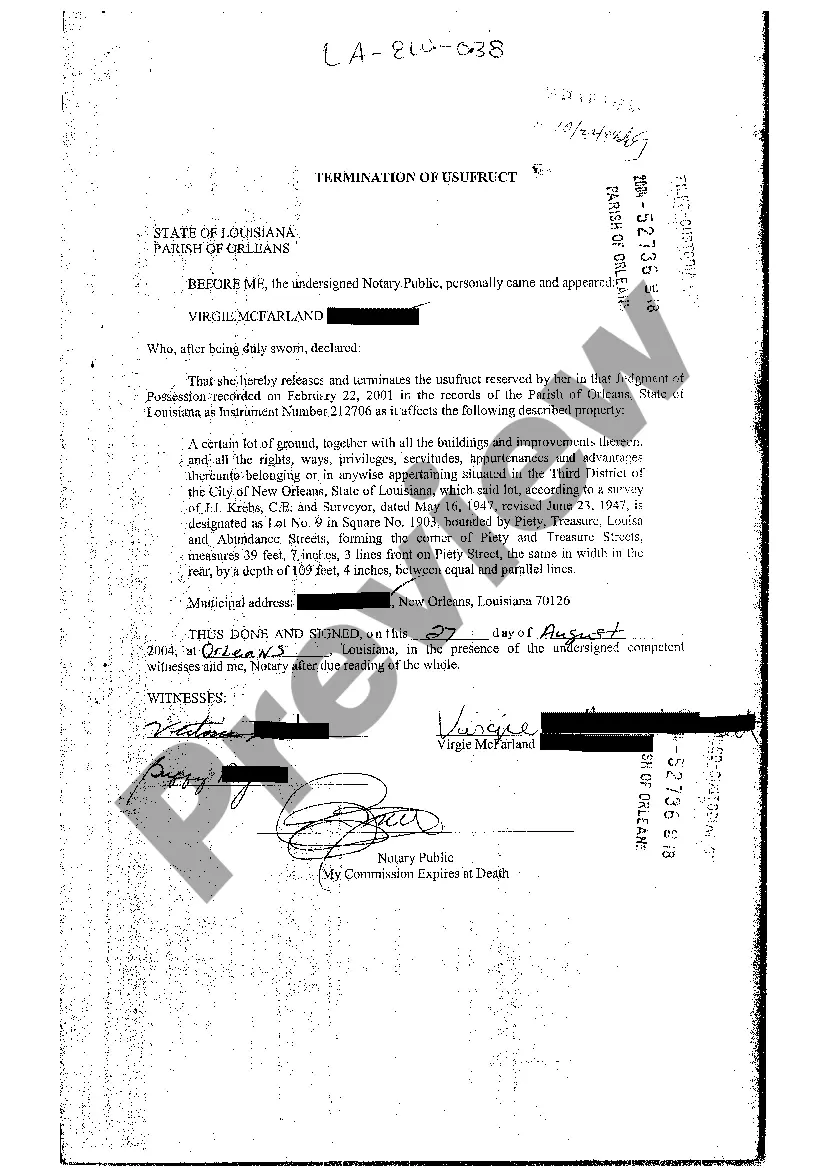

Usufruct right for real estate The conditional usufruct is chosen when the ownership of a property changes and the previous owner simultaneously receives the usufruct on a conditional basis. Once the transfer of the property is complete, the conditional usufruct becomes a fixed right of use.

While a usufruct allows extensive rights over the asset, it does not transfer the ownership of the asset itself to the usufructuary. While the usufructuary (the person who holds the usufruct right) can let the property, they are not allowed to sell it or bequeath it to another party.

A usufruct is established by law in favor of a surviving spouse when a community property spouse dies intes- tate, whereupon the decedent's children become the ?naked owners? subject to that usufruct. The granting of a usufruct is not constrained to the laws of intes- tacy, however.

U.S. Tax of a Usufruct It is similar to owning an asset as a secondary owner with no right to income. While it may be reportable (FBAR & FATCA), if there is no income attributed to the naked owner, then there is no tax. As to the Usufruct, they would be taxed.

The naked owners will become full owners at the end of the usufruct's term or upon the death of the usufructuary. The naked owners are to receive the property or its replacement value at the termination of the usufruct.