Using Deed As Collateral

Description

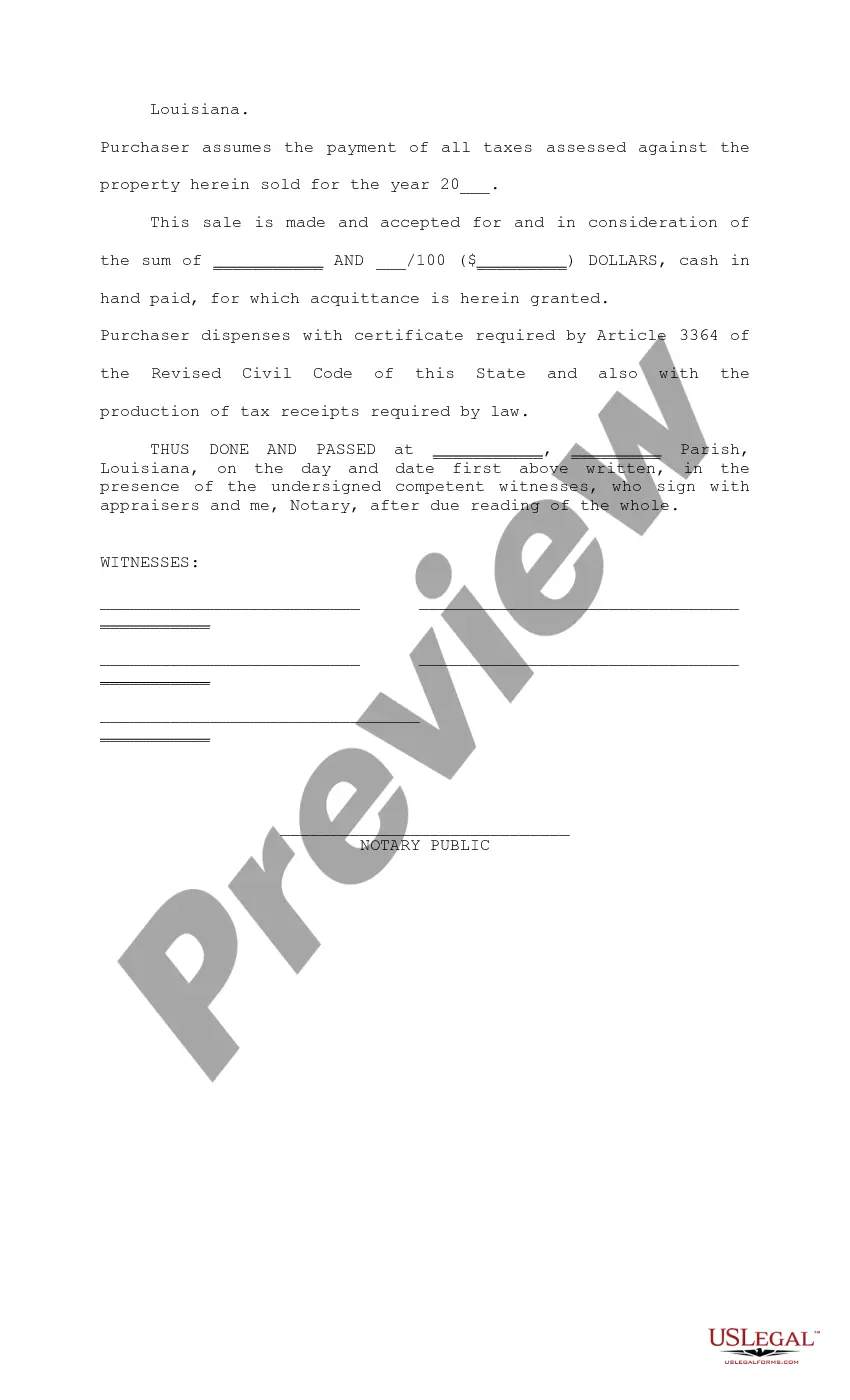

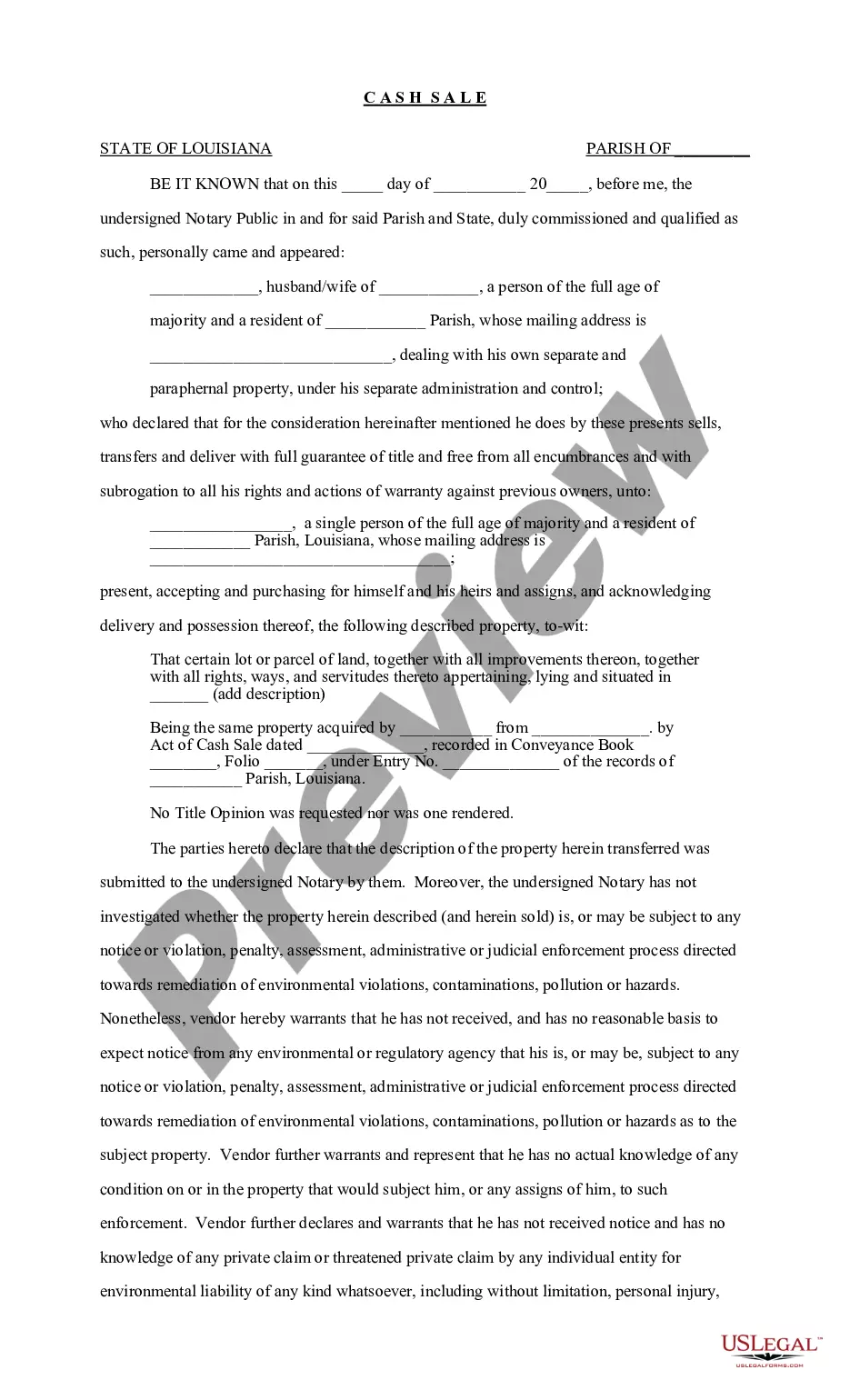

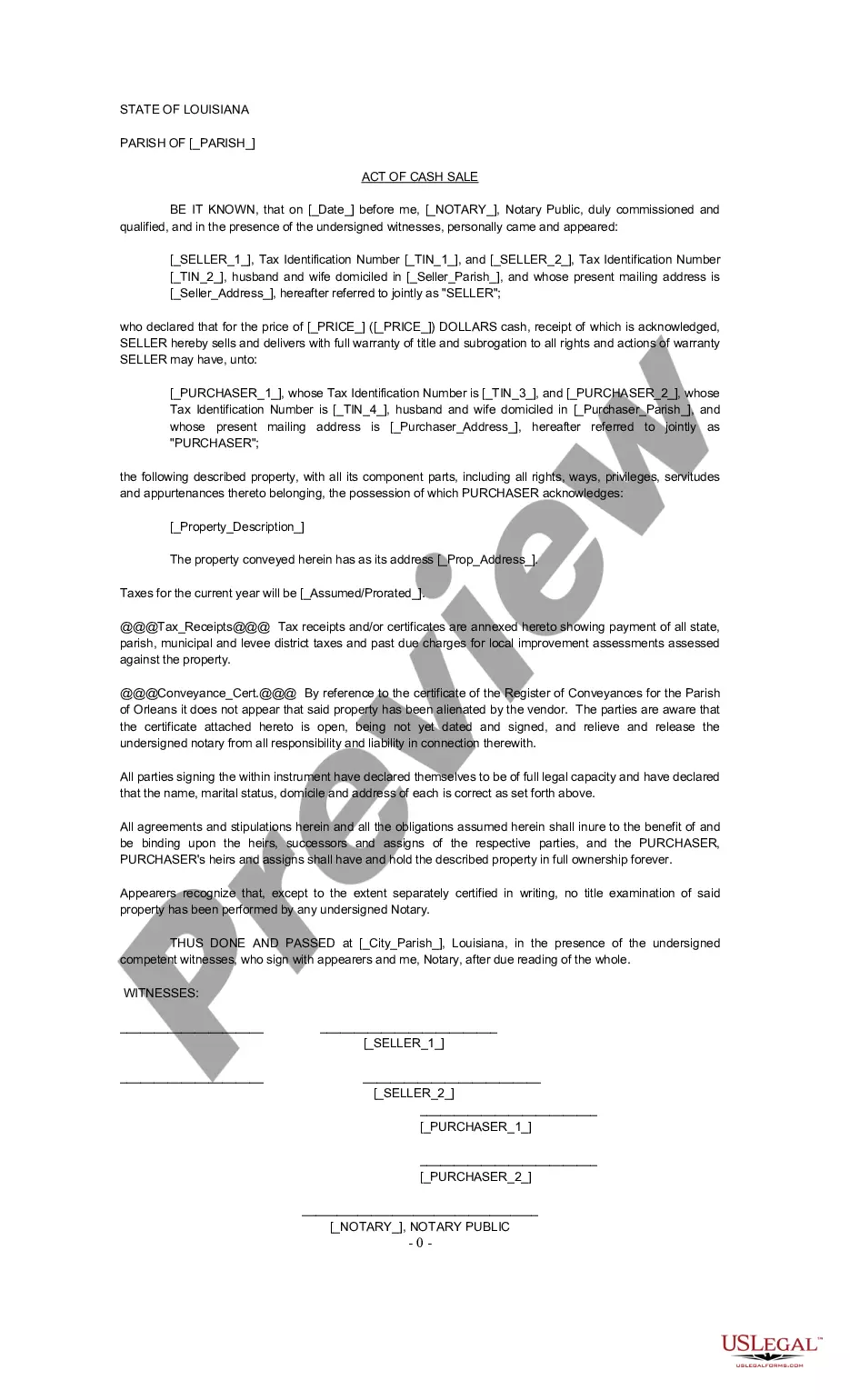

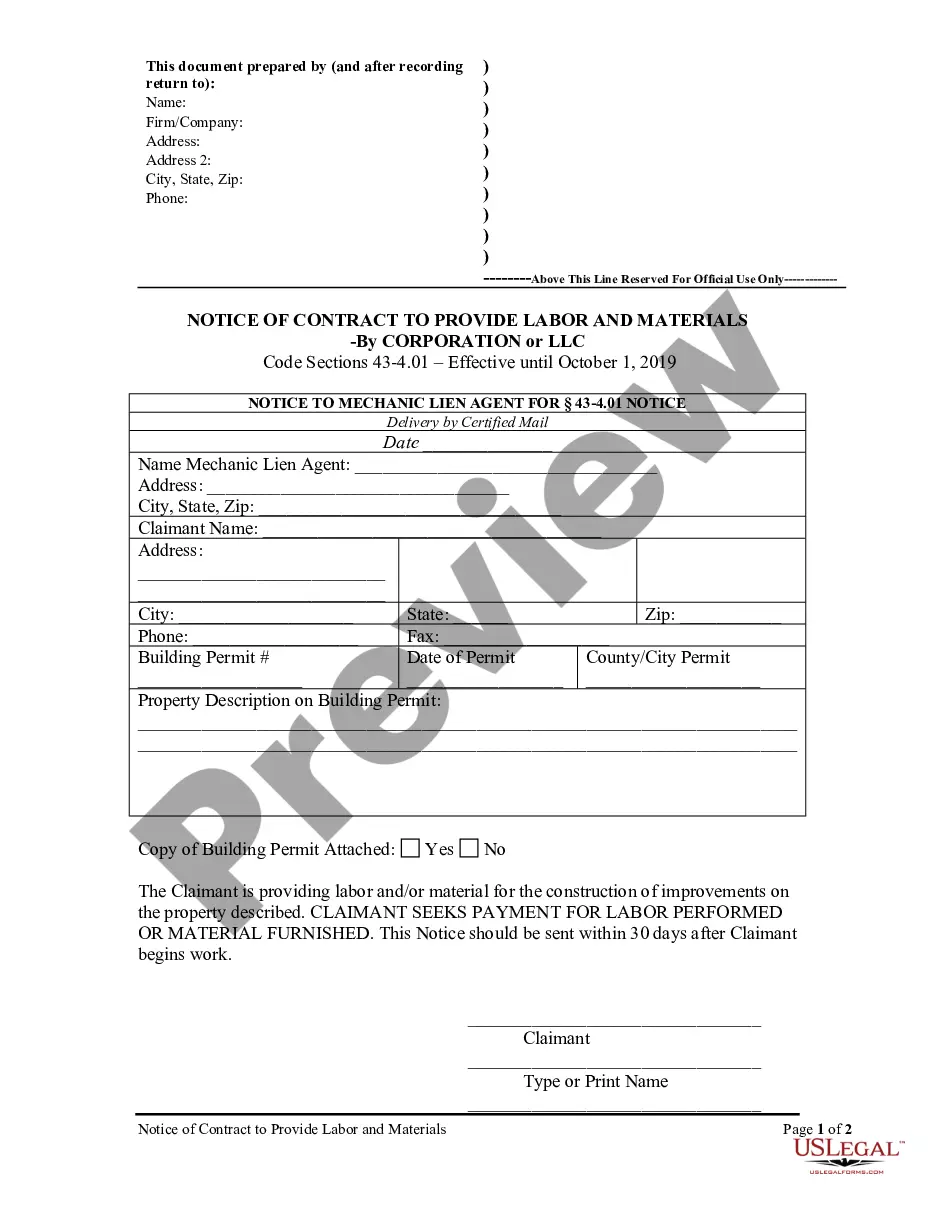

How to fill out Louisiana Cash Sale?

Legal management can be perplexing, even for seasoned professionals.

When you seek a Using Deed As Collateral and lack the time to thoroughly explore for the appropriate and current version, the procedures can be overwhelming.

With US Legal Forms, you have the capability to.

Access a valuable collection of articles, tutorials, guides, and materials pertinent to your requirements and needs.

Validate that this is the correct form by previewing it and reviewing its description.

- Conserve time and energy in locating the documents you need, and leverage US Legal Forms' sophisticated search and Preview feature to identify and download Using Deed As Collateral.

