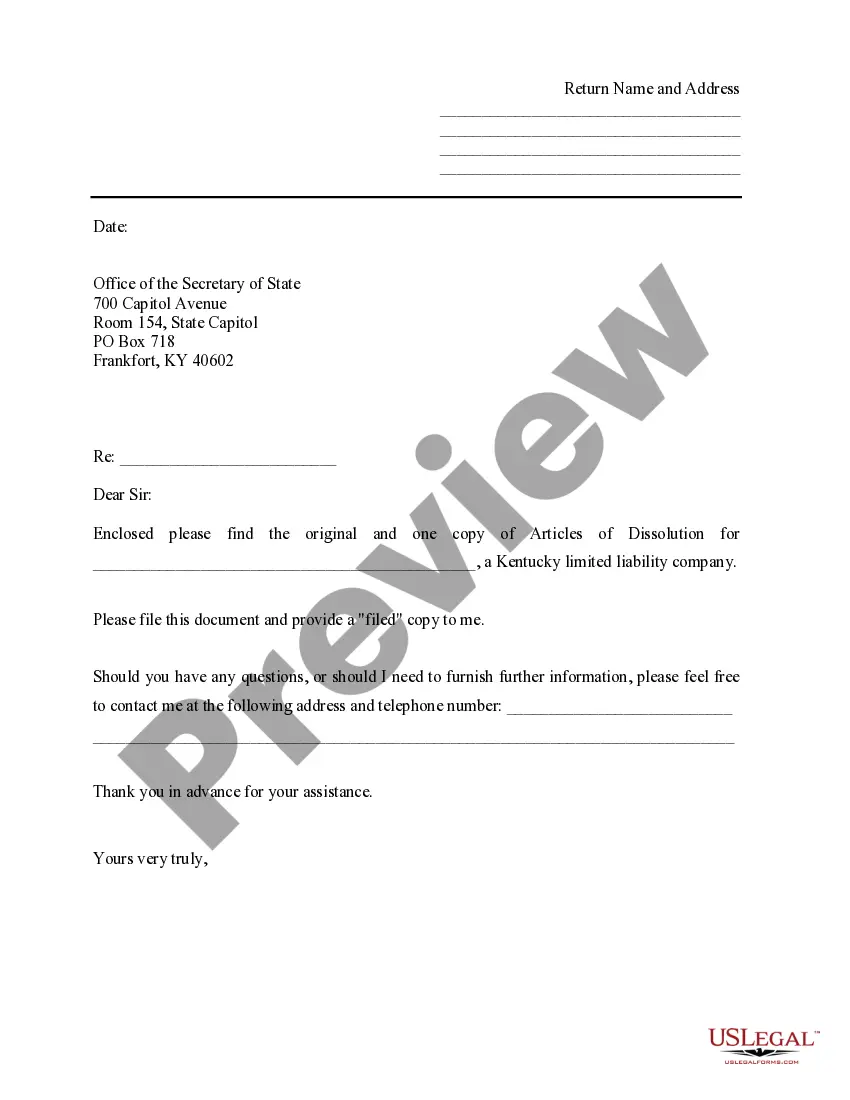

The dissolution package contains all forms to dissolve a LLC or PLLC in Kentucky, step by step instructions, addresses, transmittal letters, and other information.

Limited Liability Company For Rental Property

Description

How to fill out Kentucky Dissolution Package To Dissolve Limited Liability Company LLC?

- If you are a returning user, log into your account on the US Legal Forms website and access the form templates. Remember to verify that your subscription is active.

- If this is your first time, start by reviewing the form in Preview mode. Ensure it matches your specific requirements and complies with your local jurisdiction.

- If you find your desired form, proceed. If not, utilize the Search feature to explore other options until you find the right template.

- After selecting the proper document, click on the Buy Now button and select your preferred subscription plan. You'll need to create an account for access.

- Complete your purchase by entering your credit card details or using your PayPal account to finalize the transaction.

- Download the form directly to your device for easy completion and future access via the My Forms section in your profile.

By following these straightforward steps, you’ll quickly have access to the essential documents for establishing your LLC.

Using US Legal Forms ensures precision and legality, backed by a robust collection of forms and expert support. Start your journey towards securing your rental properties today!

Form popularity

FAQ

The best LLC structure for rental properties often includes a single-member LLC or a multi-member LLC, depending on your ownership situation. A single-member LLC offers simplicity and direct control, while a multi-member LLC allows for shared responsibilities and potential tax benefits. When structuring your limited liability company for rental property, consider consulting a professional to tailor it to your needs. Platforms such as uslegalforms can assist you in setting up the right structure effectively.

