Traduzir Hardship

Description

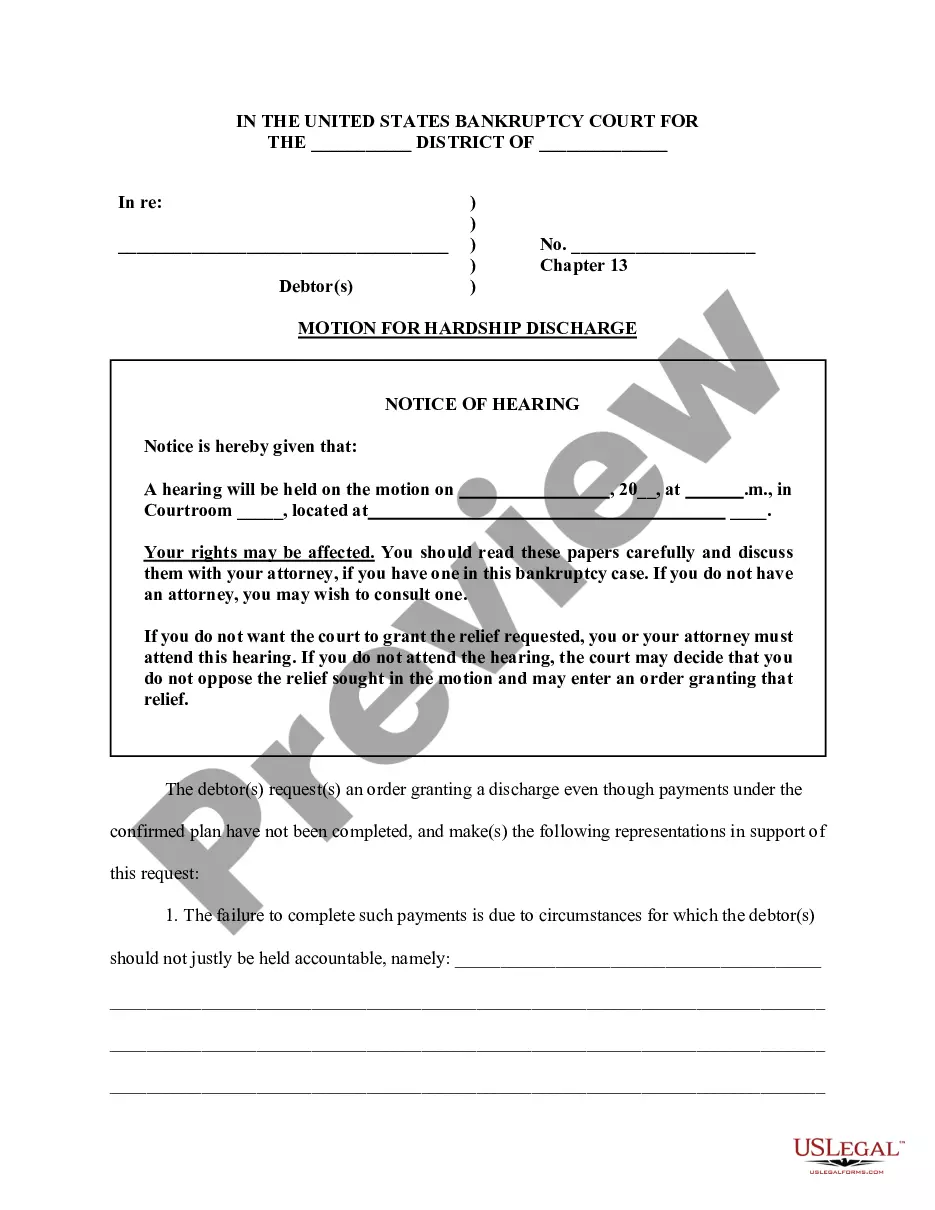

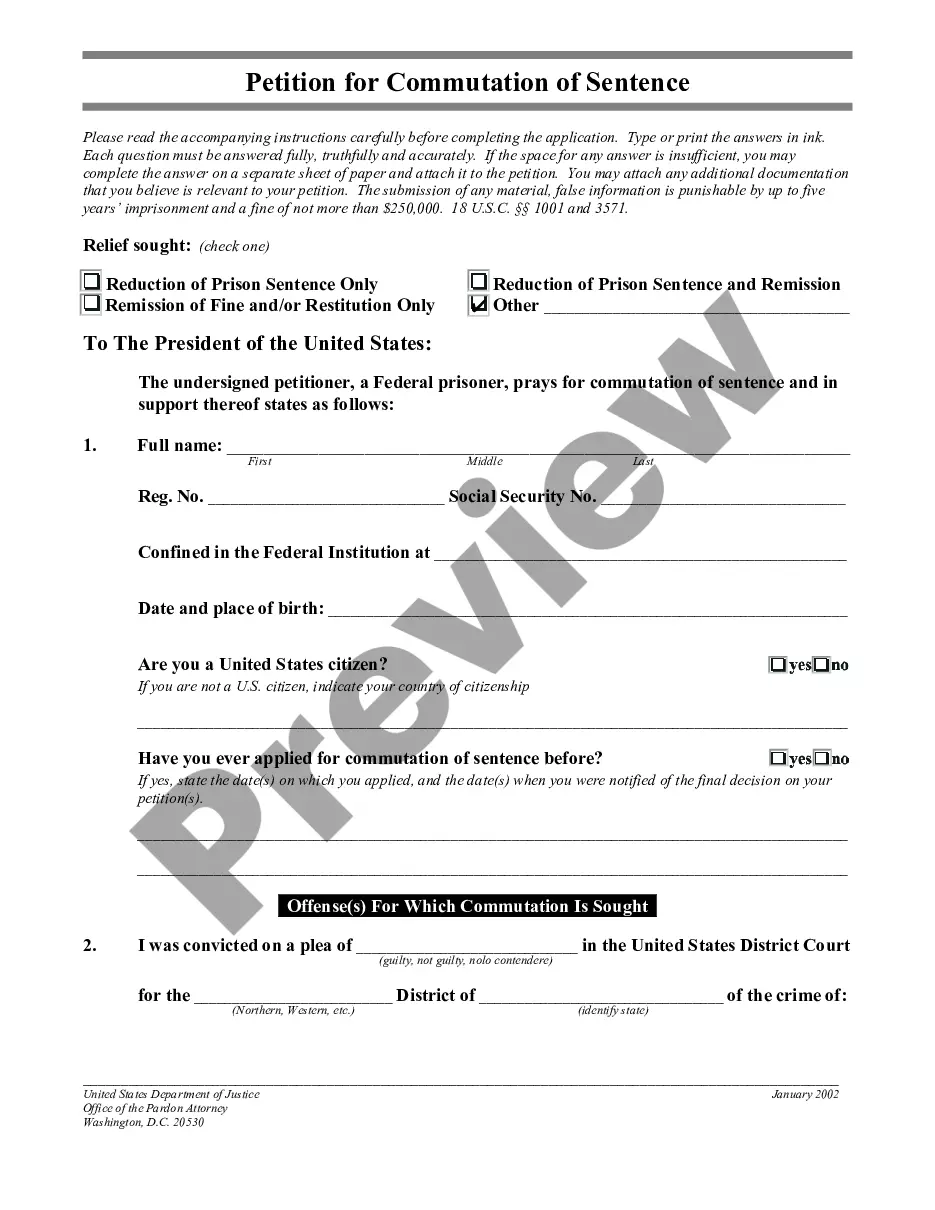

How to fill out Louisiana Petition For Hardship License?

- If you're a returning user, log in to your account and locate the desired document in your profile. Ensure your subscription is active; if not, renew it based on your chosen payment plan.

- For first-time users, begin by exploring the form collection. Review the form preview and description to confirm it aligns with your needs and jurisdiction.

- If necessary, use the Search tab to find alternative templates. Identify the right document that meets all your requirements and move on.

- Proceed to purchase the selected document by clicking on the Buy Now button. Choose a subscription plan that suits your needs, and create an account for access to the full library.

- Complete your transaction by entering your payment information using a credit card or PayPal.

- Once the purchase is confirmed, download your chosen form to your device. You can also access downloaded documents later in the My Forms section of your profile.

With US Legal Forms, you enjoy not only a robust selection of legal templates but also the added benefit of premium expert support, ensuring that your documents are accurate and legally compliant.

Start your journey today and experience the ease of obtaining legal documents with US Legal Forms. Don’t wait—get started now!

Form popularity

FAQ

When explaining your financial hardship, be straightforward and honest about your situation. Clearly outline what has led to your difficulties, such as a job loss or significant medical bills. Emphasize your willingness to work on a solution and include any steps you've taken to improve your financial circumstances. Tools provided by US Legal Forms can assist you in laying out your financial explanation effectively.

To show proof of hardship, compile relevant documentation that accurately portrays your financial struggles. This may include a hardship letter, income statements, and records of outstanding debts or essential living expenses. Organizing this information can help convey your situation effectively to creditors or lenders. For additional resources and templates, US Legal Forms can be your go-to platform.

To fill out a hardship letter effectively, start by clearly stating your current financial situation. Include details about your income, expenses, and any significant changes that have impacted your finances. It is also important to express how these challenges affect your ability to meet your financial obligations. Consider using US Legal Forms to obtain templates that guide you in crafting a comprehensive hardship letter.

