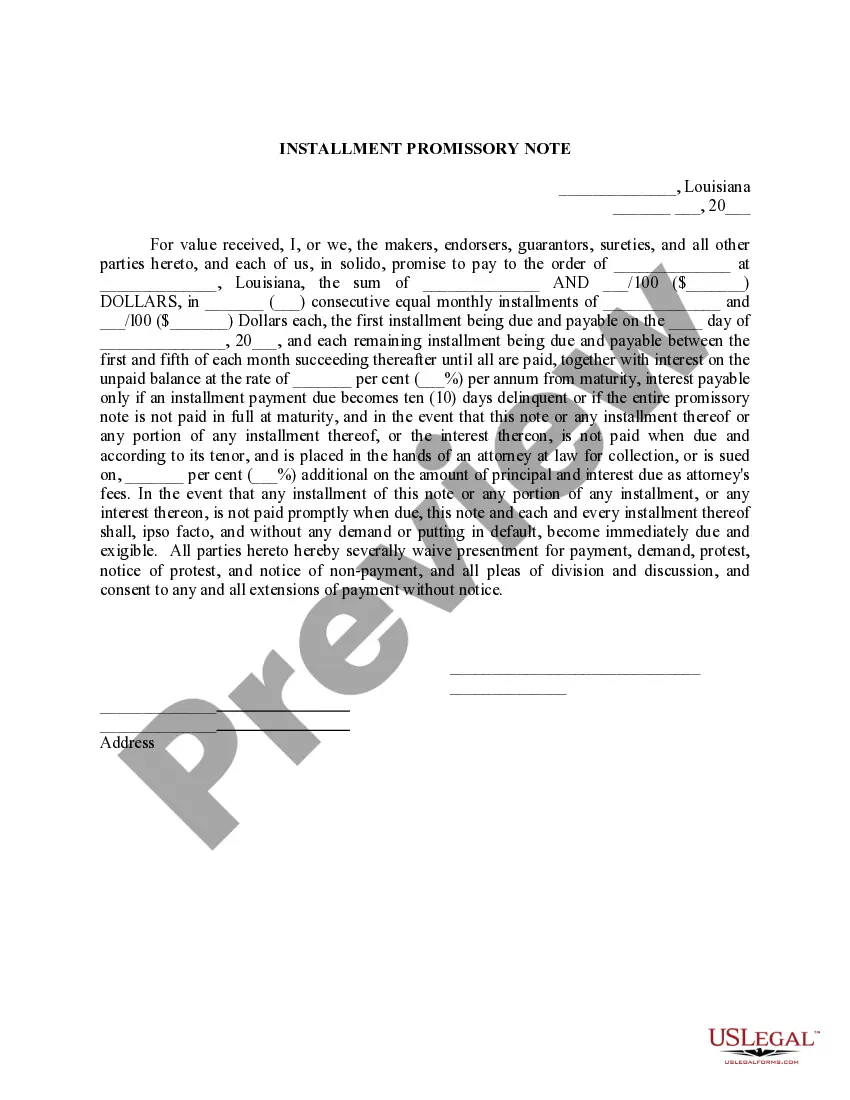

Installment Promissory Note With Balloon Payment

Description

How to fill out Louisiana Installment Promissory Note With Interest Accruing?

When you have to finish the Installment Promissory Note With Balloon Payment in accordance with the regulations of your local state, there may be numerous options available to choose from.

If you are a subscriber to US Legal Forms, there is no need to examine every form to ensure it meets all legal requirements. It is a reliable resource that can assist you in obtaining a reusable and current template on any topic.

US Legal Forms is the most extensive online repository featuring an archive of over 85k ready-to-use documents for personal and business legal matters.

Acquiring properly drafted official documents is simplified with US Legal Forms. Additionally, Premium users can leverage powerful built-in tools for online PDF editing and signing. Try it out today!

- All templates are confirmed to adhere to the regulations of each state.

- Therefore, when you download the Installment Promissory Note With Balloon Payment from our site, you can be assured that you will have a valid and up-to-date document.

