Restitution Letter Sample With Payment Plan

Description

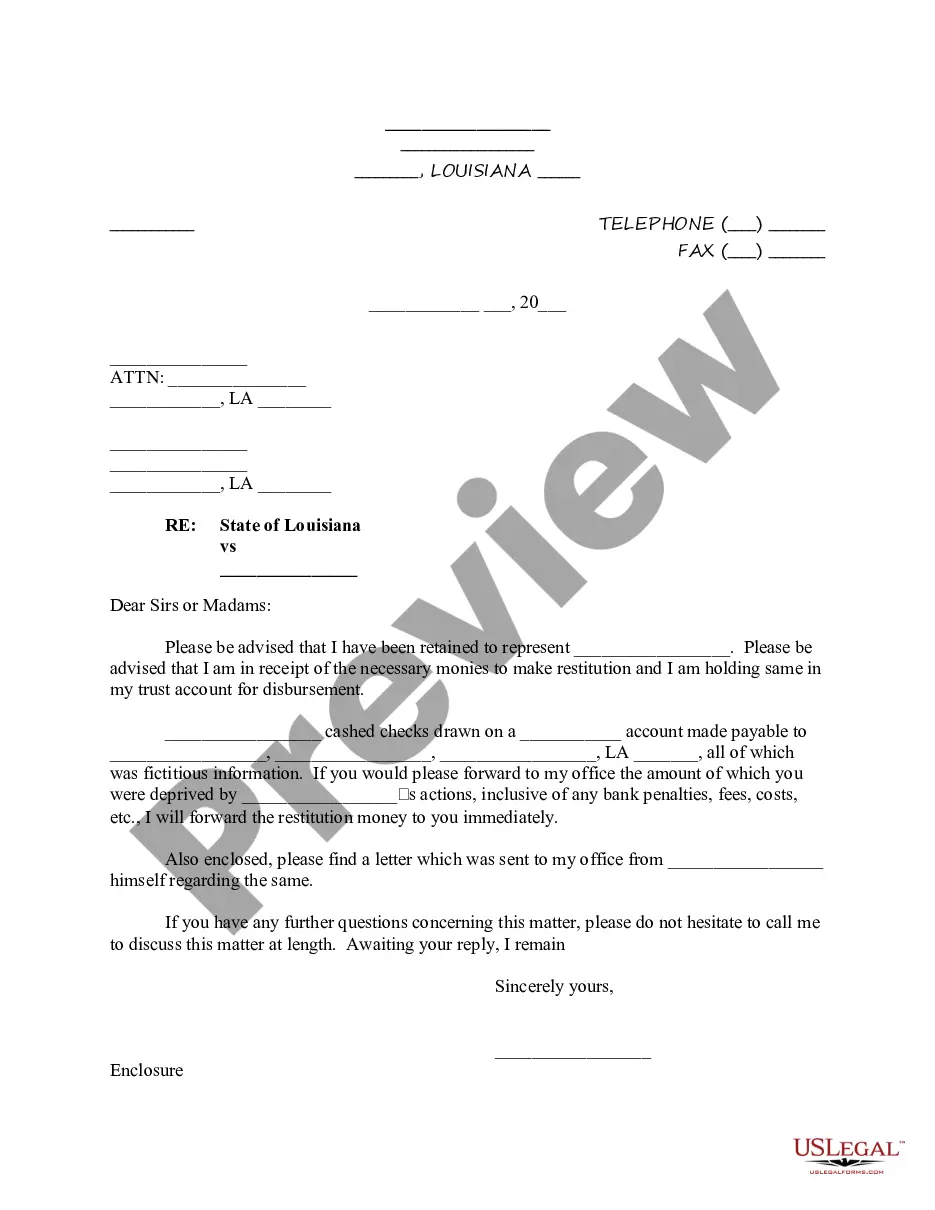

How to fill out Louisiana Follow-up Letter To Bank Regarding Restitution Offer In Bank Fraud Case?

Legal oversight can be daunting, even for the most seasoned experts.

When you seek a Restitution Letter Sample With Payment Plan but find little time to invest in finding the accurate and current version, the process can become anxiety-inducing.

Tap into a valuable collection of articles, guides, and resources pertinent to your situation and requirements.

Conserve time and energy searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Review feature to find the Restitution Letter Sample With Payment Plan and acquire it.

Experience the US Legal Forms online library, supported by 25 years of expertise and reliability. Transform your routine document management into a simple and seamless process today.

- If you hold a monthly subscription, Log In to your US Legal Forms account, look for the form, and obtain it.

- Visit the My documents section to access the documents you've saved previously and to organize your files as you prefer.

- If this is your initial experience with US Legal Forms, create a free account and gain unlimited access to all the platform's advantages.

- After acquiring the necessary form, confirm that it is the right one by previewing and reviewing its details.

- Ensure the sample is valid in your state or county.

- Click Buy Now when you are ready.

- Select a subscription option.

- Determine the file format you require, and Download, complete, sign, print, and send your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you might have, ranging from personal to corporate documentation, all in one location.

- Leverage advanced tools to create and manage your Restitution Letter Sample With Payment Plan.

Form popularity

FAQ

Form FTB 8453-FID, California e-file Return Authorization for Fiduciaries, is the signature document for fiduciary e-file returns.

Use this form to record when and why the return was not e-filed. Do not mail this form to the Franchise Tax Board (FTB). Please keep it for your records. For married/registered domestic partners (RDPs) filing jointly, only one spouse/RDP needs to sign.

Yes, a partnership, or other entity classified as a Subchapter K entity, is required to file a composite return and make composite payments on behalf of its nonresident owners or members if there are one or more nonresident owners or members at any time during the taxable year.

Corporations file this form to request that the IRS deposit a corporate income tax refund directly into an account at any U.S. bank or other financial institution that accepts direct deposits.

Credit Card Offers, Bank Statements, Canceled Checks, and More Documents Containing Financial Information. An identity thief could potentially use anything that comes from a financial institution. ... Documents Containing Personal Information. ... Documents Containing Account Information. ... Junk Mail. ... Child- and School-Related Mail.

Section 13A-8-192 - Identity theft (a) A person commits the crime of identity theft if, without the authorization, consent, or permission of the victim, and with the intent to defraud for his or her own benefit or the benefit of a third person, he or she does any of the following: (1) Obtains, records, or accesses ...

In Alabama, a person commits identity theft ing to Alabama Code Section § 13A-8-192 if he or she: Obtains, records or accesses identifying information that would assist in accessing financial resources, obtaining identification documents or obtaining benefits of the victim.

Form 8453 is a simple document that is used to include any additional paperwork needed for certain portions of your tax return that were e-Filed. In this case, you need additional documentation for your 8949, so the final box will be checked on 8453.