Spousal support, also commonly known as alimony or maintenance, refers to the financial assistance provided by one spouse to the other following a divorce or legal separation. The purpose of spousal support is to ensure that both parties can maintain a similar standard of living post-divorce and to address any imbalances that may arise due to factors such as income disparity or one spouse leaving the workforce to care for children or support the other spouse's career. There are various types of spousal support formulas used in different jurisdictions to calculate the amount and duration of support payments. These formulas consider several relevant factors, including: 1. Income disparity: The difference in earnings between the spouses is a crucial factor when calculating spousal support. The goal is to address any financial inequalities that may arise due to one spouse earning significantly more than the other. 2. Duration of the marriage or relationship: The length of the marriage is often taken into account. Longer marriages may result in longer-term or indefinite spousal support obligations, while shorter marriages may lead to temporary support payments. 3. Standard of living during the marriage: The lifestyle enjoyed by both spouses during the marriage is another factor. The aim is to enable the lower-earning spouse to maintain a similar standard of living after the divorce. 4. Custodial obligations: If one spouse has significant custodial responsibilities for children from the marriage, it can impact the calculation of spousal support. The formula may consider the additional financial burden associated with child-rearing. 5. Age and health of the spouses: The age and health of both spouses can also be influential factors. Older or less healthy spouses may require more financial assistance to meet their needs. 6. Education and employability: The education level and employability of the spouse requesting support are often considered. The formula may account for the time and resources required to enhance the earning potential of the requesting spouse through education or training. Depending on the jurisdiction, different spousal support formulas may be used, including: 1. Income-based formula: This formula takes into account the income of both spouses, often considering a specific percentage of the higher-earning spouse's income or a combination of both incomes. 2. Needs-based formula: This formula primarily focuses on the financial needs of the recipient spouse, considering factors such as housing costs, healthcare expenses, and other necessary expenditures. 3. Hybrid formula: Some jurisdictions utilize a combination of income-based and needs-based formulas to calculate spousal support. This approach aims to strike a balance between the financial capacity of the payer and the financial requirements of the recipient. It is essential to consult with a family lawyer familiar with the specific spousal support laws and formulas in your jurisdiction, as they can provide tailored advice and guidance based on your individual circumstances.

Spousal Support Formula

Description

How to fill out Spousal Support Formula?

Handling legal paperwork and procedures might be a time-consuming addition to your day. Spousal Support Formula and forms like it typically require that you search for them and navigate the way to complete them appropriately. For that reason, whether you are taking care of economic, legal, or individual matters, having a comprehensive and practical online catalogue of forms when you need it will significantly help.

US Legal Forms is the best online platform of legal templates, boasting more than 85,000 state-specific forms and numerous resources to assist you to complete your paperwork easily. Discover the catalogue of relevant papers accessible to you with just a single click.

US Legal Forms provides you with state- and county-specific forms offered at any moment for downloading. Shield your papers managing procedures with a top-notch service that lets you put together any form in minutes without extra or hidden fees. Just log in to the profile, identify Spousal Support Formula and acquire it right away in the My Forms tab. You can also access previously downloaded forms.