- Retrieving the necessary template from our platform is exceptionally straightforward.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents section in your profile and retrieve the Installment Promissory Note With Balloon Payment at any time.

- If this is your first experience with our library, please follow the guidelines below.

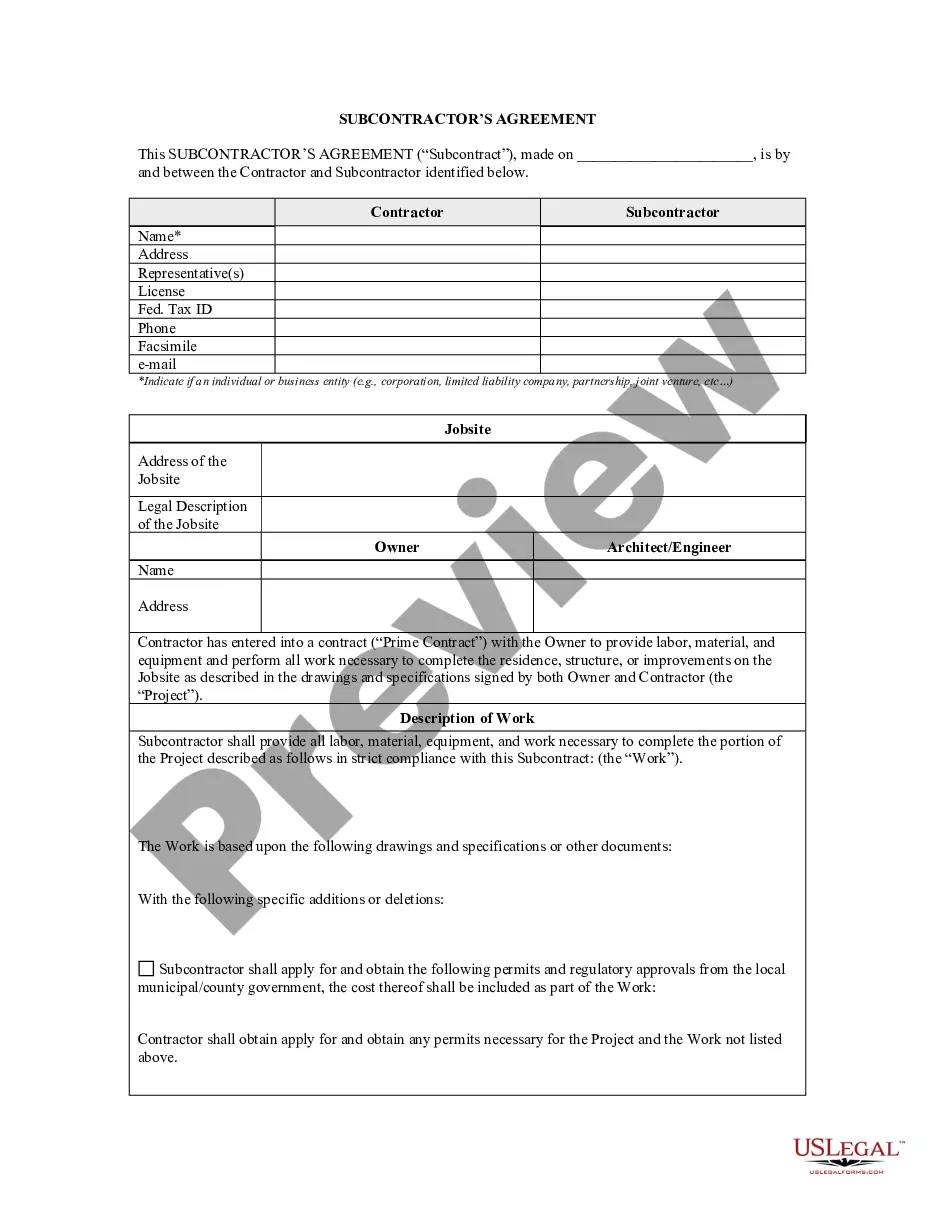

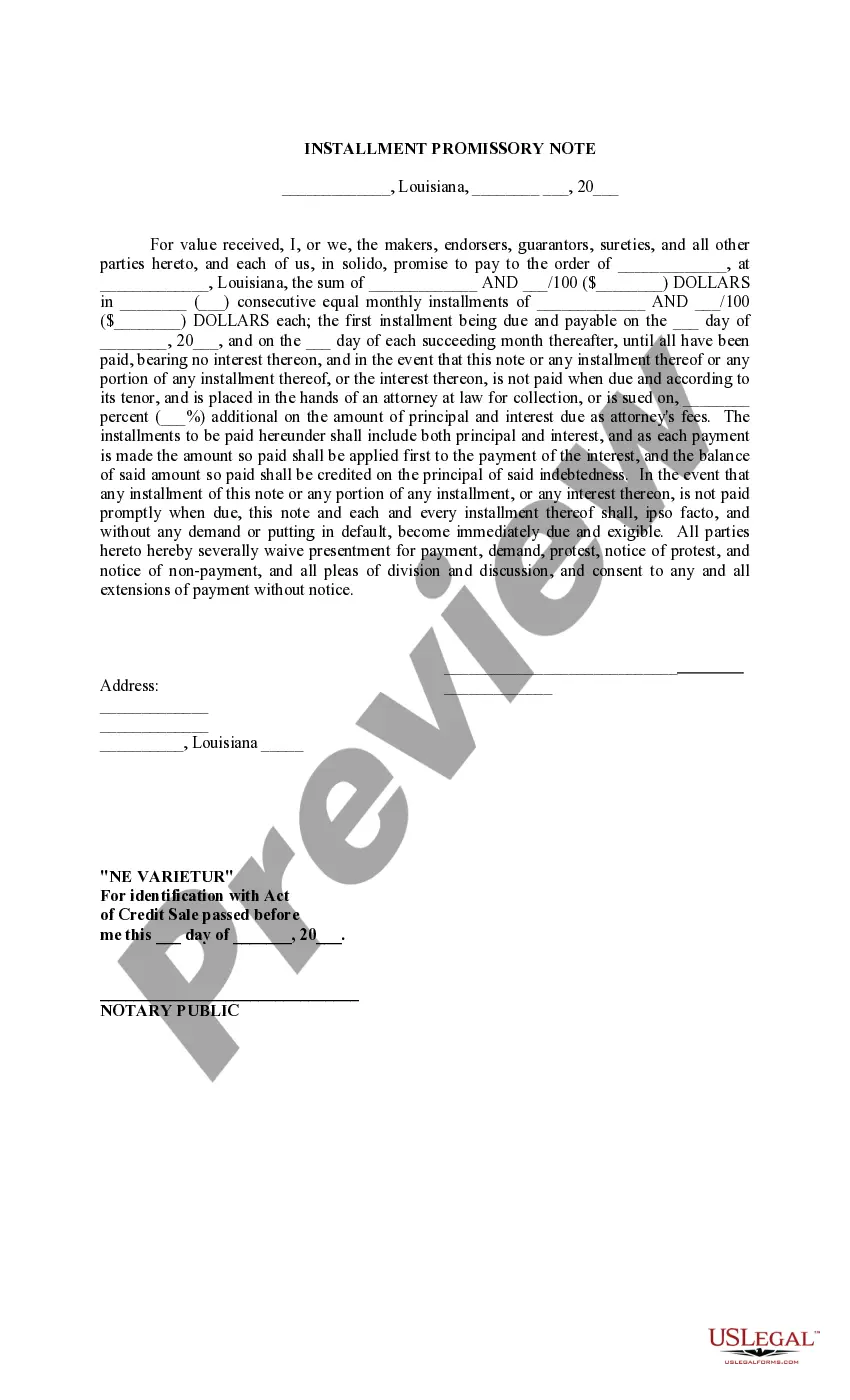

- Browse the suggested page and verify it meets your standards.