IRS hardship generally does not directly impact your credit score, but it can have indirect consequences. For example, if you fall behind on tax payments, it could lead to liens or increased debt, potentially affecting your credit profile. Addressing your IRS hardship promptly can help mitigate any negative effects on your financial health.

The hardship program for taxes is designed to assist taxpayers facing significant financial difficulty, allowing them to negotiate reduced payments or tax relief. The IRS offers various options under this program, including installment agreements and currently not collectible status. Engaging with a service like USLegalForms can streamline your application process and ensure you understand your options.

The tax extension for hardship allows taxpayers experiencing significant financial challenges additional time to file their tax returns without incurring penalties. You must submit a request for this extension, citing your hardship. This relief can provide much-needed time to gather your documents and ensure your tax return is accurate.

The tax on a hardship withdrawal depends on your specific situation, including your age and the type of plan from which you are withdrawing funds. Typically, if you're under the age of 59½, you may incur an additional 10% early withdrawal penalty on top of ordinary income taxes. Always consider consulting with a tax professional to understand the implications of your hardship withdrawal.

A hardship extension request is a formal plea to the IRS asking for more time to file your taxes due to unforeseen financial challenges. This process allows taxpayers who are facing significant difficulties to avoid penalties for late filing. When submitting your request, ensure you include all relevant documentation to support your claim of hardship.

To file for hardship for taxes, begin by filling out the Form 433-F, also known as the Collection Information Statement. This form details your financial situation, including income, expenses, and assets. Submit the completed form to the IRS along with your application for tax relief, emphasizing your hardship situation to improve your chances of approval.

Hardship generally encompasses any event or condition that imposes unusual difficulty on an individual or family. This includes, but is not limited to, financial strains, health complications, and social or family issues. To translate these hardships into manageable steps, consider seeking guidance to understand your rights and options. At US Legal Forms, you can find guidance that can help you through these challenging times.