Do You File Articles Of Incorporation For An Llc

Description

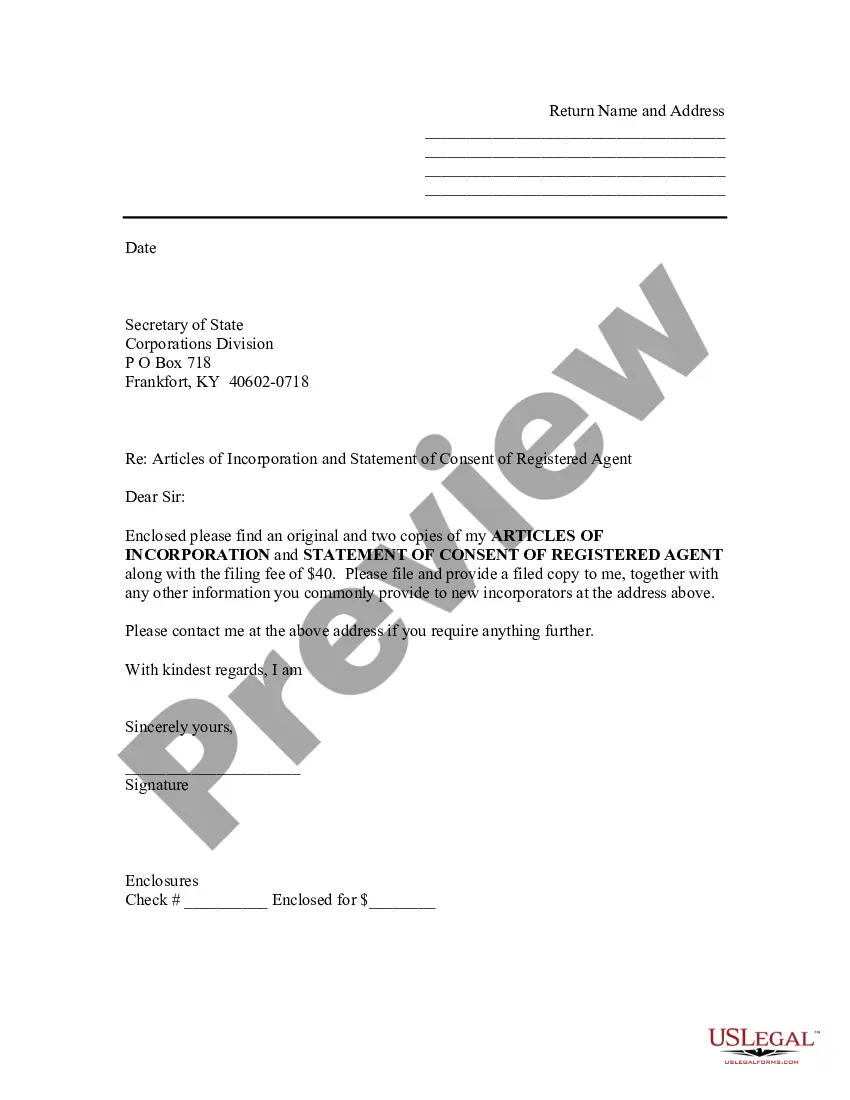

How to fill out Kentucky Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active; renew if necessary.

- Browse the extensive library of legal forms and find the articles of incorporation that align with your state's requirements. Review the form's preview and description.

- If you need a different template, utilize the search function to find the appropriate documents.

- Once you've selected the right form, click on 'Buy Now' and choose the suitable subscription plan. You will need to create an account for full access.

- Proceed with your payment using a credit card or PayPal to complete the purchase.

- Download the form to your device and access it anytime through the 'My Forms' section in your profile for completion.

In conclusion, US Legal Forms empowers you with a robust collection of over 85,000 legal forms, ensuring you have the resources necessary for an efficient filing process. Their expert assistance helps you create legally sound documents tailored to your needs.

Start your LLC journey today by visiting US Legal Forms and exploring their easy-to-use resources!

Form popularity

FAQ

The primary document that shows ownership of an LLC is the Operating Agreement, which outlines the roles and responsibilities of members. In addition to the Operating Agreement, the initial Articles of Organization may also indicate ownership structure. These documents are essential for establishing rights, sharing profits, and managing the LLC. To ensure you have the correct forms in place, consider using USLegalForms as a resource to guide you in completing the process.

An LLC typically files Articles of Organization, not Articles of Incorporation. This document officially creates your LLC and outlines its structure. While the terminology may differ, both serve to register your business with the state. Understanding this distinction is crucial when deciding whether you file Articles of Incorporation for an LLC.

No, articles of incorporation and an EIN are not the same. Articles of incorporation are legal documents that establish your LLC as a business entity, while an EIN, or Employer Identification Number, is issued by the IRS for tax purposes. An EIN is often necessary for tax filings and opening a business bank account. As you consider forming your LLC, include both filing articles of incorporation for an LLC and obtaining an EIN to fully comply with legal requirements.

To write a statement of purpose for an LLC, clearly articulate your business's primary objectives and goals. Focus on describing what your business does, its target market, and how it will operate. Keep it straightforward and specific, as it will guide your company's mission and future direction. If you find it challenging, consider using resources like USLegalForms to help craft a compelling statement that aligns with the requirements of filing articles of incorporation for an LLC.

To write articles of incorporation for an LLC, start by gathering essential information about your business, including its name, purpose, address, and details of the registered agent. Next, provide the names of the members or managers of the LLC and outline the management structure. Finally, you can find templates or services, like USLegalForms, that can guide you through the filing process and ensure accuracy. Remember, this document is vital, as it serves as your LLC's formal creation document.

To open an EIN account, you need various pieces of information including, but not limited to, your business name, address, and type of entity. Depending on your structure, you may also need details from your articles of incorporation if applicable. Keep in mind that for LLCs, having filed articles of incorporation can streamline the EIN application process. Prepare your documentation carefully to avoid any holdups.

To write articles of incorporation for an LLC, start by gathering key information like your business name, address, and the names of the members. Clearly state the purpose of your LLC and designate a registered agent. After drafting, ensure compliance with your state's specific requirements. Once prepared, you can submit your documents through platforms like US Legal Forms to ensure accuracy and completeness.

You do not need to incorporate to get an EIN. Individuals operating certain types of businesses, like sole proprietorships, can apply for an EIN without formal incorporation. However, if you plan to establish an LLC or other entity type, filing articles of incorporation can enhance your business's legal standing and credibility. It's worth considering for future growth.

No, you do not need to file articles of incorporation to obtain an EIN. You can apply for an EIN using other documentation related to your business formation. However, having an LLC structured with filed articles of incorporation can be beneficial for tax purposes and gaining financial credibility. Consider this when deciding the pathway for your business.

The articles of organization for an LLC must include essential details like the LLC's name, address, management structure, and purpose. Additionally, it’s important to identify the registered agent who will receive legal documents. These elements showcase your LLC's official status and comply with state regulations. Filing accurately ensures a smoother establishment process.