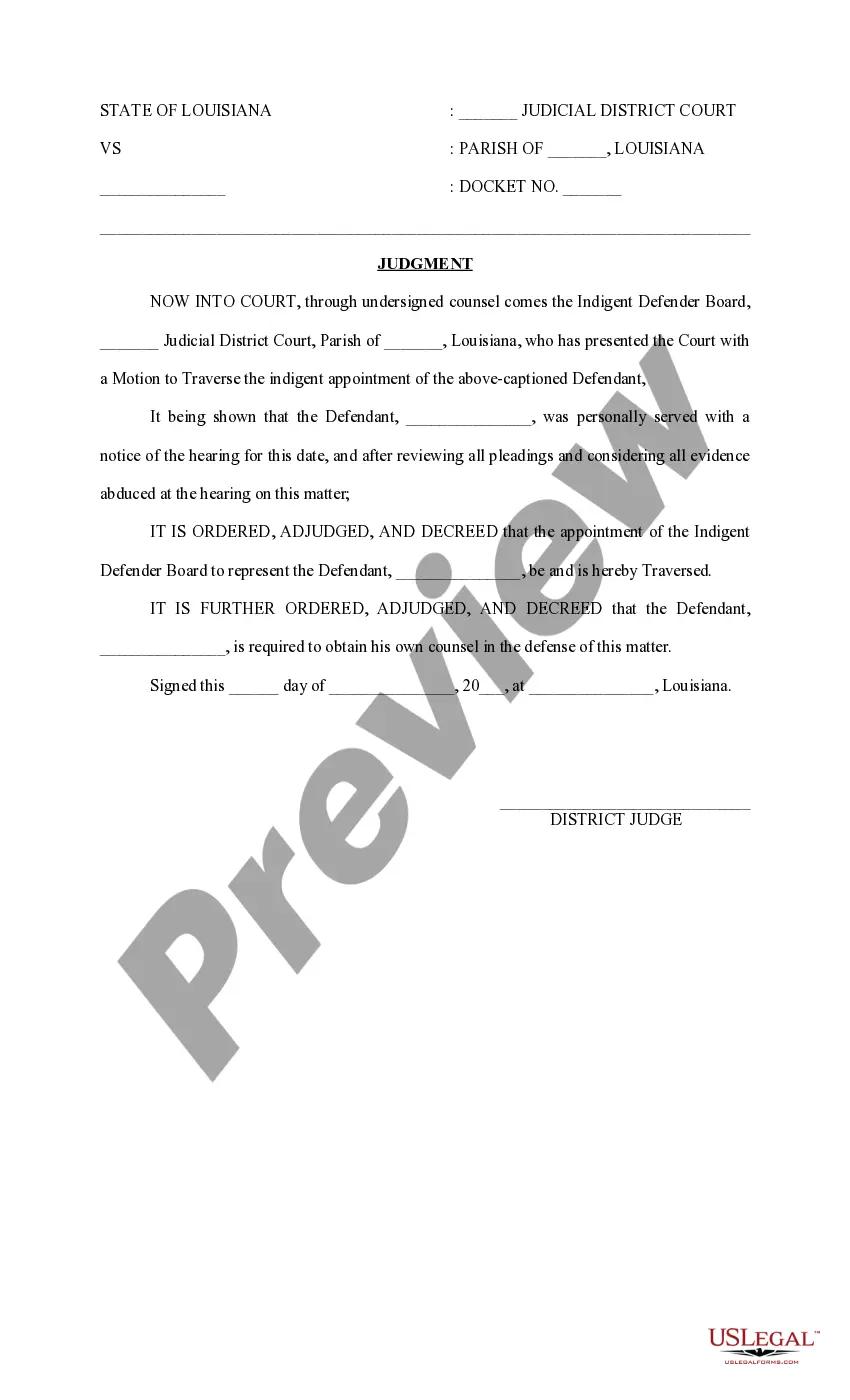

Motion To Traverse Force

Description

How to fill out Louisiana Judgment On Motion To Traverse?

Legal documentation management can be daunting, even for seasoned experts.

When you are looking for a Motion To Traverse Force and lack the time to invest in finding the suitable and current version, the process can become overwhelming.

Tap into a repository of articles, guides, and resources related to your circumstances and needs.

Save time and energy searching for the forms you require, and use US Legal Forms' advanced search and Preview feature to find Motion To Traverse Force and obtain it.

Utilize the US Legal Forms online catalog, backed by 25 years of expertise and reliability. Transform your daily document management into a seamless and user-friendly experience today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Check the My documents section to view the documents you have previously saved and manage your folders as needed.

- If it's your first experience with US Legal Forms, create an account and gain unlimited access to all platform features.

- Here are the steps to follow after securing the document you need.

- Confirm it is the correct document by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to all needs you might have, from personal to commercial paperwork, in one convenient location.

- Leverage cutting-edge tools to complete and manage your Motion To Traverse Force.

Form popularity

FAQ

Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note. If the bank fails to ?produce the note,? that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note.

No mortgage or deed having the effect of a mortgage or other lien shall constitute a lien upon any real estate after the lapse of twenty years from the date for the maturity of the lien.

So whoever is a borrower on the Note is personally liable for paying back the debt to the lender. The Note is not recorded in the Courthouse, so the original Note is returned to the lender upon closing.

If you misplaced your copy of the mortgage note, request another copy from your mortgage lender or servicer. Some lenders require you to make this request in writing. You could also try to retrieve a copy through your local recording office. When you get a new copy, store it in a secure place.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

A mortgage note?also known as a promissory note or even a mortgage promissory note?is a legal document that binds you to repay your mortgage within an agreed period. The note also outlines the terms of your lending agreement with your mortgage provider.

You'll receive a copy of the mortgage note when you close on your loan. If you misplace this copy, contact your mortgage lender or servicer and ask for a replacement. You can also find a copy of the mortgage note at your local Recorder of Deeds office.

Your mortgage lender holds the mortgage note until you fully pay off your loan. Once you do that, your lender will send the note to you, along with a notation that your note is paid in full.