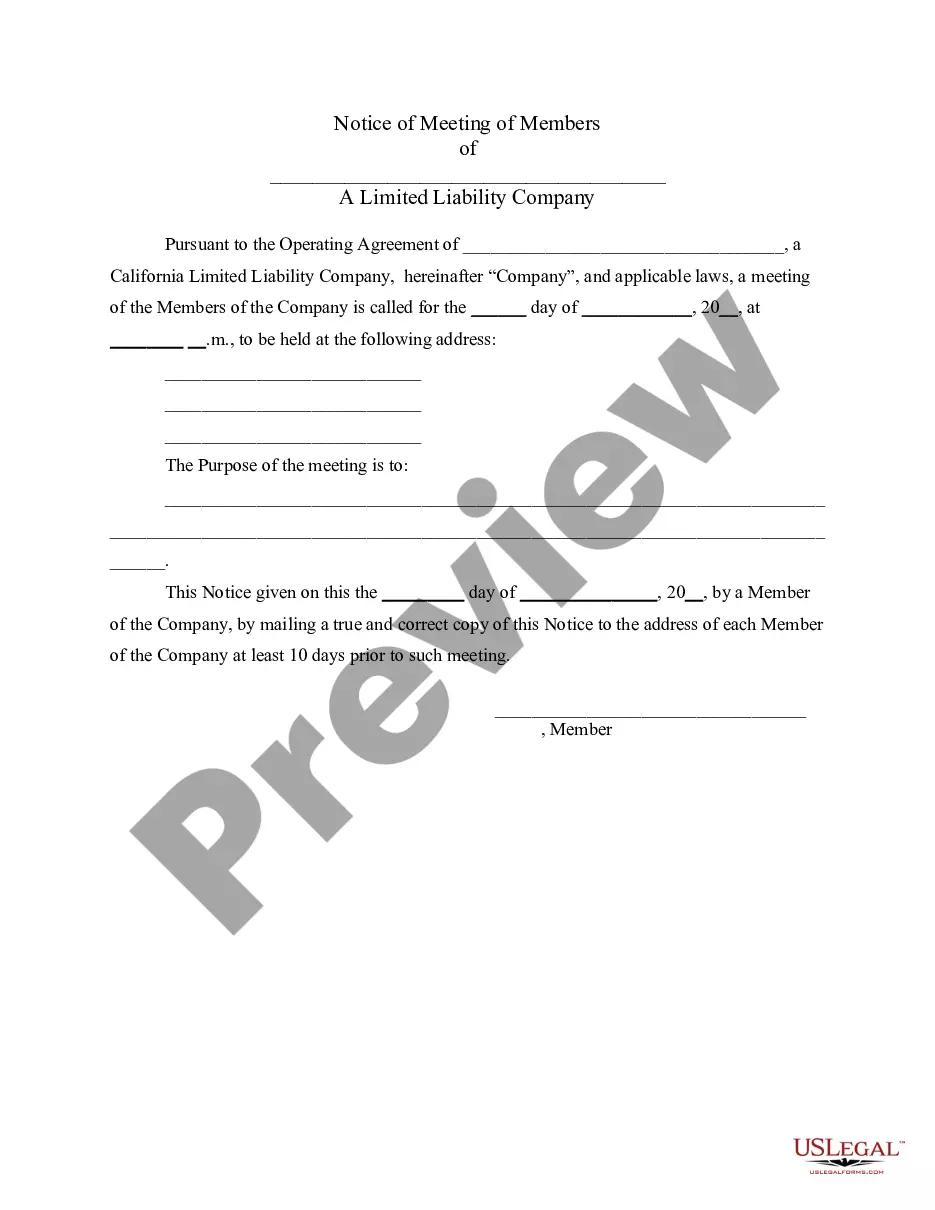

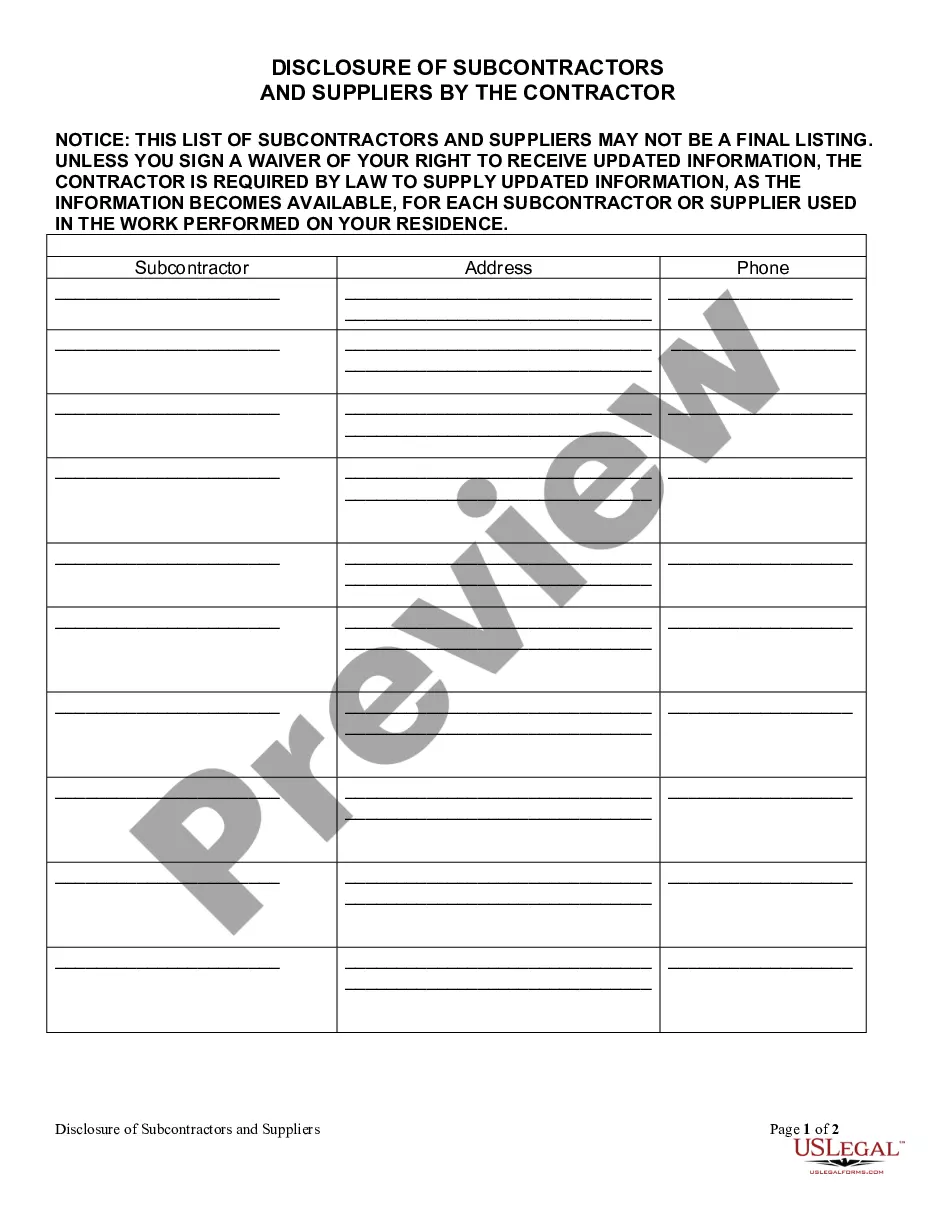

- Utilize the Preview mode and review the form description if available.

Form popularity

FAQ

Balloon payments are often packaged into two-step mortgages. In a "balloon payment mortgage," the borrower pays a set interest rate for a certain number of years. Then, the loan then resets and the balloon payment rolls into a new or continuing amortized mortgage at the prevailing market rates at the end of that term.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan.

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.

A balloon payment allows a buyer to take an amount owing on the purchase price of a car and set it aside, meaning the monthly instalment amounts are calculated on a lower value in turn making repayments more affordable. You're essentially paying off a loan for most of the car, but not all of it.