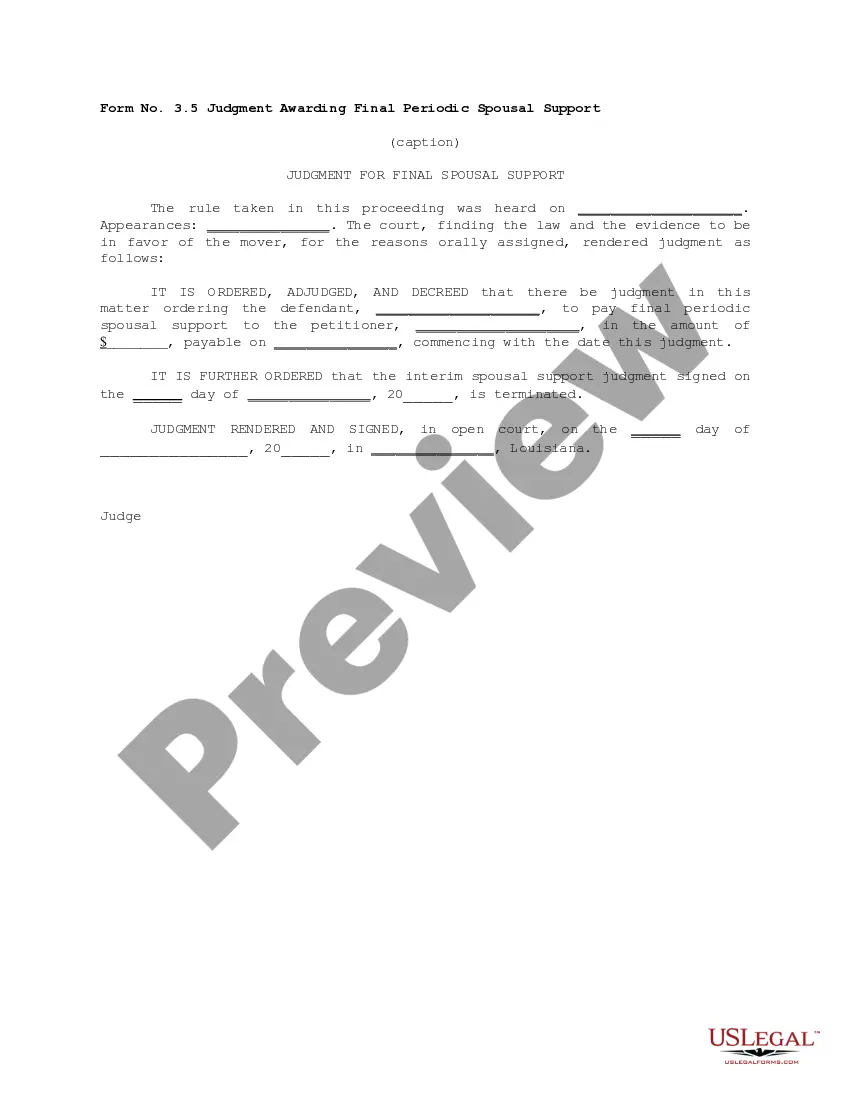

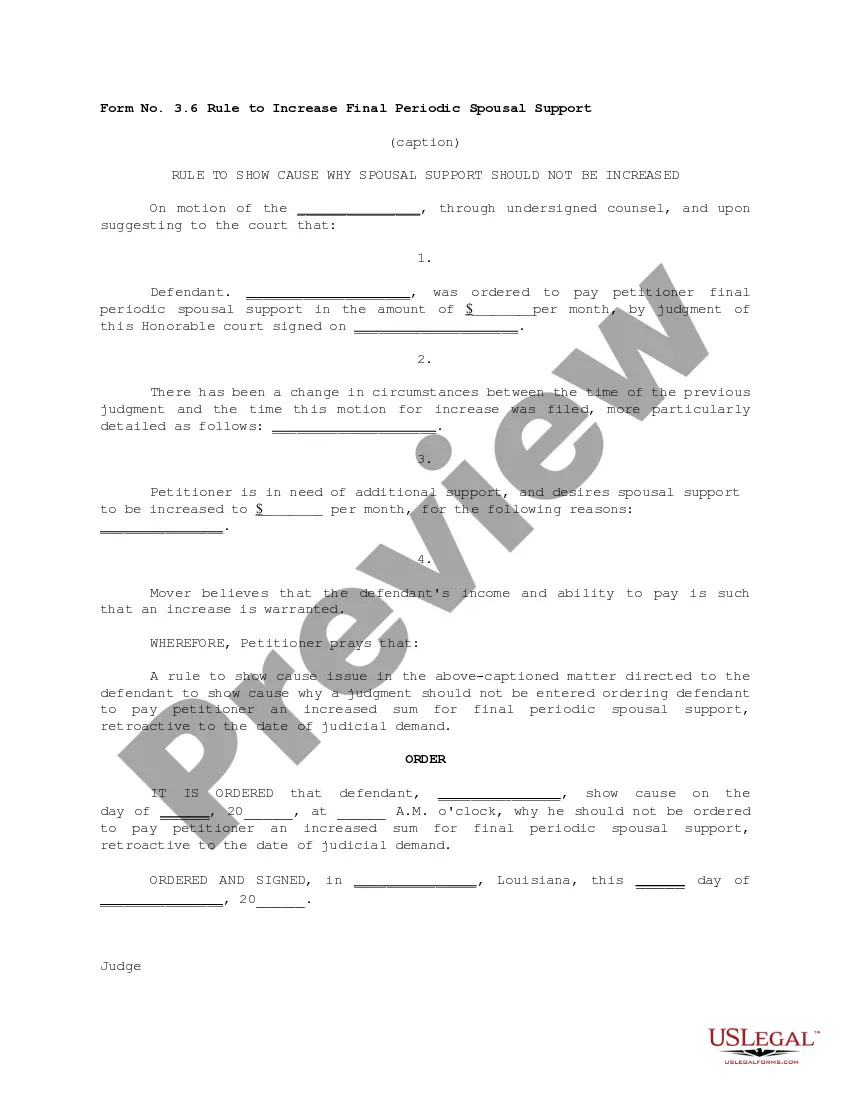

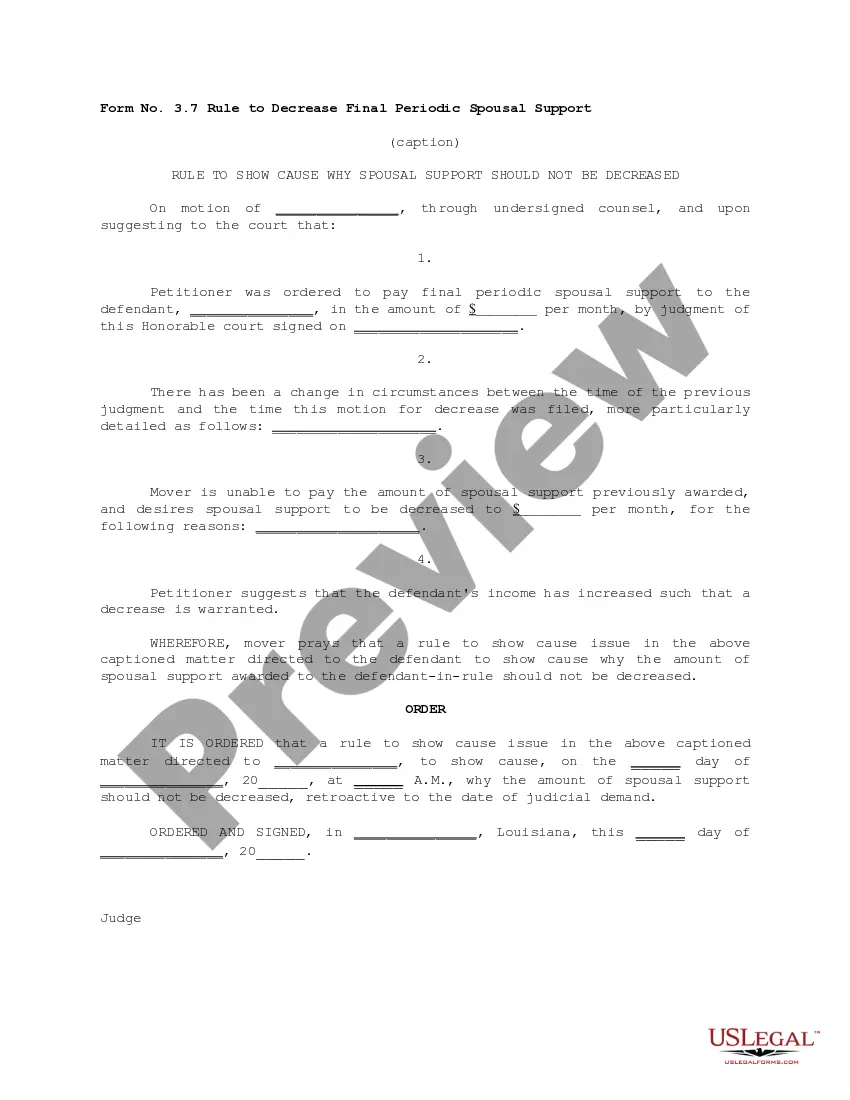

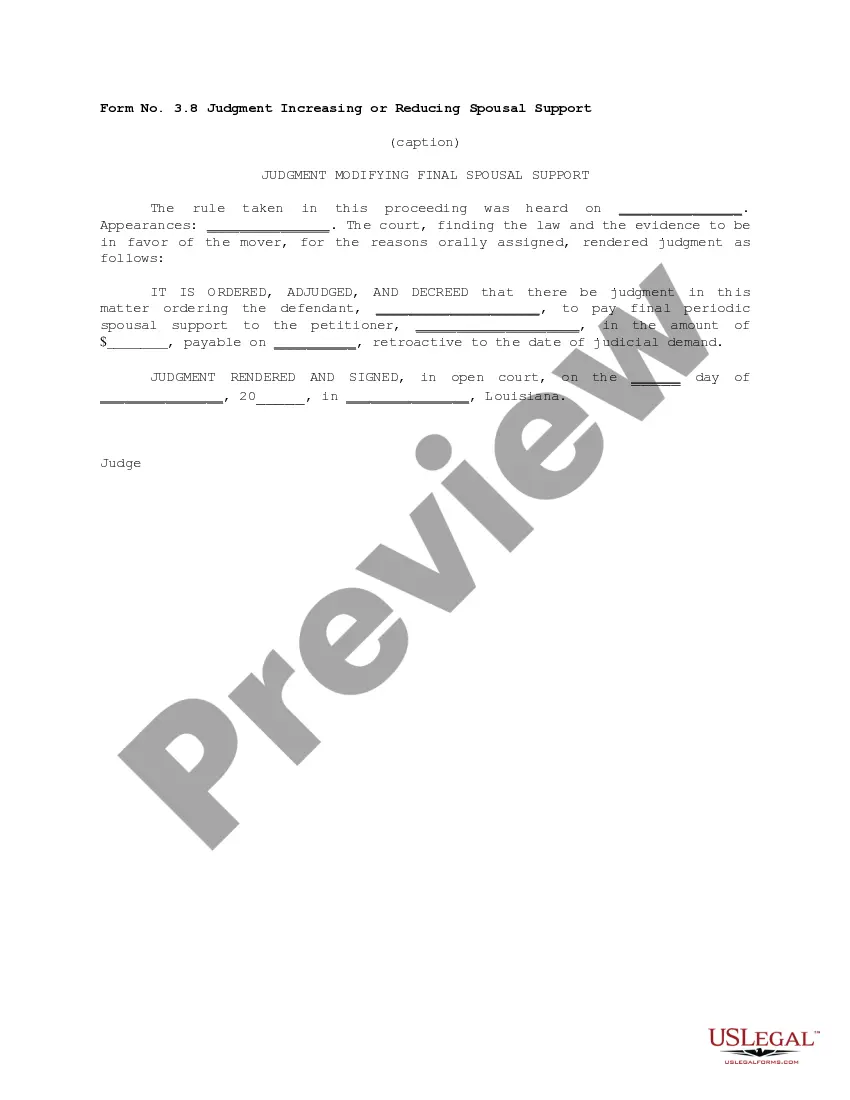

Would it be your first time making use of US Legal Forms? Sign up and set up up an account in a few minutes and you’ll have access to the form catalogue and Spousal Support Formula. Then, follow the steps below to complete your form:

- Be sure you have found the right form by using the Review option and looking at the form information.

- Choose Buy Now when ready, and select the monthly subscription plan that meets your needs.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise supporting consumers handle their legal paperwork. Discover the form you need right now and enhance any operation without breaking a sweat.

Form popularity

FAQ

Marriages lasting 0-15 years incur spousal support for 15%-30% of the length of the marriage. Marriages lasting 15-20 years incur spousal support for 30%-40% of the length of the marriage. Marriages lasting 20+ years incur spousal support for 35%-50% of the length of the marriage.

Formula to Calculate Present Value (PV) Present value, a concept based on time value of money, states that a sum of money today is worth much more than the same sum of money in the future and is calculated by dividing the future cash flow by one plus the discount rate raised to the number of periods.

As an example, the AAML alimony formula, which was created in an effort to standardize alimony calculation across different states, calculates 30% of the payor's gross income minus 20% of the payee's gross income.

The formula is simple: Divide the Wife's annual amount by the interest rate: $100,000 divided by . 10 = $1 million. The formula is known as the present value of a perpetuity because it continues in perpetuity.

How to write up a spousal support agreement Decide on amount and how it will be paid. How much one person will pay the other each month. ... Write-up your agreement. ... Sign and make copies of the agreement. ... Take your agreement to get judge's signature and pay fee. ... Get back signed agreement and give copy to your spouse.