- If you hold a membership, Log In to your US Legal Forms account, locate the form, and download it.

- Check your My documents section to review the documents you've previously saved and manage your folders as desired.

- If you are a first-time user of US Legal Forms, create a free account for unlimited access to all the benefits of the library.

- After obtaining the form you require, follow these steps.

- A robust online form library could revolutionize the way everyone handles these scenarios.

- US Legal Forms stands as a frontrunner in the realm of online legal forms, offering over 85,000 state-specific legal documents available at all times.

- Utilize advanced resources to finalize and manage your Using Deed As Collateral.

Form popularity

FAQ

Using deed as collateral can be a strategic choice, but it comes with risks. By putting your house on the line, you can secure loans with potentially lower interest rates. However, if you fail to repay, you risk losing your property. It's essential to weigh the benefits against the consequences and consider your financial situation carefully.

When considering using deed as collateral, not all assets qualify. Generally, items like personal property, unsecured debts, or intangible assets cannot be accepted. Lenders prefer solid, tangible assets with clear ownership and value, so understanding these limitations is crucial. Always check with your lender to clarify collateral requirements.

Any asset can potentially be used as collateral for a personal loan, including real estate, vehicles, savings accounts, investments, and valuables. However, it's important to have enough equity in your assets to justify using them as collateral.

Many lenders will allow land ? either owned or received as a gift ? to be used as collateral instead of a cash down payment when obtaining financing to purchase a new home.

How a down payment differs from a collateral. We now know that down payments are upfront payments that represent a certain percentage of your mortgage. For banks and lenders, collateral, on the other hand, refers to an asset by the borrower that is pawned to secure credit finance.

To use the land as collateral, the land must have an equity value that is equal to or exceeds that of the loan amount. You must own it outright unless it is specifically a land loan. Once a lender approves the land as collateral, a lien will be put on the land.

Securing a loan with a high-value asset as collateral can act as a substitute for a down payment in some cases. This is because the collateral signals to the lender that you are less risky, similar to having a high credit score.