Louisiana Concerning Property Withholding Tax

Description

How to fill out Louisiana Packet Concerning Community Property?

Whether for business purposes or for personal affairs, everyone has to manage legal situations at some point in their life. Completing legal documents needs careful attention, starting with choosing the right form sample. For instance, when you choose a wrong edition of a Louisiana Concerning Property Withholding Tax, it will be declined once you submit it. It is therefore important to get a reliable source of legal files like US Legal Forms.

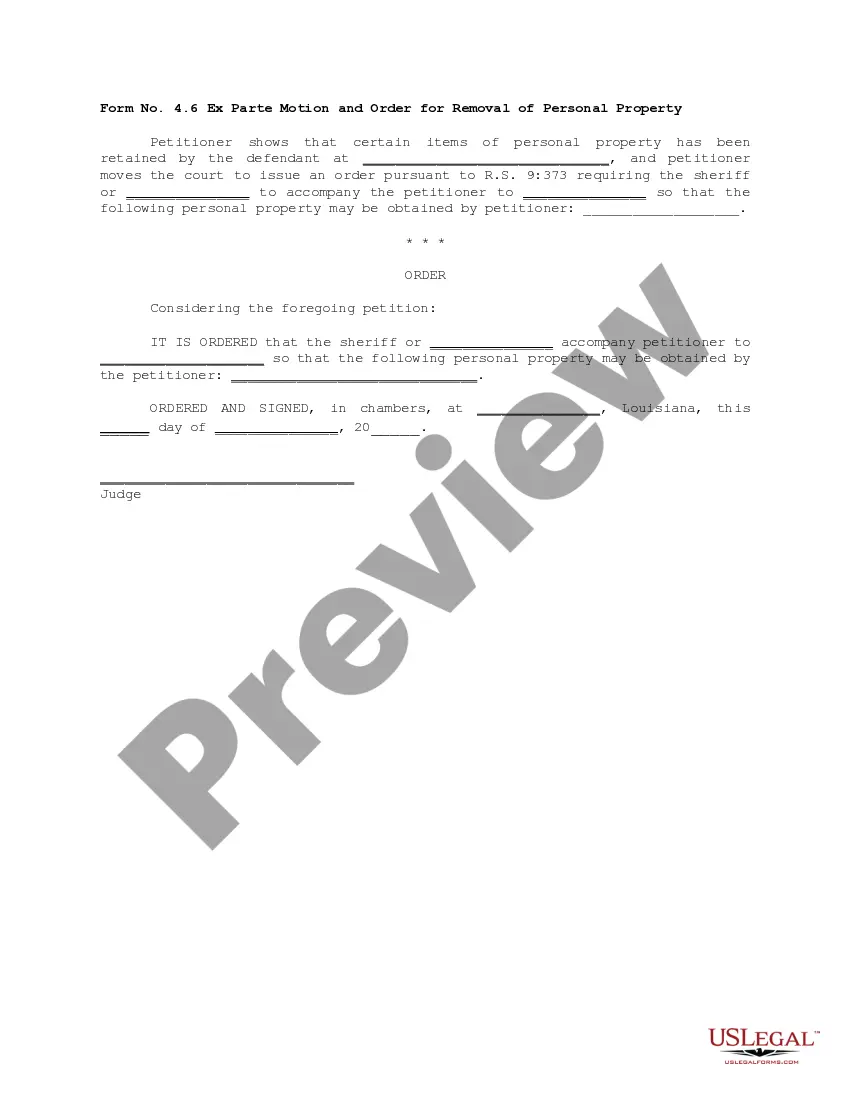

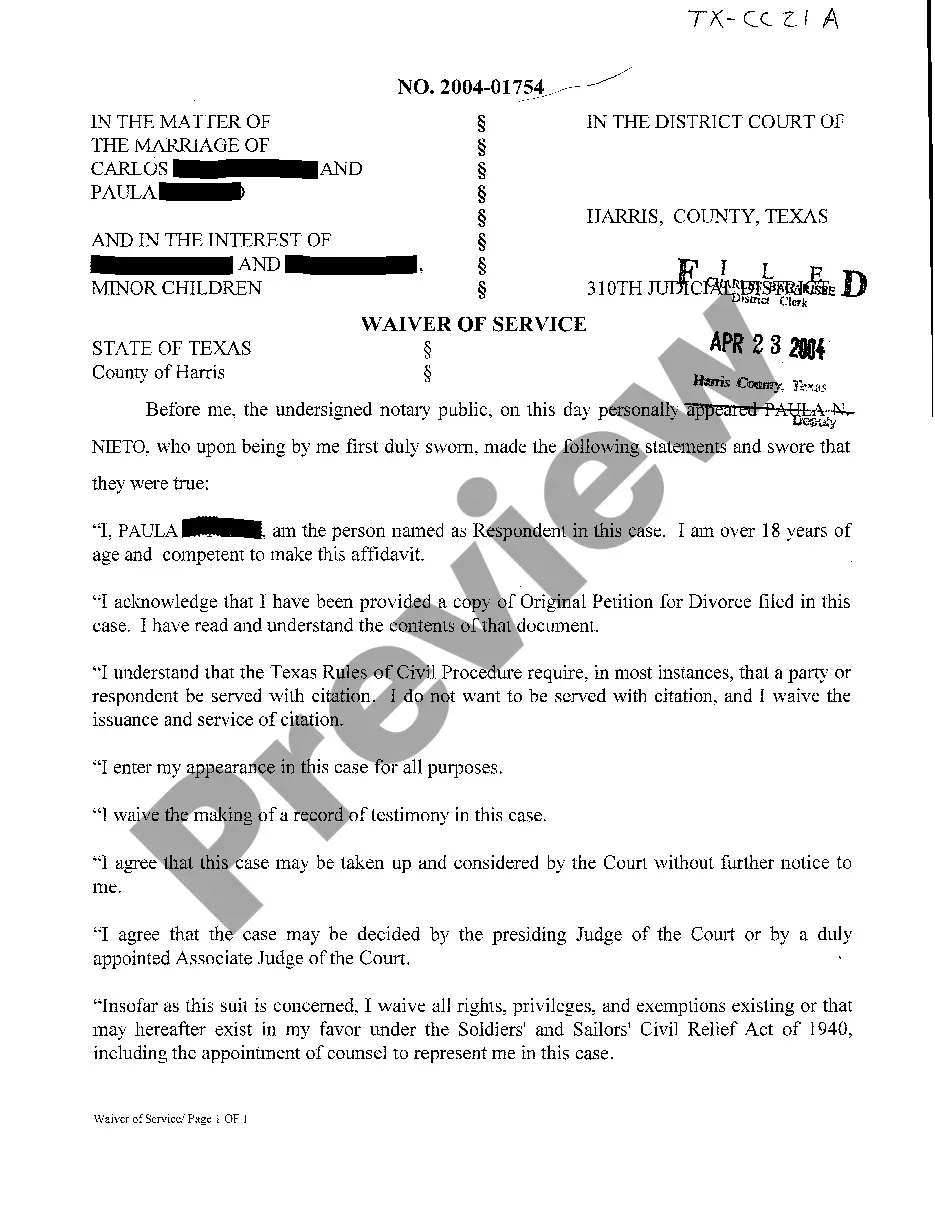

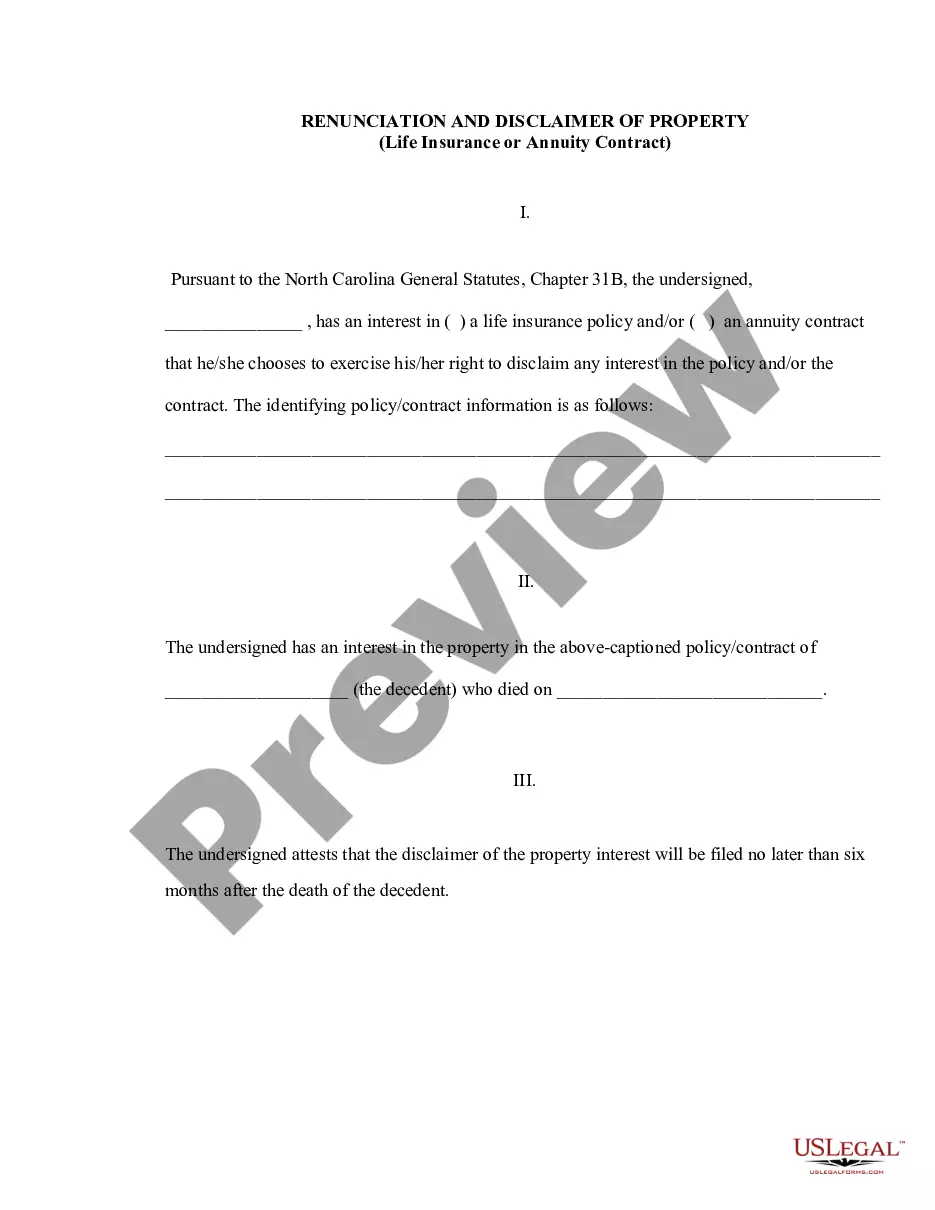

If you need to get a Louisiana Concerning Property Withholding Tax sample, follow these simple steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s description to ensure it matches your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, get back to the search function to locate the Louisiana Concerning Property Withholding Tax sample you require.

- Get the template if it meets your needs.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved documents in My Forms.

- In the event you do not have an account yet, you may download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Select the document format you want and download the Louisiana Concerning Property Withholding Tax.

- When it is downloaded, you are able to complete the form with the help of editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time looking for the right sample across the web. Make use of the library’s simple navigation to get the correct form for any occasion.

Form popularity

FAQ

Companies who pay employees in Louisiana must register with the LA Department of Revenue for a Revenue Account Number and the LA Workforce Commission for a State ID Number. Apply online at the DOR's Taxpayer Access Point portal to receive an Account Number immediately after registration or apply with this form.

If you are employed by more than one employer, you may claim the exemption from withholding with each employer, provided that the total of your anticipated income will not cause you to incur any liability for Louisiana income tax for the current year and you incurred no liability for Louisiana income tax for the ...

Employers are required to withhold income tax on all wages that are subject to Louisiana income tax as follows: Employers located in Louisiana?income tax must be withheld on all employee wages earned in Louisiana regardless of whether the employee is a resident or not.

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $12,5001.85%Over $12,500 but not over $50,000$231.25 plus 3.50% of excess over $12,500Over $50,000$1,543.75 plus 4.25% of excess over $50,000

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.