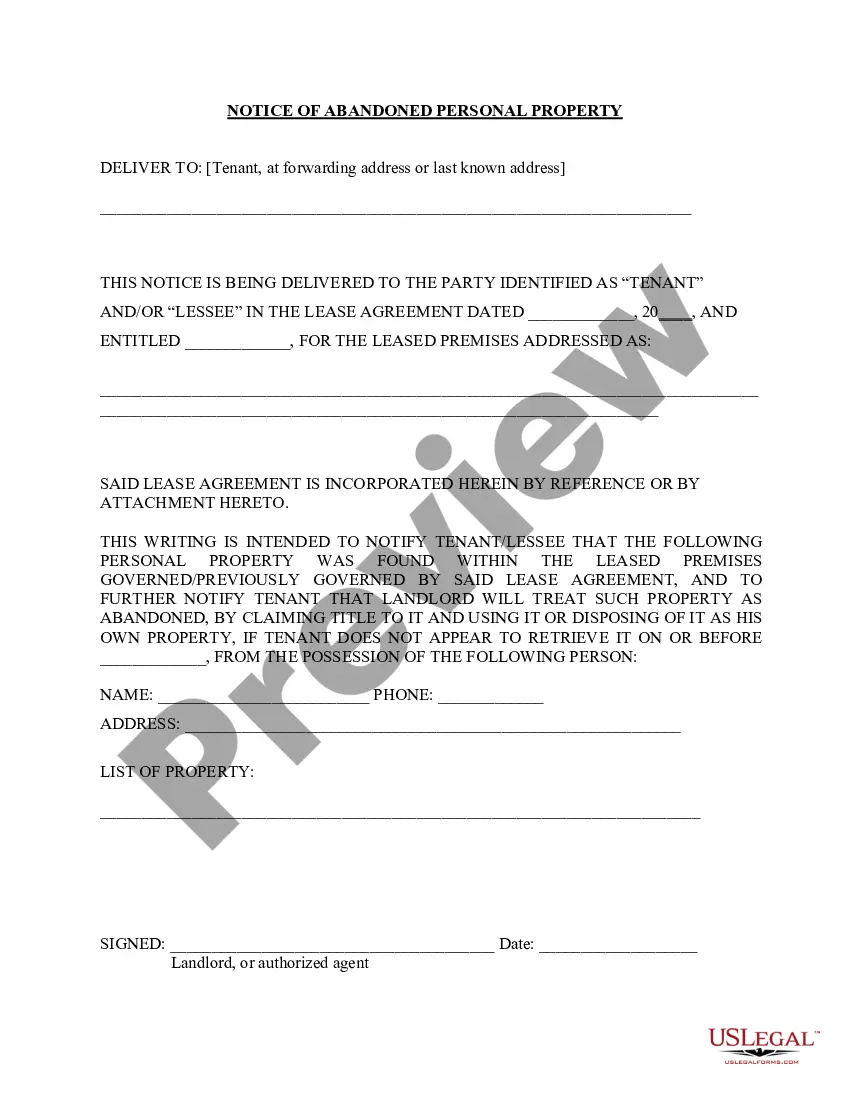

To transfer your rental property into a limited liability company for rental property, start by forming the LLC with your state's Secretary of State. Next, prepare a deed to transfer the property from your name to the LLC. Make sure to file this deed and update any property tax information. Consider using services like uslegalforms to streamline the process and ensure all paperwork is in order.

Limited liability companies for rental property have disadvantages, including potential difficulty in obtaining financing. Some lenders prefer to work with individuals rather than LLCs, which can limit your options. Additionally, the costs of creating and maintaining an LLC can add up over time. Evaluating these disadvantages alongside the benefits can help you make an informed decision for your rental property strategy.

Yes, you can put your rental property in a limited liability company for rental property even if it has a mortgage, but it often requires lender approval. Many lenders include clauses in their mortgage agreements that restrict transferring property into an LLC. Always consult your mortgage documents and a legal professional before taking such steps. Doing this correctly can protect your assets without jeopardizing your mortgage terms.

Buying a house under a limited liability company for rental property carries several advantages and disadvantages. On the pro side, LLCs afford owners personal asset protection and potential tax benefits. Conversely, the cons include setup costs and more complex tax obligations. Balancing these factors is essential to determine if this strategy aligns with your investment goals.

The best type of LLC for rental property typically varies based on individual circumstances. However, a single-member LLC is popular for individual investors, while a multi-member LLC suits those who partner with others. Consider factors like management structure, liability protection, and tax implications when deciding. Uslegalforms offers resources that can guide you in setting up the ideal LLC for your rental properties.

Wealthy individuals often choose to buy houses under a limited liability company for rental property to protect their personal assets. By using an LLC, they separate their personal finances from their real estate investments. This structure can help shield them from lawsuits related to their rental properties. Additionally, it can provide tax benefits that enhance their overall financial strategy.

To put your rental property in a limited liability company for rental property, you must first create the LLC by filing formation documents with your state. After that, you transfer ownership of the property to the LLC through a deed transfer. It's essential to update all relevant records and inform your mortgage lender, if applicable. Using uslegalforms can help you navigate the paperwork involved.

Generally, you can file personal and LLC taxes separately, especially if your limited liability company for rental property is treated as a pass-through entity. This means that the LLC's income passes through to your personal tax return. However, it’s crucial to track both income streams clearly to avoid issues during tax season.

When forming a limited liability company for rental property, consider the default structure, which is often a single-member LLC if you are the sole owner. However, you can also choose a multi-member LLC if you have partners involved. This choice affects taxation and liability, so it's wise to consult a legal expert to find the best fit for your situation.